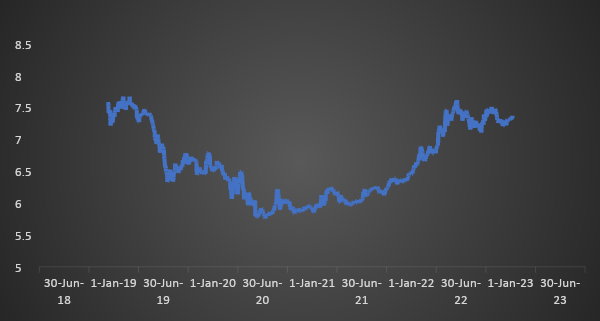

Bond markets have lost heavily in the last 5 years

Owing to corona pandemic, gross market borrowing of Union Government rose significantly which can be seen from above table. Consequently, it has caused government bond yield to rise that led to capital loss for investors.

Fiscal Year | Gross Borrowing (Rs billion) |

FY18 | 5880.00 |

FY19 | 5710.00 |

FY20 | 7100.00 |

FY21 | 13703.24 |

FY22 | 11273.82 |

FY23(as of 23rd Dec 22) | 11190.00 |

From the above chart, it can be seen that benchmark 10-year yield has moved up significantly in tandem with government borrowing’s uptrend.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield rose by 4 bps to 7.37% while 6.54% 2032 yield increased by 3 bps to 7.40%. The 5-year benchmark bond, 6.79% 2027 yield increased by 10 bps to 7.29%. 3-year benchmark 5.22% 2025 yield increased by 1 bp to 7.05%. 7.40% 2062 yield increased by 1 bps to 7.46%.

The spread of 10-year bond over 5-year bond declined to 8 bps from 13 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread decreased to 8 bps from 10 bps while the 30-year benchmark over 10-year benchmark spread declined to 7 bps from 9 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.63% from 7.62% in previous week while spread stood unchanged at 31 bps.

On a weekly basis, 1-year OIS yield rose by 2 bps to 6.73% while the 5-year OIS yield increased by 3 bps to 6.43%.

We would love to hear back from you. Please Click here to share your valuable feedback