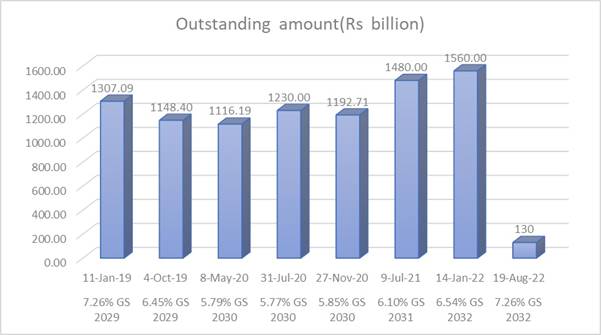

The government auctioned a new 10-year bond that saw the cut off at 7.26%. The last 5 g-sec auctions saw cut off at levels of 5.79%, 5.77%, 5.85%, 6.10% and 6.54% levels respectively. Even at 7.26% levels, the new 10-year g-sec is unlikely to make money for investors.

There are multiple headwinds still ahead in the form of high inflation driven by soaring energy prices that are driving commodity prices higher. Central banks are in a tough fight to stem inflation that is also driven by low interest rates and excess liquidity.

Governments are heavily borrowed and the bond supply is enormous even as central banks are trying to control inflation. RBI has a huge task on hand to manage inflation and keep down interest rates. The INR is trading at record lows and will most likely trend down on global market volatility.

The 10-year g-sec is better off being shorted on rallies.

Government bonds, SDL and OIS yield movements

New 10-year benchmark 7.26% 2032 yield stood at 7.2%. On a weekly basis, old benchmark 6.54% 2032 paper yield came down by 4 bps to 7.22%. The 5-year benchmark bond, 6.79% 2027 yield remained unchanged at 6.99%. 3-year benchmark 5.22% 2025 yield declined by 10 bps to 6.74%. Long-term paper, 6.99% 2051 yield declined by 6 bps to 7.52%.

The spread of 10-year bond over 5-year bond declined by 4 bps to 23 bps from 27 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread came down by 4 bps to 17 bps from 21 bps while the 30-year benchmark over 10-year benchmark spread decreased to 30 bps from 32 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.66% from 7.65% in previous week while spread came down to 38 bps from 41 bps.

On a weekly basis, 1-year OIS yield rose by 11 bps to 6.27% while the 5-year OIS yield rose by 12 bps to 6.40%.

We would love to hear back from you. Please Click here to share your valuable feedback