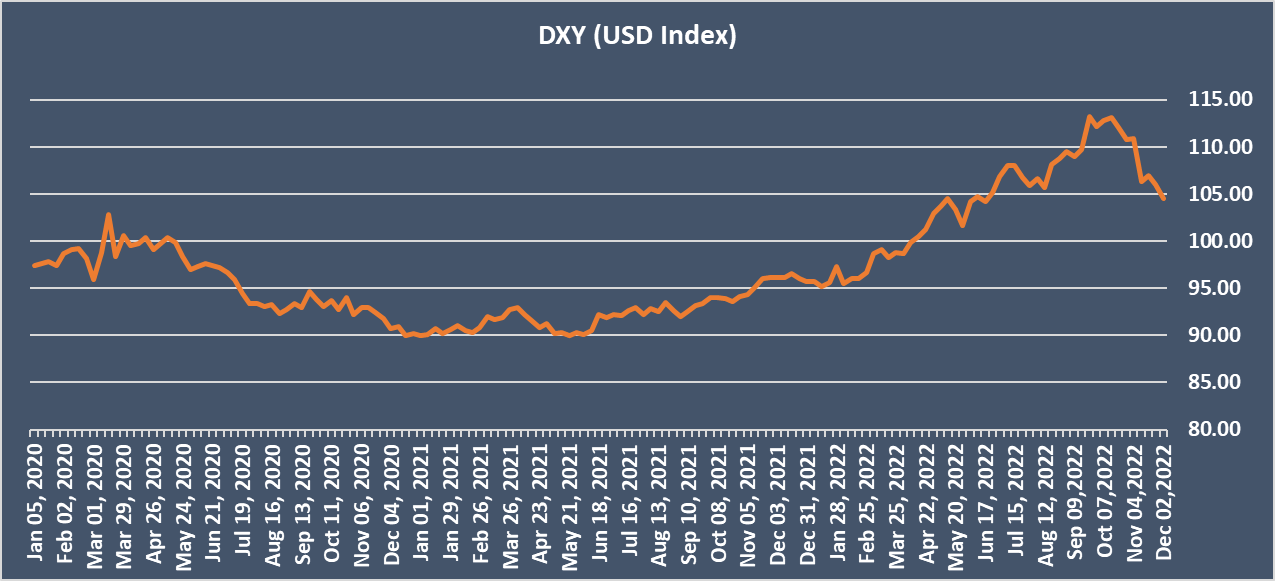

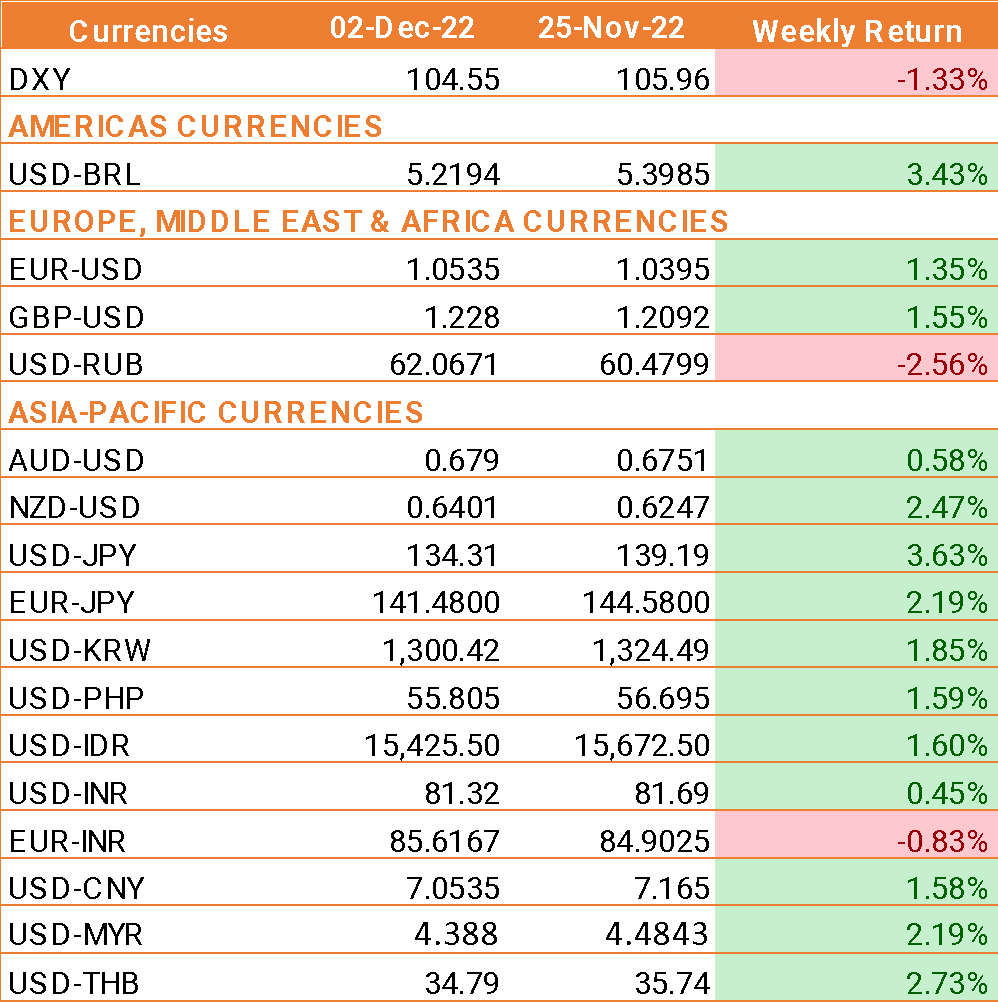

- USD fell last week after Federal Reserve Chairman Jerome Powell said that the U.S. central bank could scale back the pace of its interest rate hikes "as soon as December,"

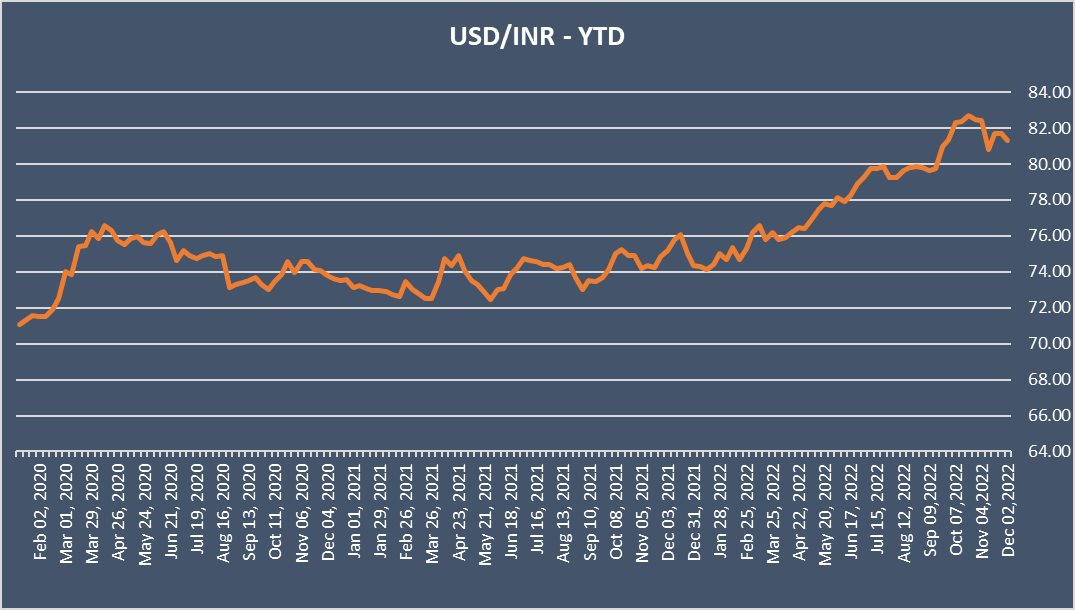

- Comments from Fed chair Jerome Powell have boosted the risk appetite to the detriment of safe haven USD, driving emerging currencies higher against the USD.

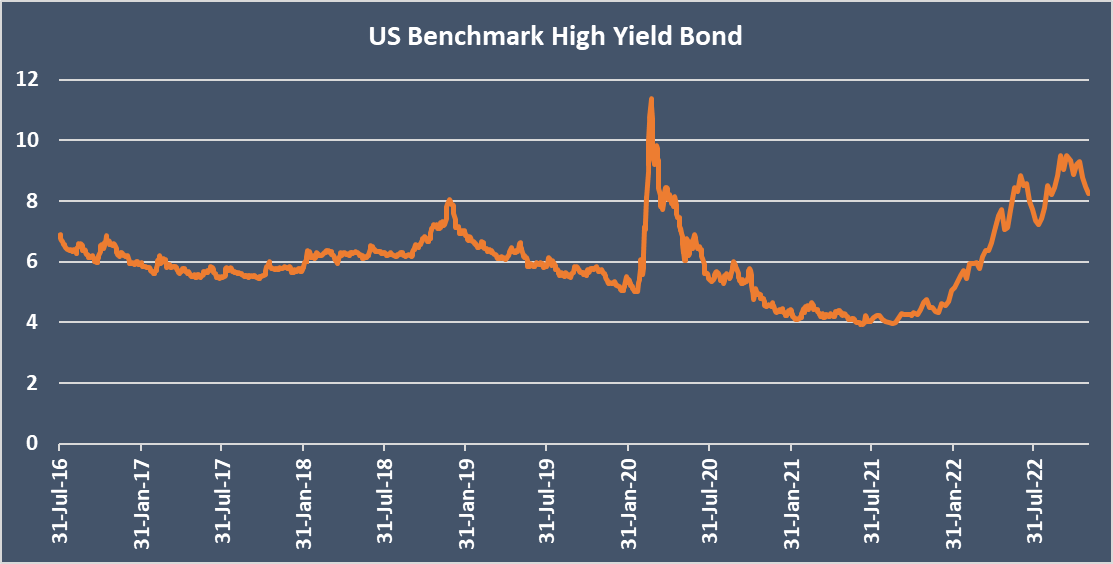

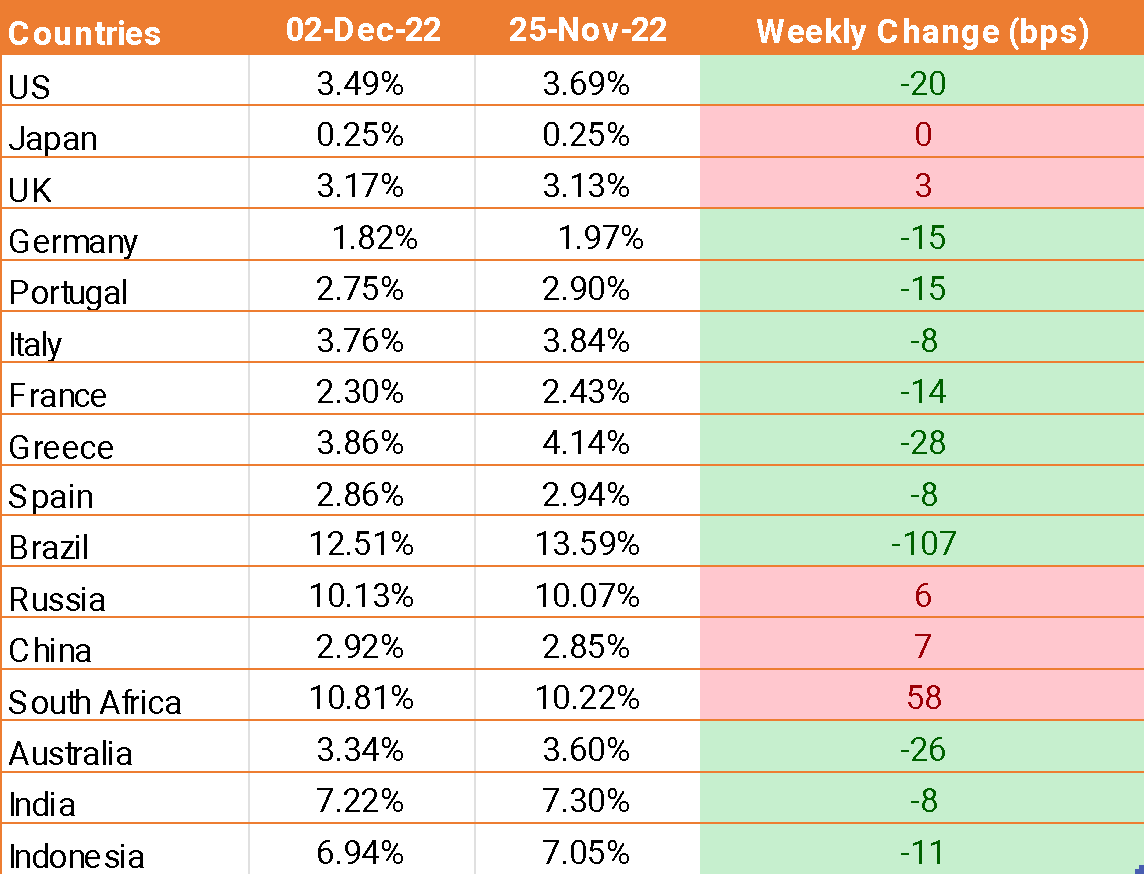

- US jobs report showed that 263,000 jobs were added in November, well ahead of the 200,000 forecasts. The October headline figures were also upwardly revised to 283,000 from 261,000.

- The unemployment rate came in at 3.7%, expectations had been for a rise to 3.8%. Meanwhile, average hourly wages jumped to 5.1% year on year, defying expectations of 4.6%, average hourly wages rose 4.9% in October.

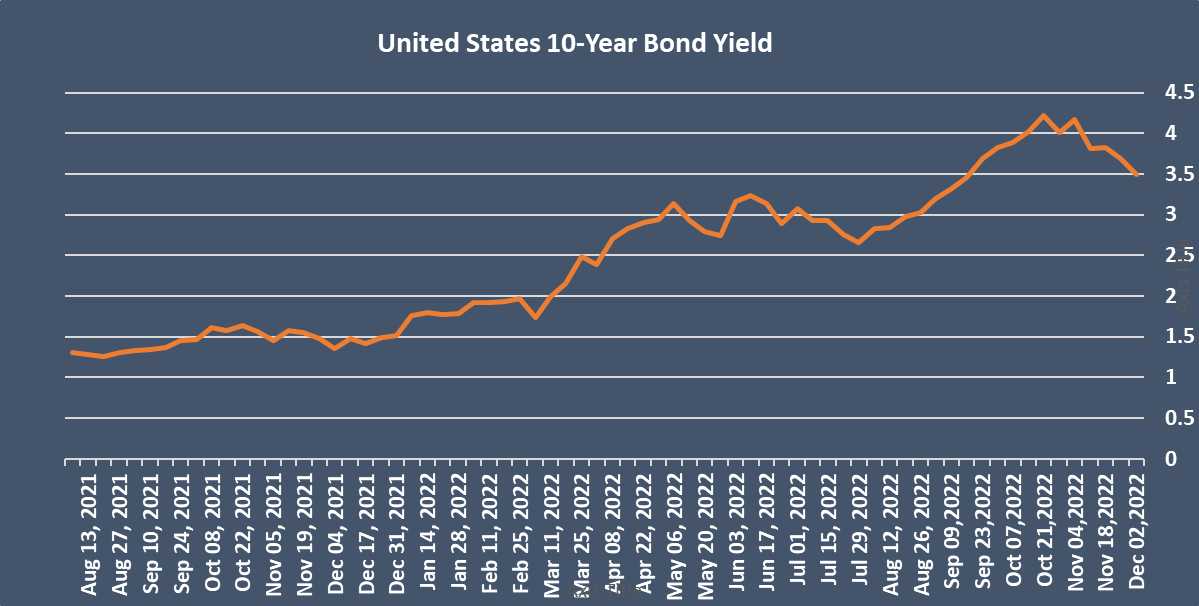

- Following the strong labor market, particularly the surge in hourly wage growth means that pressure remains on the US federal reserve to keep hiking interest rates.

- India’s foreign exchange reserves rose for a third straight week to USD 550.14 billion, up from USD 547.25 billion. India’s forex reserves have been rising since the USD fell off its peak after hitting a two-year low of USD 524 billion in October.

We would love to hear back from you. Please Click here to share your valuable feedback