Initial shock worn off

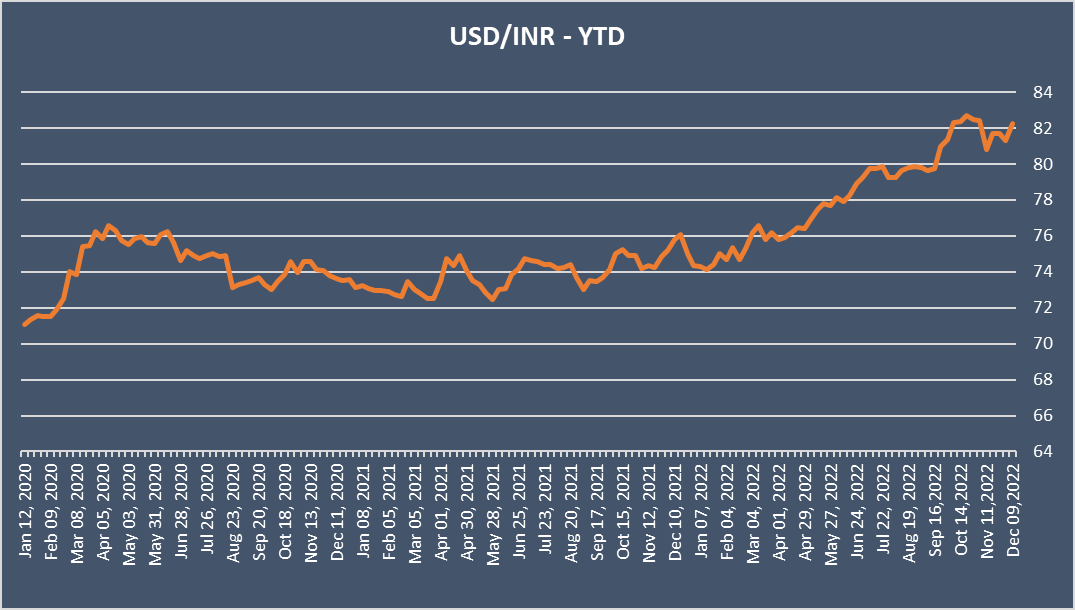

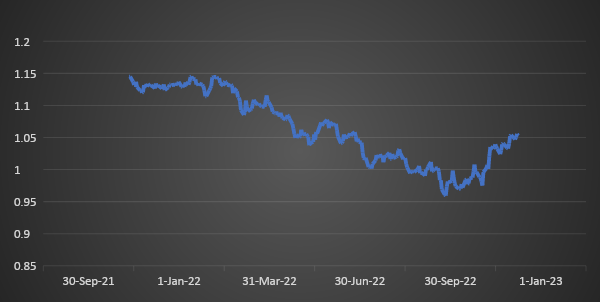

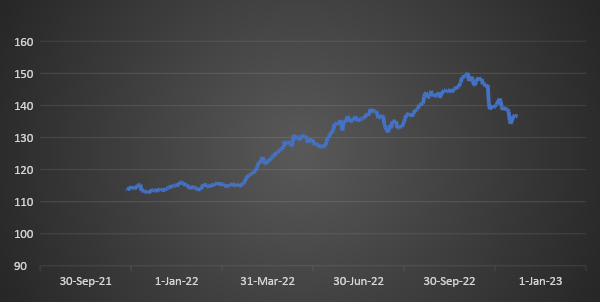

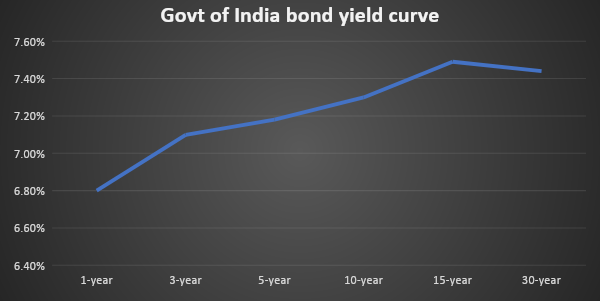

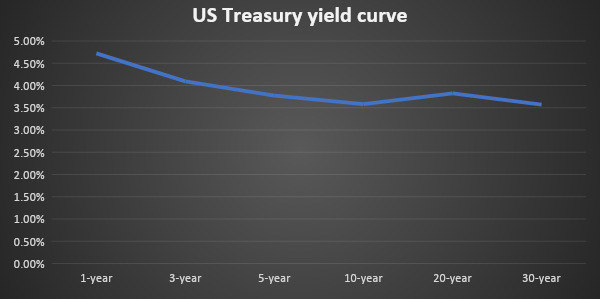

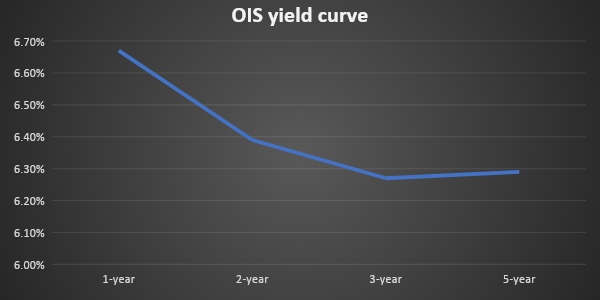

Yield curves have moved up and flattened or inverted after the sudden sharp rise in global inflation and the risk aversion seen across markets. USD has risen sharply against most currencies pulling INR to record lows. However, yield curves seem to have settled down in whatever they are in, suggesting more rate hikes may not impact them too much.

Market will start to look for opportunities outside the yield curve shapes to make money.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield rose by 8 bps to 7.30% while 6.54% 2032 yield increased by 6 bps to 7.27%. The 5-year benchmark bond, 6.79% 2027 yield increased by 10 bps to 7.21%. 3-year benchmark 5.22% 2025 yield increased by 7 bps to 7%. Long-term paper, 6.99% 2051 yield increased by 8 bps to 7.43%. 40-year paper, 7.40% 2062 yield rose by 8 bps to 7.43%.

The spread of 10-year bond over 5-year bond declined to 9 bps from 10 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread declined to 11 bps from 12 bps while the 30-year benchmark over 10-year benchmark spread remained unchanged at 13 bps on a weekly basis.

Average 10-year SDL auction cut-off declined to 7.55% from 7.62% in previous week while spread decreased to 31 bps from 35 bps.

On a weekly basis, 1-year OIS yield rose by 5 bps to 6.67% while the 5-year OIS yield increased by 4 bps to 6.29%.

We would love to hear back from you. Please Click here to share your valuable feedback