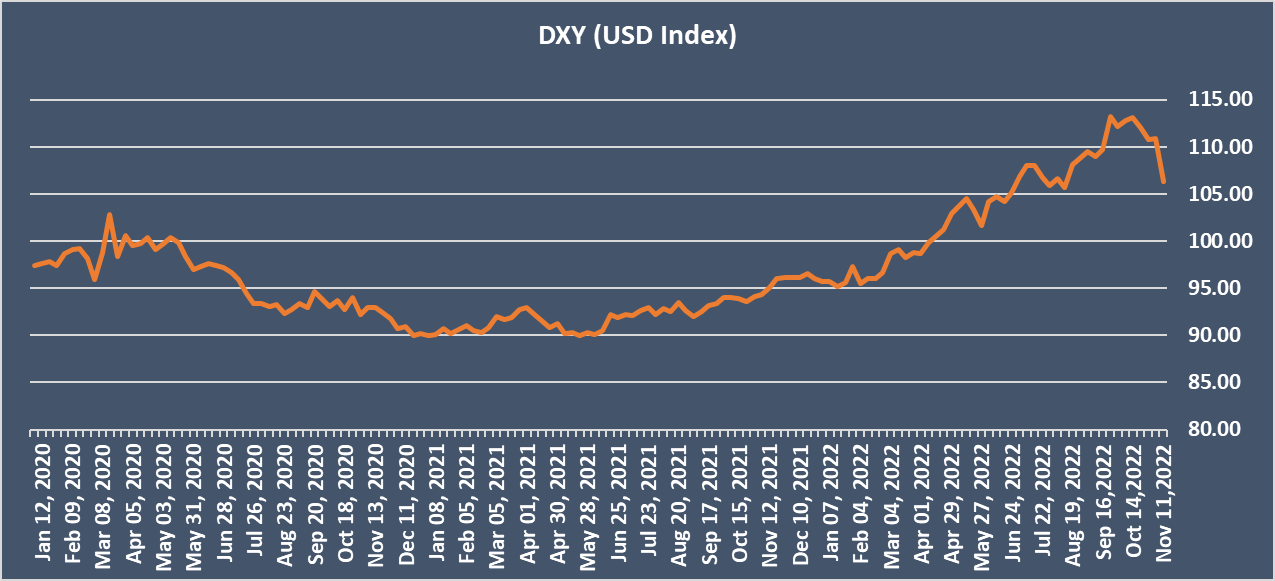

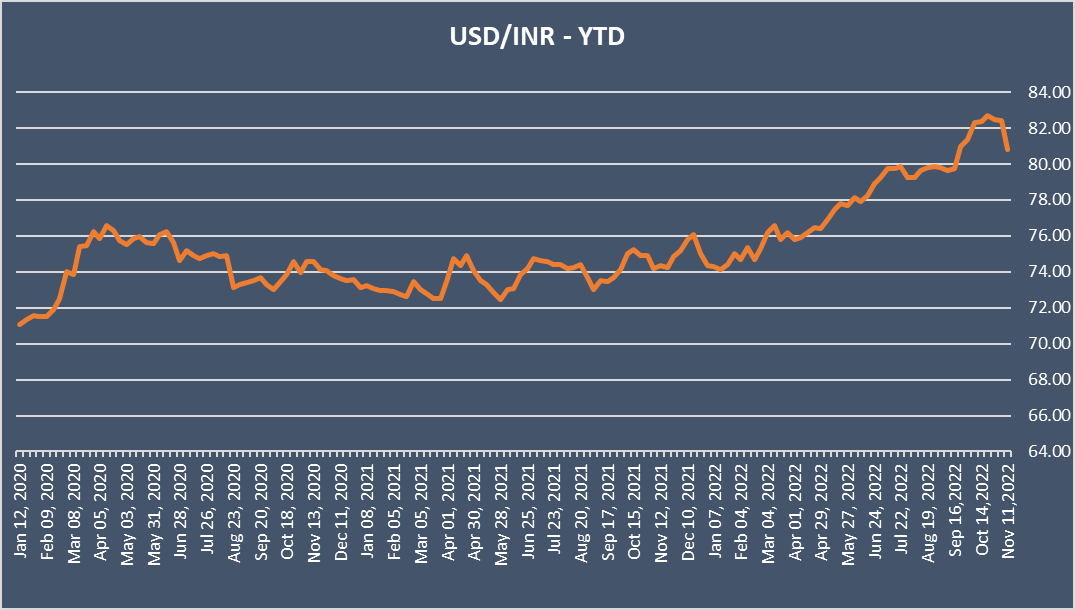

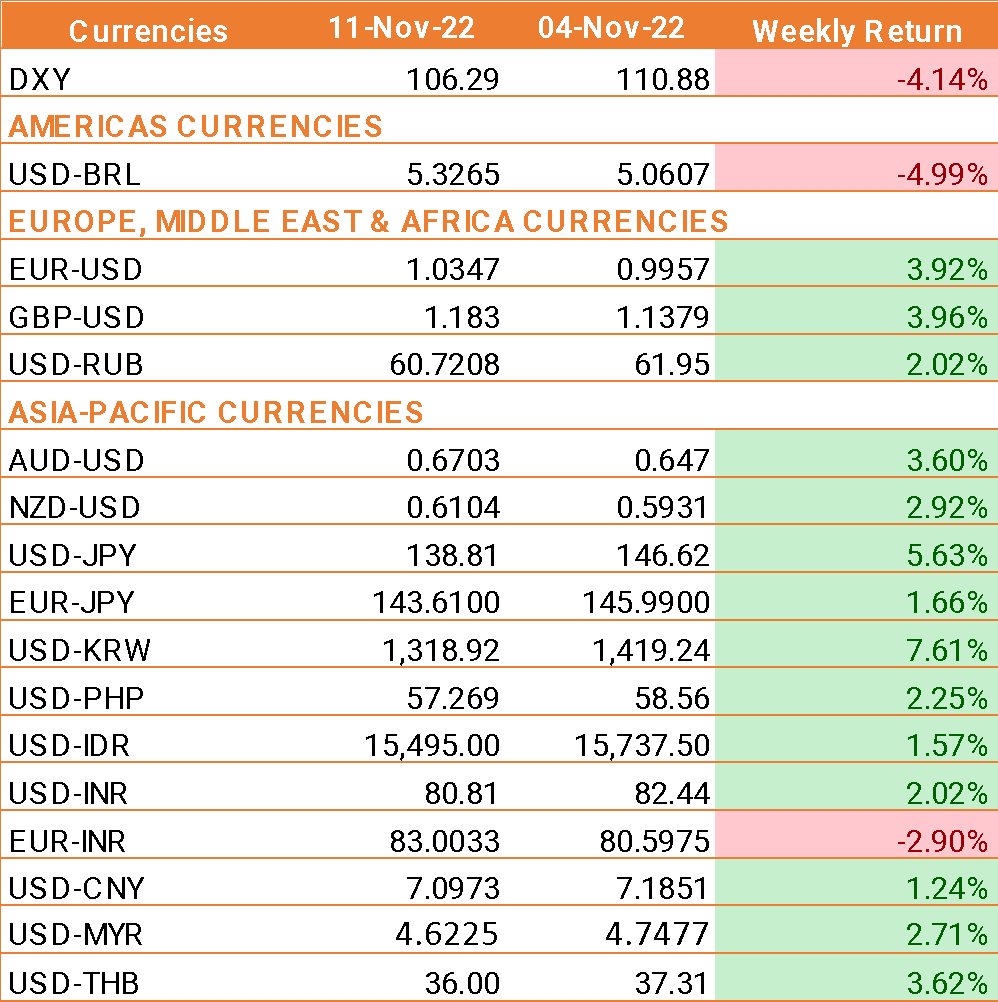

- USD ended sharply lower last week after US inflation data came in below expectations.

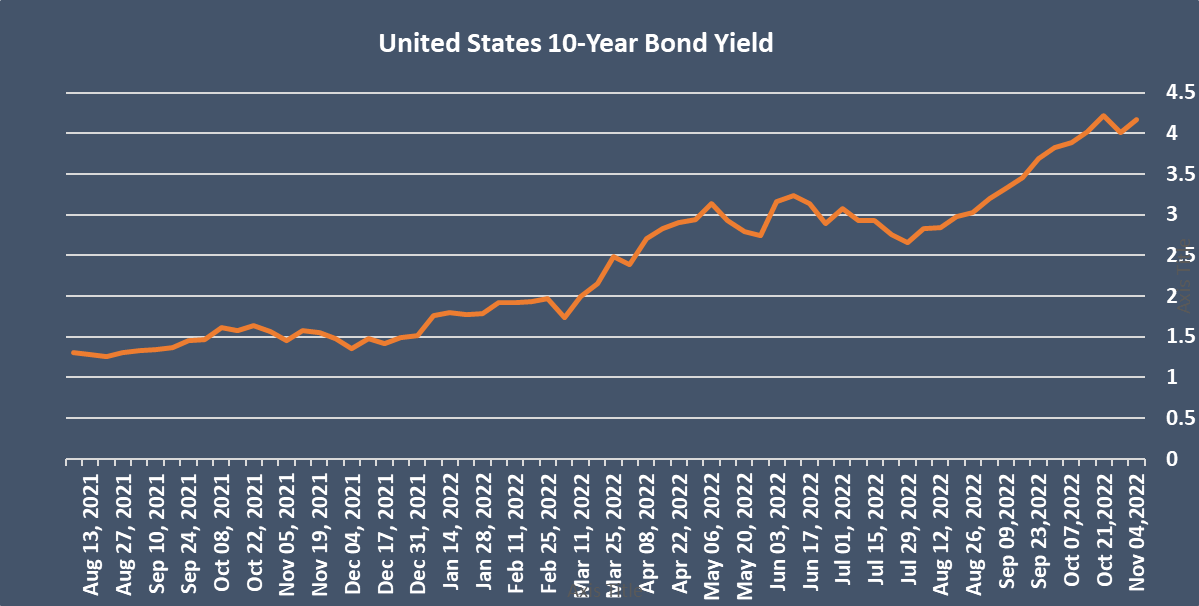

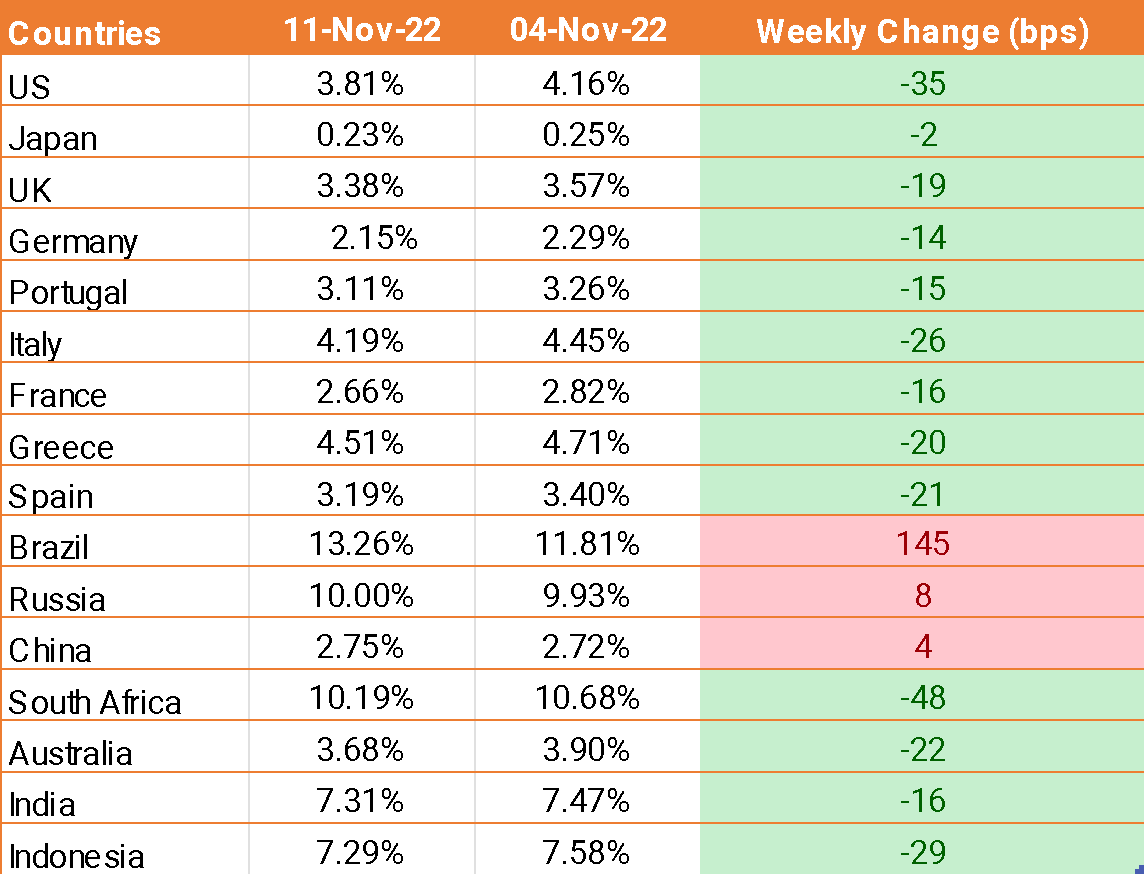

- US 2- and 10-year treasury yields posted their biggest single-day fall on Friday in over a decade.

- US CPI inflation eased to 7.7% year on year in October, down from 8.2% in September and 9.1% in August.

- U.S. core inflation which strips out volatile items such as food and fuel, also fell from 6.6% in September, a 40-year high, to 6.3% against the expectation of 6.5%.

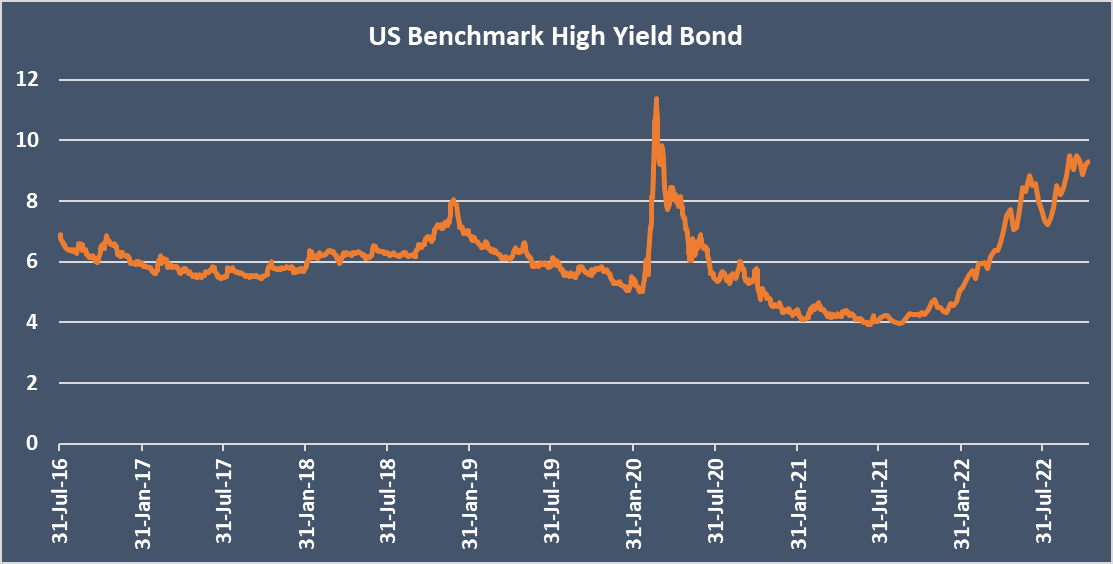

- Bigger-than-expected decline in inflation has promoted bets that the Fed could adopt a less aggressive approach to rate hikes. The market now expects a 50-bps hike from the Fed in December.

- Dallas Fed President Lorie Logan, San Francisco Fed President Mary Daly, and Fed President of Philadelphia Patrick Harker indicated that a slower pace of hikes could be appropriate.

- U.S. Michigan consumer confidence fell by more than expected to 54.7 in November, down from 59.9 in October.

- U.S. jobless claims also rose by more than expected. Claims rose by 225,000, ahead of the 220,000 expectation and up from 218,000 in the previous week. The data suggests that some weaknesses could be seeping into the labour market.

- INR rallied last week on the back of the weakening USD and on the expectation that retail inflation could come at 6.73%

We would love to hear back from you. Please Click here to share your valuable feedback