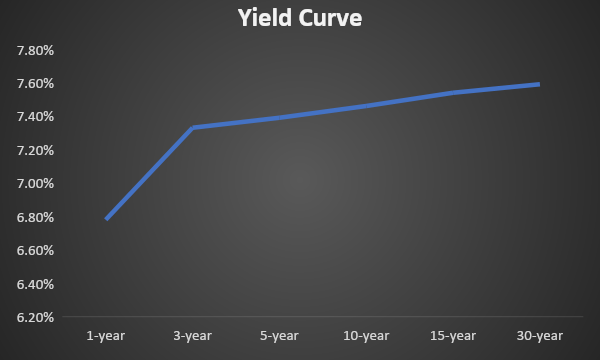

Domestic yield curves are in the path of inversion in the current economic scenario of a liquidity crunch on the back of INR hitting fresh lows. In the last 6 months, 5-year bond yield has sored by 100 bps while 10-year bond yield has moved up by 45 bps. In contrast, 15-year bond yield has only gained 20 bps indicating yield curve inversion. 1-year OIS yield is higher than 5-year OIS yield.

Systemic liquidity has dropped sharply with an inclination towards negative in the last one year as RBI has tightened monetary policy by raising policy rates to combat inflation. Domestic currency has been depreciating sharply driven by global rate hikes and high inflation.

It is expected that the long term rate is likely to stay at current level as RBI to continue rate hikes amid global rate hikes and currency depreciation.

Government bonds, SDL and OIS yield movements

New 10-year benchmark 7.26% 2032 yield rose by 6 bps to 7.46% while 6.54% 2032 yield rose by 5 bps to 7.48%. The 5-year benchmark bond, 6.79% 2027 yield increased by 18 bps to 7.43%. 3-year benchmark 5.22% 2025 yield increased by 14 bps to 7.26%. Long-term paper, 6.99% 2051 yield came down by 1 bp to 7.54%.

The spread of 10-year bond over 5-year bond declined to 3 bps from 15 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread came down to 7 bps from 11 bps while the 30-year benchmark over 10-year benchmark spread declined to 8 bps from 15 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.78% from 7.69% in previous week while spread rose to 33 bps from 31 bps.

On a weekly basis, 1-year OIS yield rose by 16 bps to 7.05% while the 5-year OIS yield increased by 5 bps to 6.97%.

We would love to hear back from you. Please Click here to share your valuable feedback