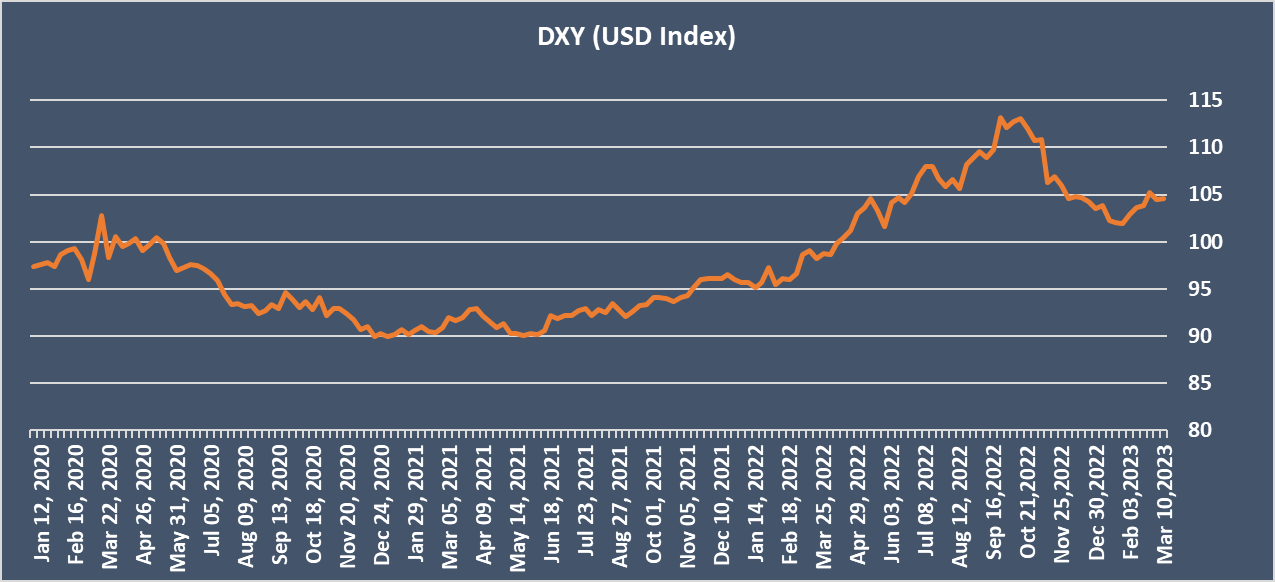

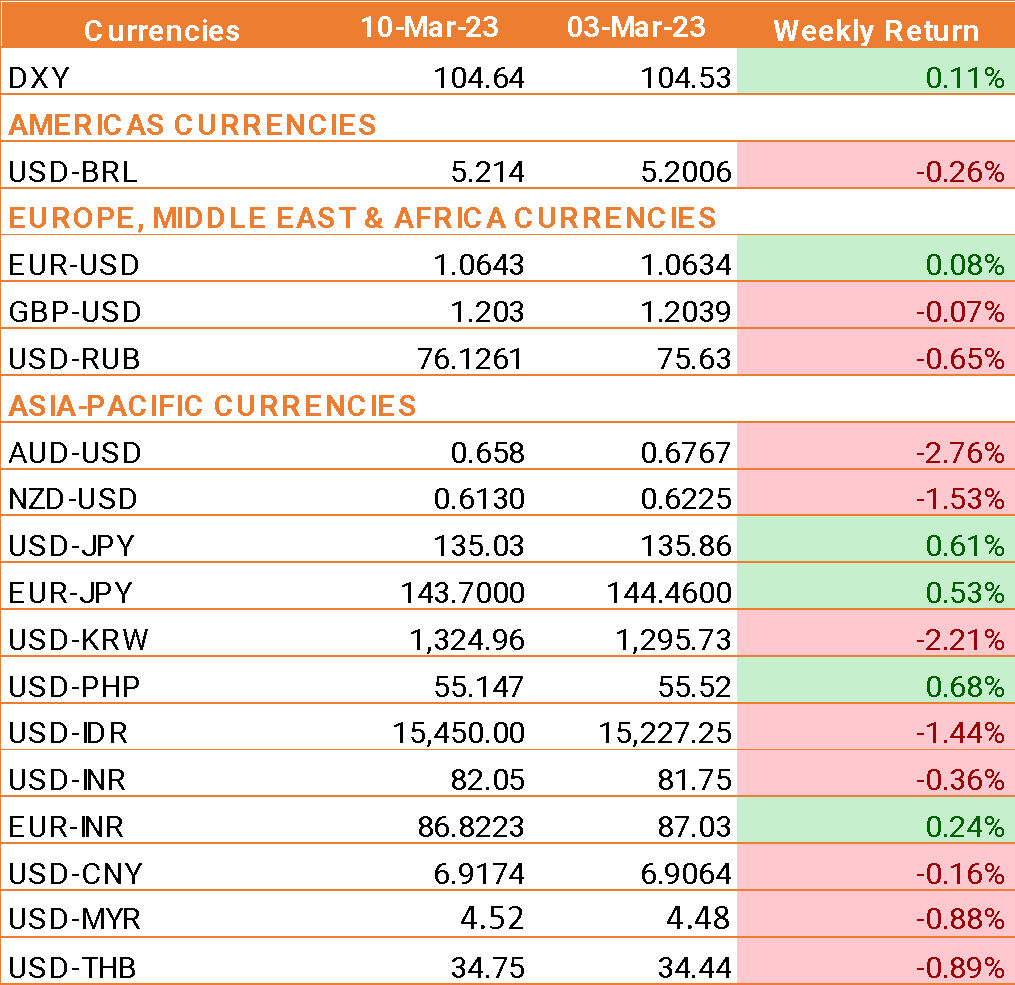

- USD traded higher after hawkish comments from the Federal Reserve chair Jero

- me Powell as he testified before Congress.

- Powell warned that interest rates could rise at a faster pace and that the terminal rate could go higher than initially expected after a series of stronger-than-forecast macroeconomic data across February.

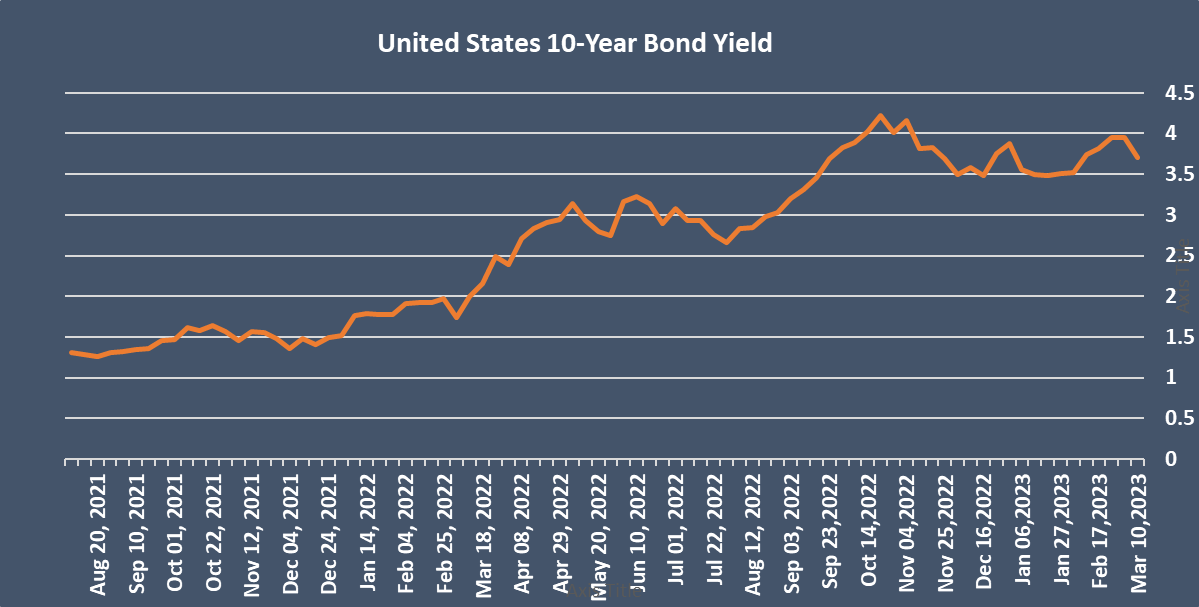

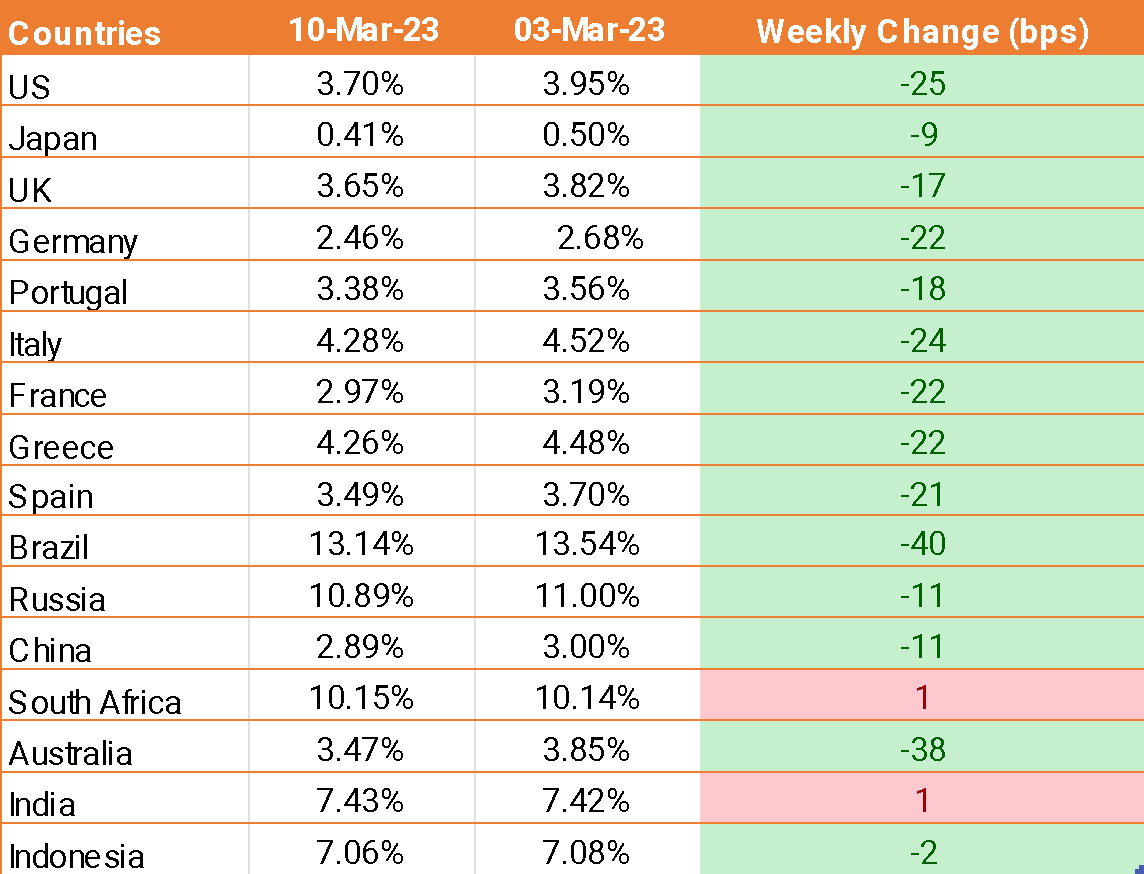

- The US 2 and 10-year bond yields are now the most inverted that they have been since the 1980s.

- US jobless claims rose by more than expected. Jobless claims rose to 211,000 up from 192,000 in the previous week and ahead of expectations of 195,000.

- US labour data released on Friday shows that Nonfarm Payrolls rose by 311,000 in February. This reading came in much higher than the market expectation of 205,000 and followed January's print of 504,000 (revised from 517,000).

- Further details of the jobs report showed that the Labor Force Participation Rate improved modestly to 62.5% from 62.4% in January. Additionally, the Unemployment Rate rose to 3.6% and the annual wage inflation, as measured by the Average Hourly Earnings, increased to 4.6% from 4.4%.

We would love to hear back from you. Please Click here to share your valuable feedback