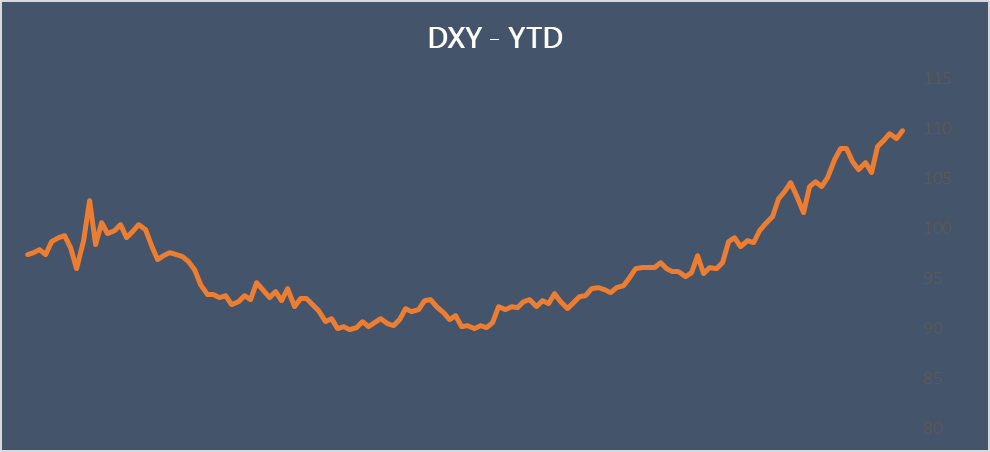

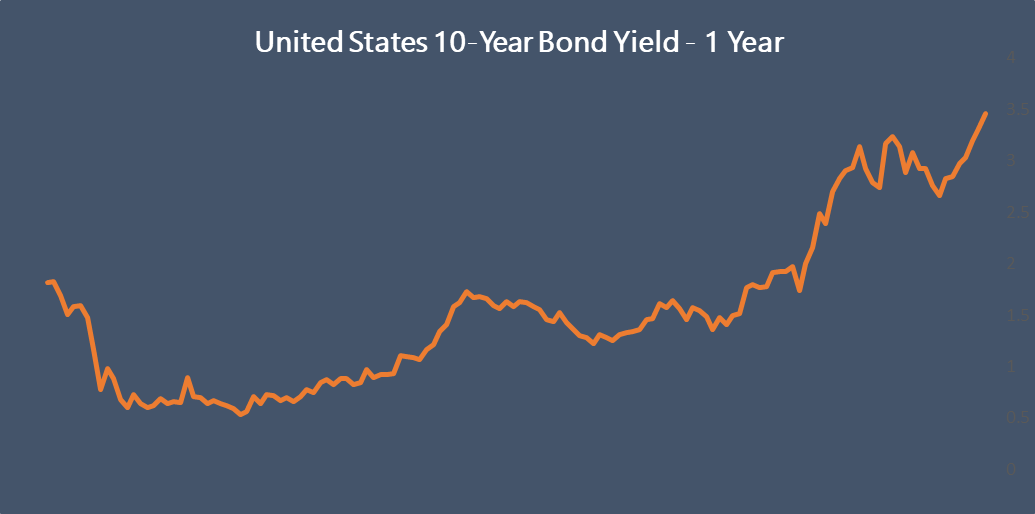

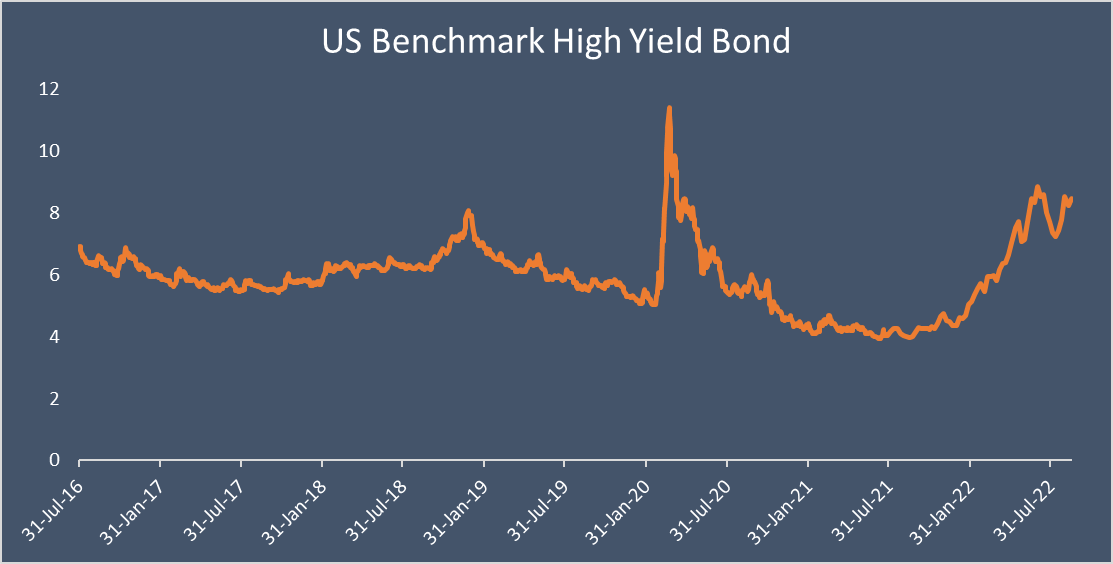

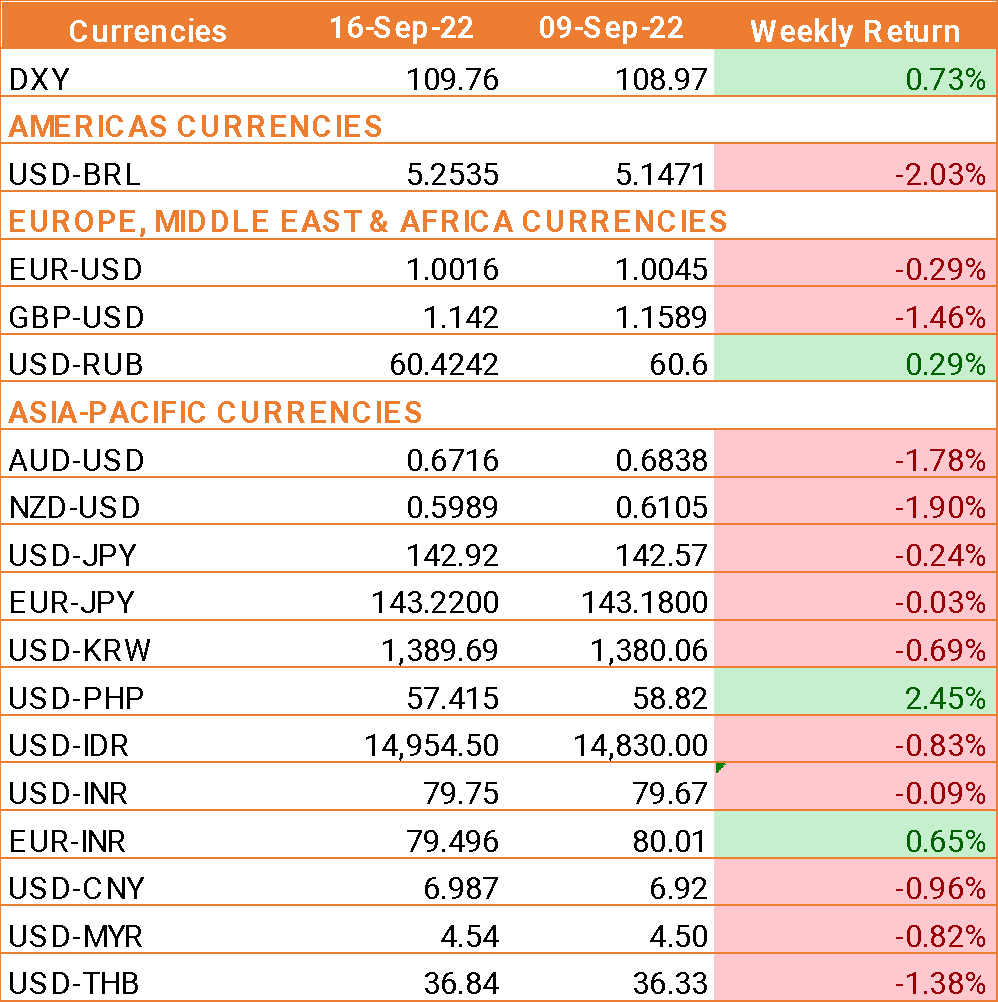

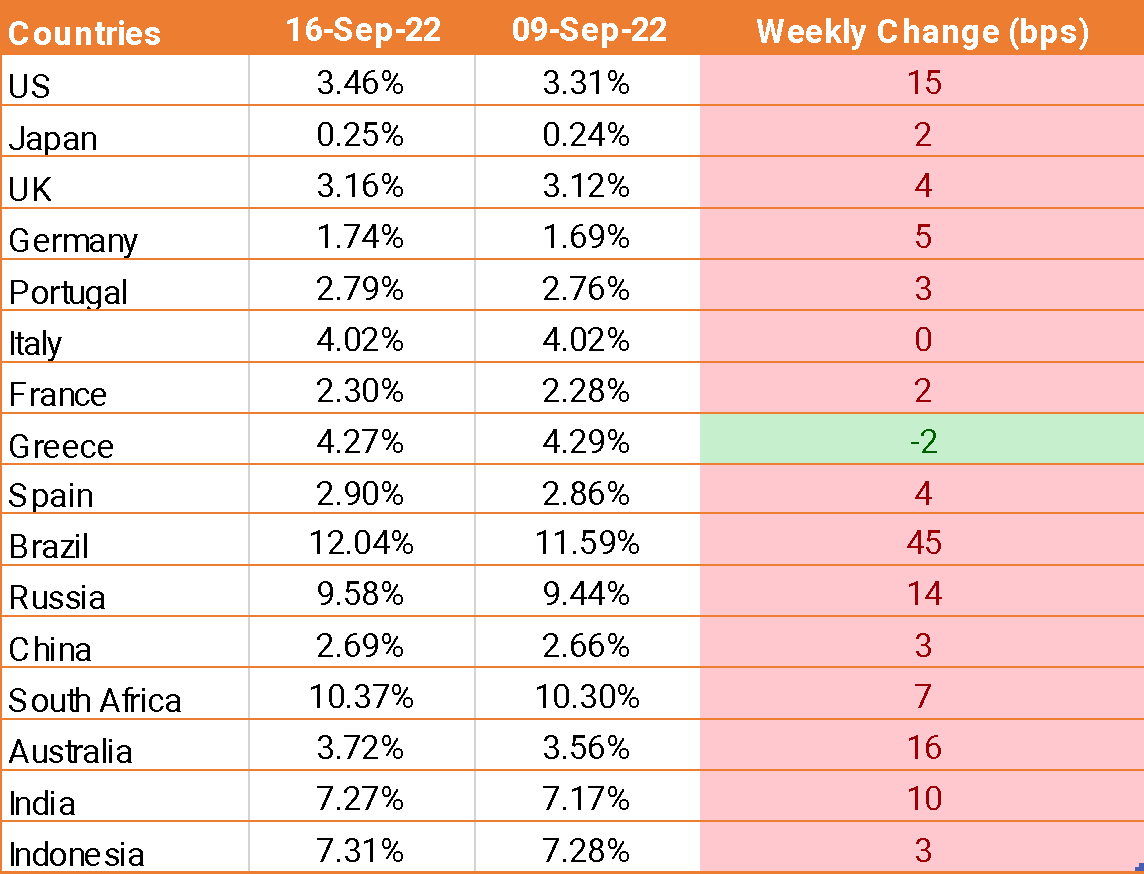

- USD rose yesterday after upbeat data boosted expectations that the Federal Reserve will raise interest rates at a faster pace in the coming months.

- US retail sales surprised the market and rose 0.3% month on month, ahead of expectation of staying unchanged at 0%.

- US initial jobless claims fell to 213,000, this was down from 218,000 in the previous week against the expectation of 126,000.

- US CPI rose 0.1% in August, and was up 8.3% from a year earlier

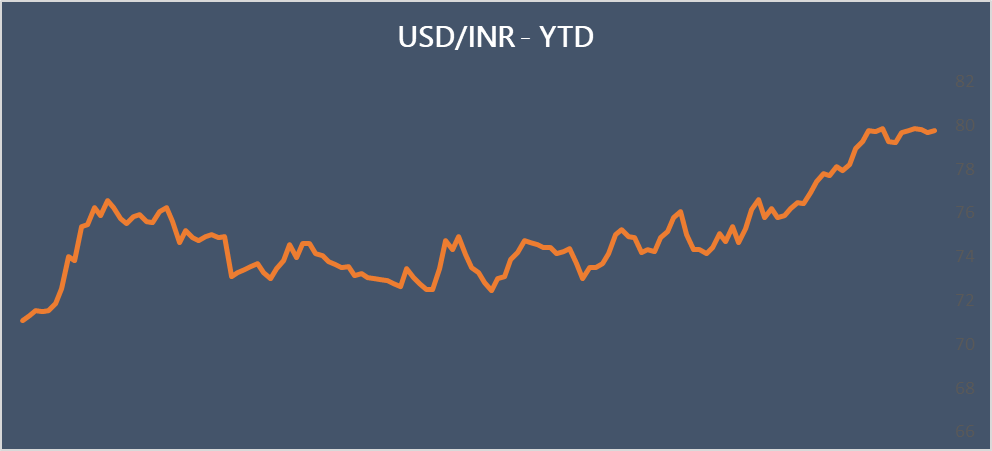

- INR fell on the expectation that the Indian current account is expected to widen to a decade high level in the April to June quarter. On the back of surging global commodity prices and the largest capital outflows since the 2008 financial crisis.

- Trade deficit in the last quarter is expected to be USD 30.5 billion, equivalent to 3.6% of GDP, the highest level in around 10 years.

- Fitch rating has cut the country’s economic growth forecasts for the current fiscal year. Fitch predicts that GDP will be 7%, down from 7.8%; it also forecast a slower pace of growth in FY 2024 to 6.7%, down from 7.4%.

We would love to hear back from you. Please Click here to share your valuable feedback