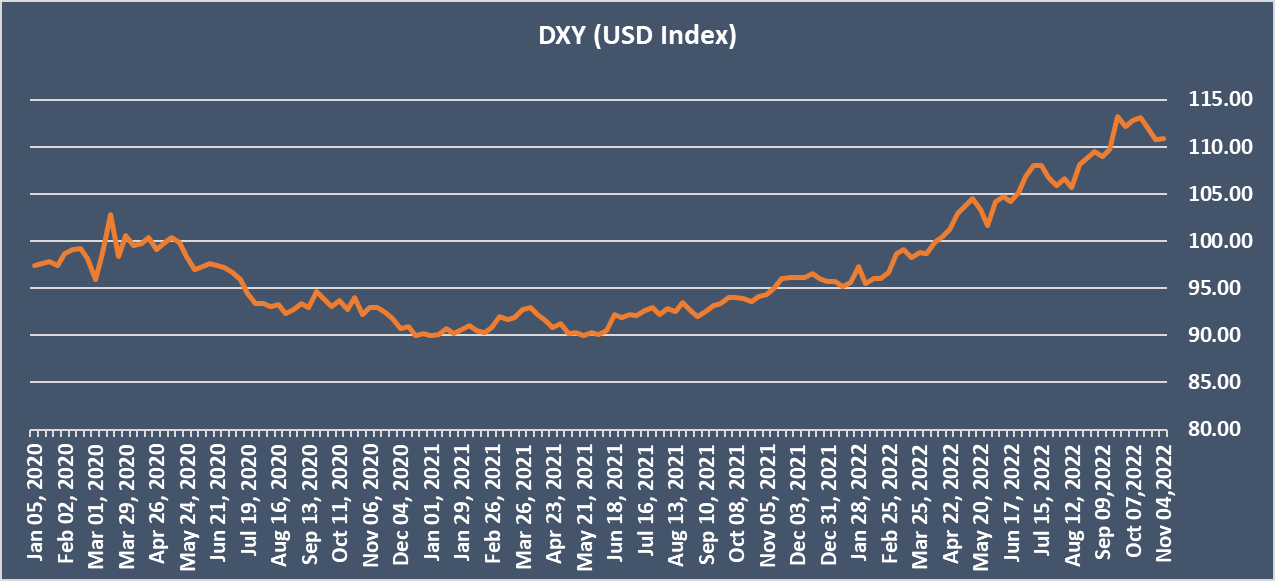

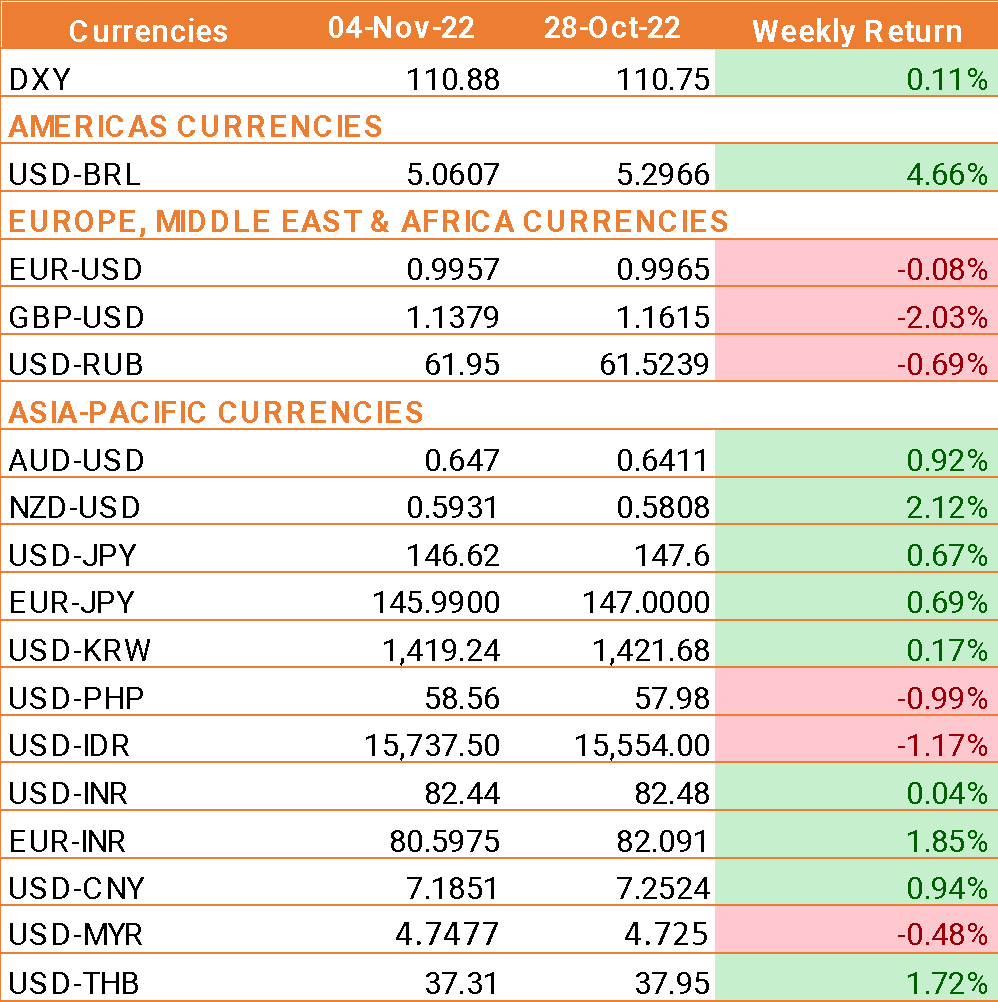

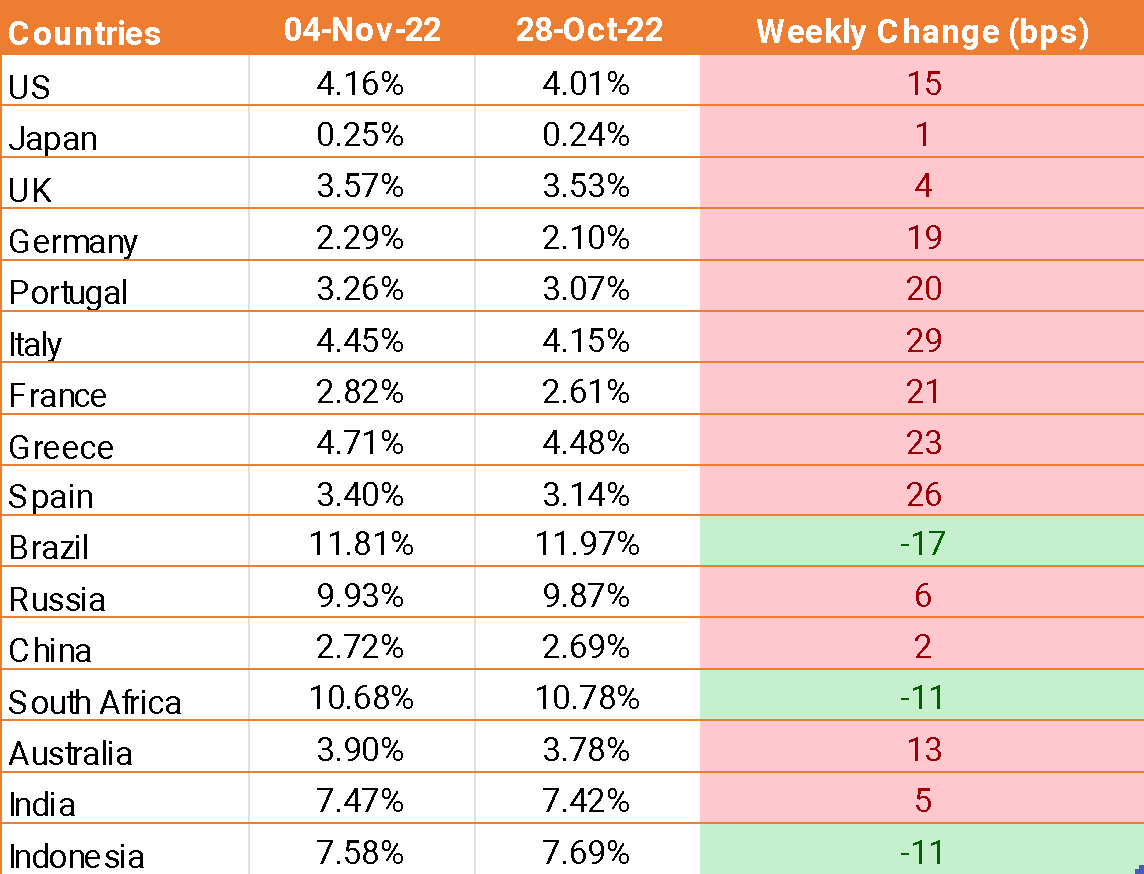

- USD ended higher last week after the fed raised interest rates by 75 bps. The statement released had a dovish lean, suggesting that the fed was nearing the final phase of its rate hiking cycle.

- However, in his speech, Federal Chair Jerome Powell warned that interest rates would need to rise higher than initially projected. He said that it was far too early to be discussing any dovish pivot. Expectations are now for a rate increase of 50 basis points in the December meeting and for the Fed terminal rate to arrive at 5%, up from 4.5%.

- US nonfarm payrolls rose by 261,000 in October. This reading came in much higher than the market expectation of 200,000. Additionally, September's reading got revised higher to 315,000 from 263,000.

- The unemployment rate edged higher to 3.7% from 3.5% and the annual wage inflation, as measured by the average hourly earnings, declined to 4.7% from 5%.

- Bank of England on Thursday announced its biggest interest rate hike of 75 bps since 1989 to fight rising inflation that it warned was pushing Britain into a recession set to last until mid-2024.

- INR strengthened on Friday as the market mood improved as major central banks adopted a less hawkish approach to monetary policy.

- Separately oil prices fell 1% after weaker-than-expected Chinese manufacturing data raised concerns over the economic recovery in the world’s largest oil importer.

- India services PMI rose to 55.1 in October up from 54.3 in September, a six-month low and easily beating expectations for 54.6.

We would love to hear back from you. Please Click here to share your valuable feedback