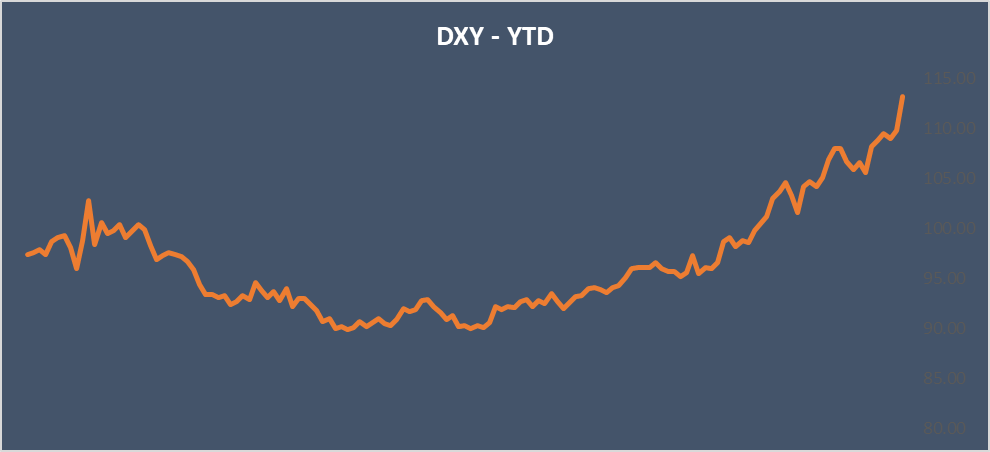

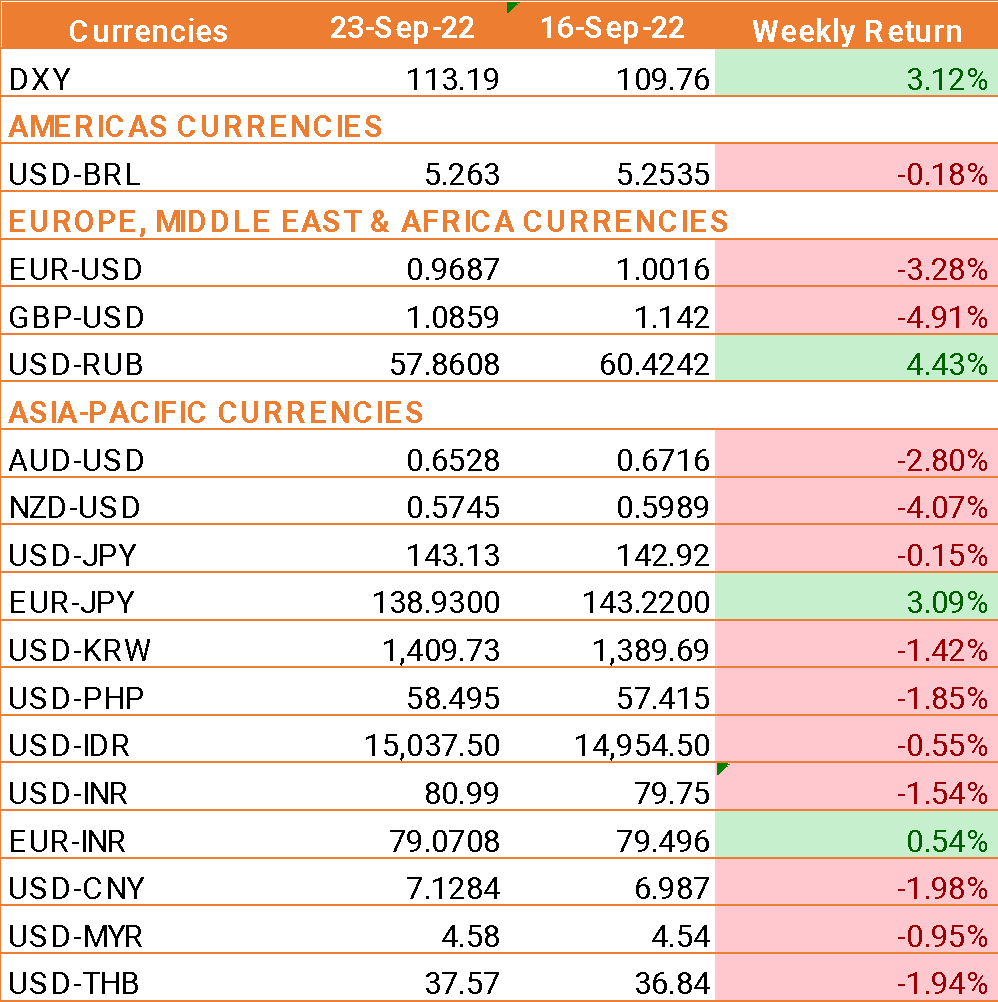

- USD trended higher, boosted by a combination of hawkish Federal Reserve bets and safe haven flows.

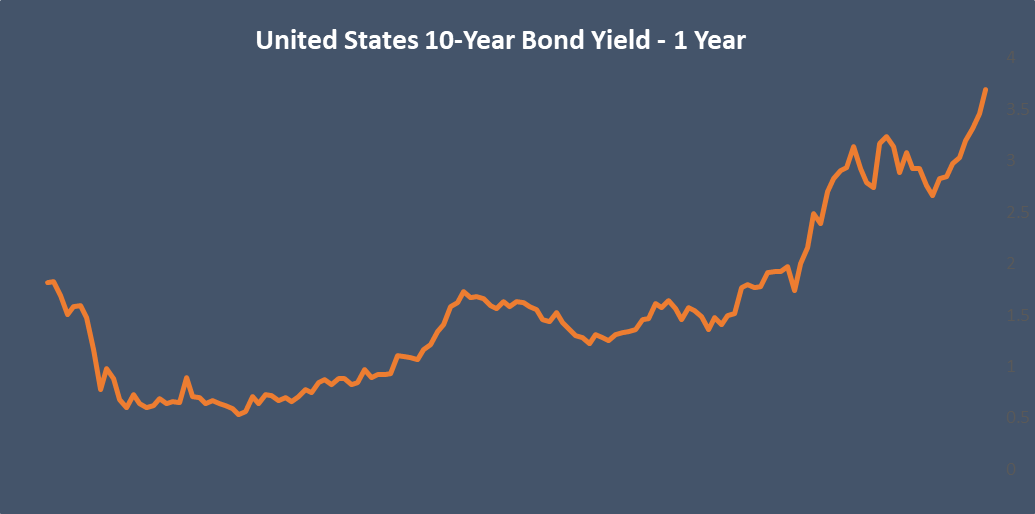

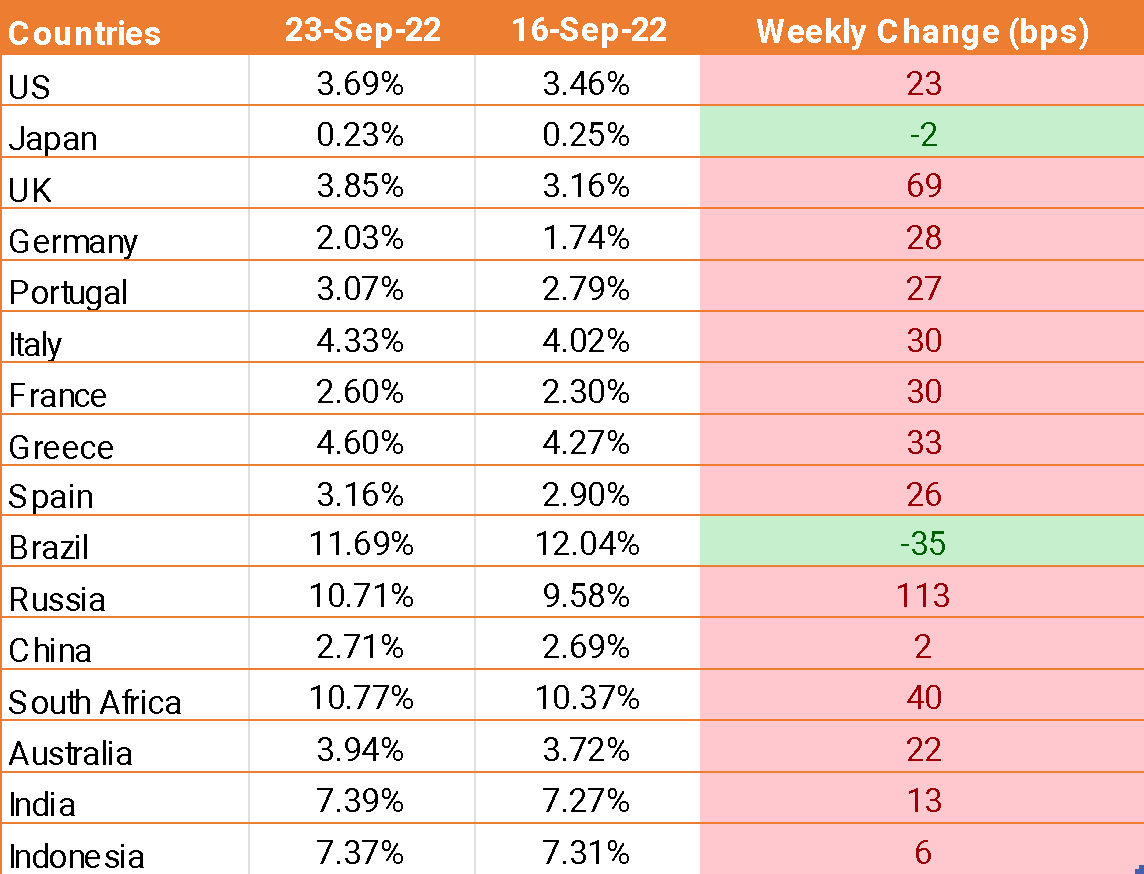

- Global bond yields hit new multi-year highs after global rate hikes.

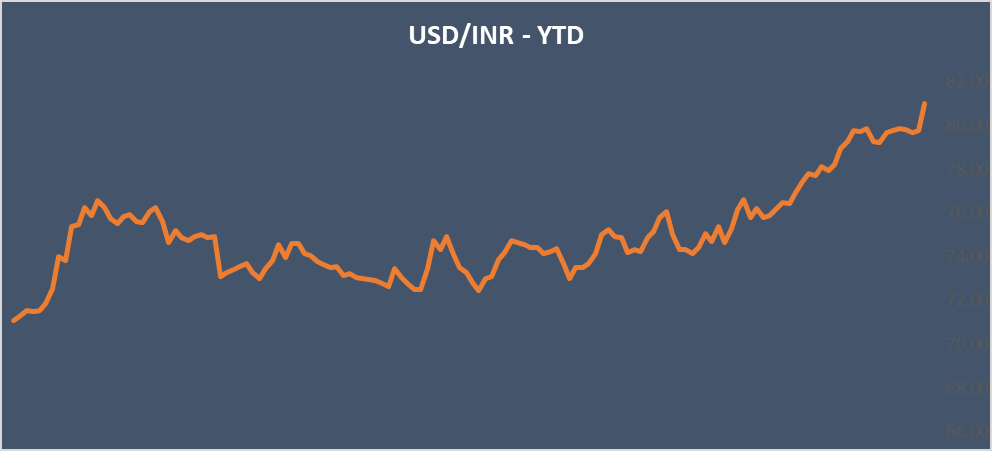

- INR along with other emerging market currencies crashed as risk sentiment plunged.

- INR touched Rs 81 per USD on Friday, but recovered and ended the week at Rs 80.99 per USD.

- India's trade deficit widened to USD 27.98 billion in August, according to data from the Commerce and Industry Ministry last week. Imports rose by 37.28% to USD 61.9 billion in August 2022.

- RBI dipping into foreign exchange reserves to control the INR fall resulted in reserves falling for a seventh straight week —dropping to USD 545.65 billion in the week to September 16, the lowest level since October 2, 2020,

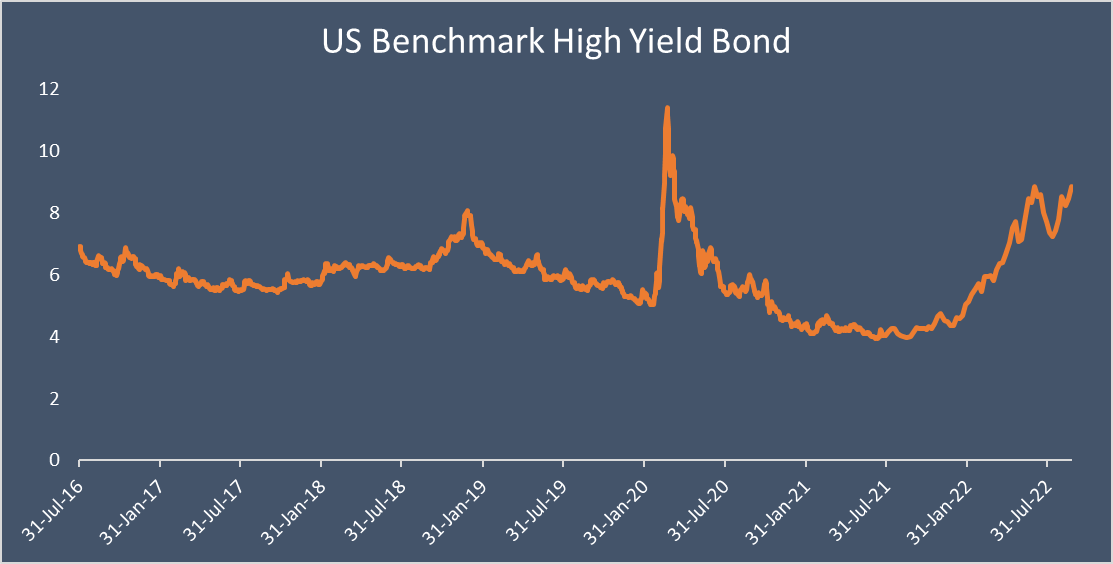

- Fears of recession surged last week after global central banks hiked interest rates, setting the scene for slower growth and a global recession.

- The US central bank raised interest rates by 75 bps for a third straight meeting. This was in line with expectations.

- Other central banks are continuing to raise rates, with the Bank of England increasing its key interest rate by 50 bps as expected. The Swiss and Norwegian central banks also raised rates on Thursday.

- The Federal Reserve was also more hawkish in its outlook, with interest rates expected to rise to 4.4% at the end of this year and 4.6% in 2023. This means that there is another 75 bps hike expected in November and at least a 50 bps ihike in the December meeting.

- Bond yield curves, viewed as good indicators of where growth and inflation are heading, signal that the magnitude of rate hikes will sharply slow growth.

- The U.S. Treasury bond yield curve is now pushing deeper into negative territory. The gap between Germany's 2- and 10-year yields had earlier tightened to 0.6 bps, its lowest since March 2020. That part of the curve hasn't inverted since 2008.

- US jobless claims came slightly above the previous week at 212,000, after a downward revision to last week’s claims to 208,000. The data shows that the labour market is tightening and supports the Fed’s more hawkish stance.

- US PMI data revealed that business activity slowed less than expected in September. The composite PMI was 49.3, up from 44.6 and well ahead of expectation of 44.7.

We would love to hear back from you. Please Click here to share your valuable feedback