India’s current account deficit was at 4.4% of GDP in Q2FY23 as compared to 2.2% of GDP in Q1FY23. Underlying the current account deficit in Q2FY23 was the widening of the merchandise trade deficit to USD 83.5 billion from USD 63.0 billion in Q1FY23 and an increase in net outgo under investment income.

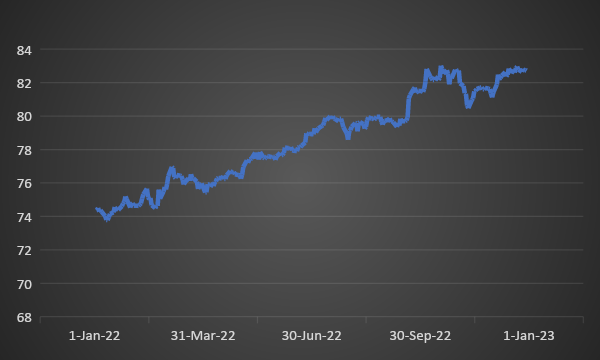

Impact on rupee- Widening current account deficit may cause further depreciation in rupee value. In the wake of global rate hikes and elevated inflation, rupee has depreciated by 11% in CY22.

Impact on government bond yields - Government bond yields may witness volatile movement by rise in current account deficit.

Fiscal deficit- During Apr-Nov FY23, Union government's fiscal deficit 59% of the full year Budget Estimate on increased capital expenditure and slow growth in non-tax revenue. In actual terms, the fiscal deficit stood at Rs 9.78 trillion during the April-November period of 2022-23. In the corresponding period last year, the deficit was 46.2% of the Budget Estimates of 2021-22.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield rose by 1 bp to 7.33% while 6.54% 2032 yield increased by 1 bp to 7.37%. The 5-year benchmark bond, 6.79% 2027 yield decreased by 4 bps to 7.19%. 3-year benchmark 5.22% 2025 yield increased by 4 bps to 7.04%. Long-term paper, 6.99% 2051 yield declined by 3 bps to 7.42%. 40-year paper, 7.40% 2062 yield decreased by 2 bps to 7.45%.

The spread of 10-year bond over 5-year bond rose to 13 bps from 9 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread increased to 10 bps from 8 bps while the 30-year benchmark over 10-year benchmark spread declined to 9 bps from 13 bps on a weekly basis.

Average 10-year SDL auction cut-off declined to 7.62% from 7.64% in previous week while spread declined to 31 bps from 32 bps.

On a weekly basis, 1-year OIS yield rose by 2 bps to 6.73% while the 5-year OIS yield increased by 3 bps to 6.43%.

We would love to hear back from you. Please Click here to share your valuable feedback