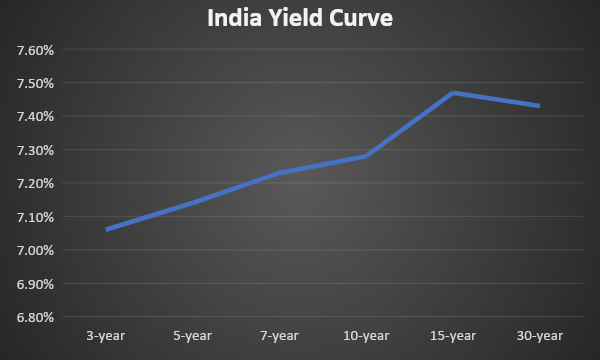

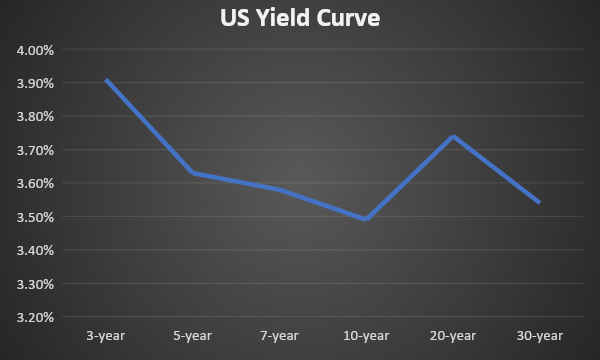

The Gsec yield curve is flat at present and is likely to stay flat given prospects of more rate hikes next year along with more government borrowing expected next fiscal. US treasury yield curve is likely to flatten with long end yields rising on persistent high inflation

Fed Fund rate hike: US FOMC hiked fund rate by 50 bps to 4.25%-4.50% which is the highest level since 2007. Further rate hike is on cards as indicated by FOMC to tame inflation. Although inflation came down to 7.1% in November from 7.7% in the previous month, it is still higher than the target rate of 2% as kept by FOMC. However, rate hike was slowed down by 50 bps as compared to three consecutive 75 bps rate hikes earlier.

RBI rate hike-RBI raised policy rates by 35 bps to 6.25% with signal of further rate hikes. RBI's focus on inflation and financial market stability will keep rates at the short-end higher while longer-end yields are unlikely to stay down. Inflation target has been kept unchanged by the RBI.

Liquidity-Domestic system liquidity stood at Rs 976 billion as of 14th Dec 2022. System liquidity has come down significantly as aa result of tight notary policy and dollar selling by RBI

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield declined by 2 bps to 7.28% while 6.54% 2032 yield increased by 5 bps to 7.32%. The 5-year benchmark bond, 6.79% 2027 yield decreased by 5 bps to 7.16%. 3-year benchmark 5.22% 2025 yield decreased by 1 bp to 6.99%. Long-term paper, 6.99% 2051 yield declined by 1 bp to 7.42%. 40-year paper, 7.40% 2062 yield stood flat at 7.43%.

The spread of 10-year bond over 5-year bond rose to 12 bps from 9 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread increased to 12 bps from 11 bps while the 30-year benchmark over 10-year benchmark spread rose to 14 bps from 13 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.57% from 7.55% in previous week while spread stood unchanged at 31 bps.

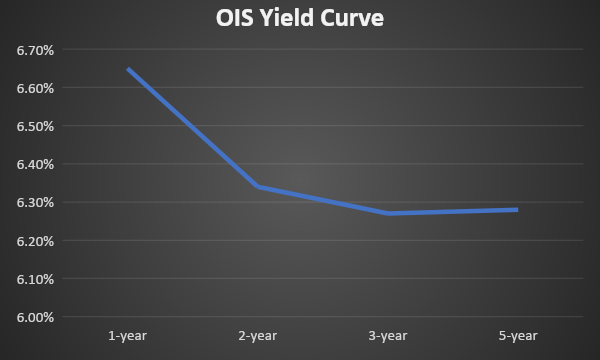

On a weekly basis, 1-year OIS yield declined by 2 bps to 6.65% while the 5-year OIS yield decreased by 1 bp to 6.28%.

We would love to hear back from you. Please Click here to share your valuable feedback