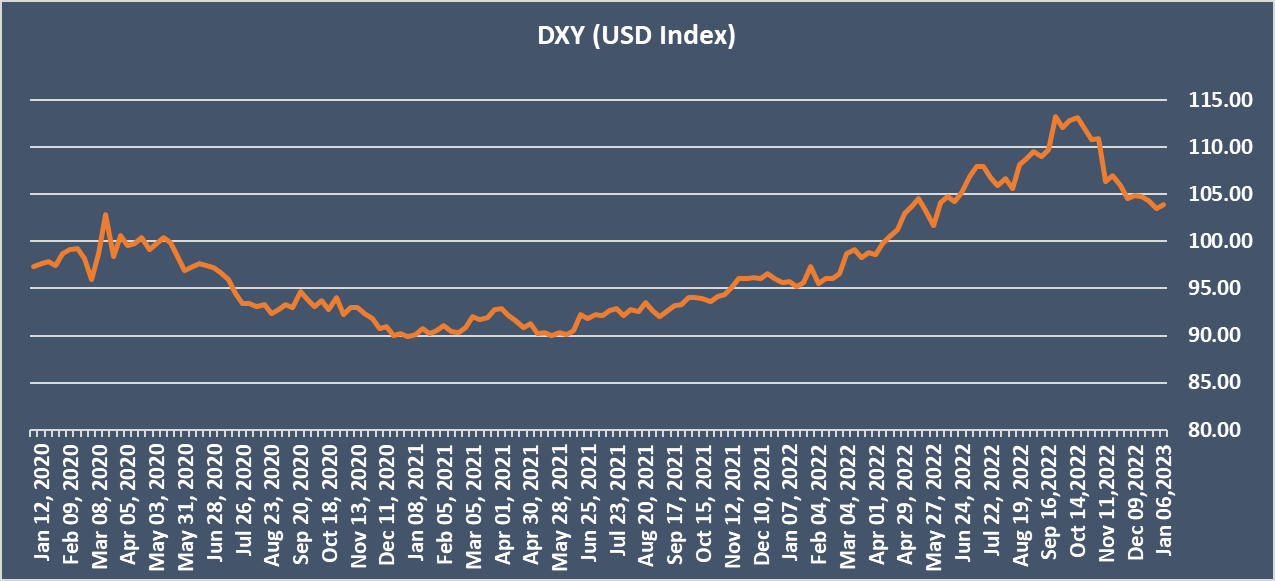

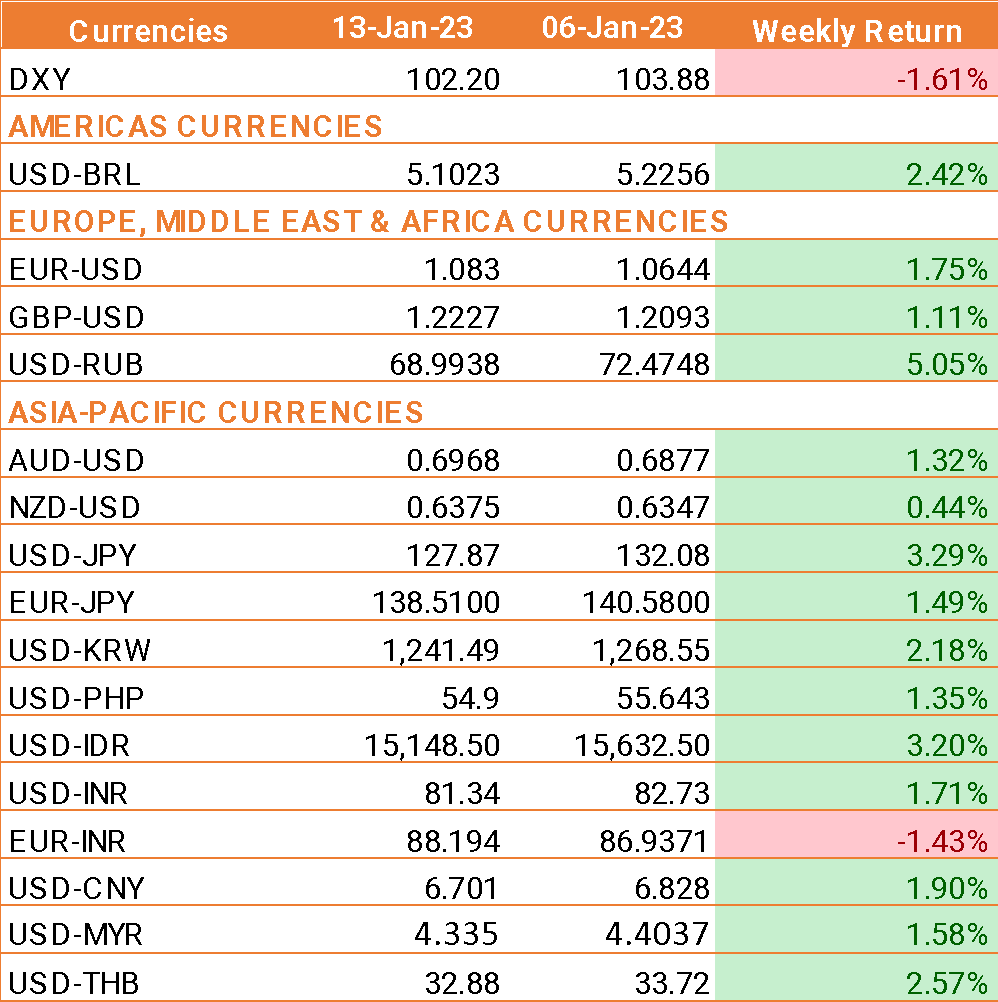

- USD edged lower last week after data showed U.S. inflation was easing, prompting bets that the Federal Reserve will be less aggressive with rate hikes going forward.

- U.S. data showed the consumer price index (CPI) was at 6,5% in December from 7.1% in November.

- On a monthly basis, the US CPI declined by 0.1% marking the first decline in the data since May 2020, when the economy was reeling from the first wave of COVID-19 infections.

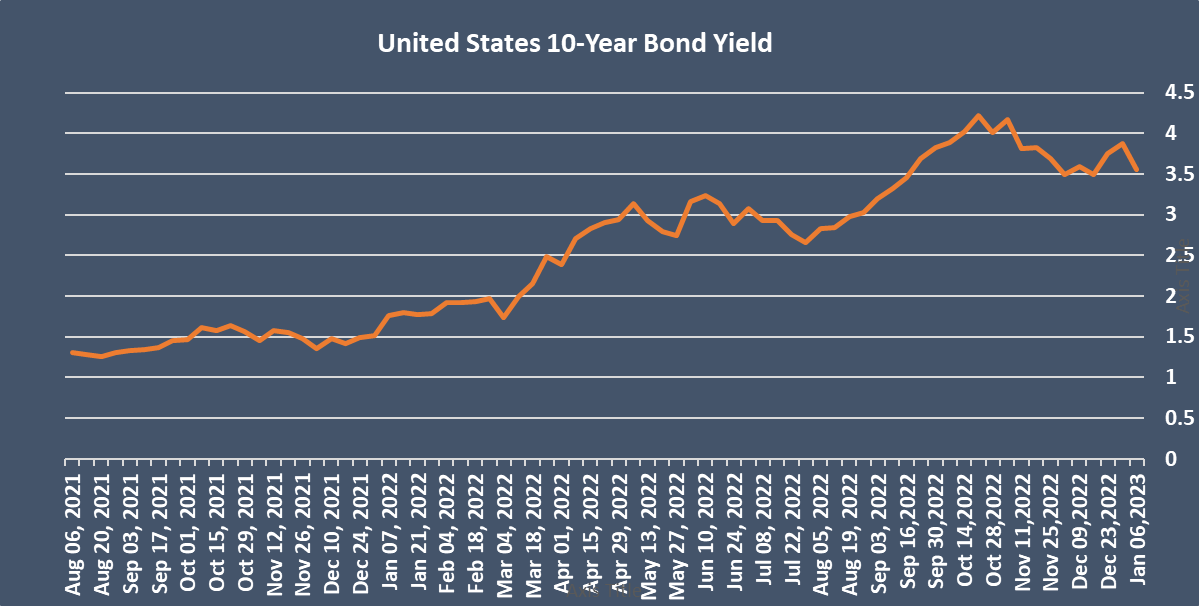

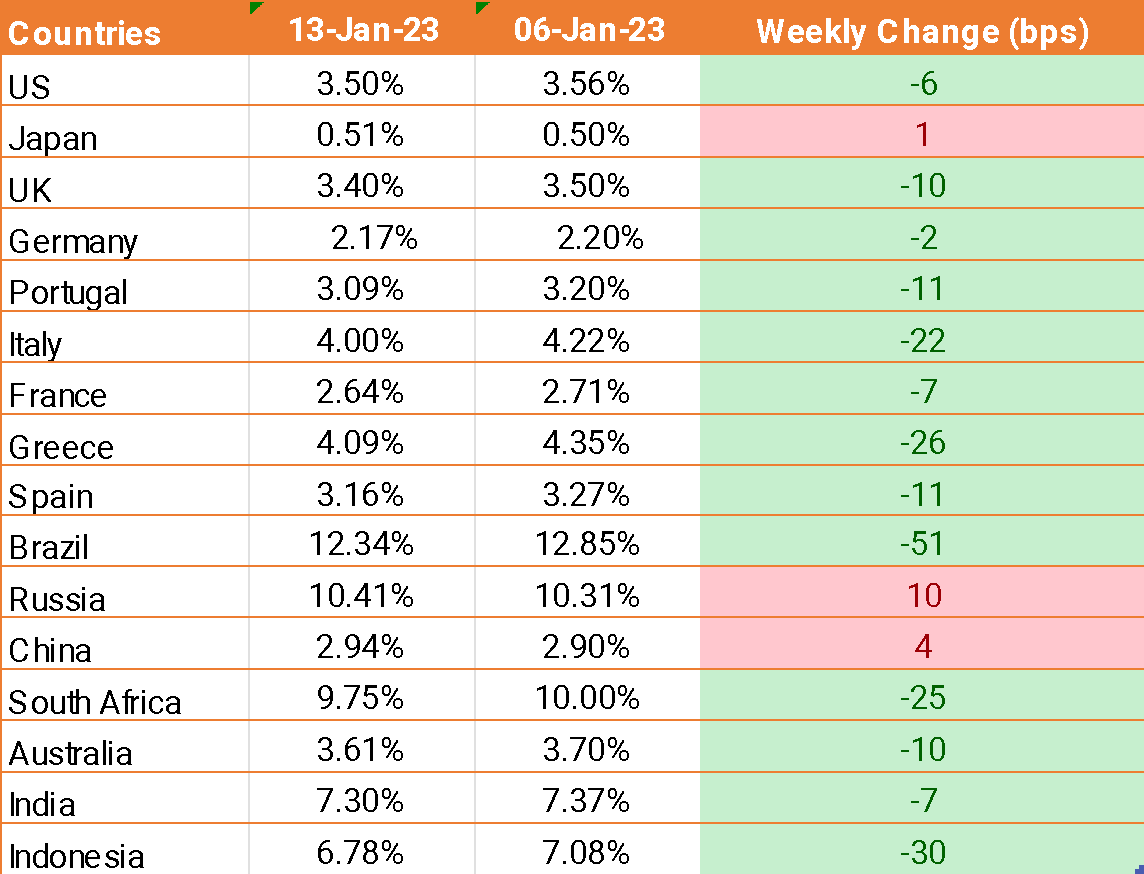

- Fed policymakers expressed relief that price pressures were easing, paving the way for a possible slowdown in interest rate hikes, but they signaled the central bank's target rate was still likely to rise above 5%.

- The yen was up last week against USD after a market report suggested that BOJ officials would review the side effects of the central bank's yield curve control, or YCC, the policy at their meeting next week.

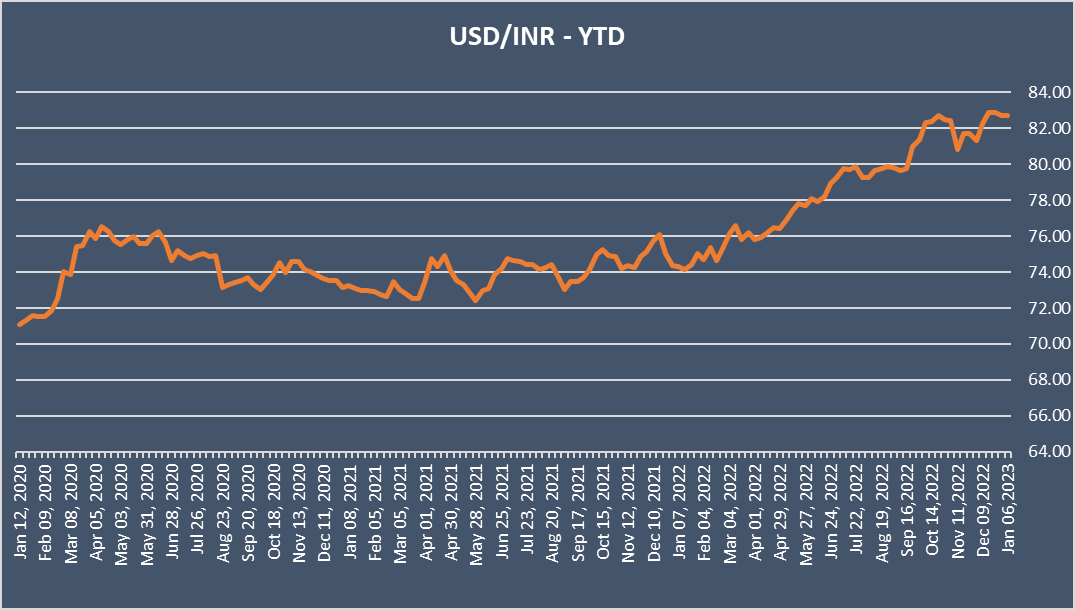

- India’s CPI inflation falls to 5.72% in December from the 5.88% level seen in November.

- December marks the second straight month when the domestic CPI figure remained under the Reserve Bank of India’s mandated tolerance band of 2-6%.

We would love to hear back from you. Please Click here to share your valuable feedback