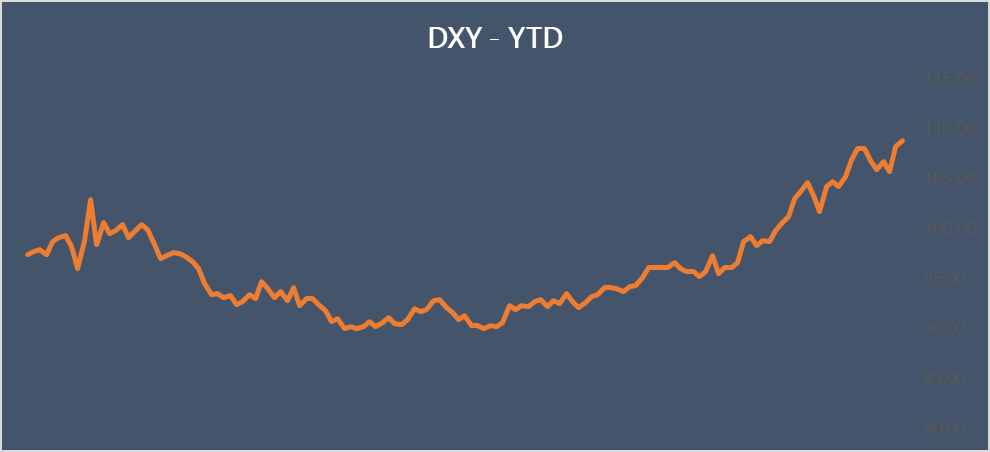

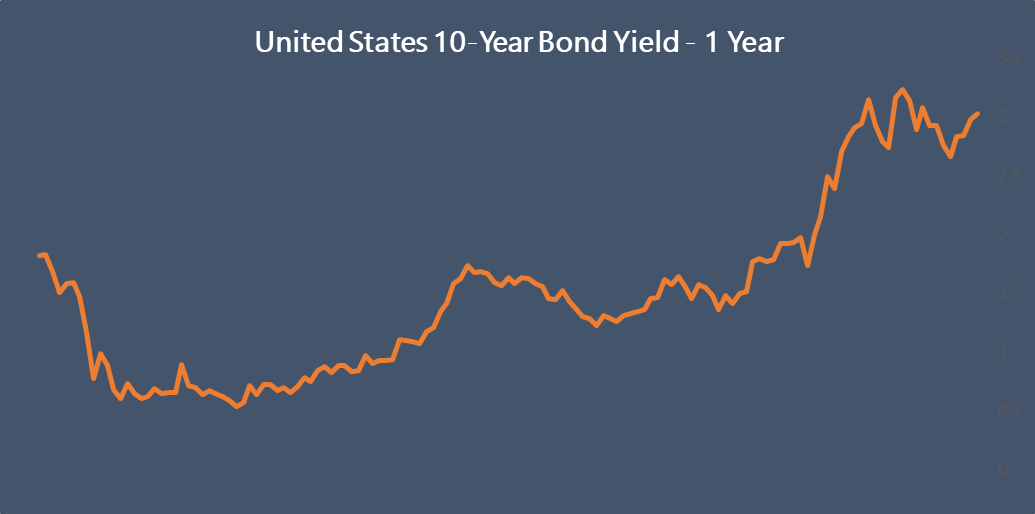

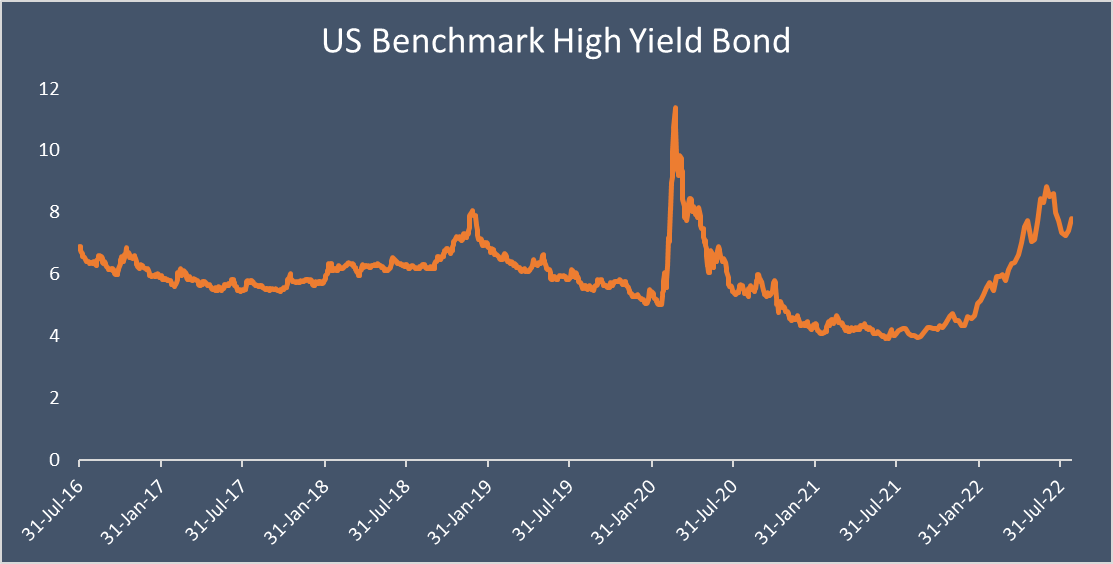

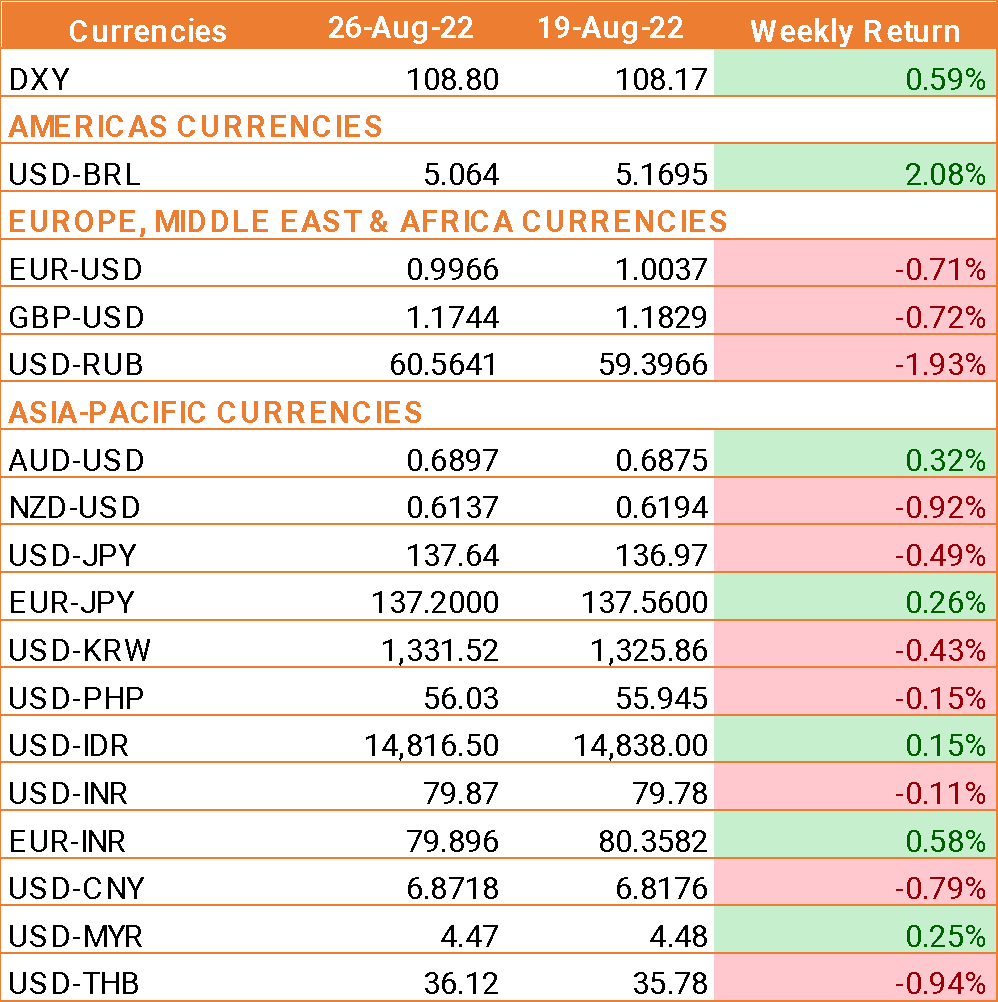

- USD ended the week higher after Federal Reserve Jerome Powell signalled that the Fed will keep hiking interest rates and leave them elevated for a while to fight inflation.

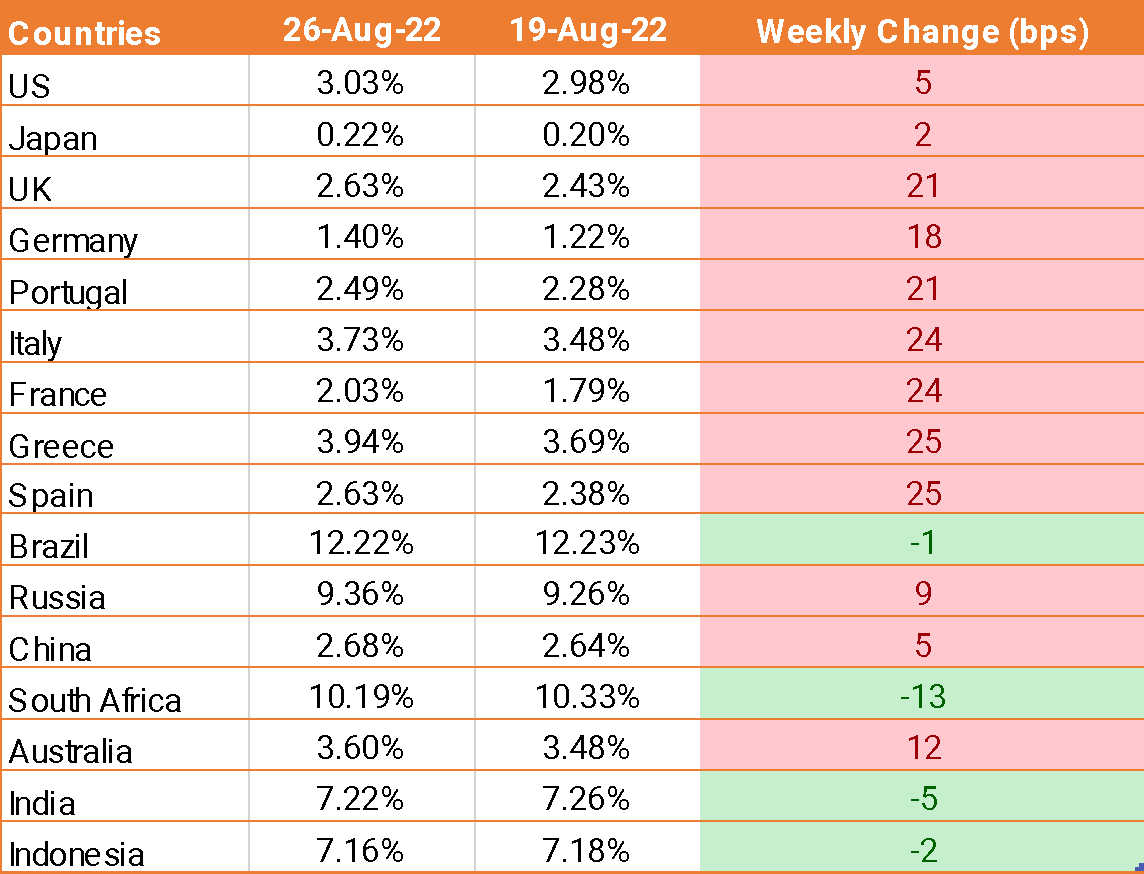

- Powell, speaking at the Fed’s annual symposium in Jackson Hole, Wyo., said that the central bank’s “overarching” goal is to bring inflation back to its 2% goal and policy makers will stick with that task until the job is done.

- In addition, he said the Fed will be using its tools “forcefully,” which will likely lead to a softening of labour market conditions, but another unusually large rate hike may be appropriate. These are the unfortunate costs of reducing inflation as failure to restore price stability would involve greater pain, according to Powell.

- The personal-consumption price index came in with a year-over-year rate of 6.3%, down from 6.8% in the prior month, while the core reading that excludes food and energy costs edged down to 4.6% from 4.8% in the 12 months ended in July.

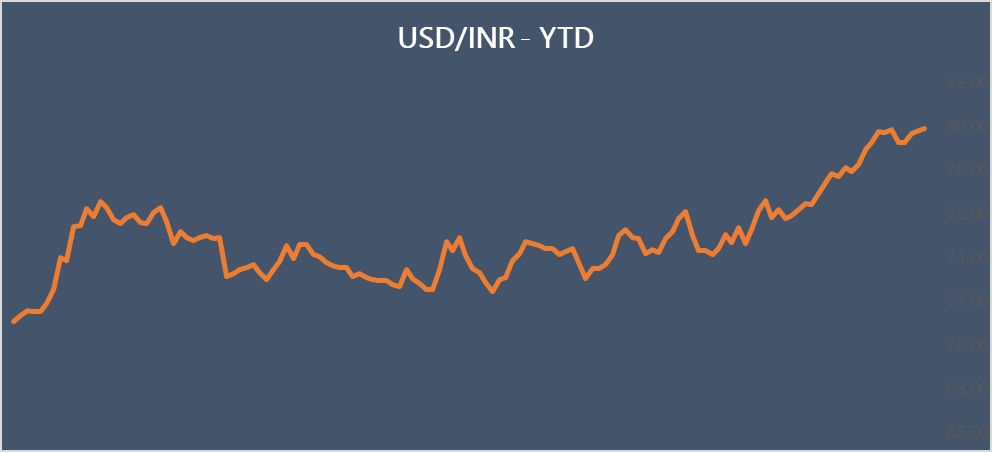

- INR trades lower amid broad USD strength

- Many market participants are optimistic about India’s growth and believe that strong growth in India will give the RBI room to hike interest rates by another 0.6% in its fight against inflation.

We would love to hear back from you. Please Click here to share your valuable feedback