In order to mitigate the pandemic crisis in 2020, the Government of India started borrowing heavily from FY21. Consequently, inflation started picking up driven by ultra-low monetary policy and liquidity infusion.

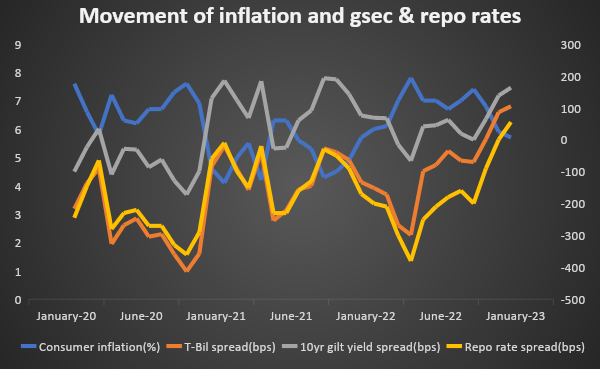

In CY2020, driven by economic lockdown, average annual consumer inflation stayed above 6% which is above the upper limit set by RBI for inflation. Consequently, spreads of T-Bill, 10- year g-sec and repo rate over inflation widened and became negative. Thus, the real interest rate became negative. Yearly average of 10-yr g-sec yield over inflation stood at -56 bps while average spread of repo rate over inflation stood at -230 bps. However, in CY21, average inflation fell to 5% which made spreads to narrow. In CY22, consumer inflation again started to pick up and went beyond 6% driven by global and domestic factors. Consequently, spreads widened between Jan to May. When the central bank started hiking policy rates, spreads narrowed and moved towards positive. During Dec 22, T-bill yield spread over inflation stood 105 bps as compared to -151 bps in Jan-22 while 10-year gilt yield spread rose to 163 bps from 68 bps during the same period. Owing to continuous rate hike by RBI, repo rate spread over inflation rose to 55 bps during Dec-22 from -200 bps during Jan-22.

For FY24, RBI has projected consumer inflation to stay at 5.3% with indication of further rate hikes. Therefore, spreads are likely to move up further from current levels.

Government bonds, SDL and OIS yield movements

The new 10-year benchmark 7.26% 2033 yield stood at 7.33%. 7.26% 2032 yield rose by 8 bps to 7.36%. The 5-year benchmark bond, 7.17% 2028 yield increased by 16 bps to 7.32%. 3-year benchmark 5.63% 2026 yield increased by 16 bp to 7.19%. Long-term paper, 7.40% 2062 yield increased by 5 bps to 7.42%.

The spread of 10-year bond over 5-year bond decreased to 4 bps from 17 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread rose to 9 bps from 7 bps while the 30-year benchmark over 10-year benchmark spread stood unchanged at 7 bps on a weekly basis.

10-yr SDL auction cut-off yield stood at 7.67% as compared to 7.69% in previous week while spread stood at 36 bps as compared to 35 bps in previous week.

On a weekly basis, 1-year OIS yield declined by 21 bps to 6.82% while the 5-year OIS yield increased by 24 bps to 6.39%.

We would love to hear back from you. Please Click here to share your valuable feedback,