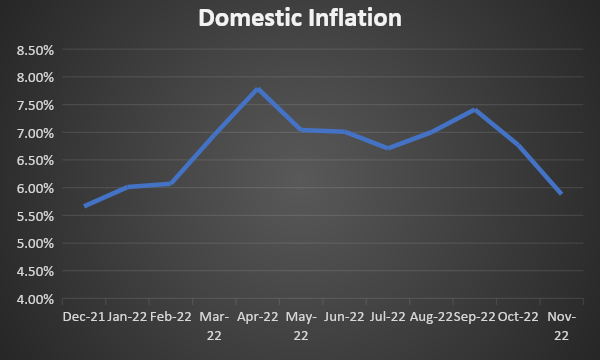

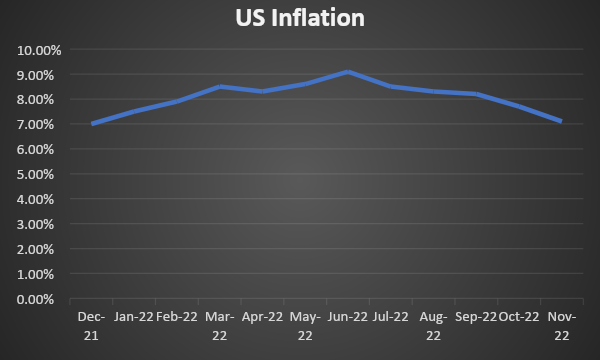

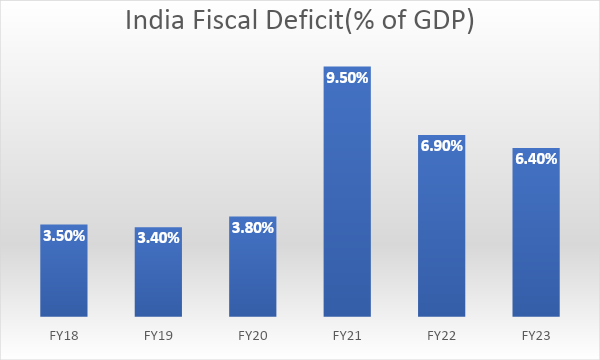

The 5, 10,15 and 30-year g-sec yields are in a range of 7.20% to 7.5% and are almost pricing in end of a rising interest rate cycle and a fall in economic growth ahead. However, inflation expectations both in India and globally are still high and central banks and governments are struggling with the effects of years of ultra-loose monetary and fiscal accommodation, the withdrawal effects will linger on for a long while to come. Hence, long term bond yields will have to price in higher uncertainty risk premium and rise accordingly.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield rose by 4 bps to 7.32% while 6.54% 2032 yield increased by 4 bps to 7.36%. The 5-year benchmark bond, 6.79% 2027 yield increased by 7 bps to 7.23%. 3-year benchmark 5.22% 2025 yield increased by 1 bp to 7%. Long-term paper, 6.99% 2051 yield rose by 3 bps to 7.45%. 40-year paper, 7.40% 2062 yield increased by 4 bps to 7.47%.

The spread of 10-year bond over 5-year bond declined to 9 bps from 12 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread decreased to 8 bps from 12 bps while the 30-year benchmark over 10-year benchmark spread declined to 13 bps from 14 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.64% from 7.57% in previous week while spread rose to 32 bps from 31 bps.

On a weekly basis, 1-year OIS yield rose by 6 bps to 6.71% while the 5-year OIS yield increased by 12 bps to 6.40%.

We would love to hear back from you. Please Click here to share your valuable feedback