In the current scenario of policy repo rate hike by RBI, high inflation and deficit system liquidity, the government bond yield curve has exhibited inversion. During the last MPC meeting, the repo rate was hiked by 25 bps with guidance of a tightening policy.

During January 2023, consumer inflation rose to 6.52% from 5.72% in the previous month. Driven by tight monetary policy, system liquidity continues to fall. As of 16th Feb, system liquidity stood at a deficit amount of Rs 123 billion. Driven by liquidity crunch, the bank's incremental credit to deposit ratio stood above 100%. 1-year OIS yield is running more than that of 5-year OIS.

In the global scenario, the US Fed continued to hike rates with indication of further rate hikes.

From the above factors, it can be said that short term yield is likely to converge with long term yield that will make the yield curve stay inverted in near future.

Wholesale inflation-Domestic WPI stood at 4.73% in Jan 23.

Industrial Production- India’s industrial output expanded by 4.3% in December 22.

Government bonds, SDL and OIS yield movements

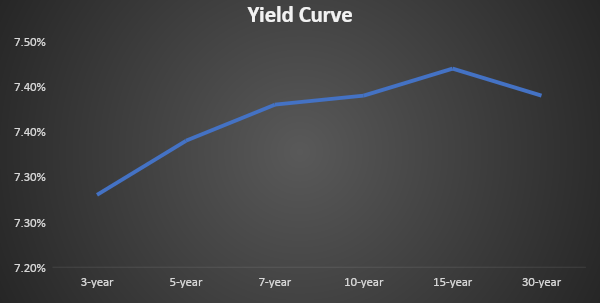

The new 10-year benchmark 7.26% 2033 yield rose by 4 bps to 7.37%. 7.26% 2032 yield rose by 3 bps to 7.39%. The 5-year benchmark bond, 7.17% 2028 yield increased by 4 bps to 7.36%. 3-year benchmark 5.63% 2026 yield increased by 9 bps to 7.28%. Long-term paper, 7.40% 2062 yield decreased by 3 bps to 7.39%.

The spread of 10-year bond over 5-year bond decreased to 1 bp from 4 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread declined to 7 bps from 9 bps while the 30-year benchmark over 10-year benchmark spread came down to 3 bps from 7 bps on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.72% from 7.67% in previous week while spread stood at 35 bps as compared to 36 bps in previous week.

On a weekly basis, 1-year OIS yield rose by 14 bps to 6.96% while the 5-year OIS yield increased by 14 bps to 6.53%.

We would love to hear back from you. Please Click here to share your valuable feedback,