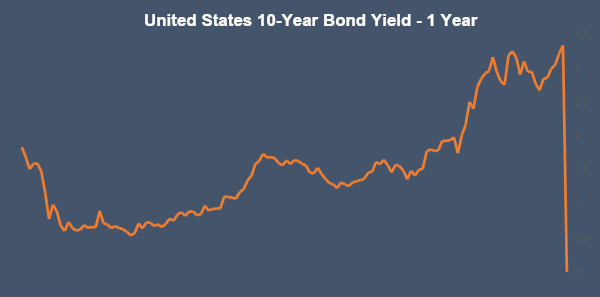

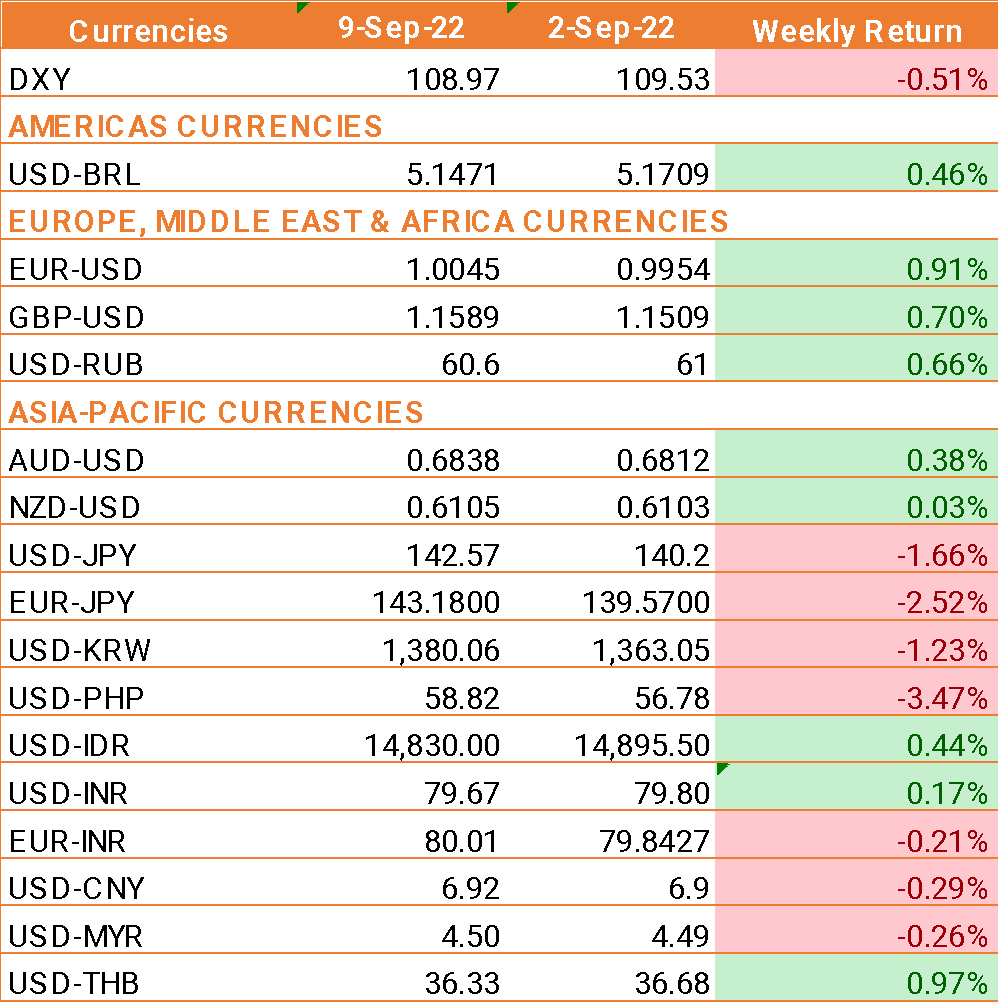

- USD fell last week as investors were cautious ahead of inflation and Fed meeting.

- US jobless claims unexpectedly fell to 222,000, down from a downwardly revised 228,000 and well below the 240,000 expectations. This was the fourth straight week of declines.

- The trade deficit in the US narrowed by $10.2 billion to a 9-month low of $70.7 billion in July 2022, in line with market forecasts of $70.3 billion.

- The ECB raised interest rates by an unprecedented 75bps in its September 2022 meeting, following a 50bps rate hike in July.

- The Euro Area economy expanded 0.8% on quarter in the second quarter of 2022, higher than a 0.6% rise in the second estimate, and the strongest growth rate in three quarters.

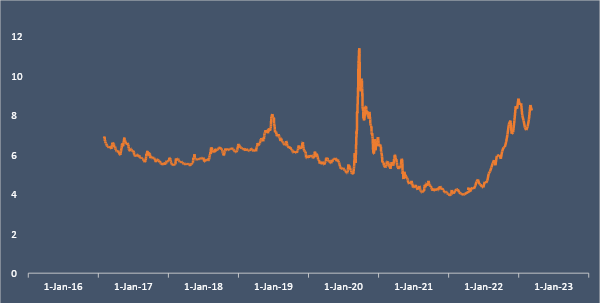

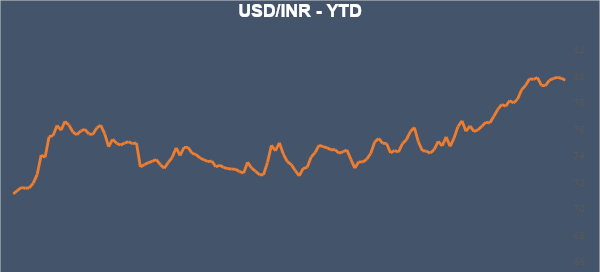

- INR appreciated against US dollar driven by fall in crude price last week.

- India’s forex reserve stood at USD 553.10 billion as of 2nd Sep 2022.

- During August 2022, FII flow into equity stood at Rs 512.04 billion and while Rs 38.45 billion into debt segment. During September, FII flow stood at Rs 55.53 billion and Rs 1.58 billion respectively in the equity and debt segment.

We would love to hear back from you. Please Click here to share your valuable feedback