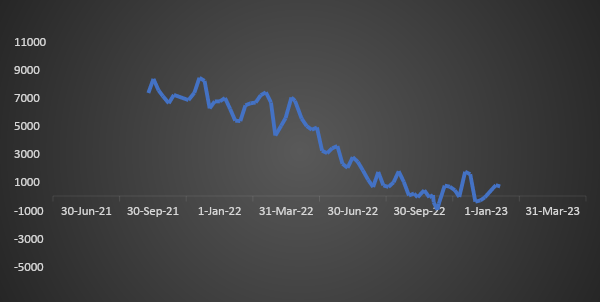

Due to tightening monetary policy adopted by RBI to combat inflation, system liquidity has come down significantly with a shift towards the deficit zone. As of 19th Jan 23, it stood at Rs 678 billion as compared to Rs 5359 billion as of 21st Jan 2022. During the last three months, system liquidity has become negative in many instances. System liquidity is likely to remain subdued in coming days.

Spike in short term rates

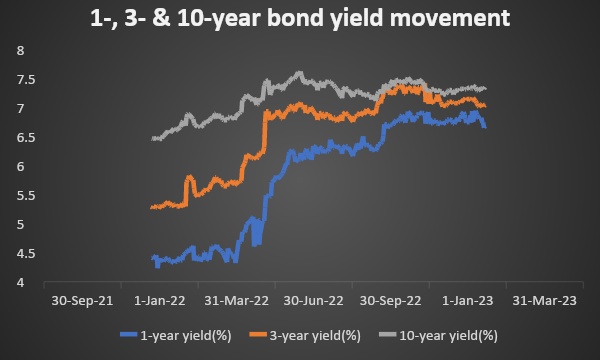

Owing to higher inflation and reduction in system liquidity, short term yield has moved up significantly as compared to long term which can be seen from below chart. In past one year, one year government bond yield rose by 230 bps as compared to 176 bps rise in 3-year bond and 89 bps rise in 10-year bond yield. Consequently, Bharat Bond ETF-2023 (which mirrors PSU yield) yield has gained 227 bps while Bharat Bond ETF -2032 yield has gained only 56 bps during the same period.

Rise in short term yield has made short maturity bonds more attractive for investors in the wake of higher inflation and rising interest rates scenario.

Government bonds, SDL and OIS yield movements

10-year benchmark 7.26% 2032 yield rose by 5 bps to 7.35% while 6.54% 2032 yield increased by 5 bps to 7.37%. The 5-year benchmark bond, 7.38% 2027 yield increased by 4 bps to 7.17%. 3-year benchmark 5.22% 2025 yield increased by 3 bps to 6.90%. Long-term paper, 7.40% 2062 yield increased by 3 bps to 7.40%.

The spread of 10-year bond over 5-year bond rose to 18 bps from 17 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread decreased to 5 bps from 7 bps while the 30-year benchmark over 10-year benchmark spread declined to 5 bps from 7 bps on a weekly basis.

On a weekly basis, 1-year OIS yield rose by 4 bps to 6.64% while the 5-year OIS yield decreased by 8 bps to 6.13%.

We would love to hear back from you. Please Click here to share your valuable feedback.