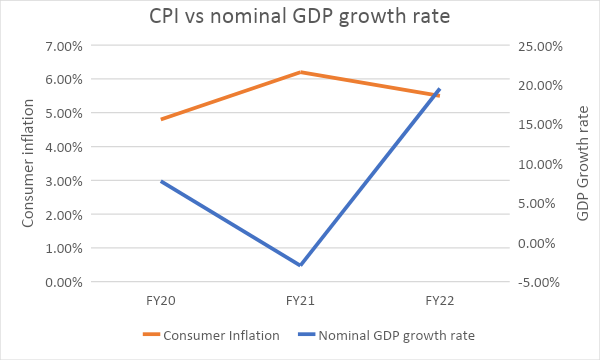

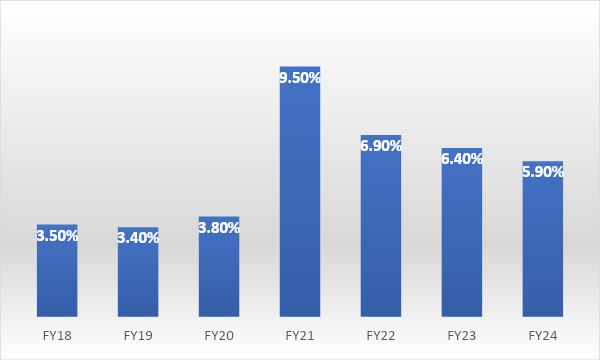

As per RBI’s estimation, consumer inflation is projected at 6.5% in 2022-23, with Q4 at 5.7%. On the assumption of a normal monsoon, CPI inflation is projected at 5.3% for 2023-24, with Q1 at 5%, Q2 at 5.4 per cent, Q3 at 5.4% and Q4 at 5.6%. Real GDP growth for 2023-24 is projected at 6.4% with Q1 at 7.8%, Q2 at 6.2%, Q3 at 6.0% and Q4 at 5.8%.

During Apr-Jan FY23, India’s fiscal deficit stood at 67.8% of budgeted target FY23 which is higher than 58.9% during the corresponding period of previous fiscal year. In absolute terms, the fiscal deficit stood at Rs 11.9 trillion during the above mentioned period. During Apr-Jan 23, the net tax collection stood at Rs 16.9 trillion or 80.9% of the RE 2022-23 as compared to 87.7% that in FY22.

It can be mentioned that the Union Government has pegged the domestic fiscal deficit at 5.9% of GDP for FY24 while it retained fiscal deficit at 6.4% for the current fiscal year. It is expected that the Union Govt will be able to meet the fiscal deficit target by higher tax collection for the current fiscal year.

According to Economic Survey 2023, resilient economic growth, higher revenue collection, and careful expenditure management over the medium run, the Union Government will be on track with the fiscal consolidation with the target of fiscal deficit of 4.5% by FY26 in the absence of any global or domestic economic disruption.

GDP growth- During Q3FY23, India’s GDP stood at 4.4% on yearly basis while the estimates for FY22 have been revised upwards to 9.1%.

Government bonds, SDL and OIS yield movements

The new 10-year benchmark 7.26% 2033 yield rose by 1 bp to 7.40% while 7.26% 2032 yield stood flat 7.42%. The 5-year benchmark bond, 7.38% 2027 yield remained unchanged at 7.39%. 3-year benchmark 5.63% 2026 yield increased by 4 bps to 7.35%. Long-term paper, 6.95% 2061 yield stood at 7.50%.

The spread of 10-year bond over 5-year bond decreased to 1 bp from 3 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread rose to 5 bps from 4 bps while the 30-year benchmark over 10-year benchmark spread came down to 5 bps from 1 bp on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.74% from 7.71% in previous week while spread declined to 31 bps from 35 bps in previous week.

On a weekly basis, 1-year OIS yield rose by 5 bps to 7.05% while the 5-year OIS yield increased by 2 bps to 6.65%.

We would love to hear back from you. Please Click here to share your valuable feedback,