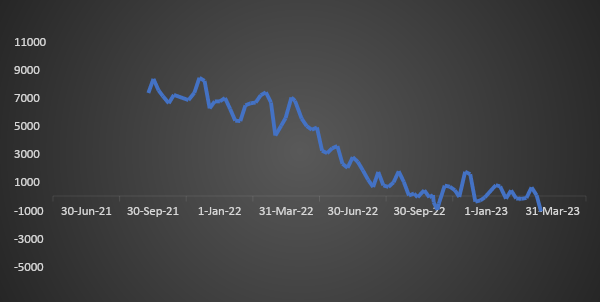

In order to mitigate the economic downturn due to the onslaught of the corona pandemic, RBI kept policy rates at ultra -low levels with infusion of liquidity through long term repo operations and OMO purchases following the footsteps of global central banks. Consequently, inflation started an uptrend driven by high system liquidity. At that time, economic growth was the primary concern of the central bank in lieu of taming inflation. In CY2020, average annual consumer inflation stayed above 6% which is above the upper limit set by RBI for inflation. At the end of 2020, system liquidity stood at a surplus amount of Rs 5569 billion.

During H1FY22, RBI conducted G-SAP to maintain system liquidity at ample levels so that long term bond yields will not rise by much in the wake of higher government borrowing. It can be noted that as of Sep 2021, system liquidity stood at more than the surplus amount of Rs 7 trillion.

However, since CY22, rising inflation was the major concern for global central banks including RBI. In the view of an uptrend in inflation and global rate hikes, RBI started hiking policy rates with hawkish stance which led to drastic fall in liquidity in the system to deficit levels and with selling of USD to arrest depreciation in domestic currency. As of 16th March, liquidity stood at a deficit amount of Rs 1107 billion.

RBI is expected to continue rate hikes with a hawkish stance on monetary policy in the wake of elevated inflation and indication of US Fed rate hikes in coming days. Therefore, the current state of liquidity crunch is likely to persist in the coming days.

T Bill auction-Last week, 91 days, 184 days & 364 days T-bill auction cut-off stood at 6.85%, 7.27% and 7.30% respectively.

Consumer inflation- India’s consumer inflation declined marginally to 6.44% in Feb 23 from 6.52% in previous month. Core inflation is hovering around 6%.

Government bonds, SDL and OIS yield movements

On a weekly basis, the new 10-year benchmark 7.26% 2033 yield declined by 8 bps to 7.34% while 7.26% 2032 yield came down by 8 bps to 7.35%. The 5-year benchmark bond, 7.38% 2027 yield declined by 17 bps to 7.23%. 3-year benchmark 5.63% 2026 yield decreased by 17 bps to 7.20%. Long-term paper, 7.40% 2062 yield came down by 9 bps to 7.40%.

The spread of 10-year bond over 5-year bond increased to 11 bps from 2 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread declined to 7 bps from 9 bps while the 30-year benchmark over 10-year benchmark spread decreased to 7 bps from 8 bp on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.73% from 7.71% in previous week while spread rose to 38 bps from 31 bps as compared to previous week.

On a weekly basis, 1-year OIS yield declined by 23 bps to 6.79% while the 5-year OIS yield decreased by 21 bps to 6.35%.

We would love to hear back from you. Please Click here to share your valuable feedback,