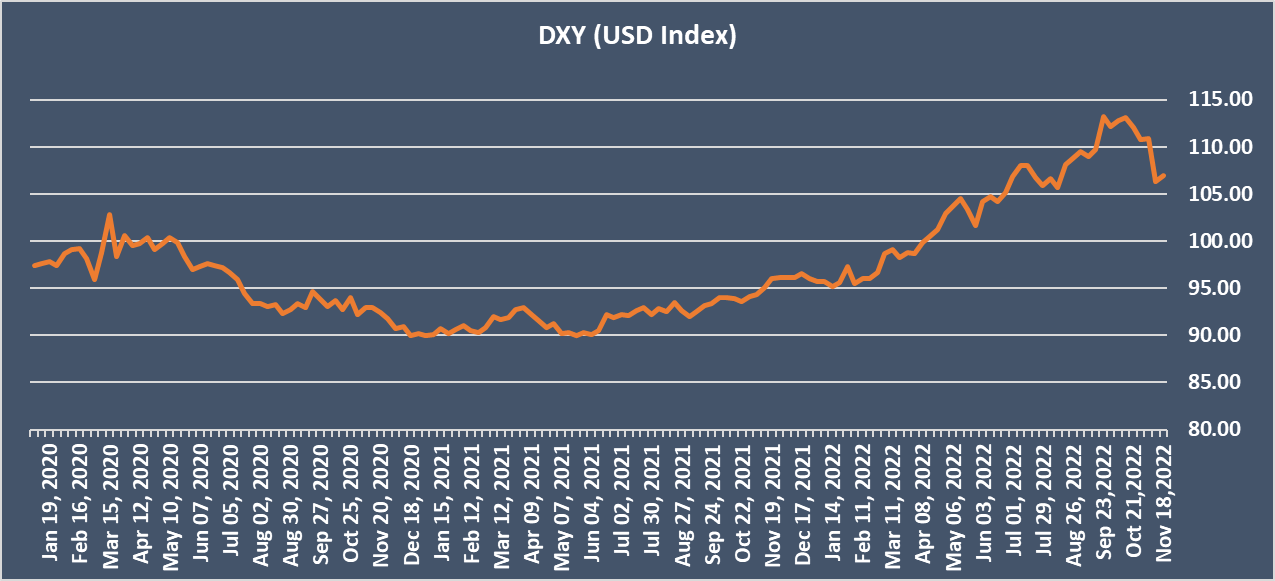

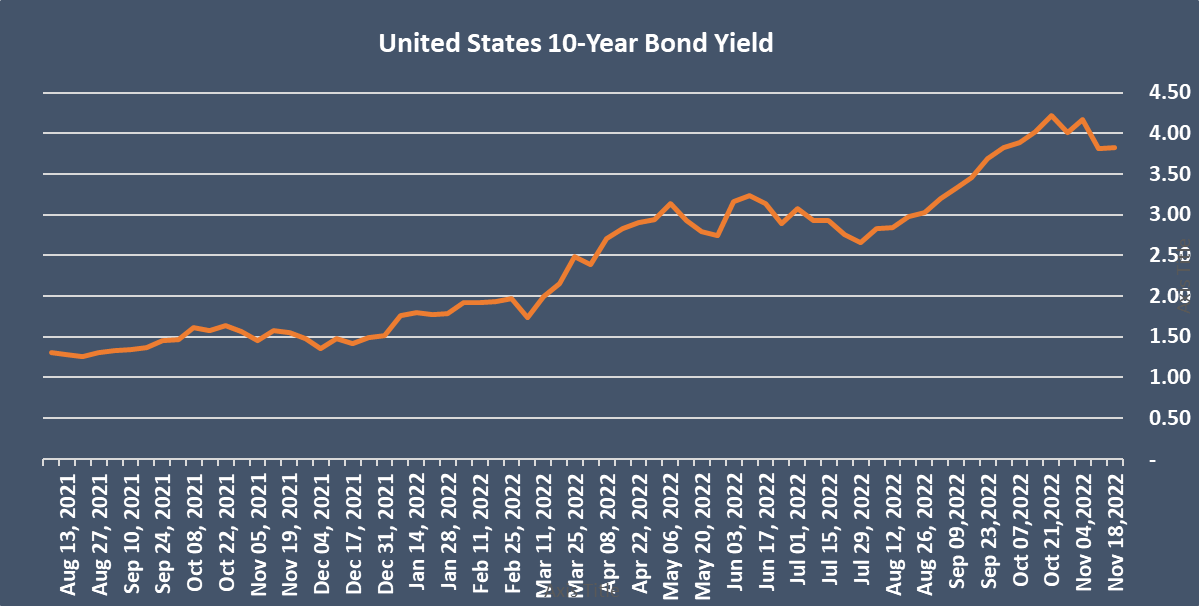

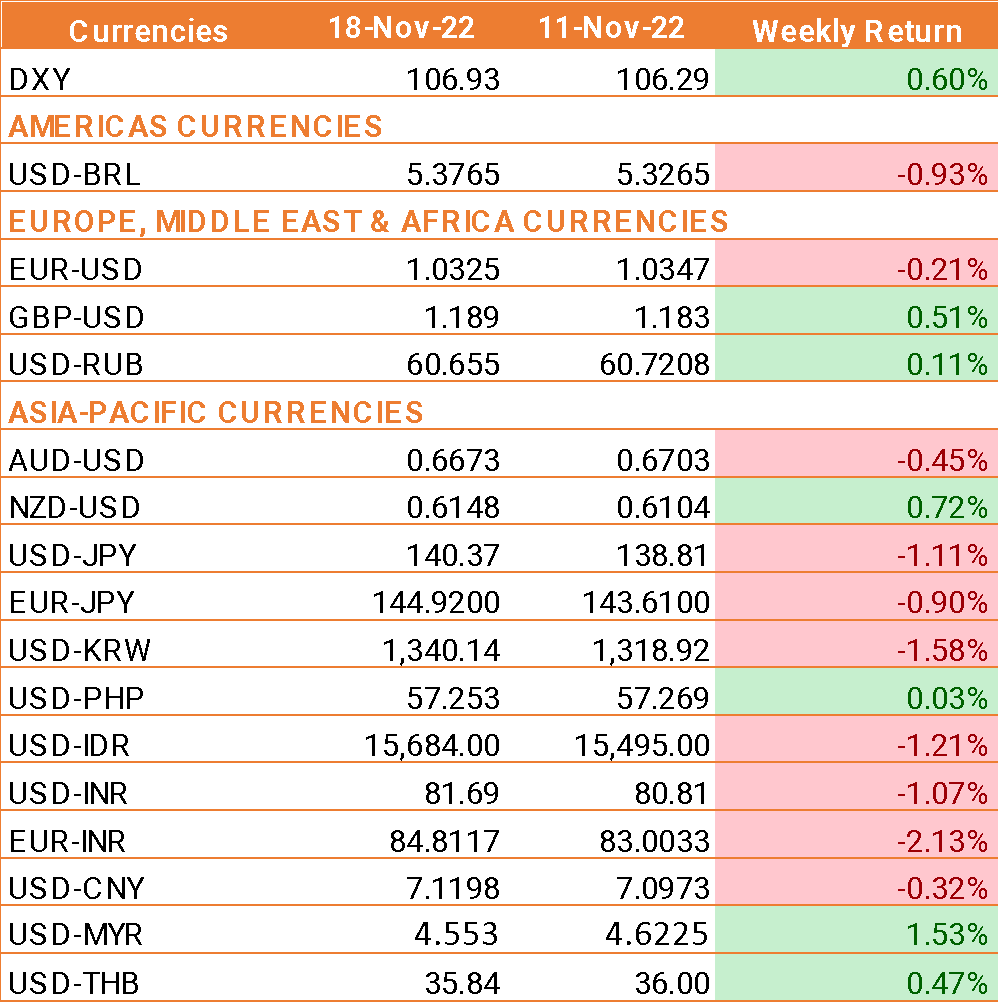

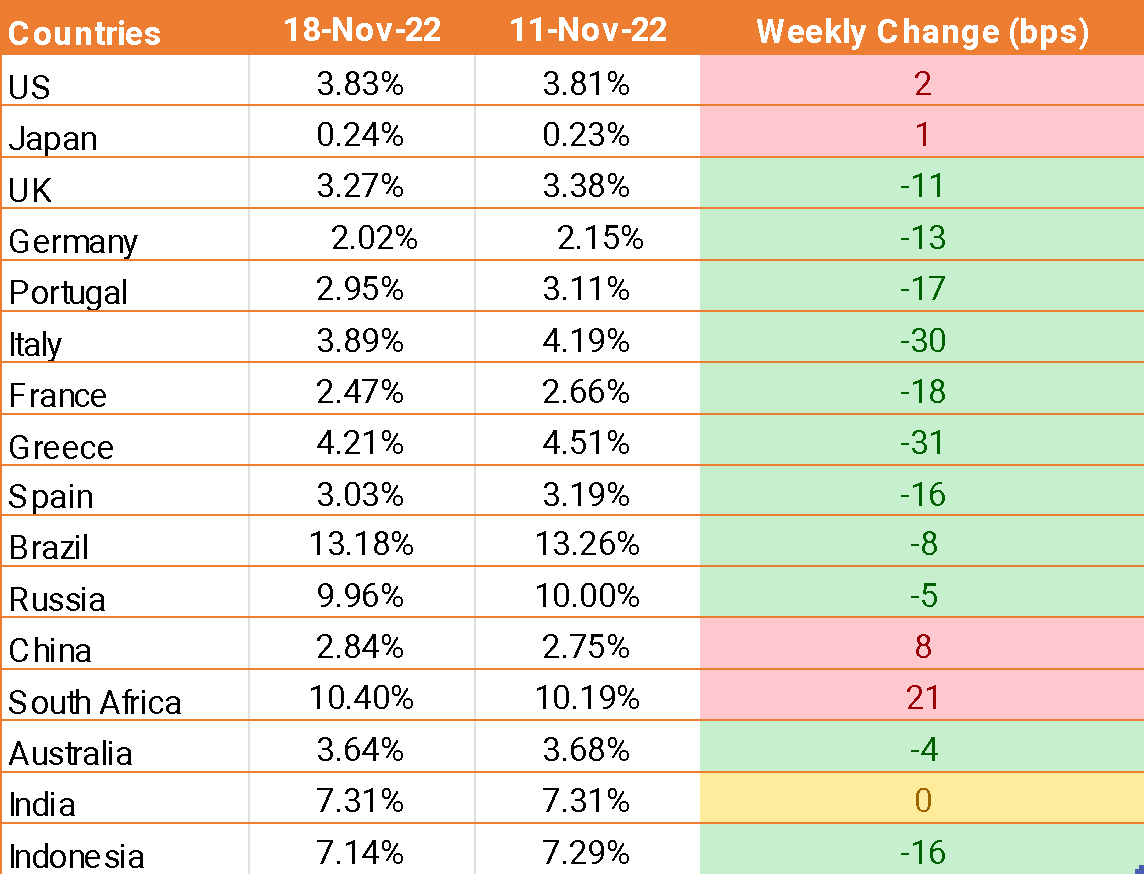

- USD traded higher last week as investors eyed rising bond yields and continued to make bets on the U.S. Federal Reserve's interest rate hiking path.

- On Thursday, market participants reacted to hawkish policymaker comments with St. Louis Fed President James Bullard saying that even under a "generous" analysis of monetary policy, the Fed needs to keep raising rates as its tightening so far "had only limited effects on observed inflation."

- Fed President Neel Kashkari said that the central bank shouldn’t stop hiking rates until it was clear that inflation had peaked.

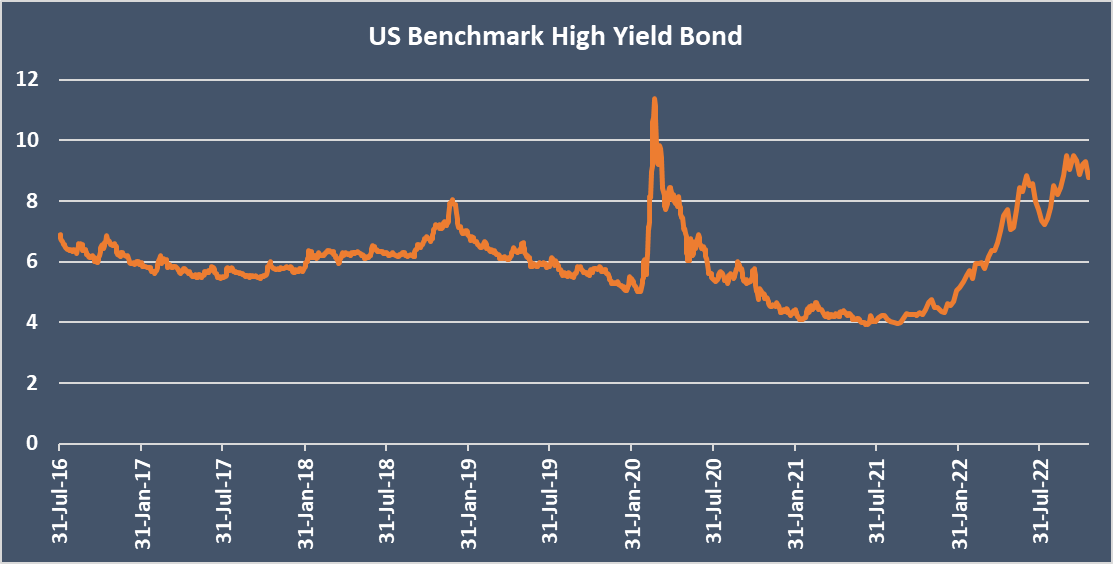

- In the early part of the week, USD was under pressure amid growing signs that US inflation is starting to slow. Last week both headline and core CPI fell, and this week wholesale inflation (PPI) also fell by more than expected.

- US PPI was reported at 8% in Oct, against the expectation of 8.3% and lower than the previous reading of 8.4% in Sep.

- US retail sales were reported at 8.37% in Oct, lower than the previous reading of 8.59% in September.

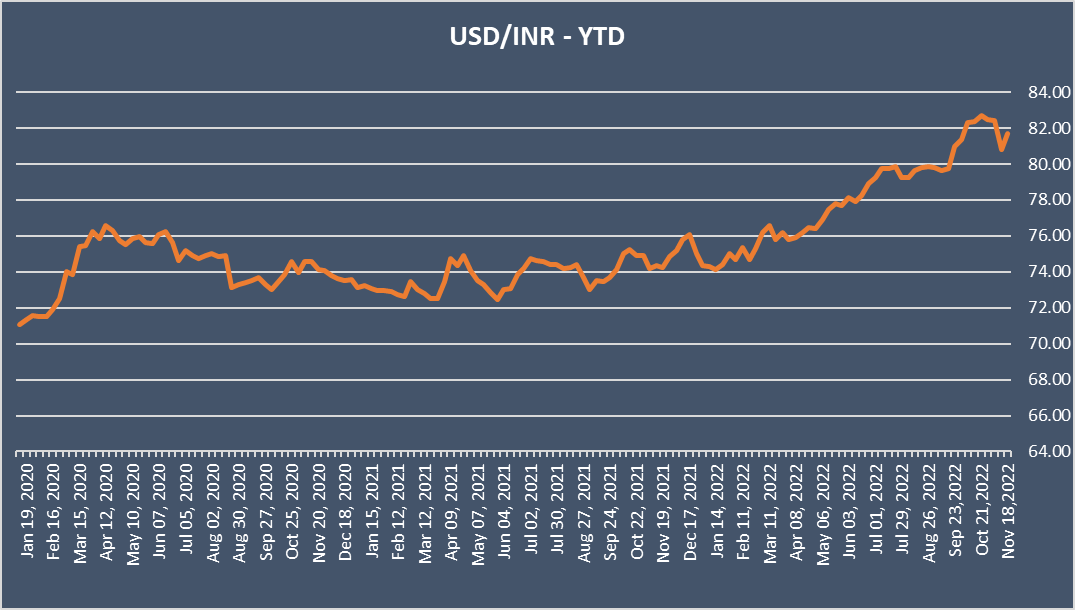

- INR traded lower last week amid strong USD demand.

- India’s trade deficit widened in October to USD 26.91 billion from USD 25.71 billion in the previous month.

- Exports fell to USD 29.78 billion from USD 35.45 billion, while imports declined to USD 56.69 billion from USD 61.16 billion.

We would love to hear back from you. Please Click here to share your valuable feedback