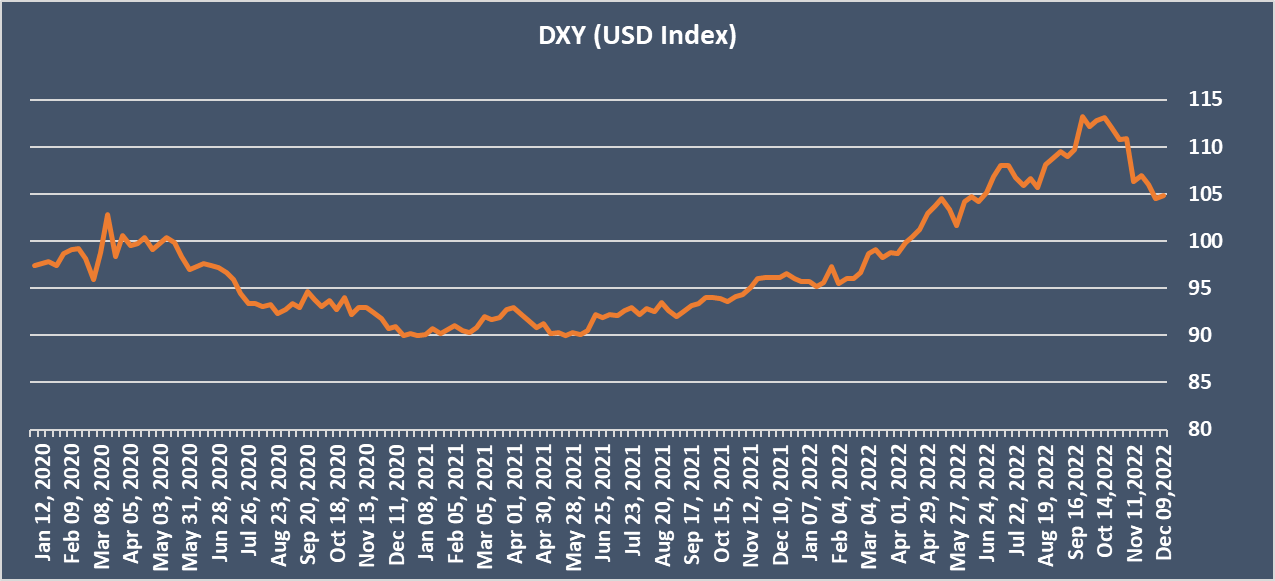

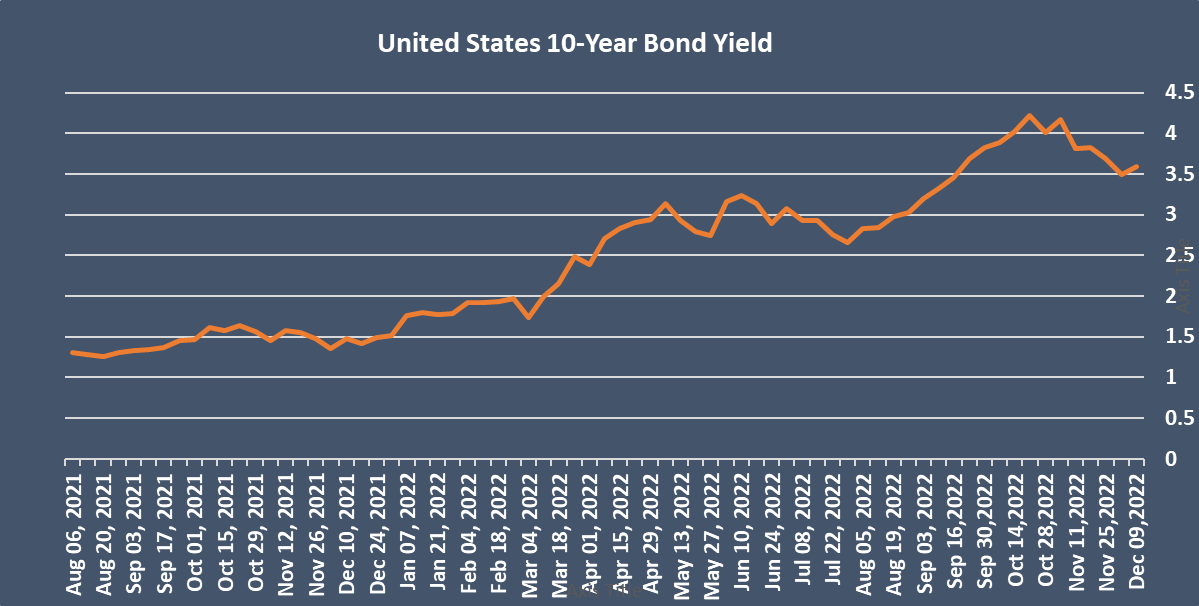

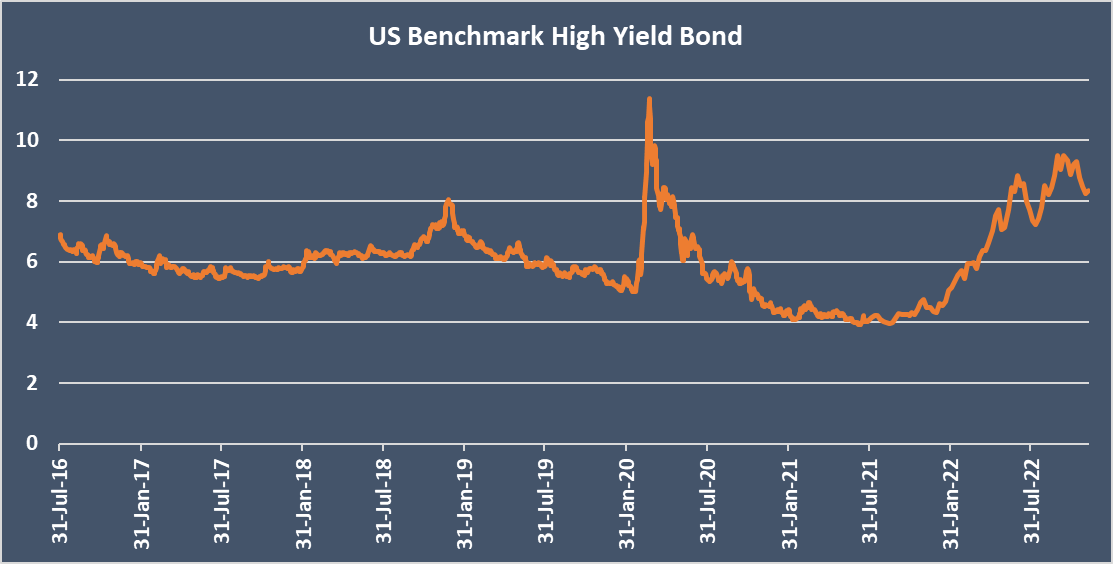

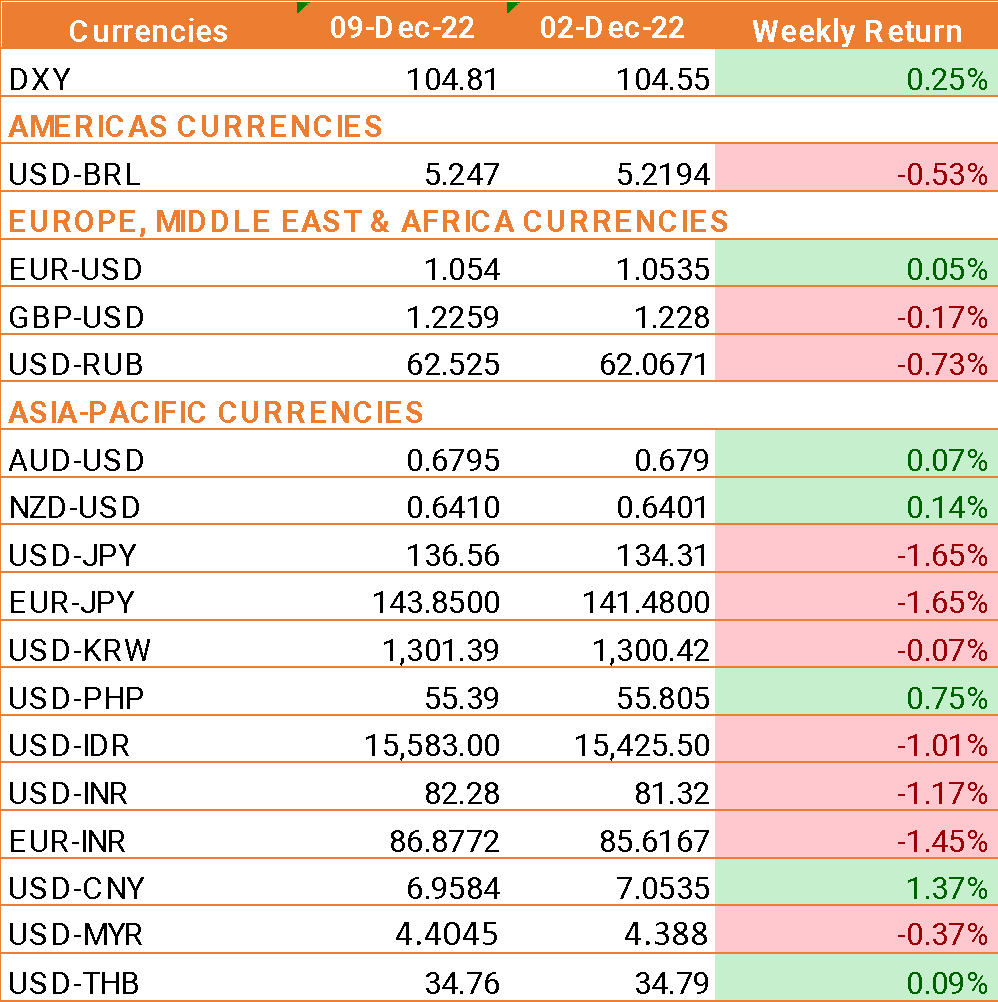

- USD ended the week higher amid fears that the U.S. economy was heading toward recession, ahead of next week’s crucial Federal Reserve meeting.

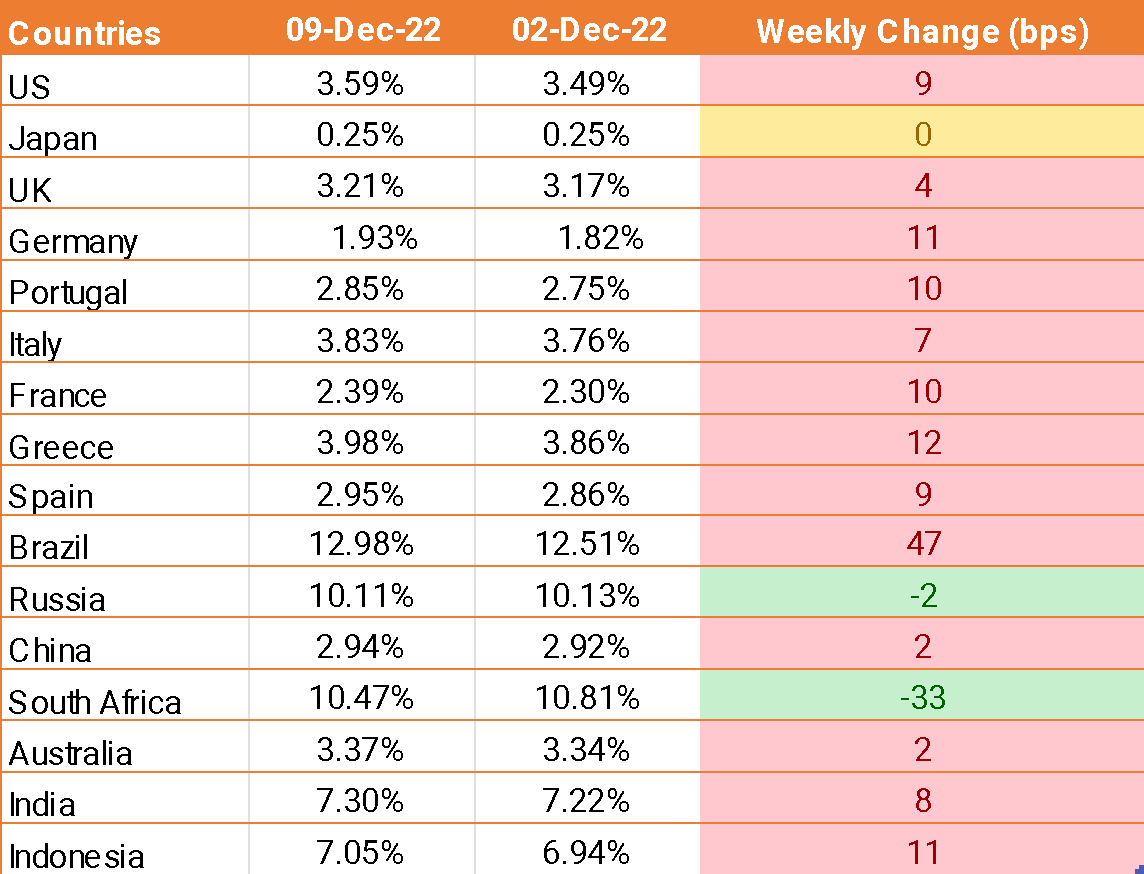

- Amid recession fears, the bets are increasing that the Federal Reserve will slow the pace of interest rates going forward

- US initial jobless claims showed that the number of U.S. citizens claiming unemployment benefits for the first time rose again to 230,000, up from 225,000 in the previous week.

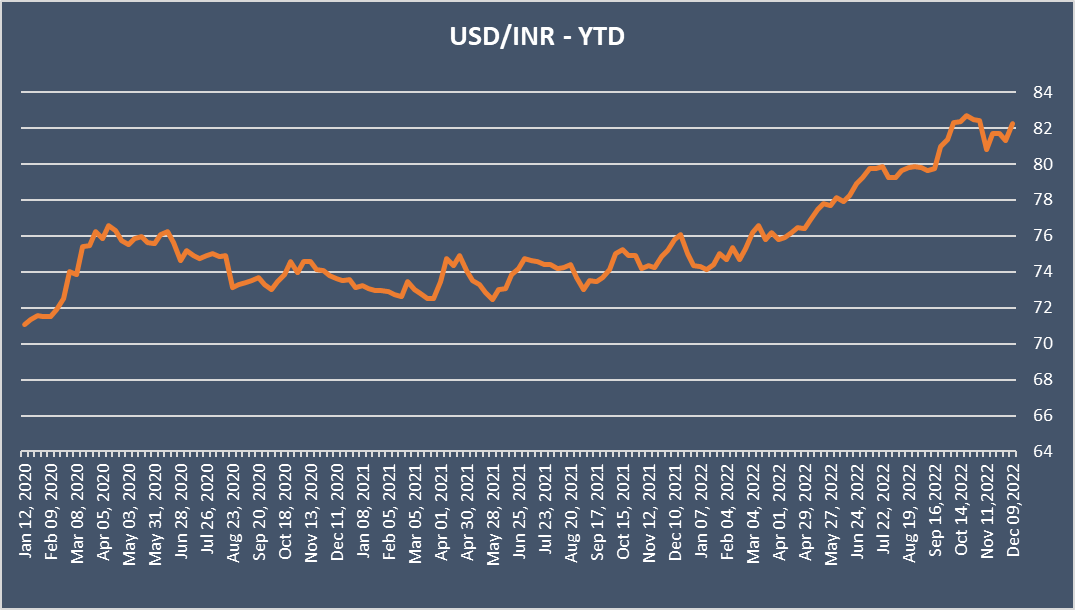

- The Reserve Bank of India raised interest rates by 35 basis points taking the benchmark lending rate to 6.25%. This is the 5th straight rate increase and takes the key rate to the highest level over three years.

- Inflation has stayed above the upper end of the RBI’s 2-6% tolerance band all year and while there have been tentative signs that inflation could be easing, the Reserve Bank of India highlighted that persistently high inflation was the main risk.

- Inflation in India, as measured by consumer prices, is expected to fall to a nine-month low of 6.4% in November as food prices moderated.

We would love to hear back from you. Please Click here to share your valuable feedback