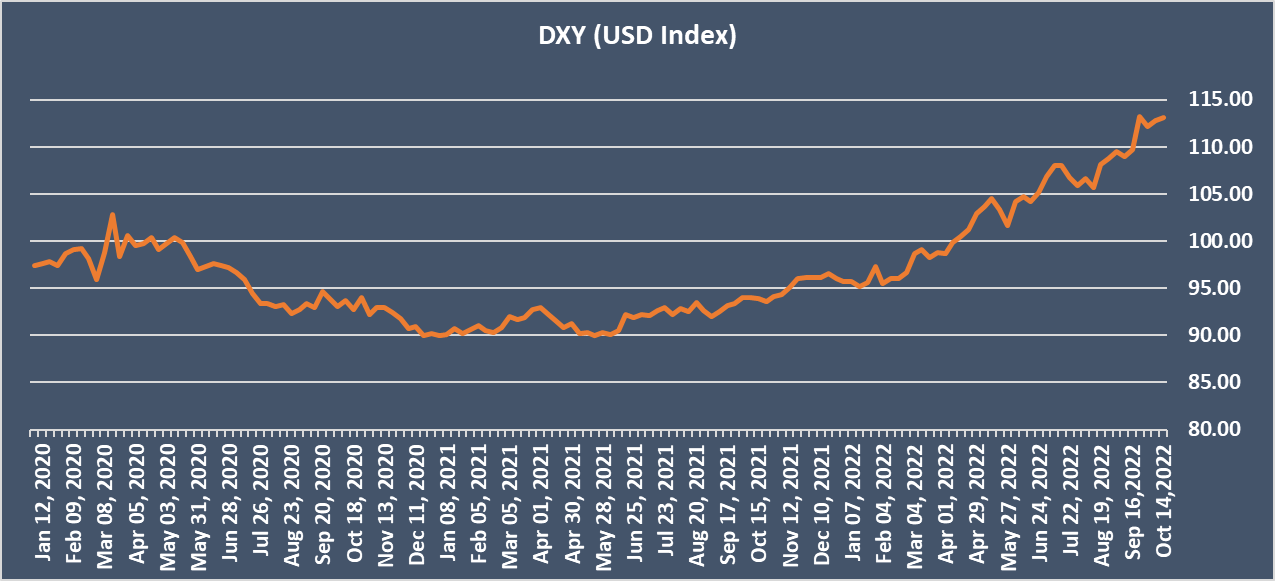

- USD is rallying higher across the board in risk-off trade, reflected in a steep selloff in the equity markets.

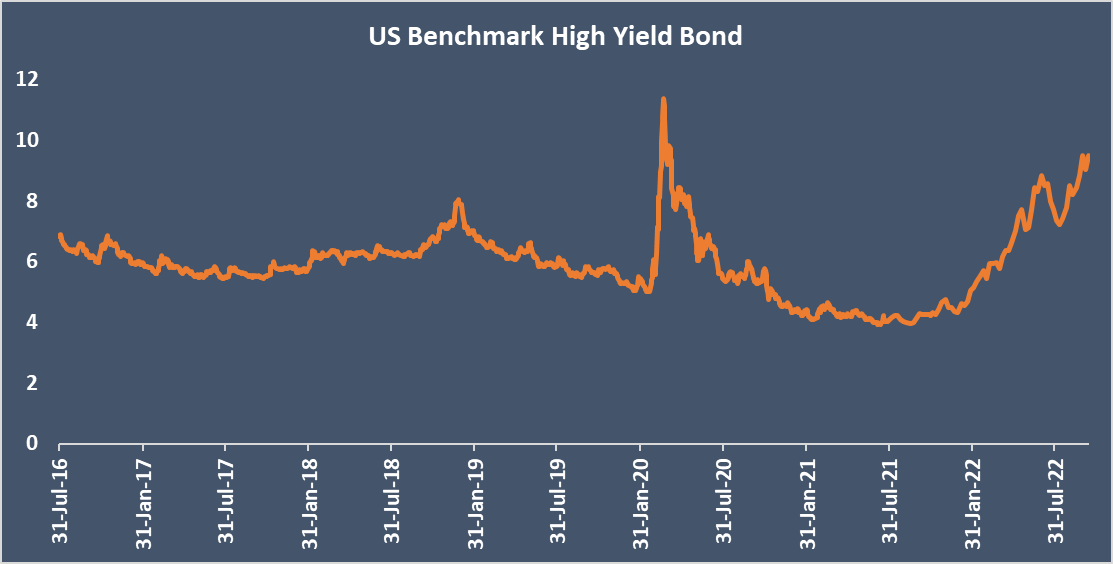

- US consumer prices eased by less than forecast to 8.2% year on year, down from 8.5% in August but above the expectation of 8.1%.

- US core inflation rose 6.6% annually, up from 6.3% and above expectations of 6.5%.

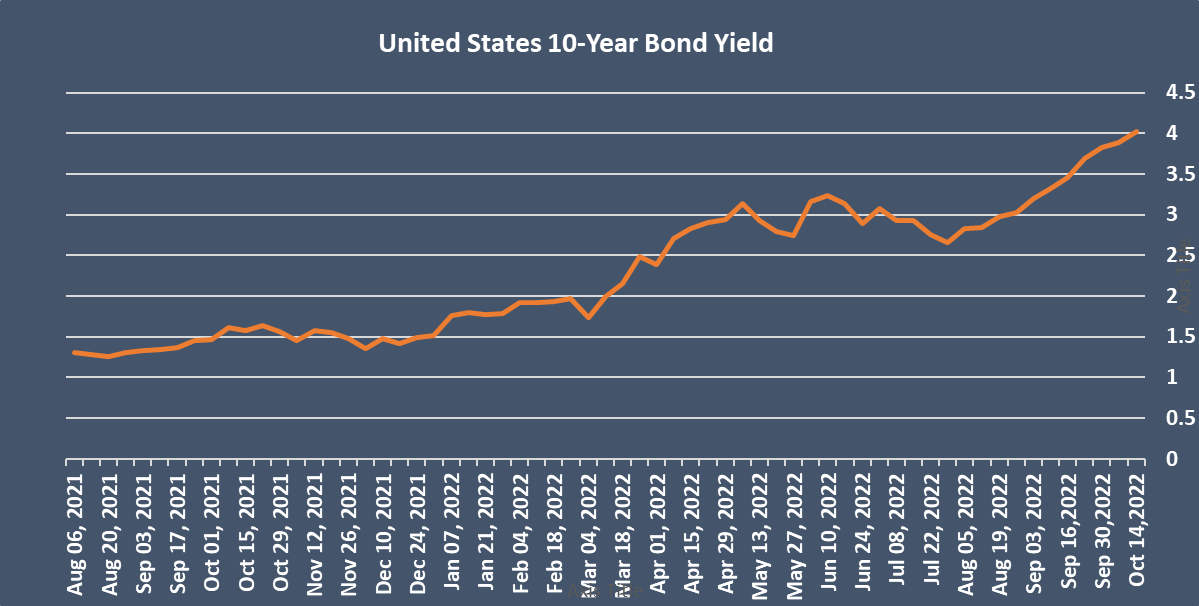

- The yield on the 10-year UST rose to 4.002% last week, topping the key 4% level. The 2-year Treasury yield rose six basis points to 4.509%, after having risen to levels last seen in August 2007 on Thursday.

- US retail sales were worse than expected. The data showed that sales stalled at 0% month on month in September, down from 0.4% in August. The weaker sales indicate that the US consumer, who has been incredibly resilient across the year is starting to feel the impact of rising prices.

- US consumer confidence rose by more than expected to 59.8, up from 58.6 and ahead of forecasts of 59.

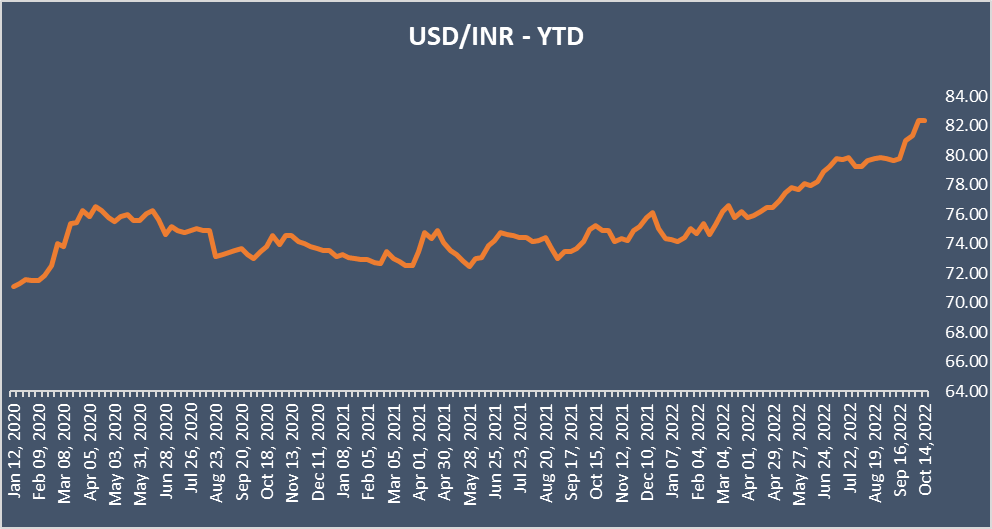

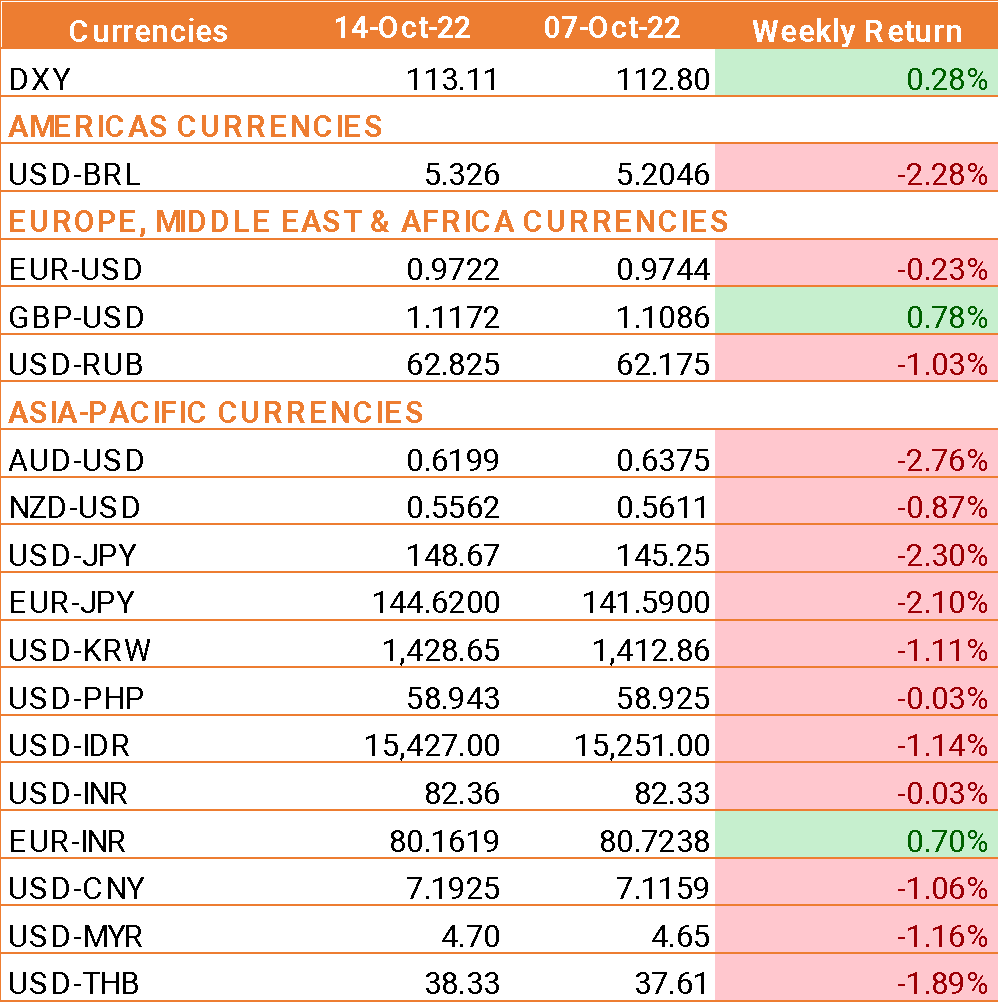

- INR ended lower amid broad USD strength and CPI inflation coming at 7.41% in September higher than the 7% seen in August and higher than the expectation of 7.30%.

- India’s wholesale price inflation cooled slightly in September to 10.7% year on year. This was down from 12.4% the previous month and was below the 11.5% forecast.

We would love to hear back from you. Please Click here to share your valuable feedback