Uptrend in consumer in inflation

Despite previous rate hikes by RBI, consumer inflation remained at an elevated level which has become the major concern for the central bank. Consumer inflation rose to 7.41% in Sep 22 from 7% in the previous month.

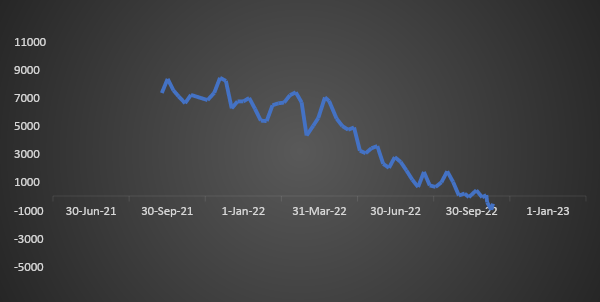

Deficit in system liquidity

Driven by tight monetary policy by the RBI and USD sales, systemic liquidity has declined sharply to deficit in the last one year. As of 27th October 2022, systemic liquidity stood at a deficit of Rs 849 billion as compared to Rs 7644 billion of surplus as of 13th Oct 2021. As RBI continues to sell USD to protect domestic currency, system liquidity is likely to remain in deficit zone in near future.

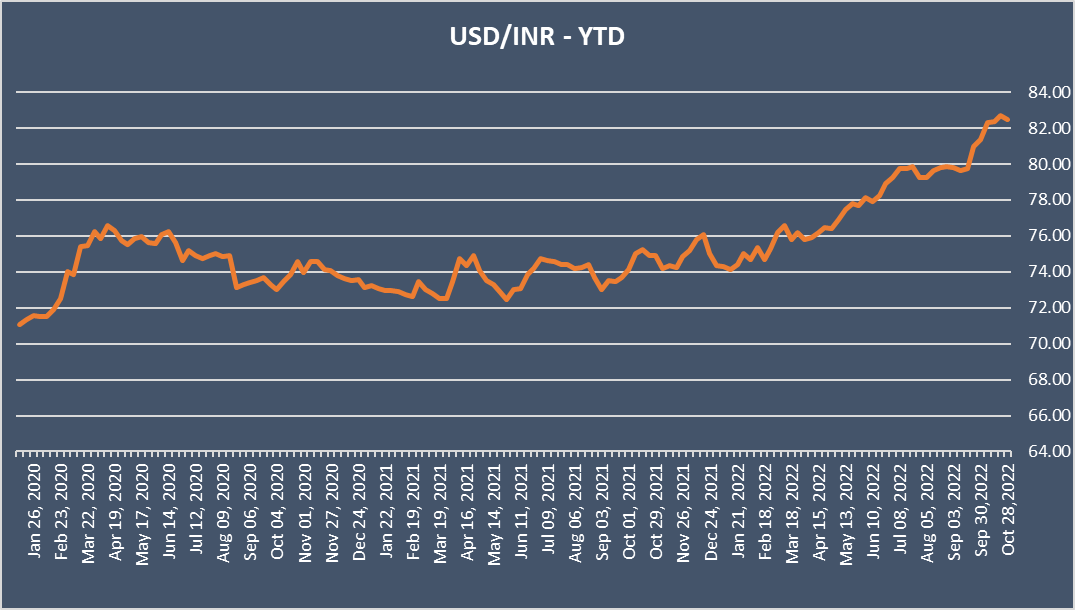

Sharp depreciation in rupee

In the current scenario of high inflation and global rate hikes, Indian currency depreciated significantly despite RBI’s policy rate hikes. Since last one year, USD INR exchange rate soared to Rs 82.29 from Rs 73.69. It is expected the central bank will continue buying Indian rupee and selling of USD to protect domestic currency value.

Global rate hikes

In forthcoming US Fed meeting, 75 bps fund rate hike is on cards for a fourth consecutive time as inflation pressure intensifies. US consumer prices eased by less than forecast to 8.2% year on year, down from 8.5% in August but above the expectation of 8.1%.

In its last meeting, ECB hiked rate by 75 bps to 1.5% with indication of further rate hikes. Since July 2022, ECB has hiked rates by 150 bps.

Possible rate hike by RBI

RBI is expected to follow the footsteps of the US Fed indication of further rate hikes. If US Fed takes aggressive stands on future rate hikes, RBI is likely to hike rate by 75 bps. Otherwise, a smooth transition rate hike may be possible with 40 to 50 bps.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield declined by 9 bps to 7.42% while 6.54% 2032 yield came down by 9 bps to 7.45%. The 5-year benchmark bond, 6.79% 2027 yield decreased by 10 bps to 7.38%. 3-year benchmark 5.22% 2025 yield decreased by 20 bps to 7.04%. Long-term paper, 6.99% 2051 yield lost 11 bps to 7.53%. 40-year paper, 7.40% 2062 yield decreased by 14 bps to 7.50%.

The spread of 10-year bond over 5-year bond rose to 4 bps from 3 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread rose to 8 bps from 7 bps while the 30-year benchmark over 10-year benchmark spread decreased to 11 bps from 13 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.84% from 7.74% in previous week while spread increased to 40 bps from 32 bps.

On a weekly basis, 1-year OIS yield declined by 12 bps 6.95% while the 5-year OIS yield decreased by 22 bps to 6.85%.

We would love to hear back from you. Please Click here to share your valuable feedback