The outlook for bond yields is higher despite a flat yield curve with inflation running high, INR dropping to record lows, bond supply from centre and states staying high, global risk factors extremely negative. G-sec yields will move higher to reflect higher risk premium.

India’s consumer inflation peaked to 5-month high at 7.41% in Sep 22 from 7% in previous month which is still above the upper band of inflation (6%) set by the RBI. During the month, food inflation rose to 8.60% from 7.62% in the previous month.

India’s wholesale price inflation cooled slightly in September to 10.7% year on year. This was down from 12.4% the previous month and was below the 11.5% forecast.

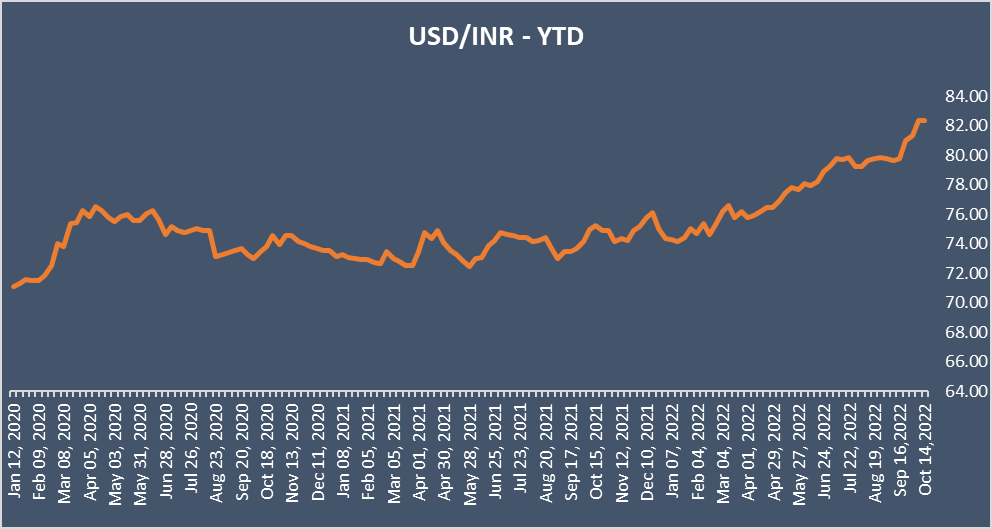

Owing to high inflation and global rate hikes, domestic currency has depreciated significantly in the past 1 year to Rs 82.42 per USD, although the central bank has sold USD and raised policy rate. Going ahead, in the wake of global rate hike and rupee depreciation, RBI is expected to continue rate hikes.

In the second half of fiscal year 2022-23, the Union Government will borrow Rs 5760 billion, which is 38.53% of the total budgeted borrowing of Rs 14950 billion for the full fiscal year. During FY23, GoI has borrowed Rs 8540 as gross amount from the market.

Driven by tight monetary policy by the RBI, systemic liquidity has declined sharply to deficit in the last one year. As of 13th October 2022, systemic liquidity stood at a deficit of 25.59 billion as compared to Rs 7644 billion of surplus as of 13th Oct 2021. The liquidity crunch has led to inversion of the g-sec yield curve.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield rose by 1 bp to 7.47% while 6.54% 2032 yield rose by 3 bps to 7.51%. The 5-year benchmark bond, 6.79% 2027 yield came down by 1 bp to 7.42%. 3-year benchmark 5.22% 2025 yield increased by 6 bps to 7.32%. Long-term paper, 6.99% 2051 yield rose by 8 bps to 7.62%. 40-year paper, 7.40% 2062 yield stood at 7.60%.

The spread of 10-year bond over 5-year bond rose to 5 bps from 3 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread rose to 10 bps from 7 bps while the 30-year benchmark over 10-year benchmark spread increased to 15 bps from 8 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.85% from 7.78% in previous week while spread rose to 39 bps from 33 bps.

On a weekly basis, 1-year OIS yield rose by 9 bps 7.14% while the 5-year OIS yield increased by 6 bps to 7.03%.

We would love to hear back from you. Please Click here to share your valuable feedback