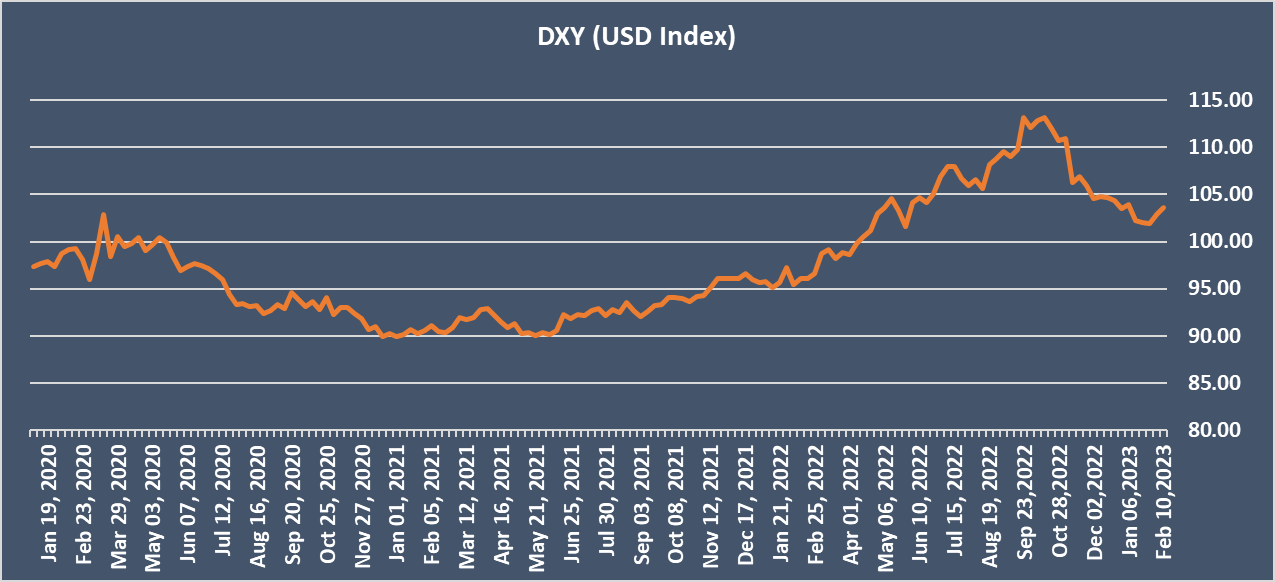

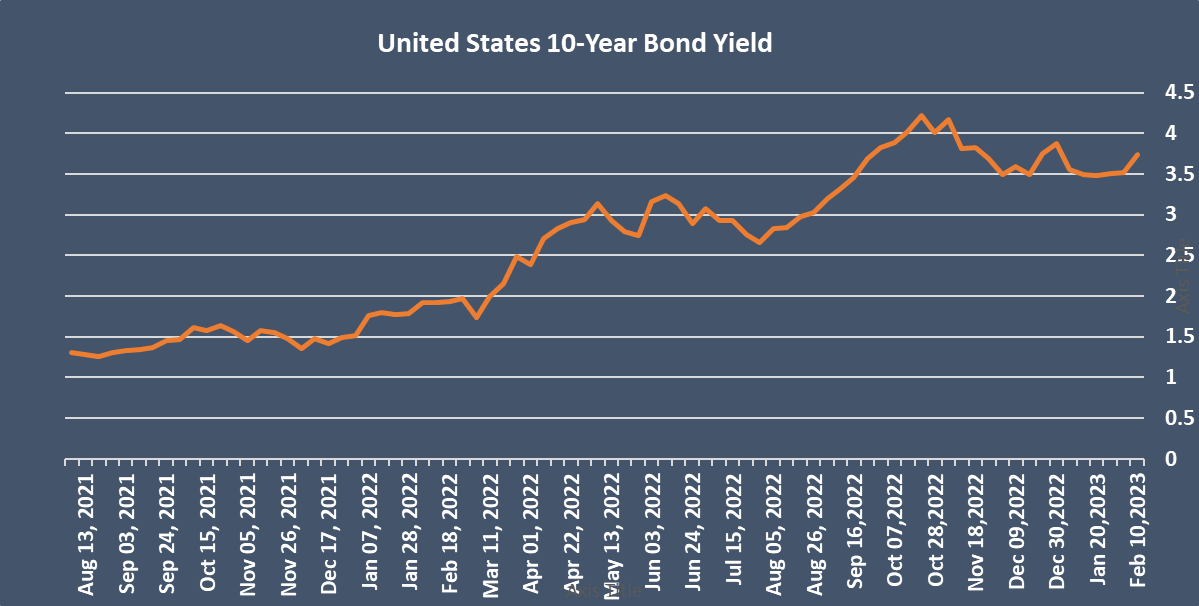

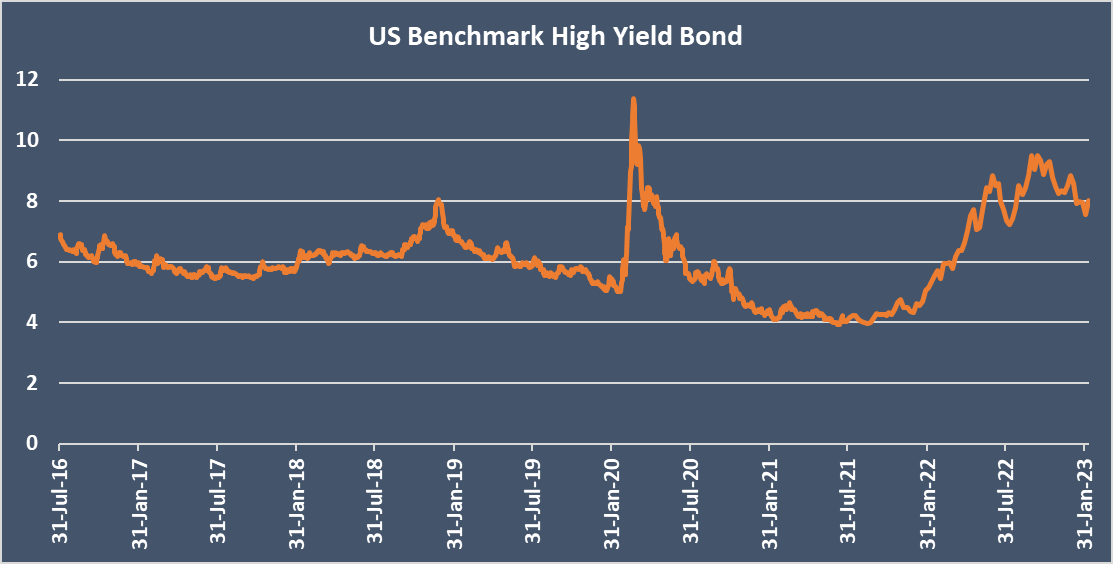

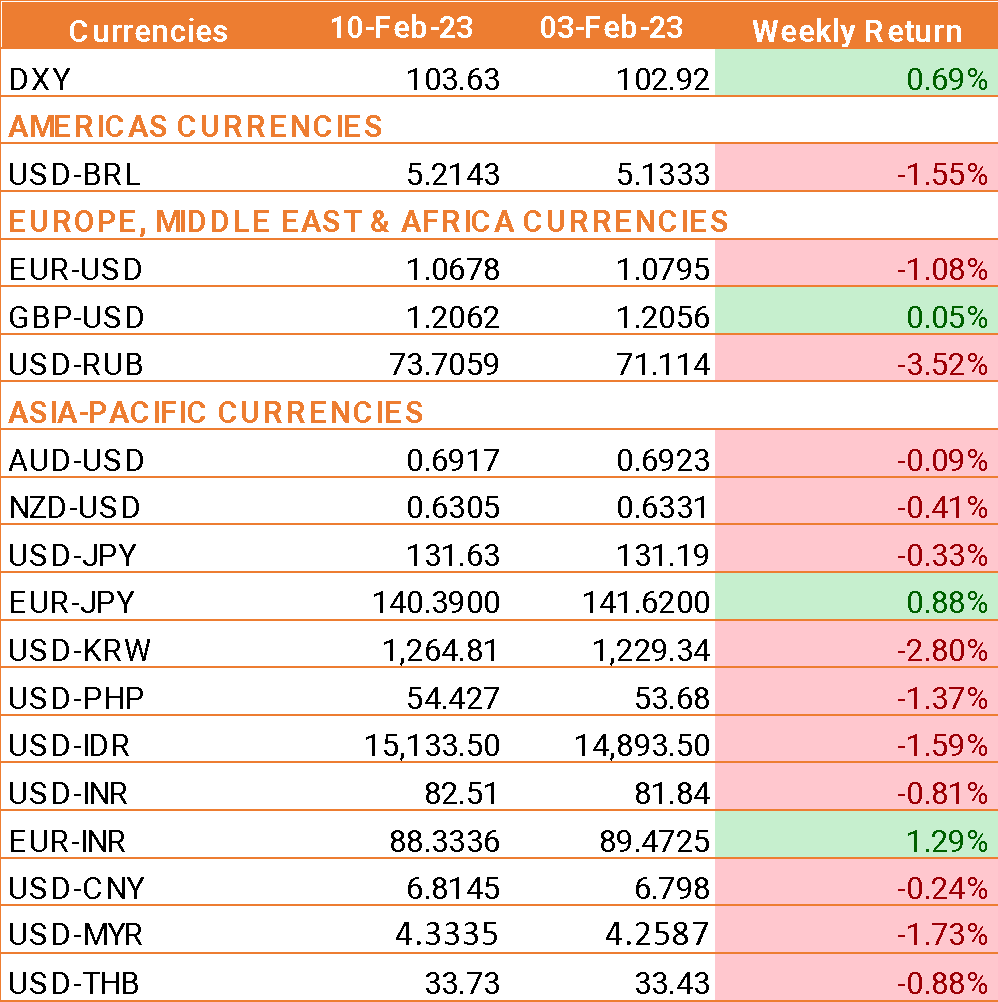

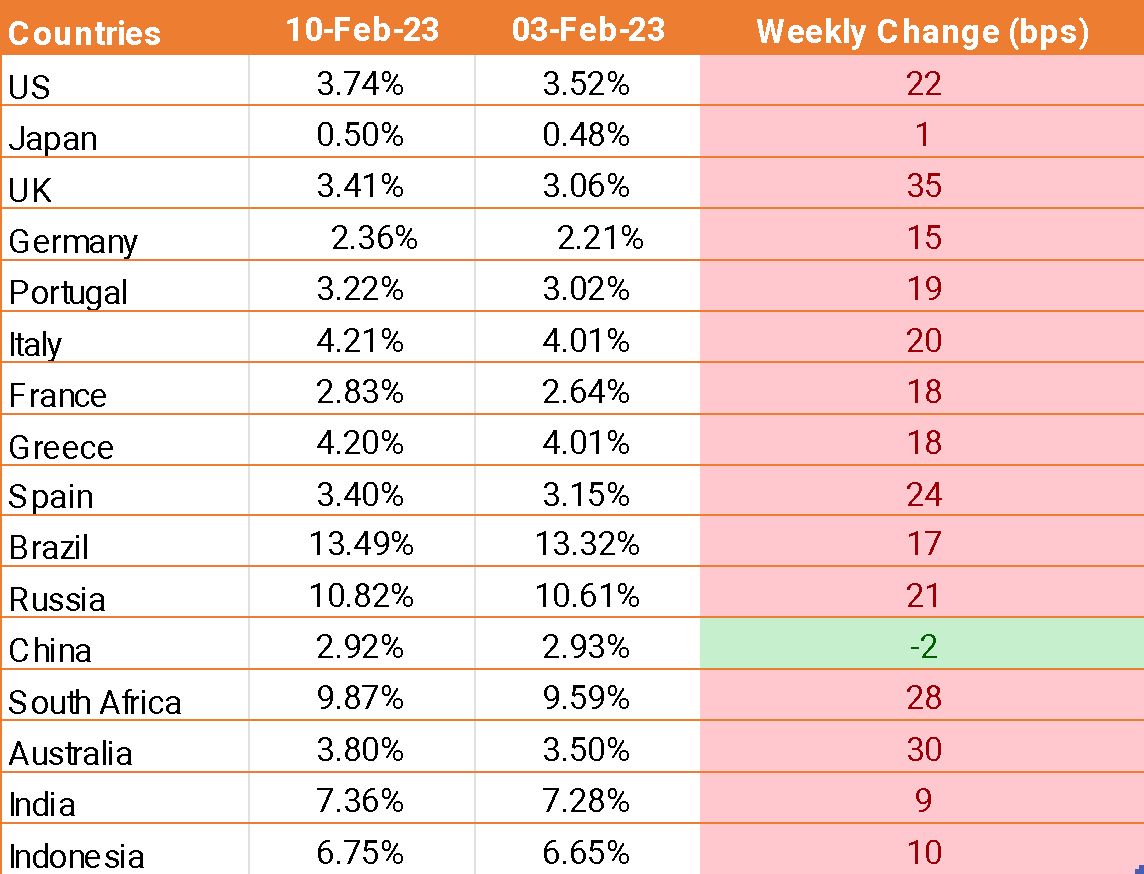

- USD traded higher last week on hawkish Fed commentary which also drives up the bond yields. Federal Reserve speakers, including Jerome Powell, have been hawkish this week, reiterating the need to raise interest rate further.

- Powell had said on Tuesday and last week that disinflation, or a deceleration in the rise of overall prices, has started.

- Richmond Federal Reserve president Thomas Barkin noted that demand was slowing but still resilient and the labour market still healthy, which means that inflation is still elevated and requires further action from the Fed.

- Fed governor Christopher Waller and New York fed president John Williams said that the Fed still probably needs to raise interest rates above 5% owing to the strong US jobs market.

- US Michigan consumer sentiment data came in at 66.4 in February ahead of the expectation of 65 and up from 64.5 in January.

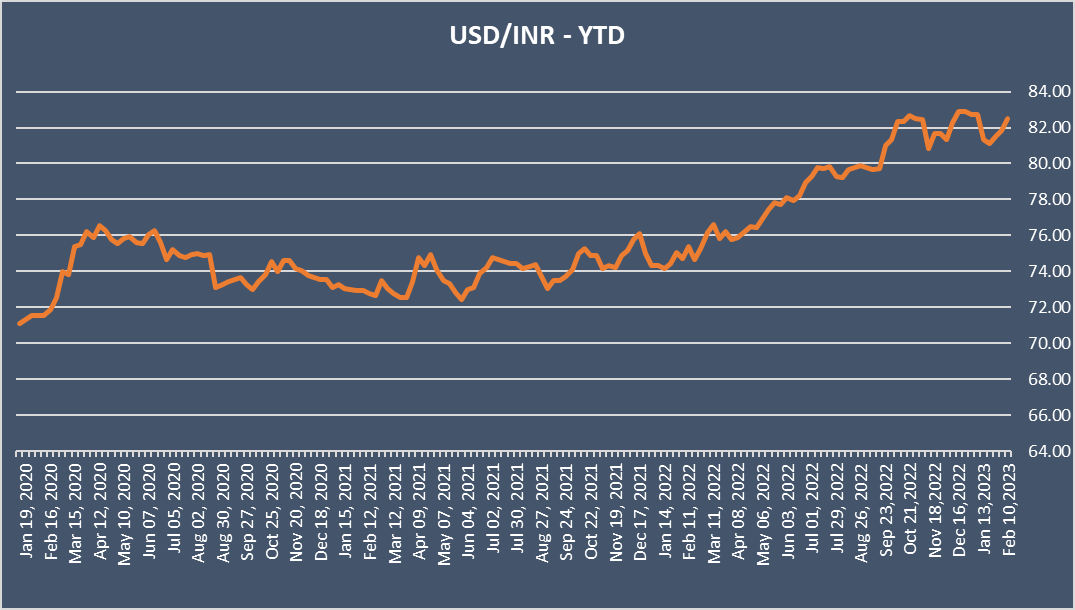

- INR ended lower amid broad strength exhibited by USD and despite RBI in latest policy hiked policy rate by 25 bps.

We would love to hear back from you. Please Click here to share your valuable feedback