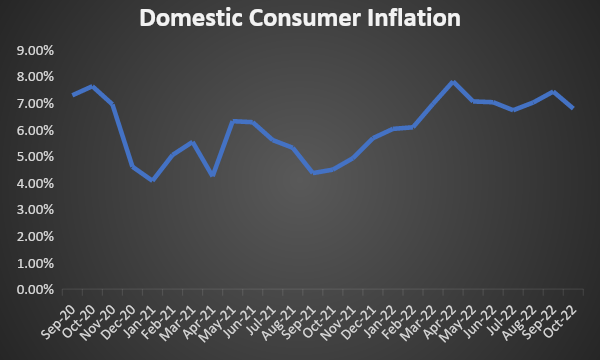

Ease in domestic Inflation

India’s consumer inflation came down to 6.77% in Oct 22 from 7.41% in the previous month. Core inflation remained in the range of 5.9% to 6.30% during the month. In the same line, the wholesale inflation rate declined to 8.39% in October from 10.7% in the previous month.

Although consumer inflation mitigated during last month, it is still above the upper band of inflation rate of 6% as fixed by RBI. Therefore, policy rate hike on cards in forthcoming RBI MPC meeting.

Sharp fall in System Liquidity

As of 17th November 2022, systemic liquidity stood at a surplus of Rs 975 billion as compared to Rs 7980 billion of surplus as of 1st Nov 2021. The liquidity crunch has led to inversion of the g-sec yield curve. As RBI is continuing absorption of excess liquidity with hawkish stance on monetary policy, system liquidity to maintain downtrend.

Ease in US inflation

Although US inflation mitigated to 7.7% in October from 8.2% in previous month, it is still much higher than the target average inflation of 2% as set by the US Fed. Therefore, US Fed will continue to hike fund rate with a slower place as inflation eases

Considering the above factors, g-sec yields will continue to stay high despite a temporary fall driven by decline in consumer inflation.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield stood unchanged at 7.31% while 6.54% 2032 yield rose by 1 bp to 7.35%. The 5-year benchmark bond, 6.79% 2027 yield increased by 2 bps to 7.19%. 3-year benchmark 5.22% 2025 yield increased by 2 bps to 7.09%. Long-term paper, 6.99% 2051 yield decreased by 5 bps to 7.43%. 40-year paper, 7.40% 2062 yield decreased by 6 bps to 7.43%.

The spread of 10-year bond over 5-year bond came down to 11 bps from 14 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread stood unchanged at 13 bps while the 30-year benchmark over 10-year benchmark spread decreased to 12 bps from 17 bps on a weekly basis.

Average 10-year SDL auction cut-off declined to 7.68% from 7.83% in previous week while spread increased to 46 bps from 40 bps.

On a weekly basis, 1-year OIS yield remained unchanged at 6.69% while the 5-year OIS yield decreased by 9 bps to 6.42%.

We would love to hear back from you. Please Click here to share your valuable feedback