Easing market indicators

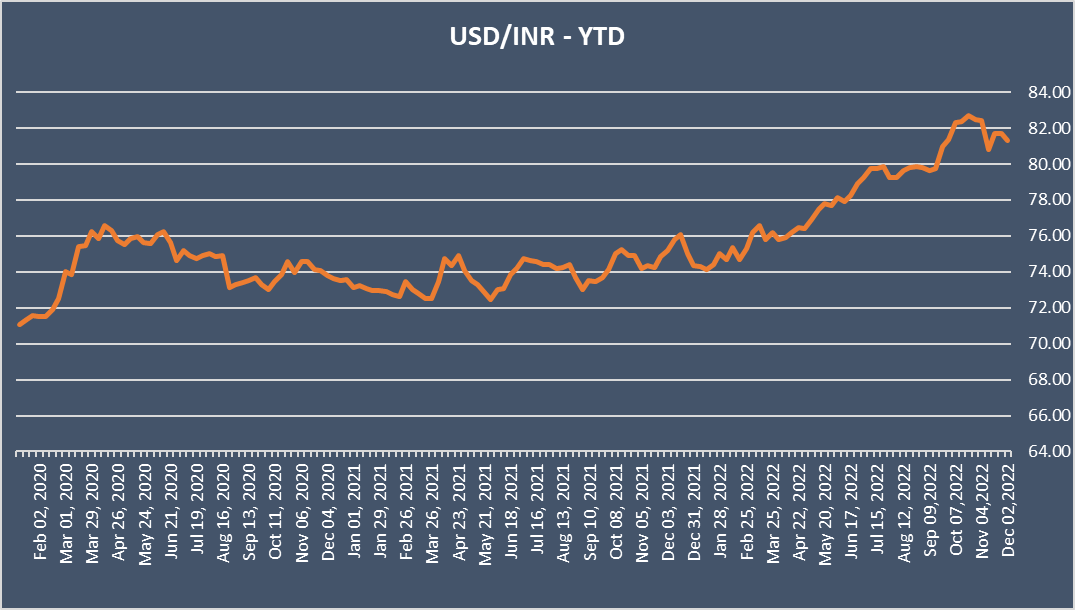

The high risk aversion on inflation and global central bank rate hikes has cooled off. INR has climbed from record lows, gsec yields have fallen from highs and equity markets are at record highs. The factors for easing market sentiments include Fed signalling a slower pace of rate hikes on inflation coming off from highs.

On the domestic front, CPI inflation has come off from highs and government borrowing is going through smoothly with no undue pressure on government finances on high tax collections.

However, given the fact that the Fed is only signalling a slower pace of rate hikes from 75bps to 50bps and global inflation is still at elevated levels, RBI will weigh the consequences of 25bps rate hilke and 50bps rate hike. The short end of the yield curve suggests that Repo rate will stabilise at around 6.5% to 7% levels at present.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield came down by 8 bps to 7.22% while 6.54% 2032 yield declined by 7 bps to 7.27%. The 5-year benchmark bond, 6.79% 2027 yield decreased by 6 bps to 7.11%. 3-year benchmark 5.22% 2025 yield decreased by 1 bp to 6.93%. Long-term paper, 6.99% 2051 yield decreased by 7 bps to 7.35%. 40-year paper, 7.40% 2062 yield declined by 8 bps to 7.35%.

The spread of 10-year bond over 5-year bond declined to 10 bps from 13 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread remained unchanged at 12 bps while the 30-year benchmark over 10-year benchmark spread rose by 1 bp to 13 bps on a weekly basis.

Average 10-year SDL auction cut-off declined to 7.62% from 7.69% in previous week while spread decreased to 35 bps from 40 bps.

On a weekly basis, 1-year OIS yield declined by 5 bps 6.62% while the 5-year OIS yield decreased by 5 bps to 6.25%.

We would love to hear back from you. Please Click here to share your valuable feedback