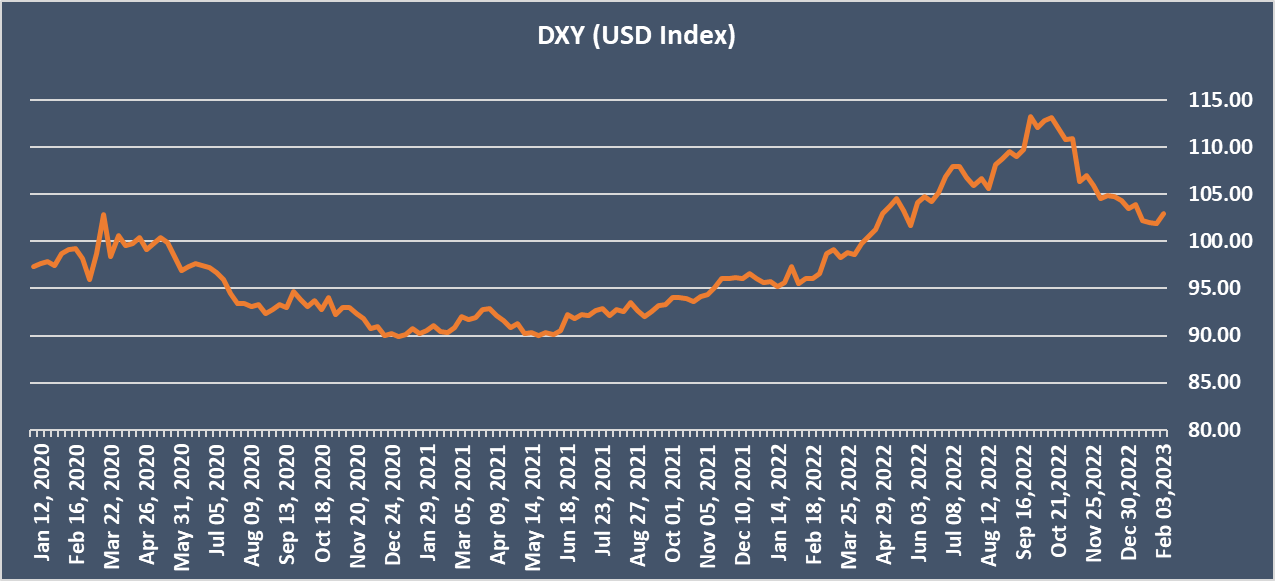

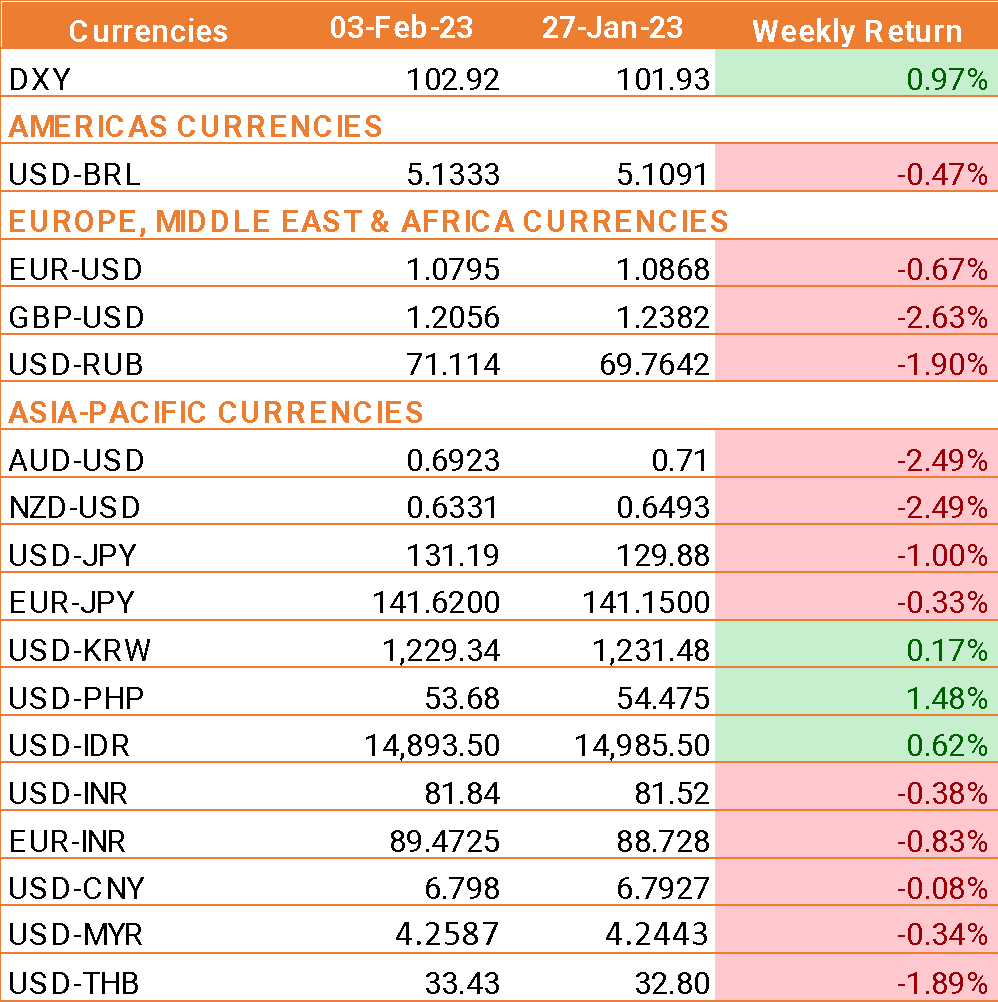

- USD traded higher last week after data showed that U.S. employers added significantly more jobs in January than economists expected, potentially giving the Federal Reserve more leeway to keep hiking interest rates.

- U.S. Labour Department's reported that nonfarm payrolls surged by 517,000 jobs last month. The data for December was revised higher to show 260,000 jobs added instead of the previously reported 223,000.

- Average hourly earnings rose 0.3% after gaining 0.4% in December. That lowered the year-on-year increase in wages to 4.4% from 4.8% in December. Market participants expected a gain of 185,000 jobs and a 4.3% year-on-year jump in wages.

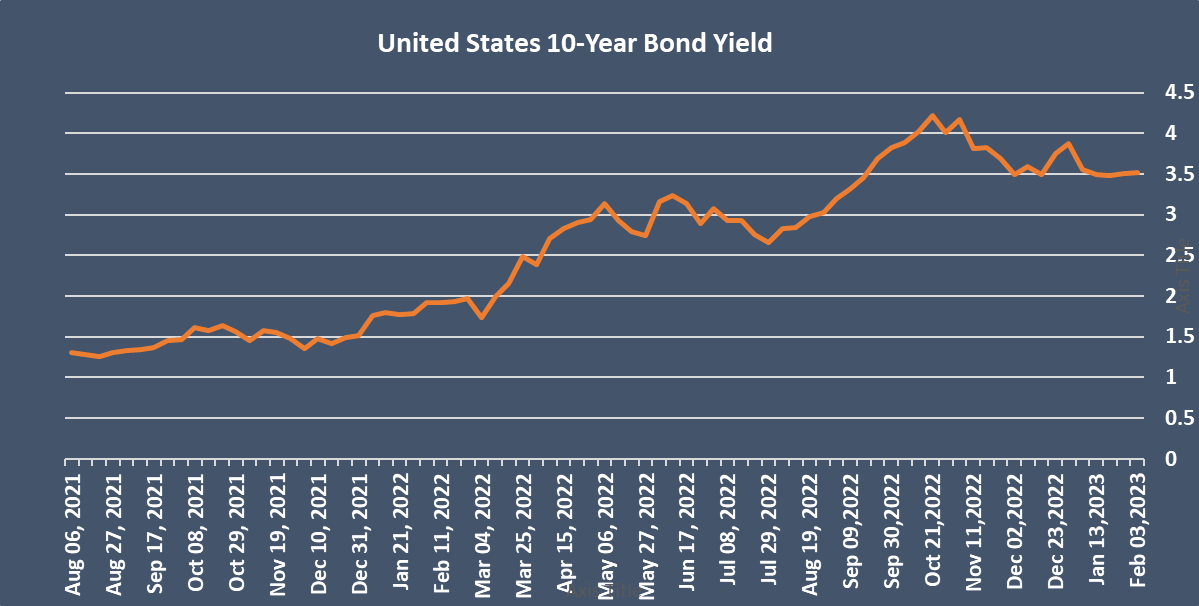

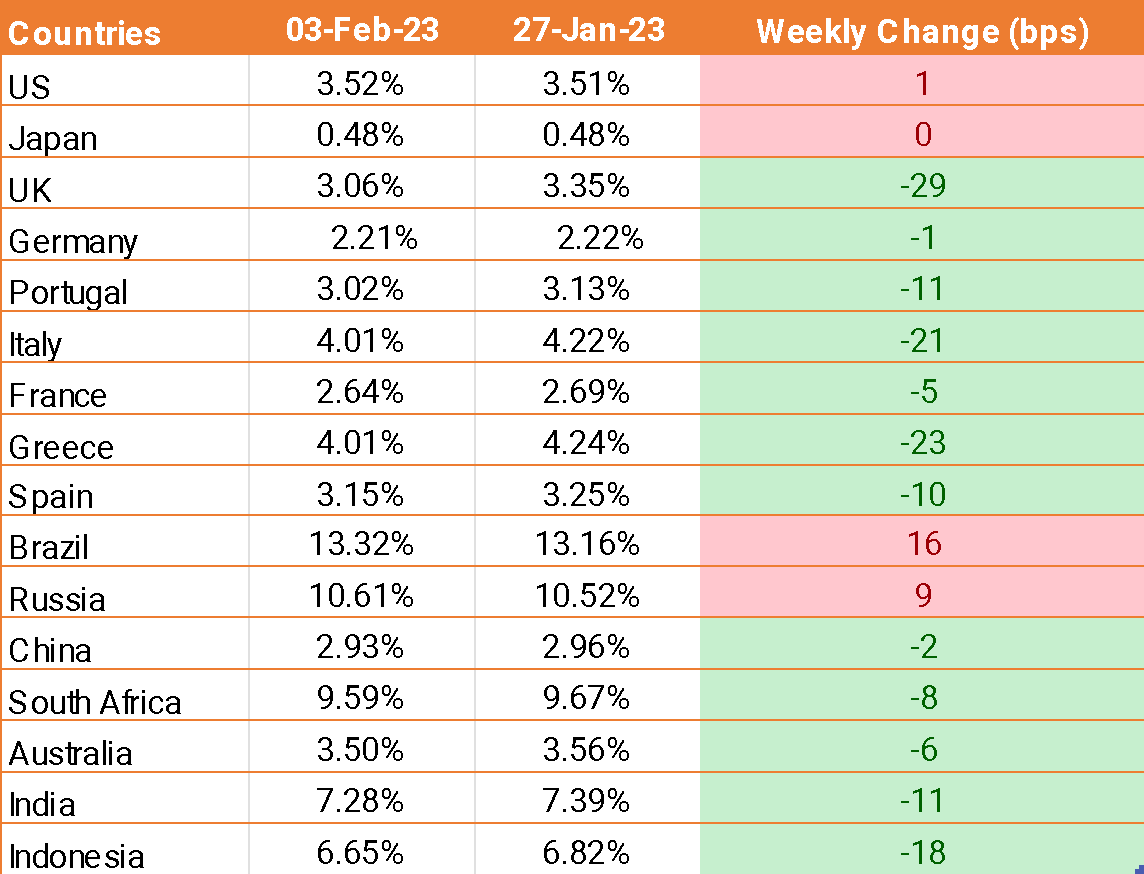

- Federal Reserve in its latest FOMC hiked rates to 25 basis points taking the benchmark rate to 4.75%. The move was expected, and the statement was relatively hawkish.

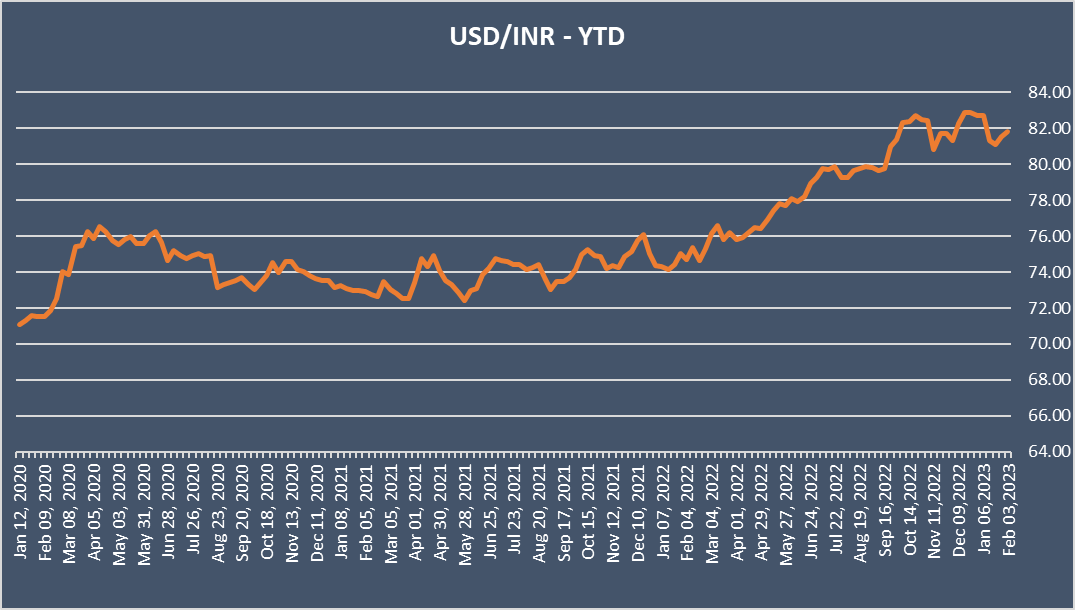

- INR post a weekly decline against USD after data showed that solid growth in India’s service sector slowed last month after hitting a six-month peak in December.

- The services PMI fell to 57.2 in January, down from 58.5 in December, missing forecasts of 58.1.

- India expects growth to slow in the coming year. The Indian government’s growth forecast for the coming year to 6% – 6.8% in the 2023/24 fiscal year, down from the 7% growth forecast for the current year, ending March 31. The slowdown comes as a global economic slowdown is likely to hurt exports.

We would love to hear back from you. Please Click here to share your valuable feedback