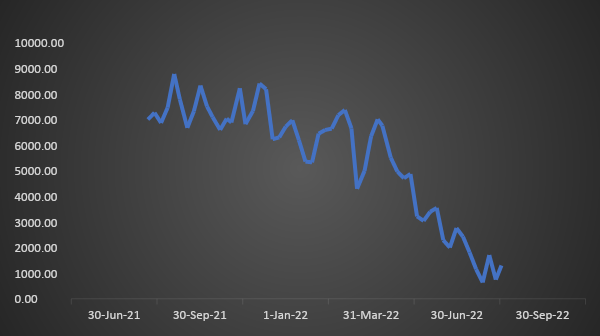

Domestic system liquidity has come down to Rs 1299.28 billion (as of 18th Aug 2022) from Rs 7383.36 billion as of 2nd Aug 2022. During H1FY22, RBI conducted GSAP and OMO to infuse liquidity in the system to help recover the economy from impact of covid pandemic, while keeping policy repo rate at an ultra-low level. Consequently, it led to high inflation that went beyond the upper limit of inflation pegged by the central bank (6%). Indian rupee also depreciated, driven by higher inflation, low policy rate and high liquidity.

In order to combat rising inflation and to cope with global rate hikes, RBI has started raising rates with hawkish stance on monetary policy. It has decided to absorb excess liquidity from the system. In addition, the central bank has conducted sell-buy operations of USD/INR to protect domestic currency from rapid depreciation. Owing to all these factors, systemic liquidity has followed a declining trend.

Since last one year, bank’s incremental credit to deposit ratio (ICDR) soared to 110% from 45% (as of July 2021). This indicates that credit is growing much faster than deposits and will lead to liquidity tightening in the near term.

Government bonds, SDL and OIS yield movements

Auction cut-off yield for new 10-year benchmark stood at 7.26%. Last week, 10-year benchmark 6.54% 2032 paper yield came down by 3 bps to 7.26%. The 5-year benchmark bond, 6.79% 2027 yield increased by 1 bp to 6.99%. 3-year benchmark 5.22% 2025 yield declined by 1 bp to 6.84%. Long-term paper, 6.99% 2051 yield declined by 8 bps to 7.58%.

The spread of 10-year bond over 5-year bond declined by 4 bps to 27 bps from 31 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread stood unchanged at 21 bps while the 30-year benchmark over 10-year benchmark spread decreased to 32 bps from 37 bps on a weekly basis.

Average 10-year SDL auction cut-off came down to 7.65% from 7.75% in previous week while spread came down to 41 bps from 44 bps.

On a weekly basis, 1-year OIS yield rose by 5 bps 6.16% while the 5-year OIS yield rose by 5 bps to 6.28%.

We would love to hear back from you. Please Click here to share your valuable feedback