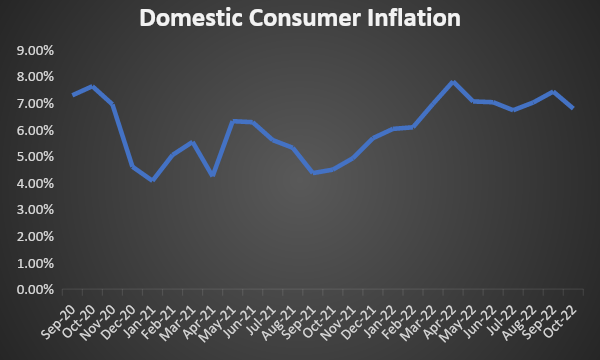

- Ease in domestic Inflation- India’s consumer inflation came down to 6.77% in Oct 22 from 7.41% in the previous month. Core inflation remained in the range of 5.9% to 6.30% during the month. In the same line, the wholesale inflation rate declined to 8.39% in October from 10.7% in the previous month.

- Government Borrowing-As of 25th Nov, gross market borrowing of Union Government stood at Rs 10310 billion during FY23.

7.26% 2032 auction cut-off | |

Date | Cut-off yield |

25-Nov-22 | 7.27% |

11-Nov-22 | 7.25% |

21-Oct-22 | 7.52% |

7-Oct-22 | 7.49% |

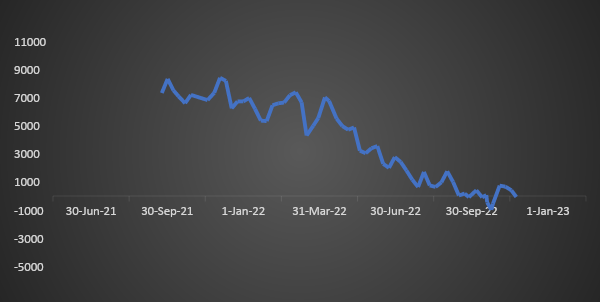

- Sharp fall in System Liquidity-As RBI is continuing absorption of excess liquidity with hawkish stance on monetary policy, system liquidity has come down significantly in last one year. As of 24th November 2022, systemic liquidity stood deficit at Rs 70 billion as compared to Rs 7980 billion of surplus as of 1st Nov 2021.

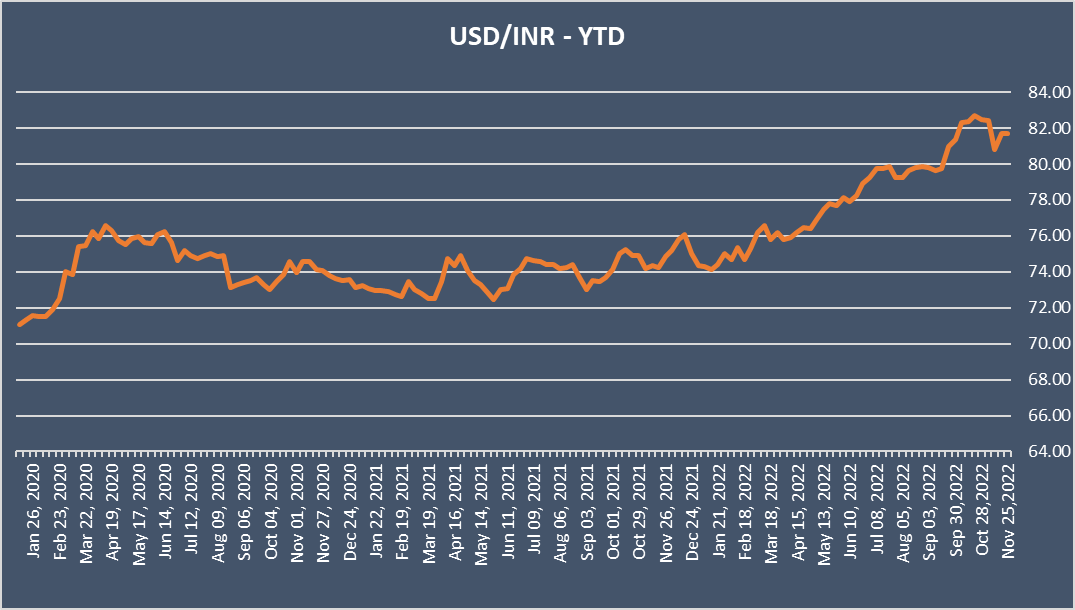

- Depreciation in Indian rupee- In the current scenario of high inflation and global rate hikes, Indian currency depreciated significantly despite RBI’s policy rate hikes. Since last one year, USD INR exchange rate soared to Rs 81.67 from Rs 80.59.

- Domestic tax collection-India’s gross direct collection rose by 31% Rs 10.54 trillion as of 10th Nov FY23 so far. During the same period, net direct collection stood at Rs 8.71 trillion.

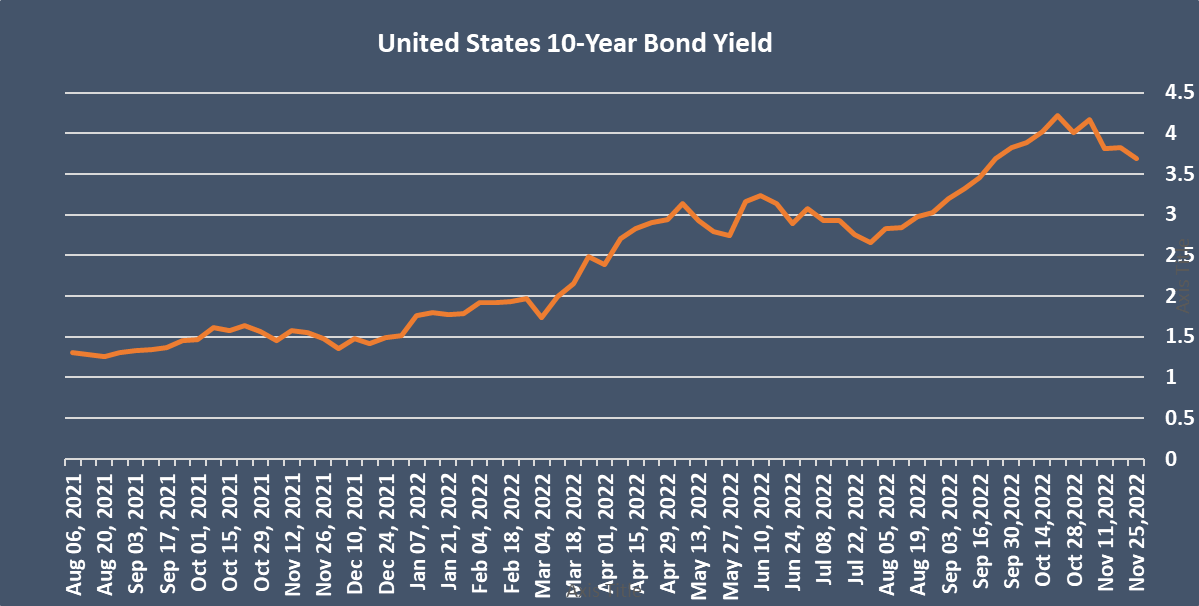

- Rise in global bond yields- In the current economic scenario, all major government bonds saw yields rise sharply indicating a structural shift globally. The major cause of this phenomena can be attributed to elevated global inflation that has compelled central banks to hike policy rates. 10-year US Treasury yield has moved up to 3.691% from 1.46% in last one year.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield came down by 1 bp to 7.30% while 6.54% 2032 yield declined by 1 bp to 7.34%. The 5-year benchmark bond, 6.79% 2027 yield decreased by 2 bps to 7.17%. 3-year benchmark 5.22% 2025 yield decreased by 15 bps to 6.94%. Long-term paper, 6.99% 2051 yield decreased by 1 bp to 7.42%. 40-year paper, 7.40% 2062 yield stood unchanged a t7.43%.

The spread of 10-year bond over 5-year bond rose to 13 bps from 11 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread came down to 12 bps from 13 bps while the 30-year benchmark over 10-year benchmark spread unchanged at 12 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.69% from 7.68% in previous week while spread decreased to 40 bps from 46 bps.

On a weekly basis, 1-year OIS yield declined by 2 bps 6.67% while the 5-year OIS yield decreased by 12 bps to 6.30%.

We would love to hear back from you. Please Click here to share your valuable feedback