The INR is in focus given its record lows on the back of global bond crisis, rising trade and current account deficit and risk aversion. RBI has been defending the INR by selling USD and is hiking interest rates. With prospects of higher inflation due to rising energy prices and falling INR, RBI will have to hike rates faster to curb INR depreciation.

Gsec yield curve is likely to invert on higher rates and tight liquidity. However there are positives with government borrowing going through smoothly at higher levels and prospects of strong flows next year on the back of Gsec inclusion in global bond indices and this can keep long bonds from rising too fast.

Policy rate hike by RBI- In last RBI MPC meeting

Policy repo rate has been hiked by 50 bps to 5.9%. Consequently, the standing deposit facility (SDF) rate is adjusted to 5.65%. Inflation projection has been kept unchanged at 6.7% for FY23. However, in the current scenario of rapid rupee depreciation and aggressive rate hikes by global central banks, 50 bps rate hike may not be enough to cope with current market volatility. It is expected that a sharper rate hike is on cards in coming policy meetings.

Union Government to Borrow Rs 5.76 trillion during H2FY23

In the second half of fiscal year 2022-23, the Union Government will borrow Rs 5760 billion, which is 38.53% of the total budgeted borrowing of Rs 14950 billion for the full fiscal year. During H1FY23, the Government of India has borrowed Rs 8010 billion. In addition to the notified borrowing amount of Rs 5760 billion, Government of India will issue Sovereign Green Bond worth Rs 160 billion.

Current Account Deficit-

India’s current account balance recorded a deficit of USD 23.9 billion (2.8% of GDP) in Q1FY23 as compared to USD 13.4 billion (1.5% of GDP) in Q4FY22 and a surplus of USD 6.6 billion (0.95 of GDP) in Q1FY22.

Government bonds, SDL and OIS yield movements

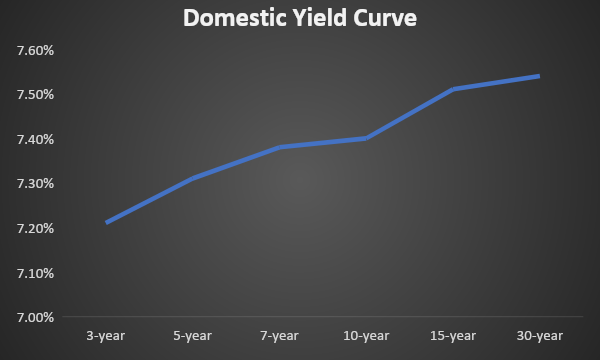

New 10-year benchmark 7.26% 2032 yield rose by 1 bp to 7.40% while 6.54% 2032 yield remained unchanged at 7.43%. The 5-year benchmark bond, 6.79% 2027 yield declined by 12 bps to 7.25%. 3-year benchmark 5.22% 2025 yield came down by 10 bps to 7.12%. Long-term paper, 6.99% 2051 yield rose by 2 bps to 7.55%.

The spread of 10-year bond over 5-year bond rose to 15 bps from 2 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread stood unchanged at 11 bps while the 30-year benchmark over 10-year benchmark spread rose to 15 bps from 14 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.69% from 7.55% in previous week while spread rose to 31 bps from 26 bps.

On a weekly basis, 1-year OIS yield declined by 4 bps to 6.89% while the 5-year OIS yield came down by 7 bps to 6.92%.

We would love to hear back from you. Please Click here to share your valuable feedback