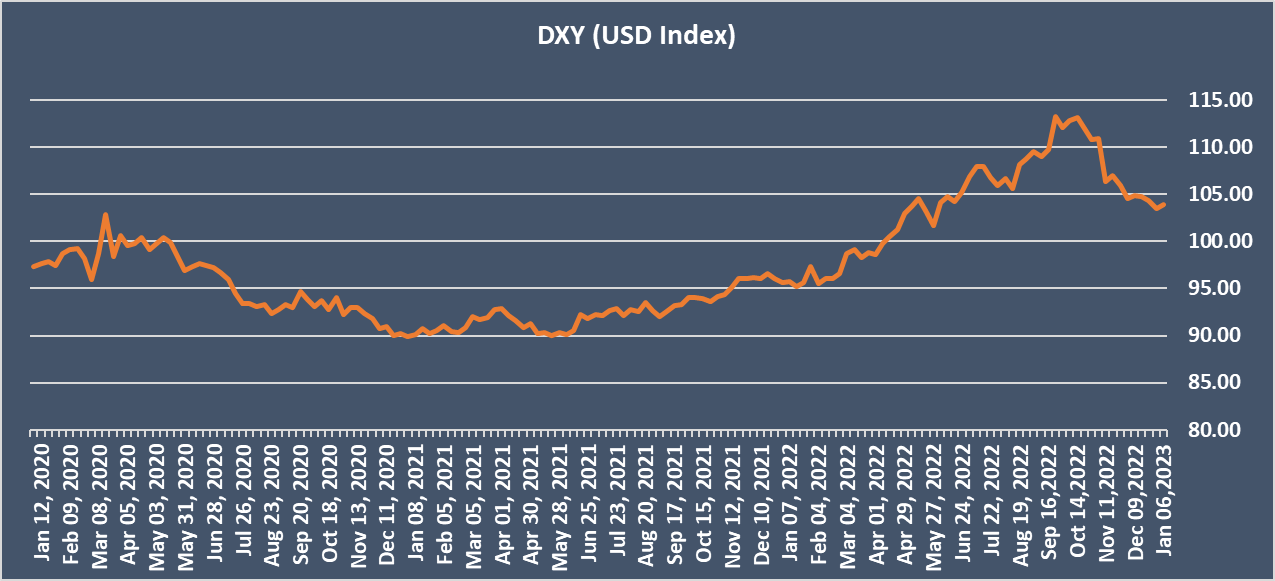

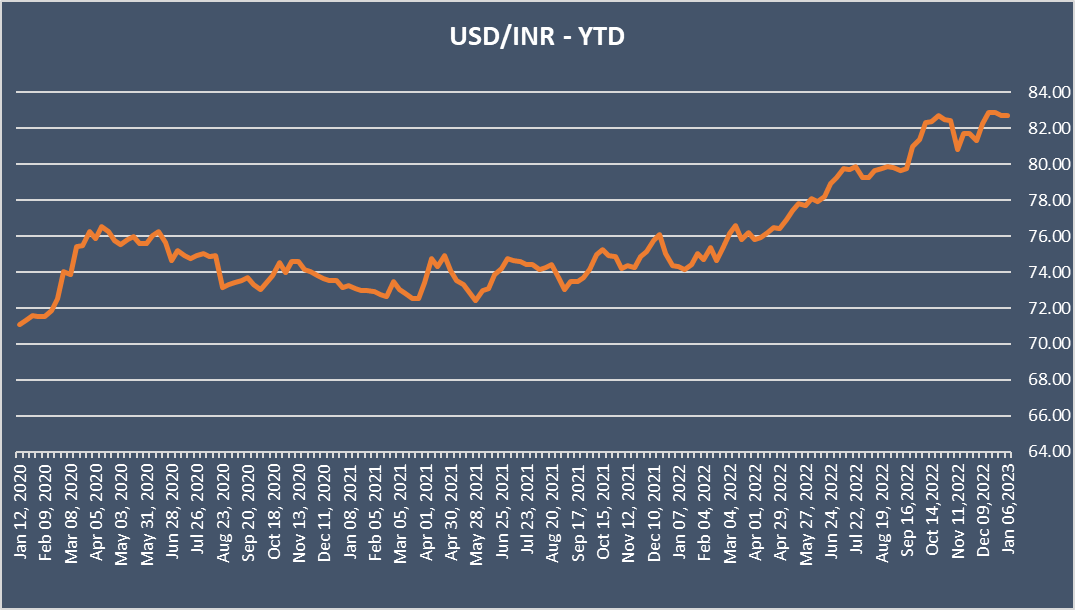

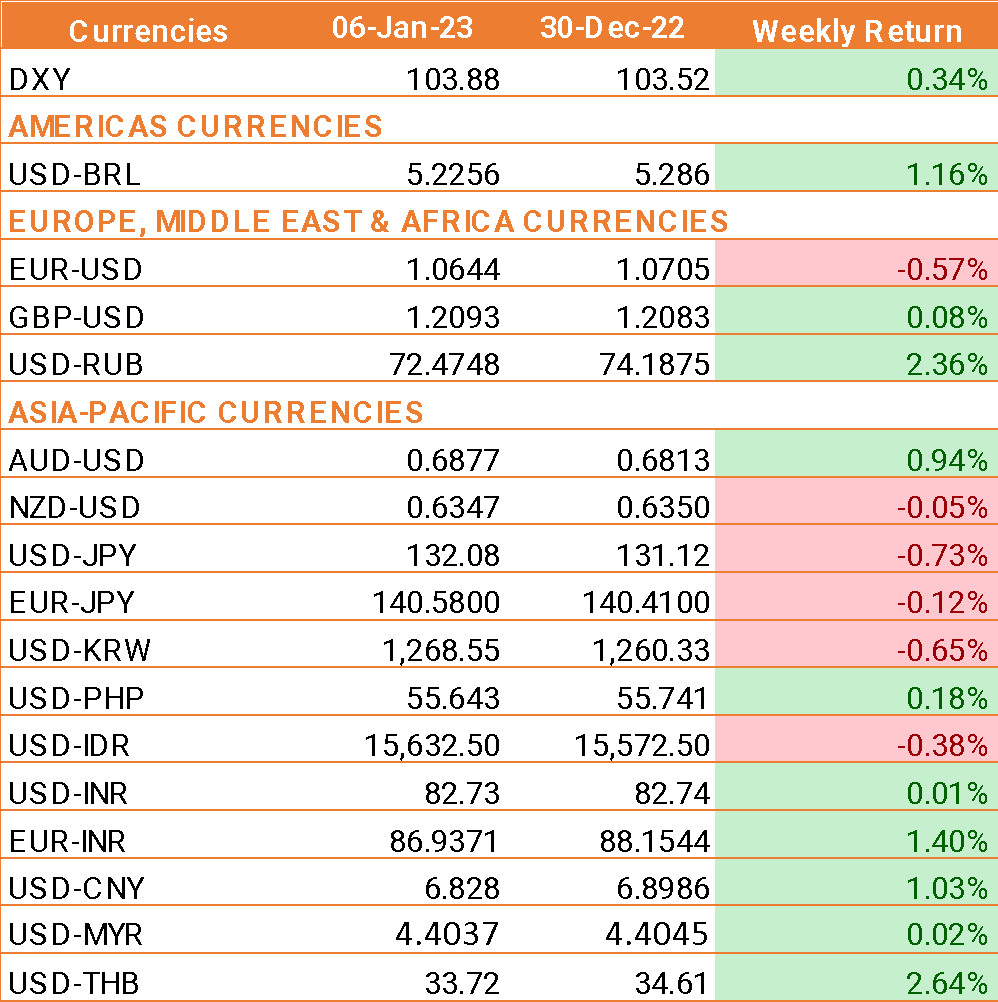

- USD traded higher last week after data pointed to a strong jobs market, supporting the prospect that the Federal Reserve could keep up the pace of aggressive rate hikes.

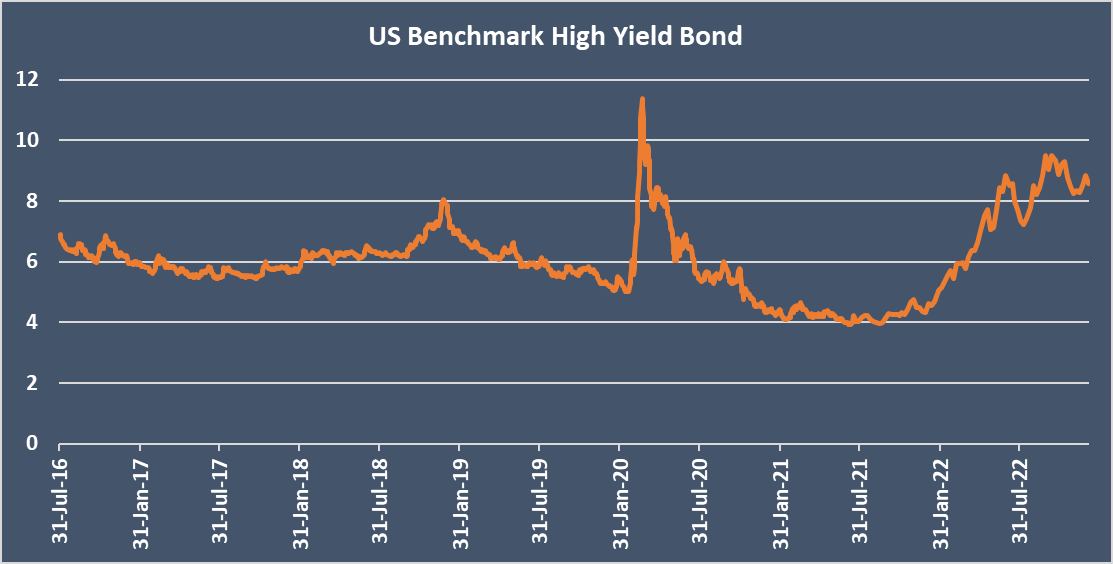

- US economy added 223,000 jobs in December, more than the expectation of 200,000.

- Wages also grew 0.3% last month, less than 0.4% in November and below forecasts of 0.4%. That lowered the year-on-year increase in wages to 4.6% from 4.8% in November.

- The unemployment rate dropped to 3.5% from 3.6% in November.

- U.S. Commerce Department also said on Friday that factory orders dropped 1.8% in November, after gaining 0.4% in October against the expectation of orders falling 0.8%

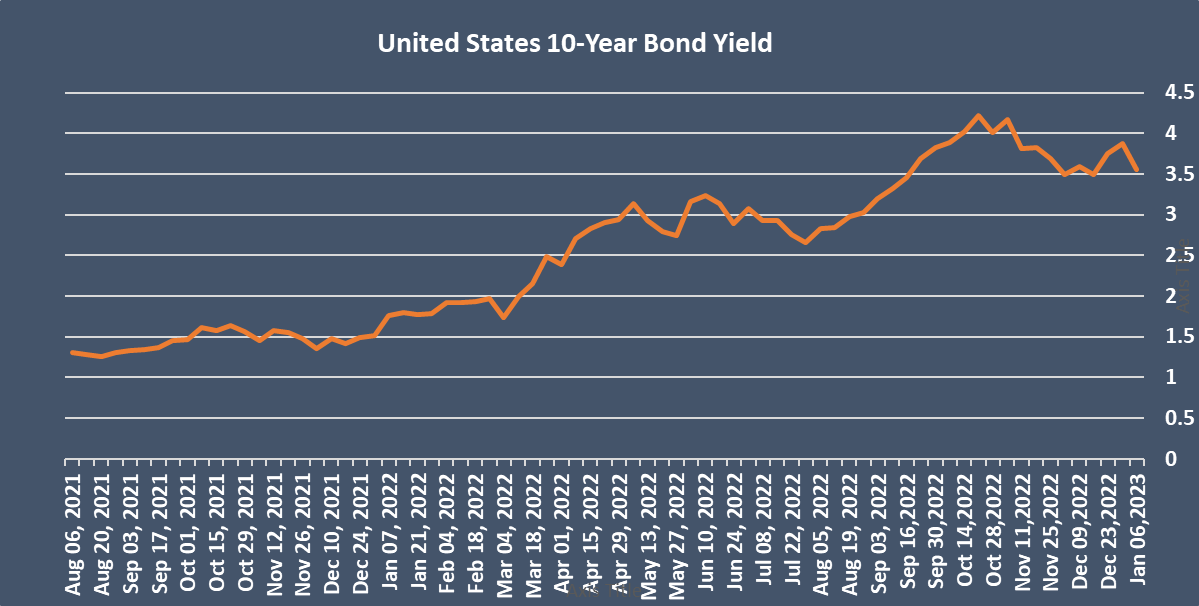

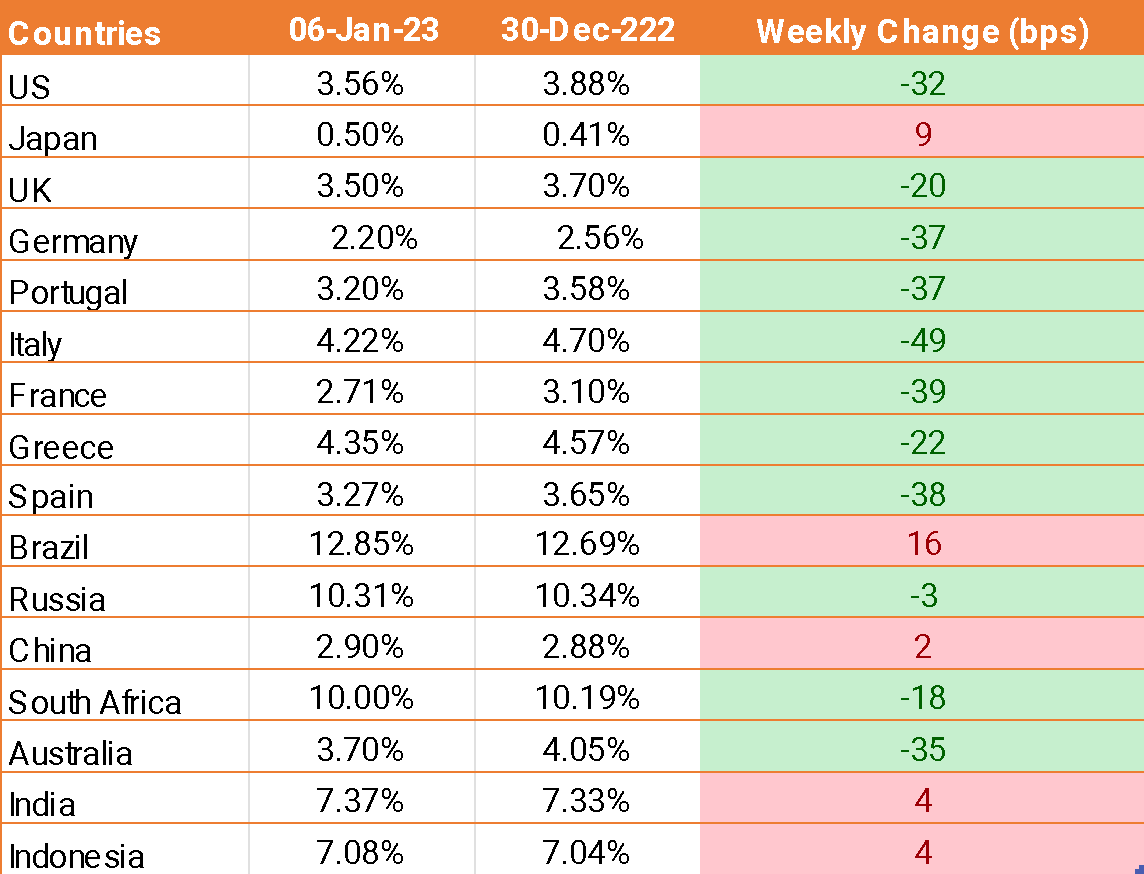

- Atlanta Federal Reserve President Raphael Bostic said on Friday that the latest U.S. jobs data was another sign that the economy is gradually slowing. If that continues, the Fed can step down to a quarter percentage point interest rate hike at its next policy meeting.

- Richmond Fed President Thomas Barkin also said the U.S. central bank's move to smaller interest rate hike increments would help limit damage to the economy.

- Eurozone consumer price index fell to 9.2% from 10.1% in November. The CPI peaked at a euro-era high of 10.6% in October.

We would love to hear back from you. Please Click here to share your valuable feedback