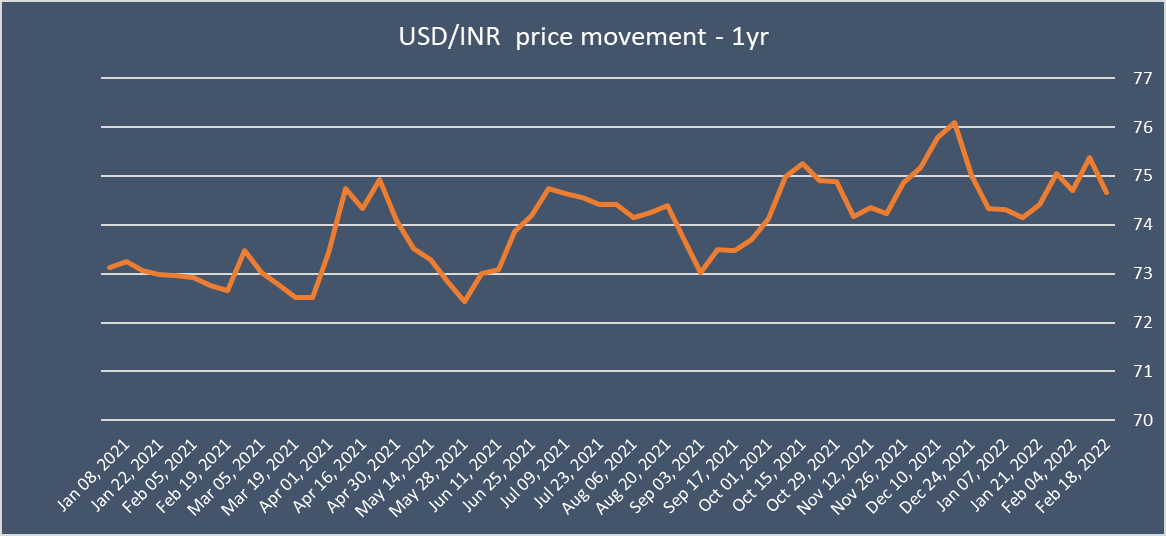

- INR ended the week lower but gained after RBI hiked rates by 50 bps

- The RBI raised its benchmark repo rate on Friday by 50 bps. This was the fourth consecutive increase by the central bank as it continues to battle high inflation. The repo rate now sits at 5.9%, after 5 of the 6 monetary policy members voted in favor of the hike.

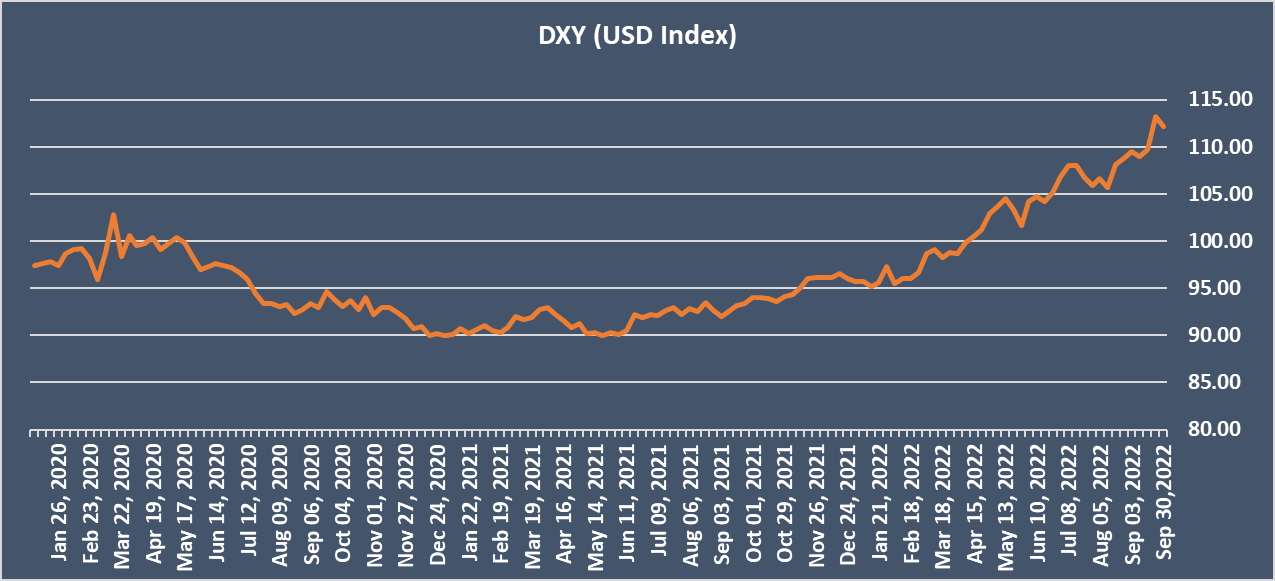

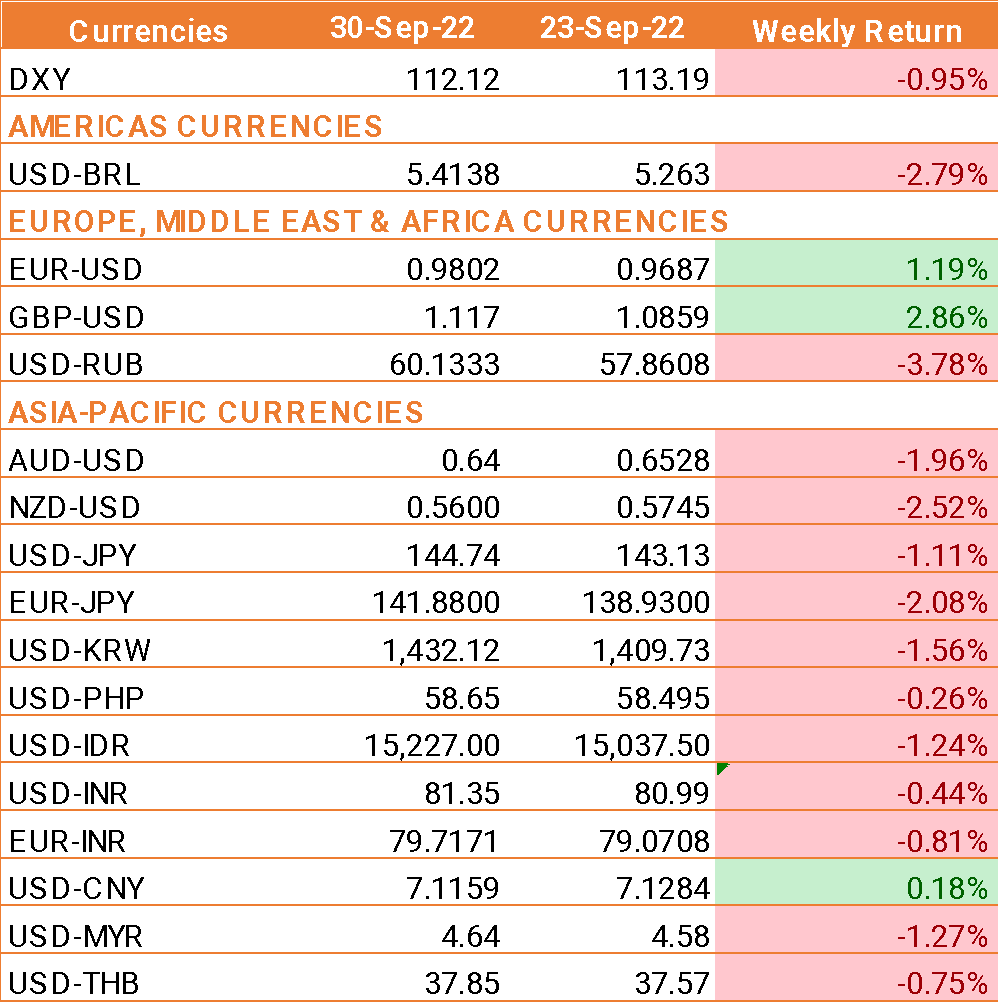

- USD fell back across the board despite a bout of stronger than expected release of data during the week.

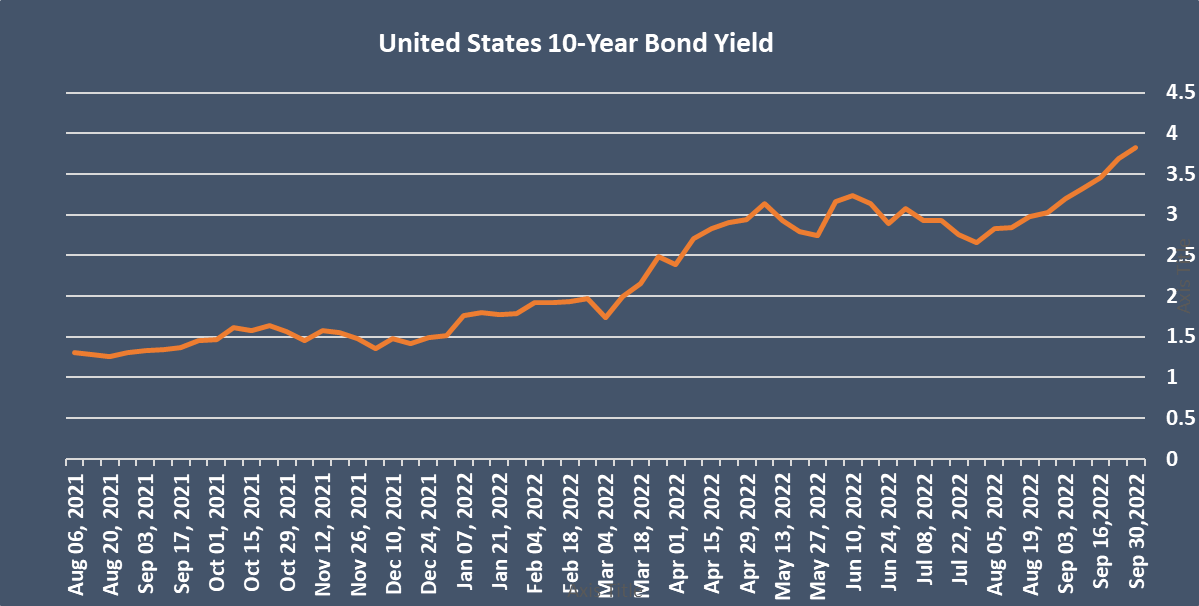

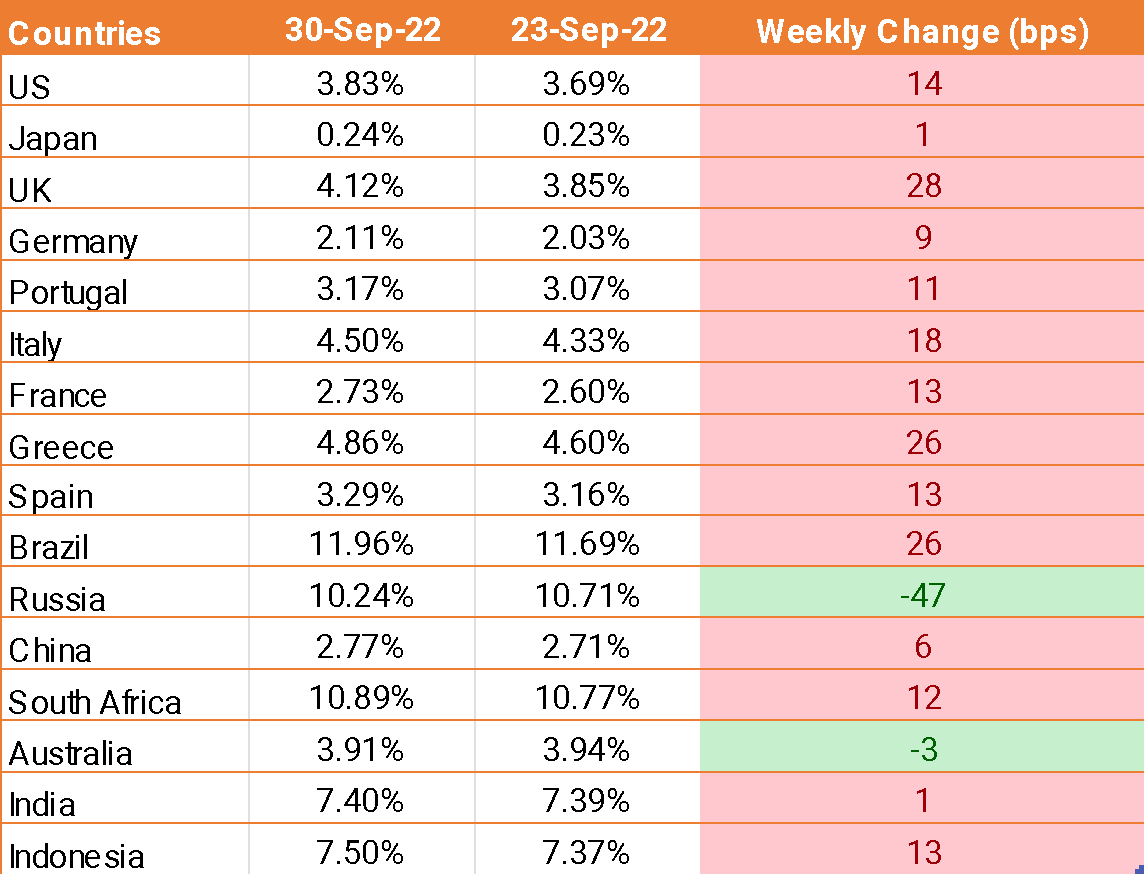

- 10-year UST bond yield rose sharply and touched its highest level since Apr 2010 after the policy-sensitive 2-year Treasury yield hit its highest since Aug 2007.

- US core PCE, the Federal Reserve’s preferred measure for inflation, rose by more than expected to 4.9% year on year in August, up from 4.7% in July.

- US consumer spending also rose by more than forecast at 0.4% month on month, up from 0.2%.

- US jobless claims fell by more than expected, hitting a five-month low, highlighting the labor market’s resilience. The number of US citizens filing new unemployment claims fell to 193,000, down from 213,000 the previous week and below forecasts of 215,000.

- US GDP for the second quarter confirmed the -0.6% contraction from the earlier reading.

- GBP rose sharply from record lows hit on Monday after the Bank of England conducted rounds of bond buying to stabilize financial markets.

- On Thursday, the BoE bought 1.415 billion pounds (USD 1.55 billion) of British government bonds with maturities of more than 20 years, the second day of a multi-billion-pound program designed to stabilize the market.

We would love to hear back from you. Please Click here to share your valuable feedback