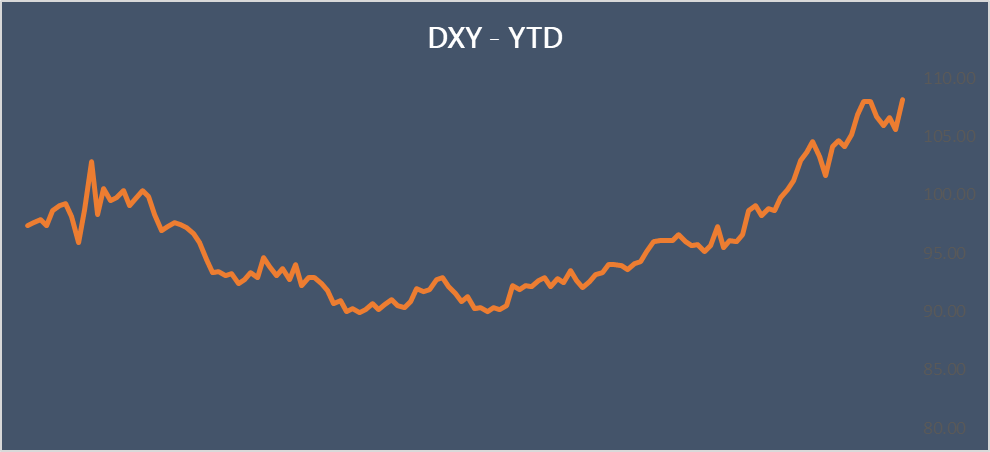

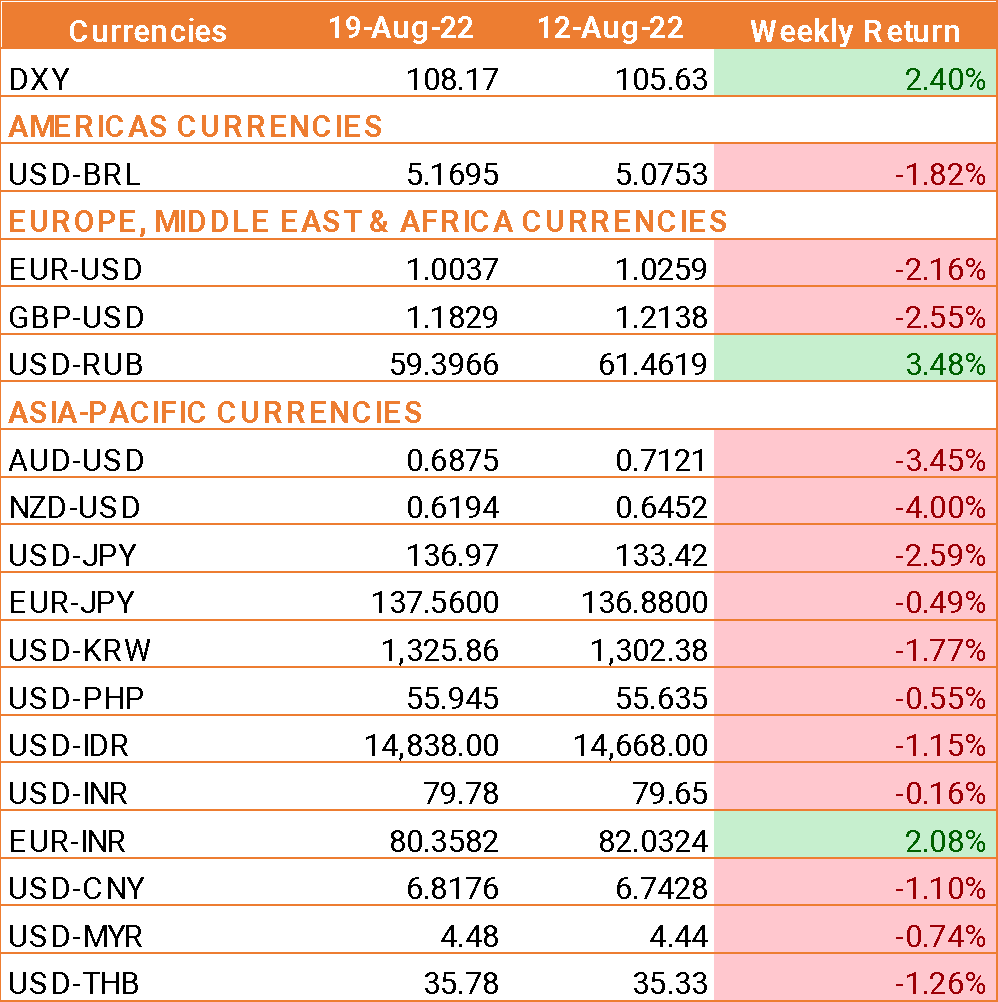

- USD trades higher after the release of the latest FOMC minutes. Fed’s minutes revealed that some policy members saw “little evidence” for inflation to peak, helping lift the USD.

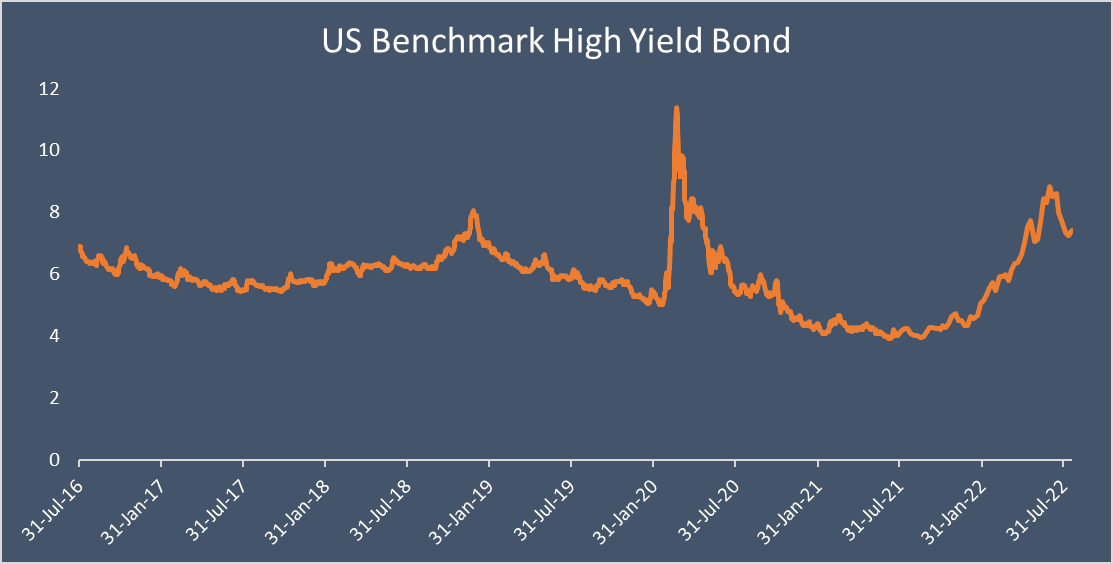

- The Fed also sees it appropriate to slow the pace of rate hikes, but it would be data-dependent.

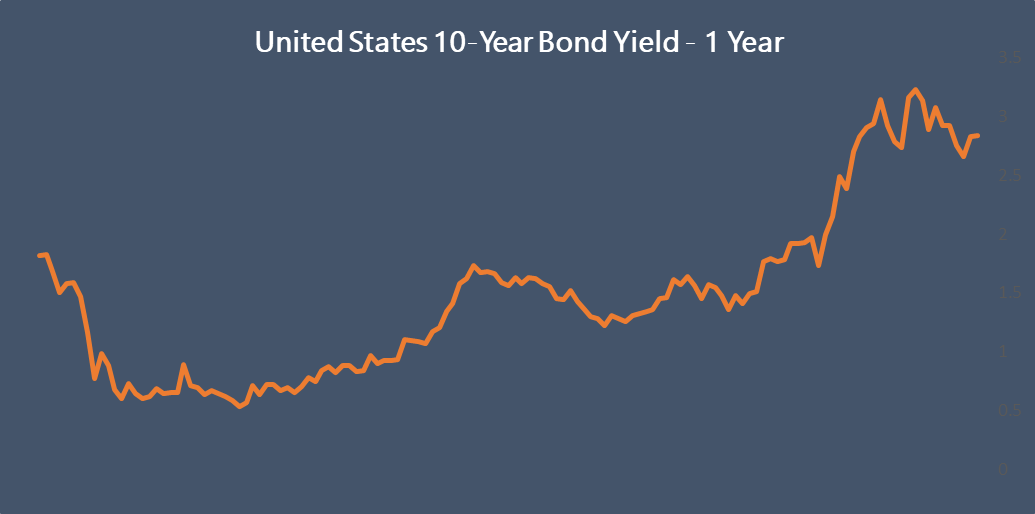

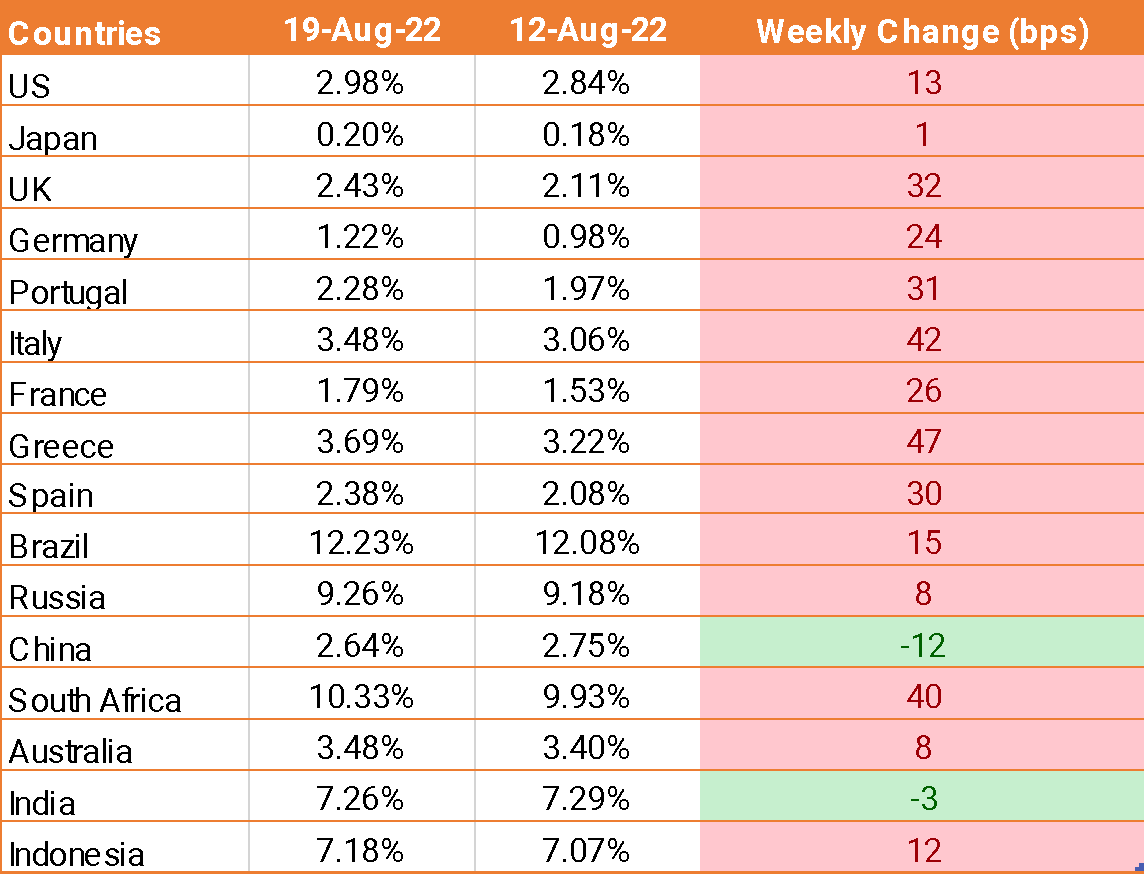

- US 10yr treasury yield rose by 13bps to 2.98% as Richmond Fed President Thomas Barkin, who became the latest Fed official said that the central bank will do what it takes to return inflation back to its target, even if that means risking a recession

- St. Louis Fed President James Bullard said he favoured a 75bps rate hike at the next policy review in September, while his Kansas City counterpart, Esther George, said the pace of rate hikes remains up for debate.

- Divergent comments from Fed officials on Thursday had left investors unsure of which way policy makers are leaning with their next move.

- Retail sales in the US were broadly weaker in July down from 0.8% in June to 0.0% suggesting a deterioration in consumer spending.

- US weekly jobless claims unexpectedly fell by 2,000 to 250,000 compared to a downward revised 252,000 previous reading.

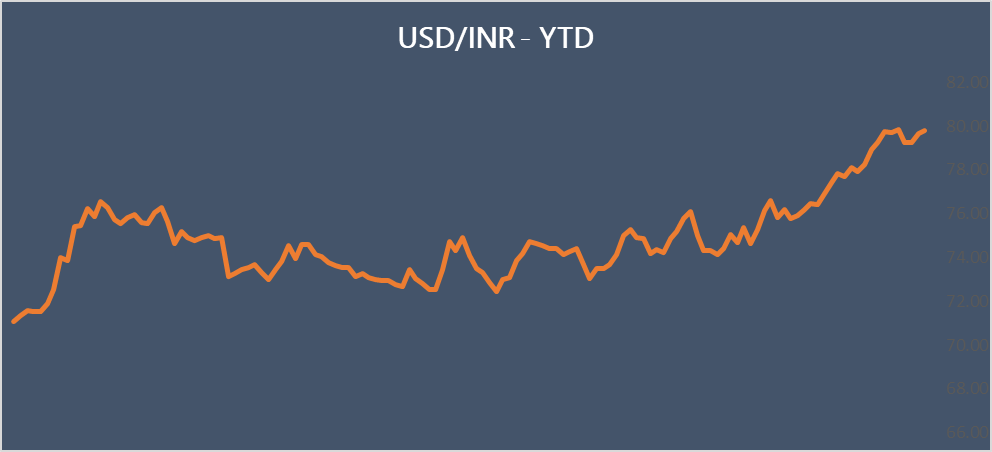

- India’s WPI eased to 13.93% in July down from a 15.18% increase in June. This has fuelled expectations that the RBI will hike rates again next month to tame down double digits’ inflation readings.

We would love to hear back from you. Please Click here to share your valuable feedback