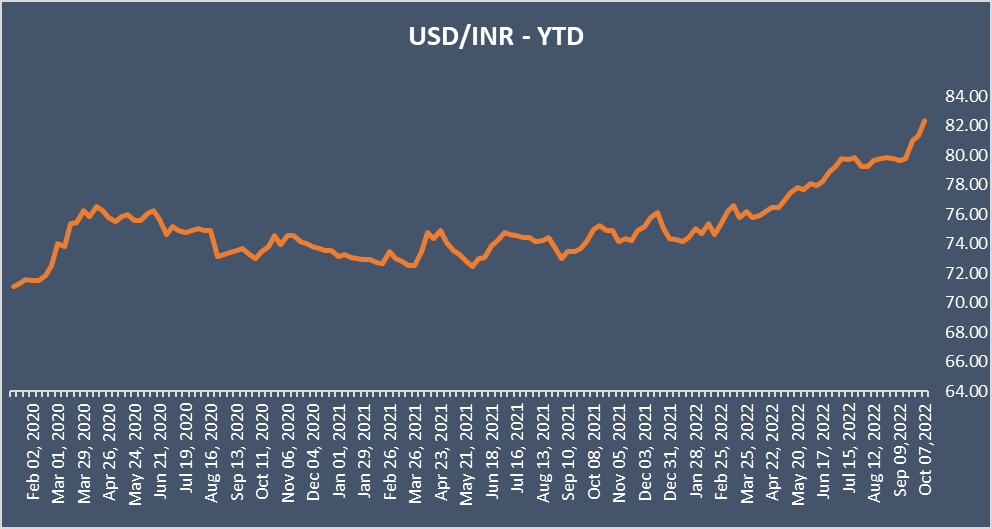

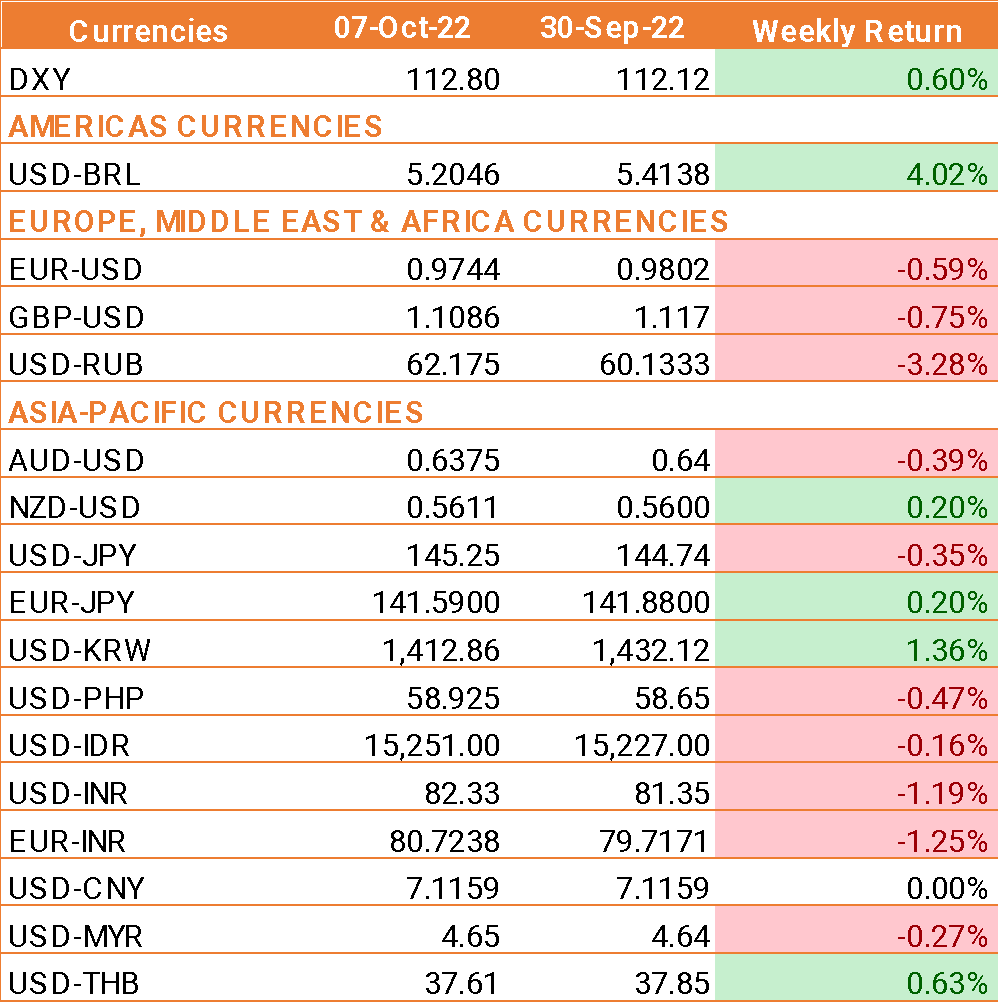

- INR on Friday breached yet another psychologically crucial level of Rs 82 per USD on rising crude oil prices and on chances of aggressive rate hikes by the US Federal Reserve that led to a rally in the USD globally.

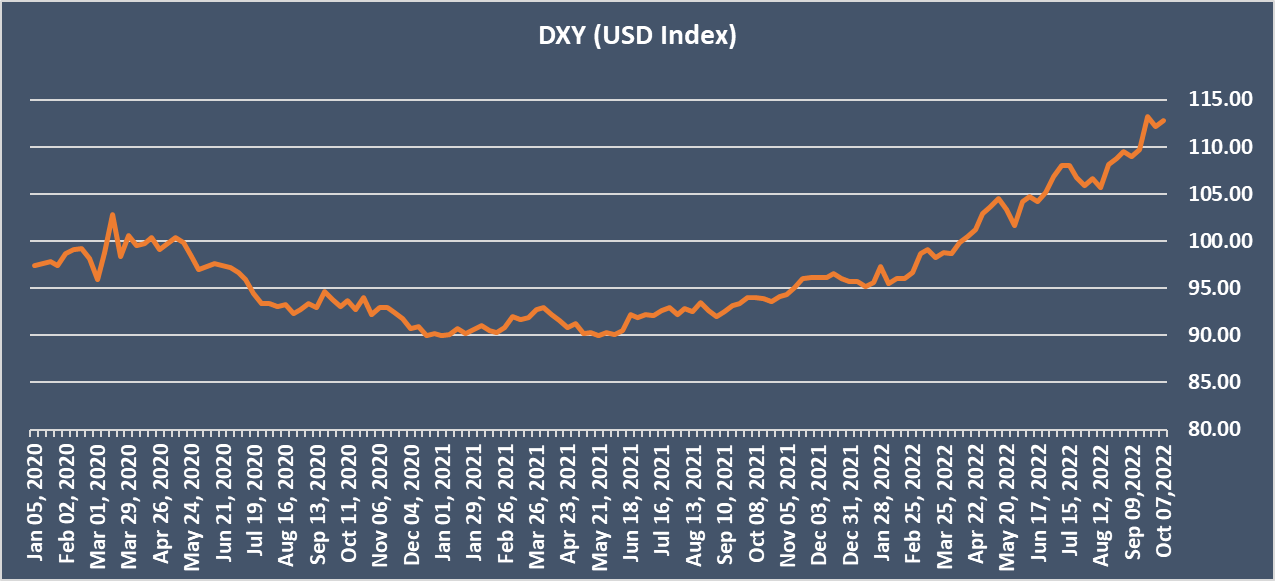

- USD rose during the week ahead of US jobs data, scheduled for Friday.

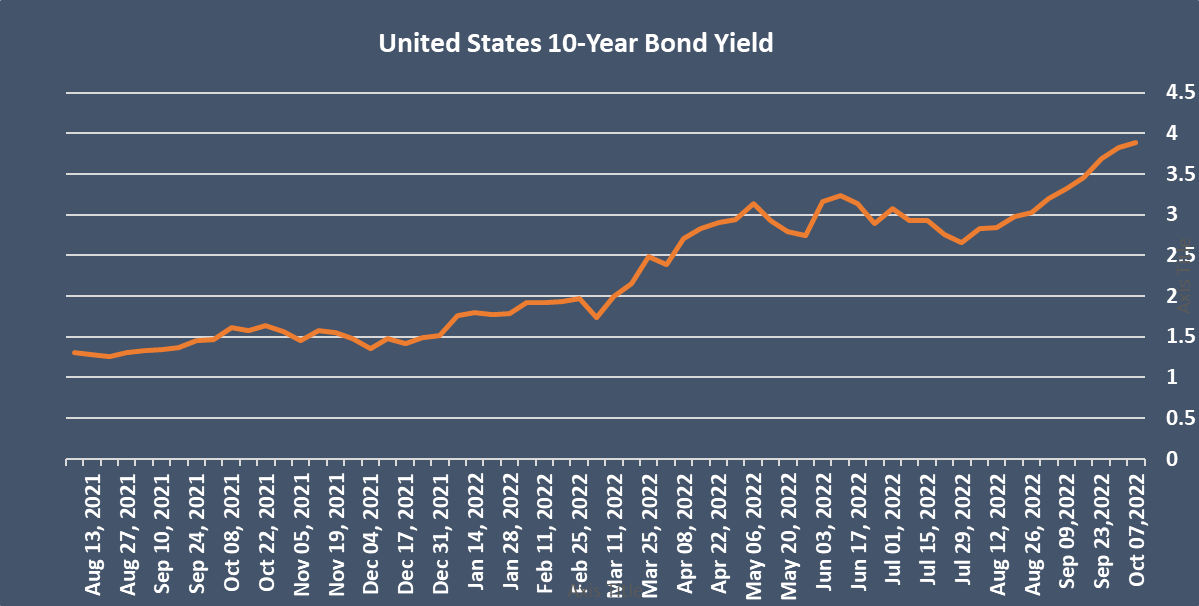

- US job growth slowed moderately in September while the unemployment rate dropped to 3.5%, pointing to a tight labor market that keeps the Fed on its aggressive monetary policy tightening.

- Nonfarm payrolls increased by 263,000 in September from 315,000 in August.

- U.S. unemployment rate fell to 3.5% from 3.7%

- Average hourly earnings rose 0.3%; up 5.0% year-on-year

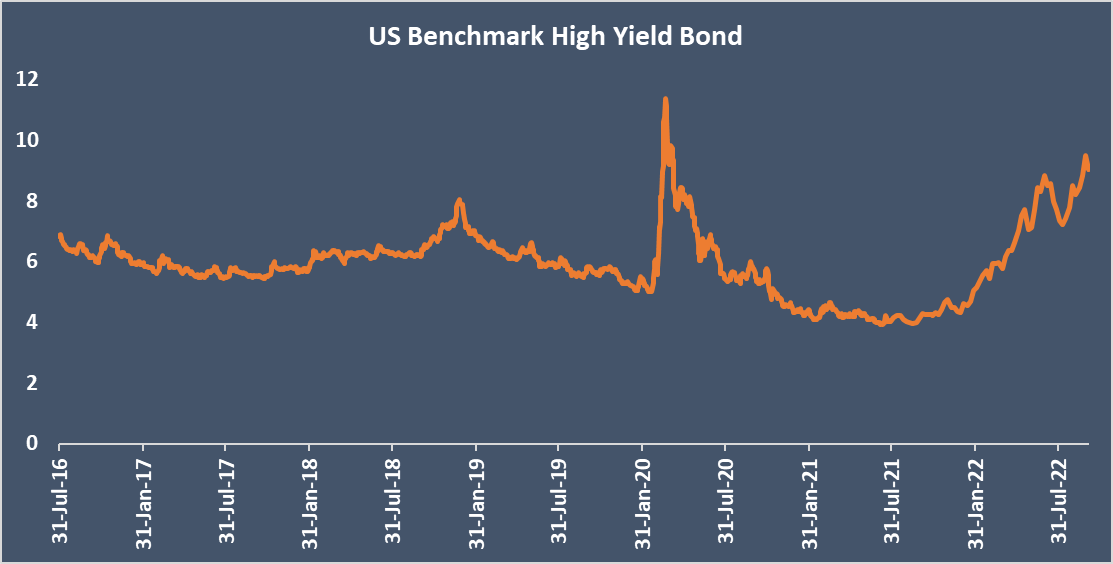

- On Thursday, Fed Governor Christopher Waller had warned that interest rates would keep rising into next year, while Chicago Fed President Charles Evans said that he expects the Fed Funds rate to reach 4.75% before the Fed stops tightening.

- Prices of crude oil settled higher last week after OPEC and its allies agreed to tighten global supply with a deal to cut production targets by 2 million barrels per day, the producers' largest reduction since 2020.

We would love to hear back from you. Please Click here to share your valuable feedback