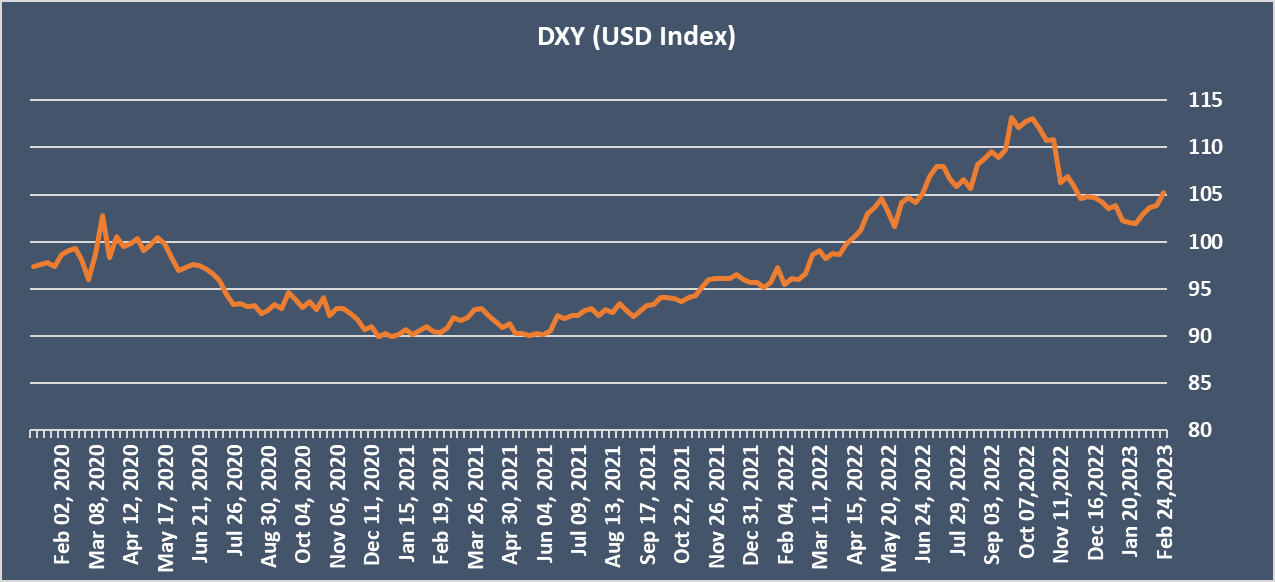

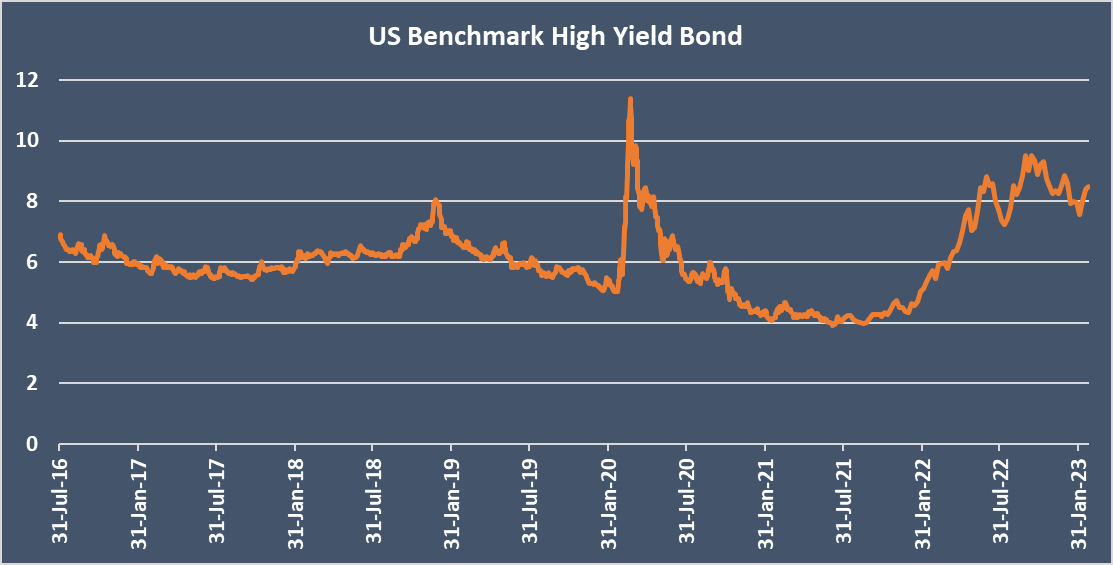

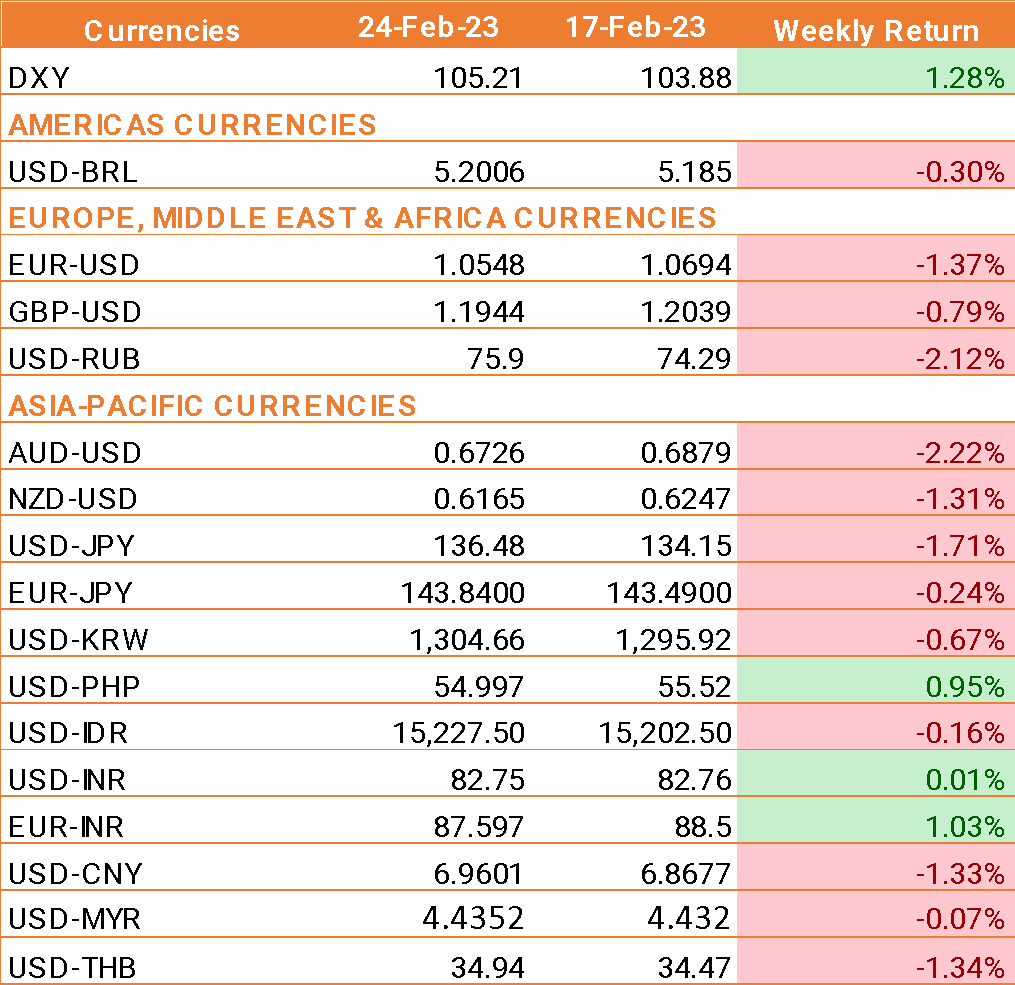

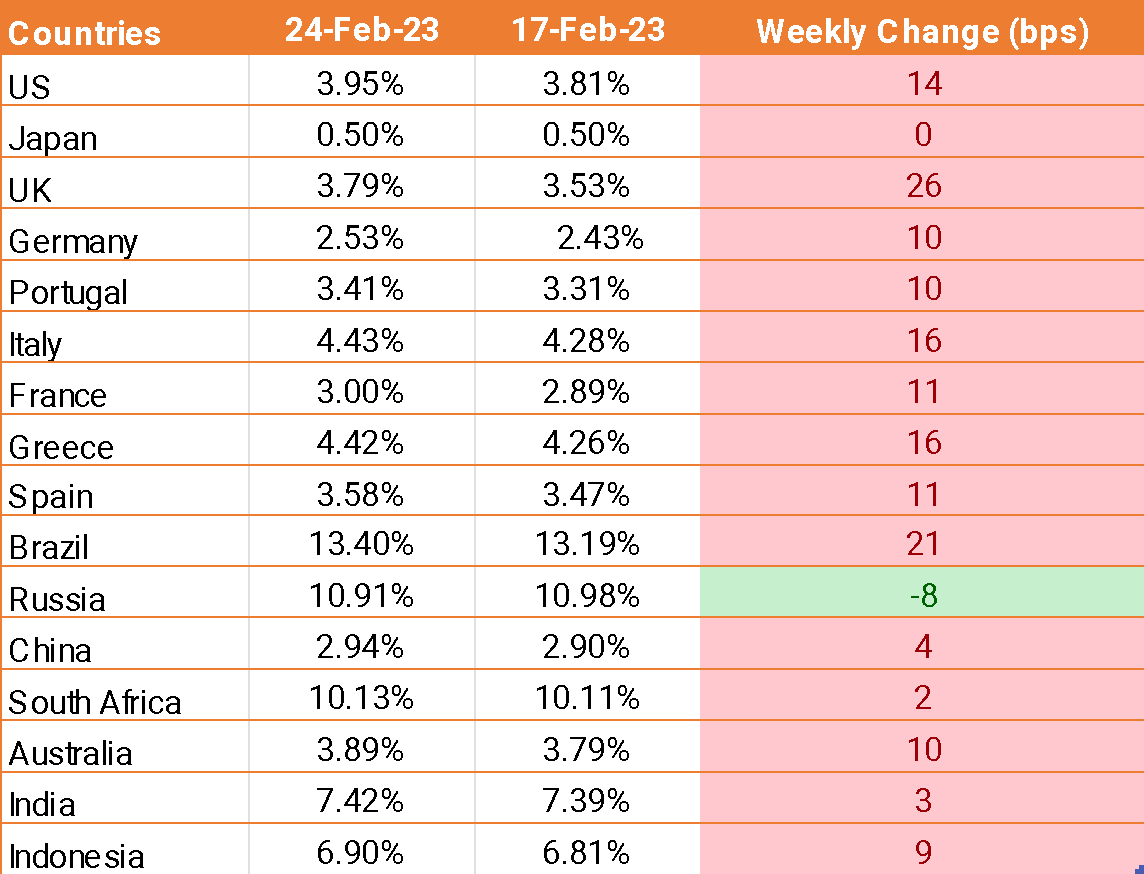

- USD traded higher after the release of the minutes from the February Fed FOMC meeting and on data showing still-high inflation which reinforced expectations that interest rates could stay higher for longer.

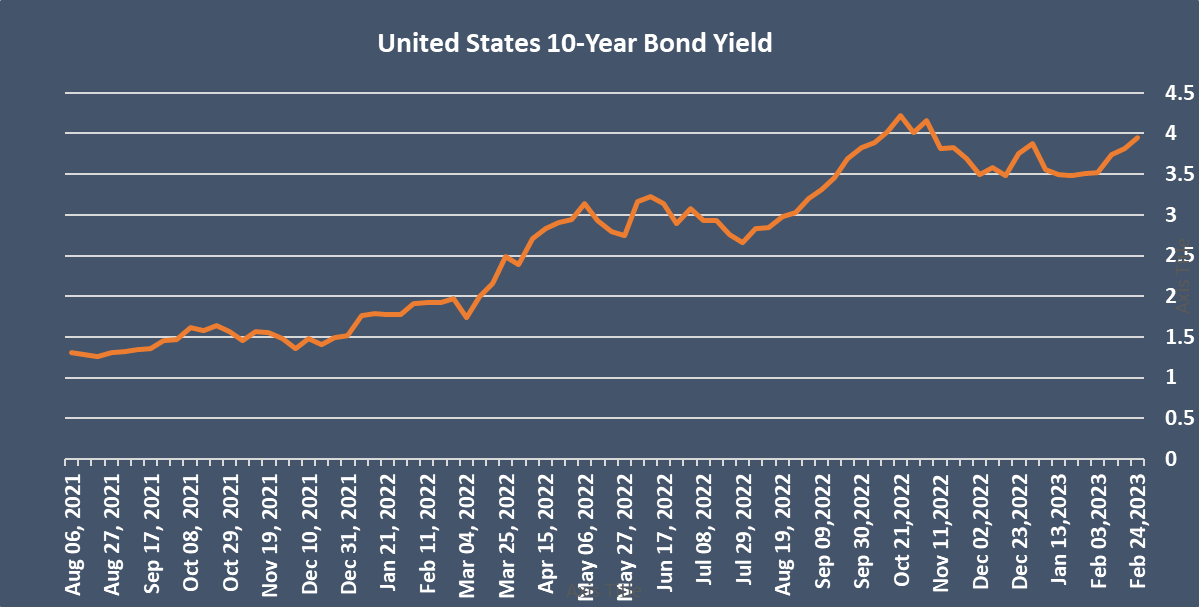

- The minutes revealed that most fed officials supported the slower pace of rate hikes at 25 bps as it would allow them to assess the economy’s progress better. However, there were still some policymakers who preferred a larger 50 bps increase.

- St Louis Fed President James Bullard said the Fed needs to tighten monetary policy further. He expects interest rates to peak between 5.25 to 5.5%, which is still 50 basis points above the current level.

- US personal consumption expenditures (PCE) price index rose 0.6% last month after gaining 0.2% in December. The PCE price index accelerated 5.4% in the 12 months through January, after rising 5.3% in December.

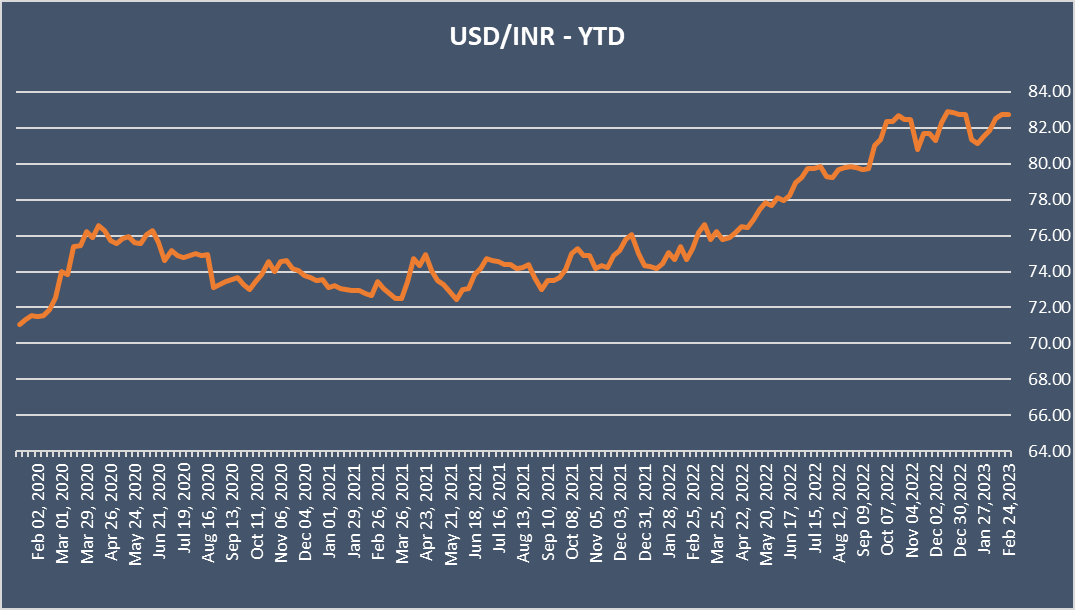

- INR remains flat due to risk-off trade on the expectation that Fed will hike rates further.

- Oil prices are falling, offering some support to the INR. The prospect of higher interest rates dampening global growth and oil demand is pulling oil prices lower.

We would love to hear back from you. Please Click here to share your valuable feedback