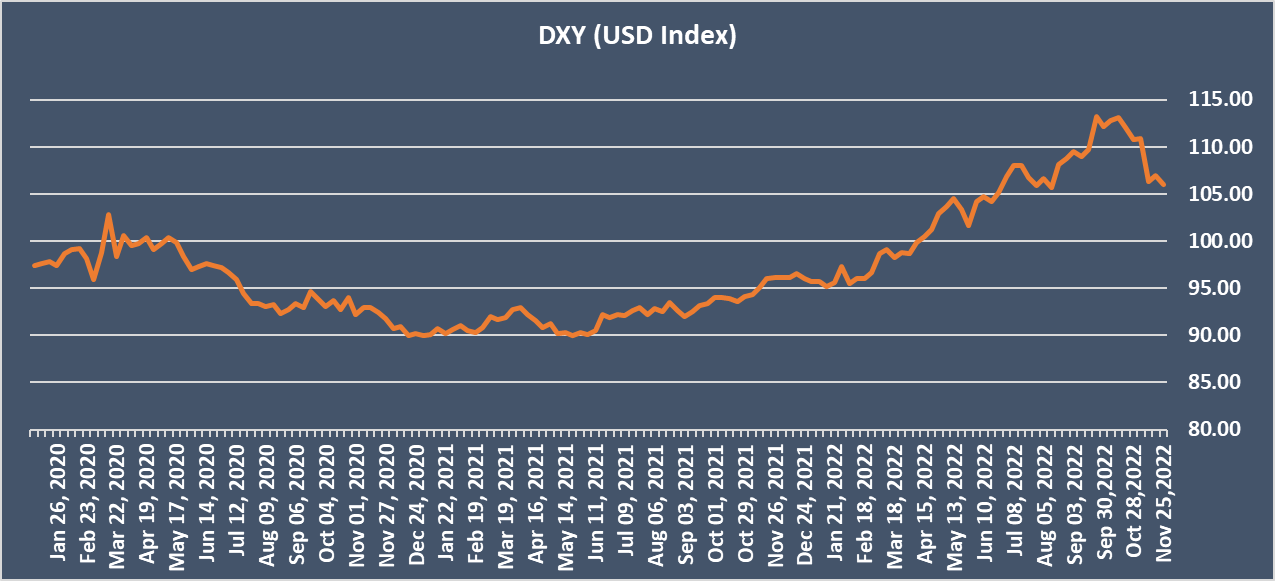

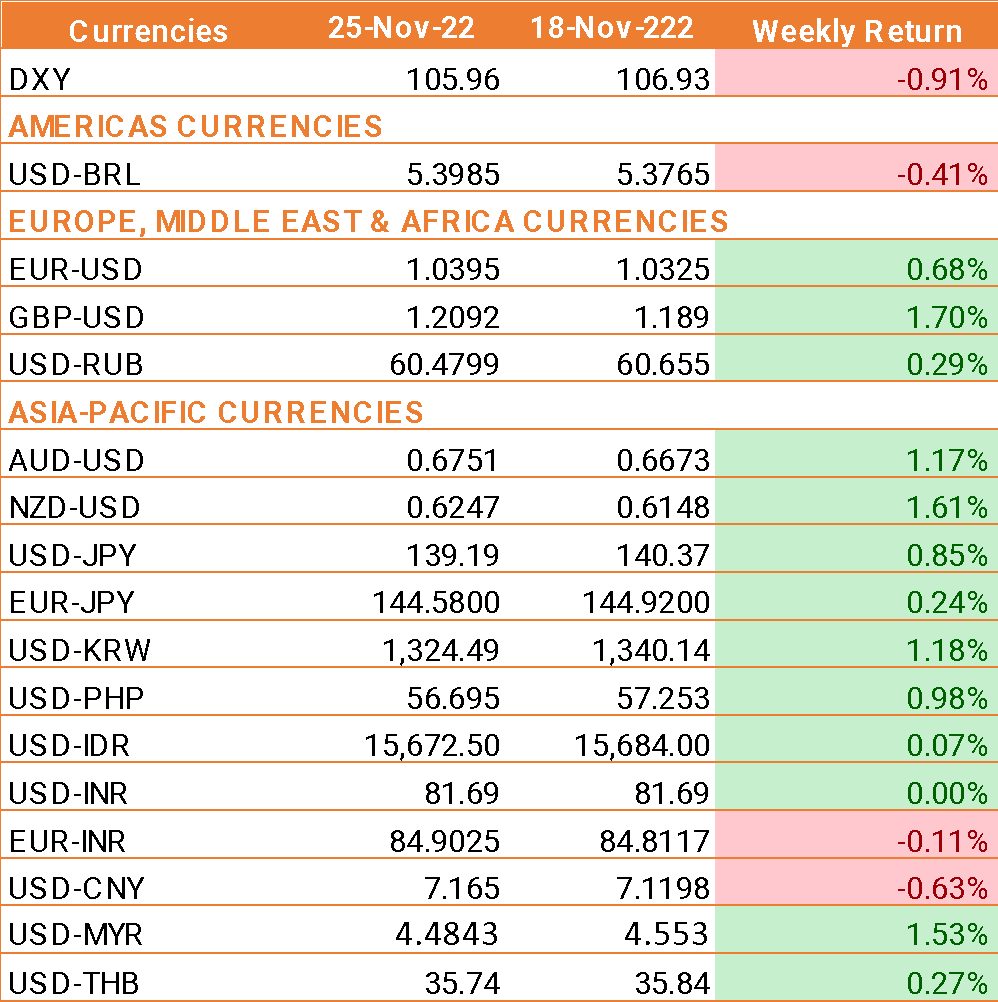

- USD traded under pressure last week following the dovish FOMC minutes released on Wednesday.

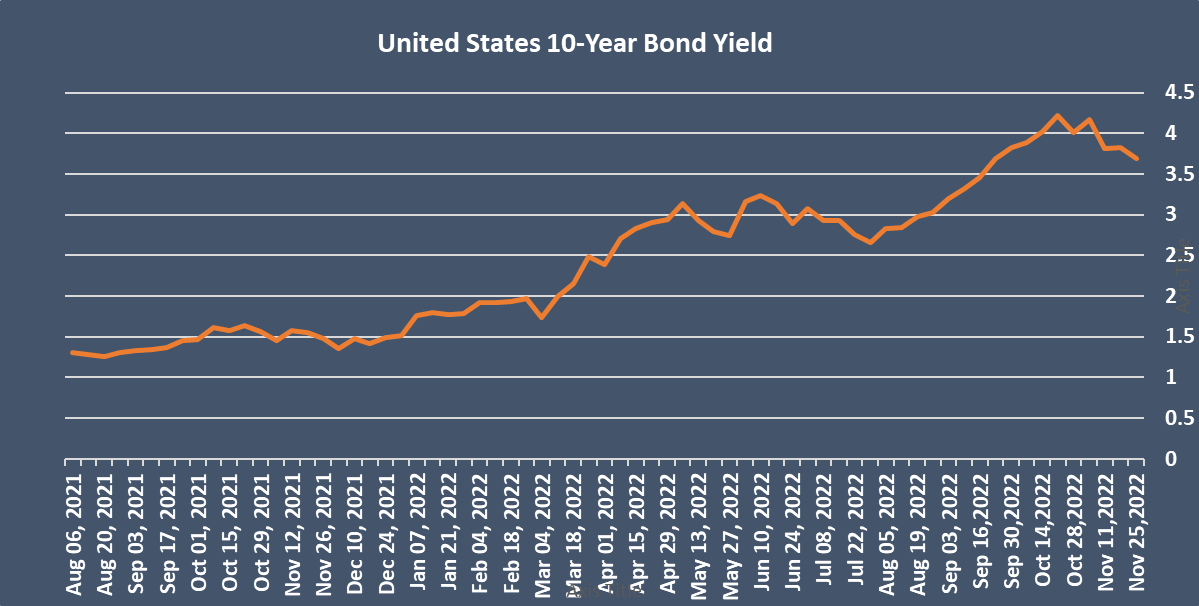

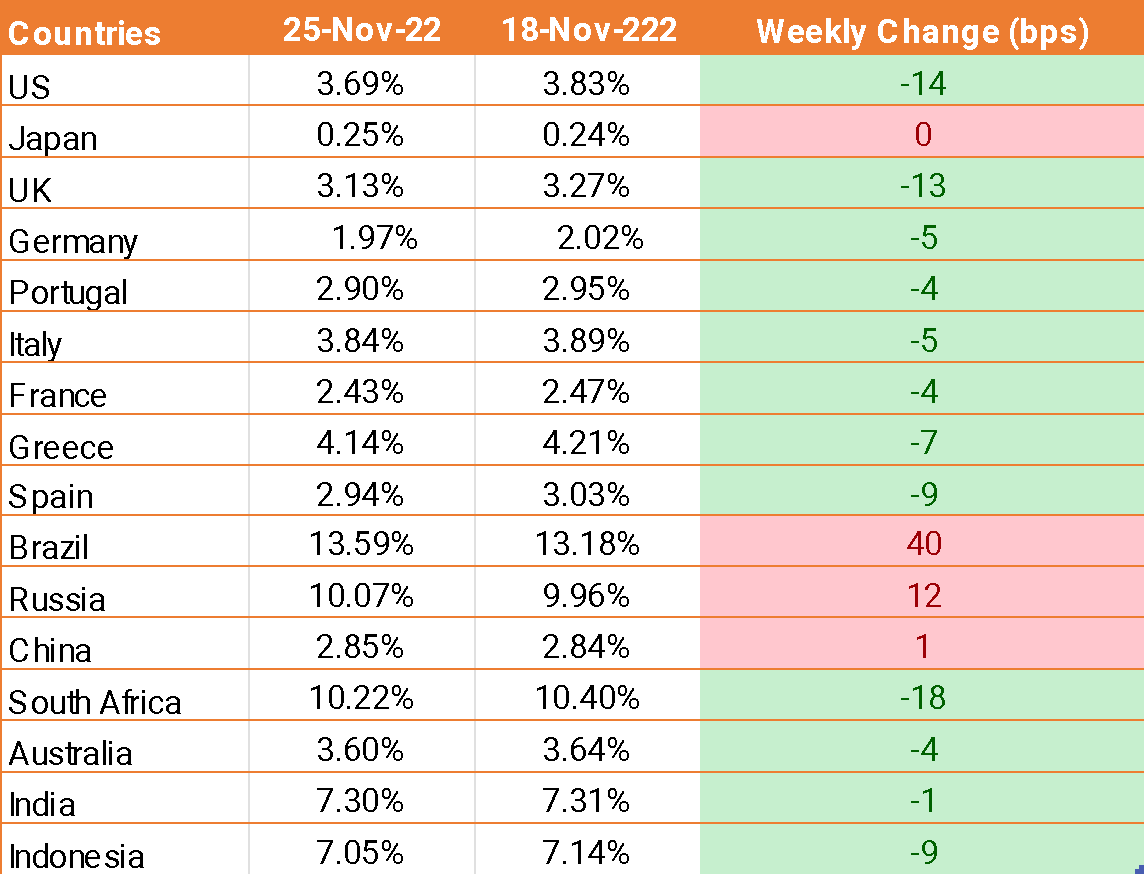

- The market is growing increasingly confident that the Federal Reserve will slow the pace of rate hikes in the December meeting to 50 bps driving UST yields down.

- The Federal Reserve's November meeting minutes showed that most policymakers at the central bank agreed that it would soon be appropriate to slow the pace of interest rate hikes.

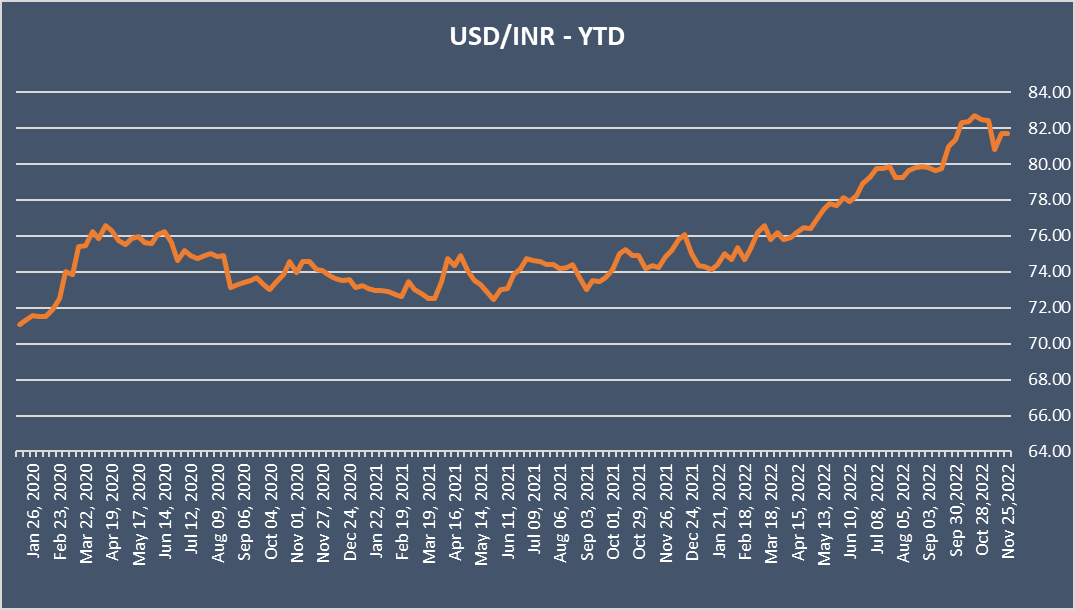

- INR remained flat as inflation expectations cool

- According to India’s finance ministry, India’s inflation is expected to cool in the coming months as commodity prices start to fall.

- India’s annual retail inflation has remained stubbornly above the central bank’s upper tolerance limit of 2% to 6% since the start of the year. Most recently, inflation has eased to 6.77% in October.

- The Finance Ministry also said that the global slowdown could impact India’s exports.

We would love to hear back from you. Please Click here to share your valuable feedback