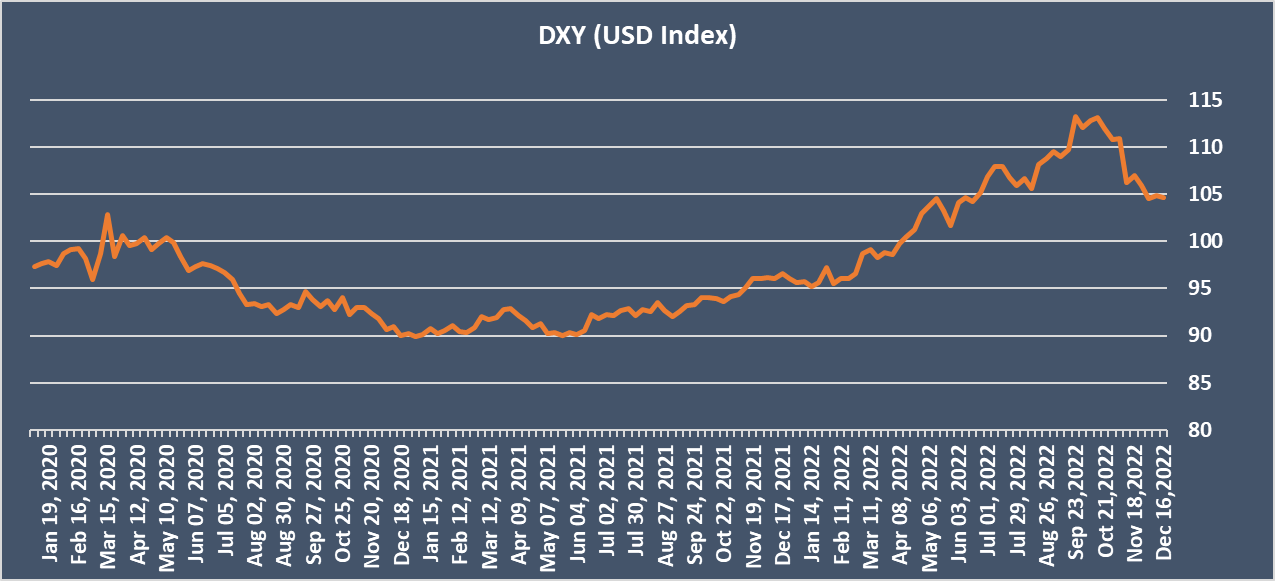

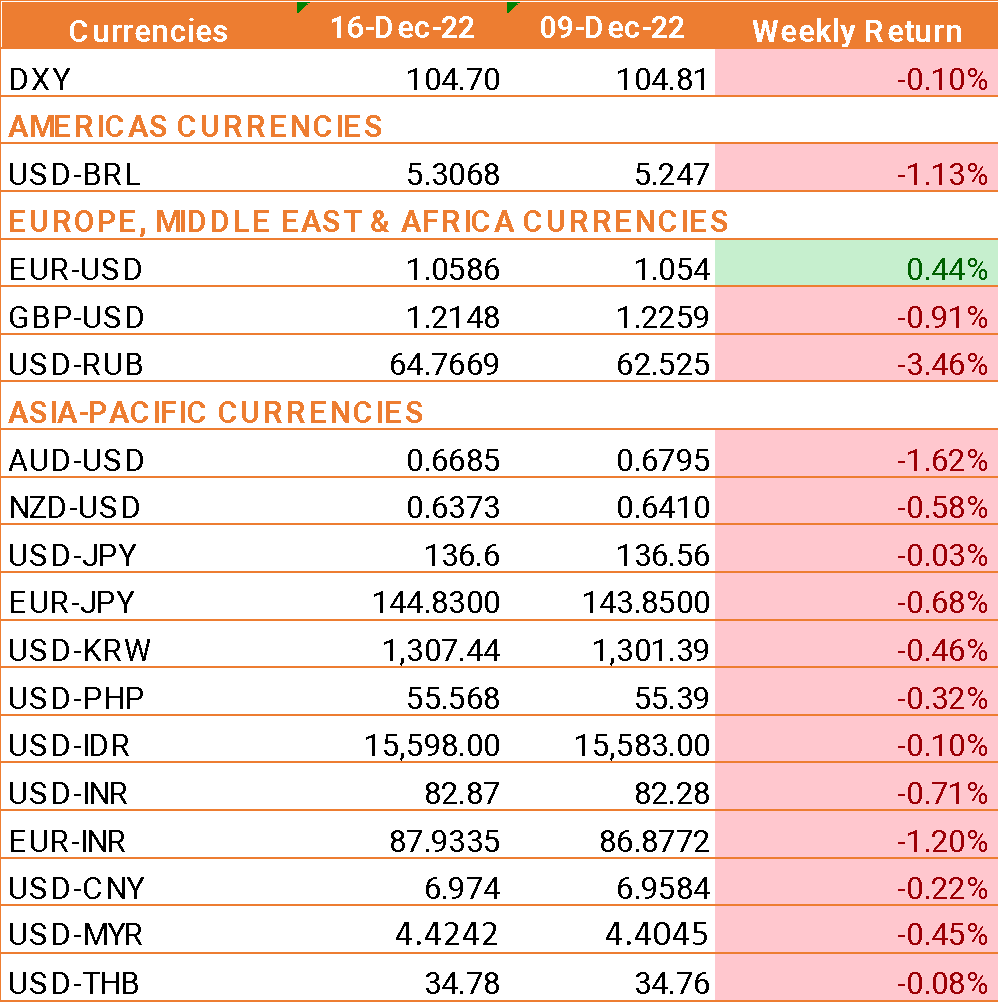

- USD traded higher before falling on Friday. The broad strength in USD was exhibited largely on the back of the Fed FOMC meeting and its forward guidance on interest rates.

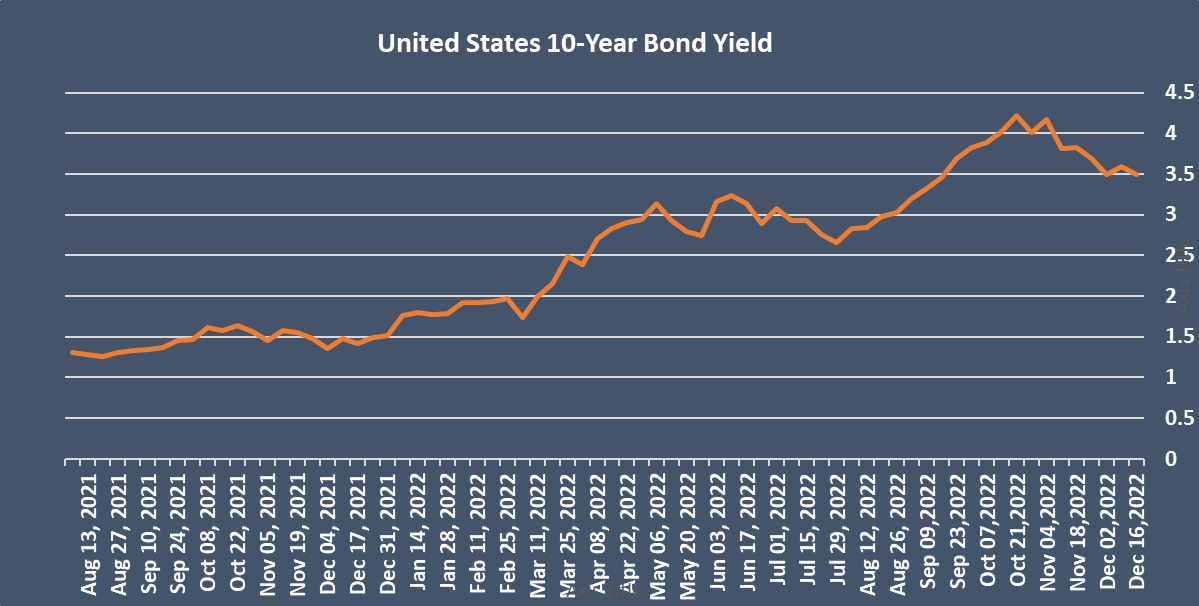

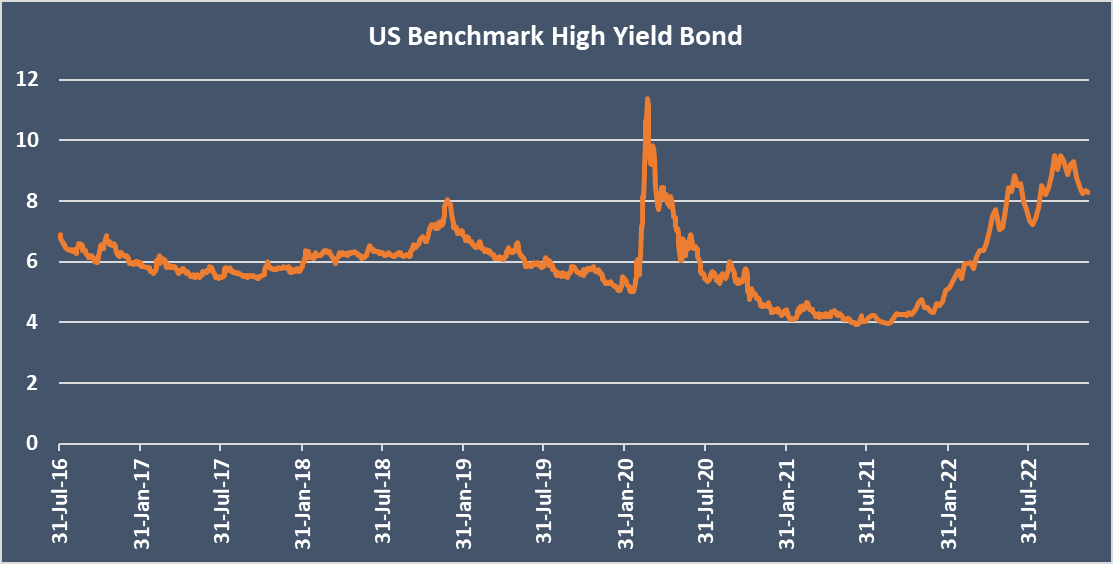

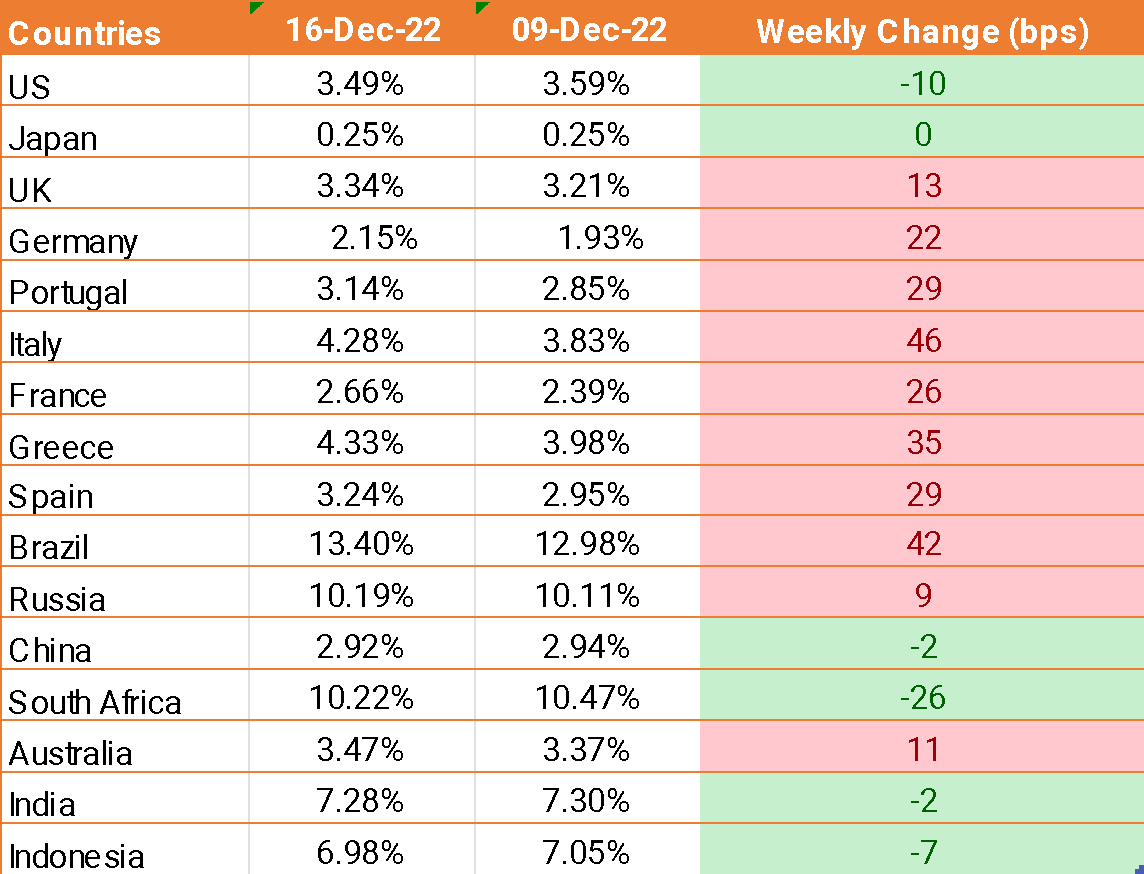

- Federal Reserve raised interest rates at a slower pace of 50 basis points, down from 75 basis points in the last four meetings. However, the Fed also pointed to more rate hikes next year, lifting the terminal fed rate to 5.1% up from 4.6%.

- The Fed also pushed back on expectations of a rate cut next year and Fed Chair Jerome Powell suggested that there was still much work to be done.

- Lower than-expected US consumer inflation also weighed on the USD. Inflation, as measured by the consumer price index, fell to 7.1% year on year in November, down from 7.7% annually in October. This was below forecasts of 7.3%.

- Core inflation which strips out more volatile items such as food and fuel fell to 6% year on year, down from 6.3% and below forecasts of 6.1%.

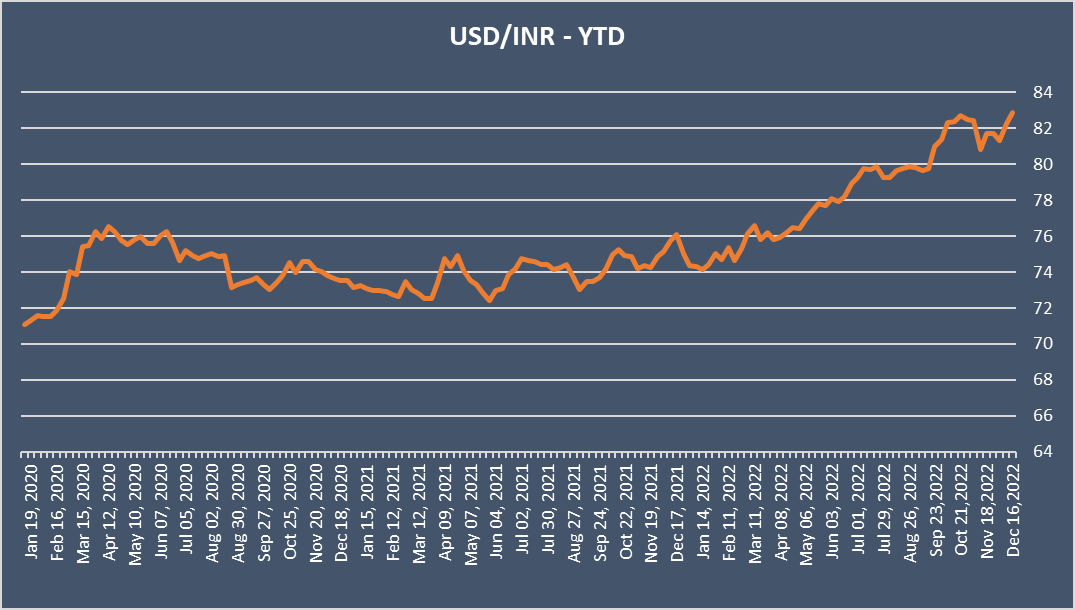

- INR falls amid USD broad strength as CPI inflation data came lower than expected.

- India retail inflation, which is measured by the Consumer Price Index (CPI), eased to an 11-month low of 5.88% last month, down from 6.77% in October.

\

We would love to hear back from you. Please Click here to share your valuable feedback