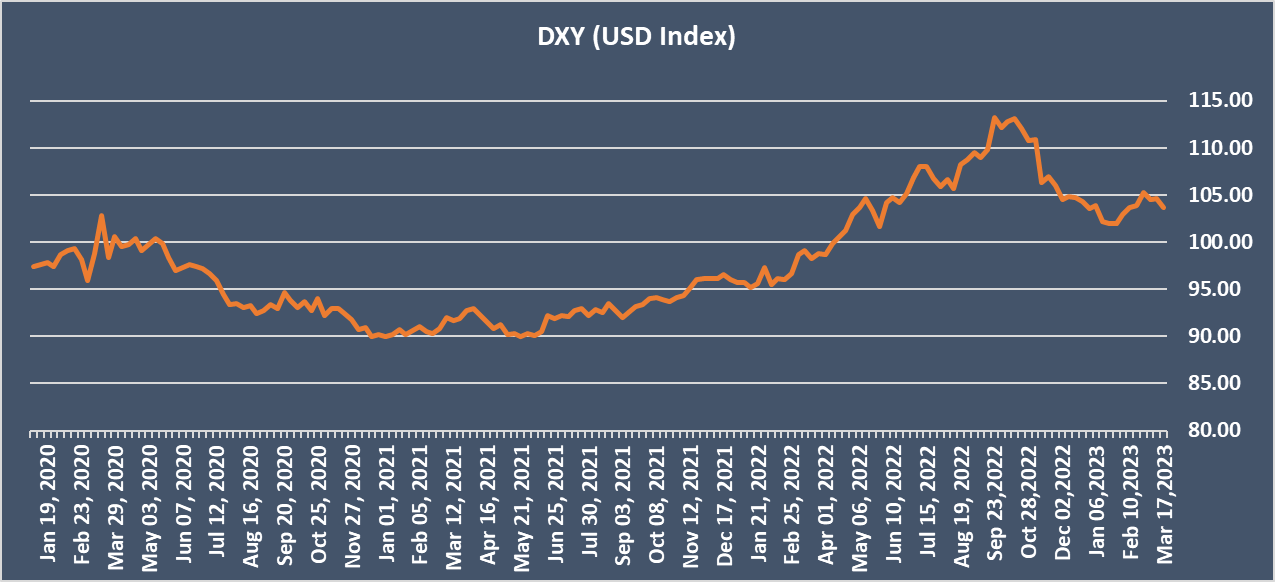

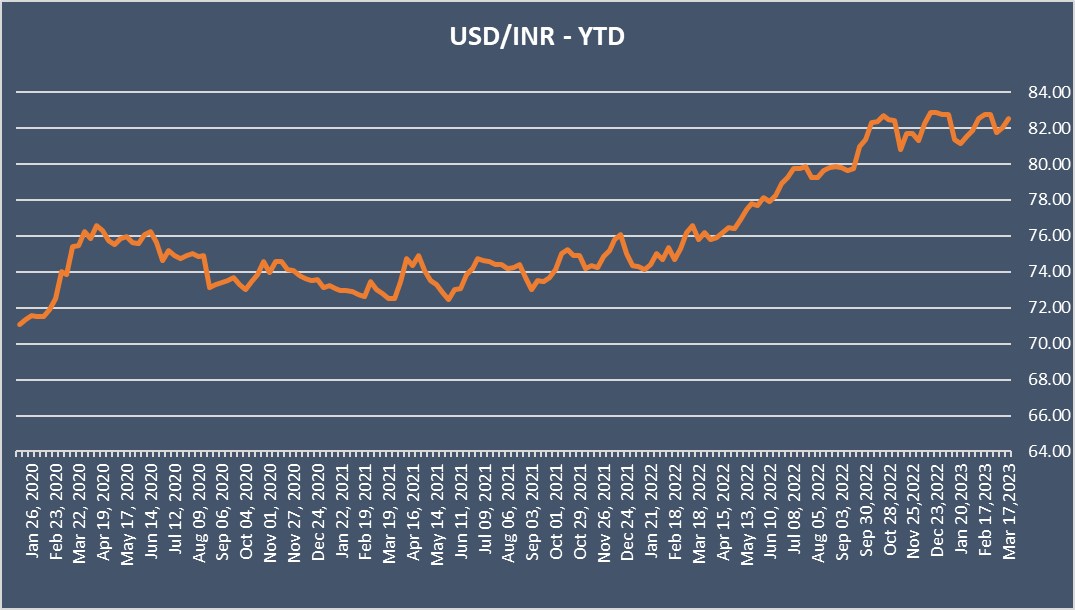

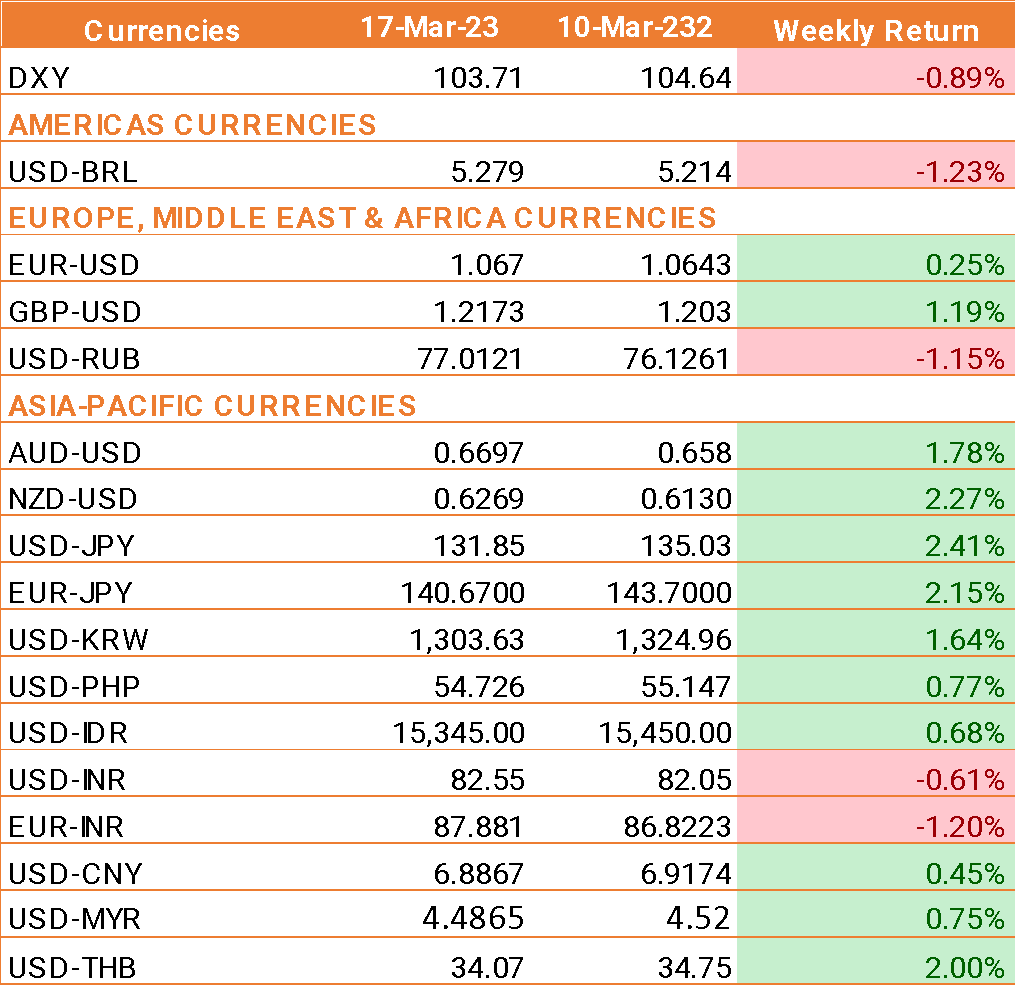

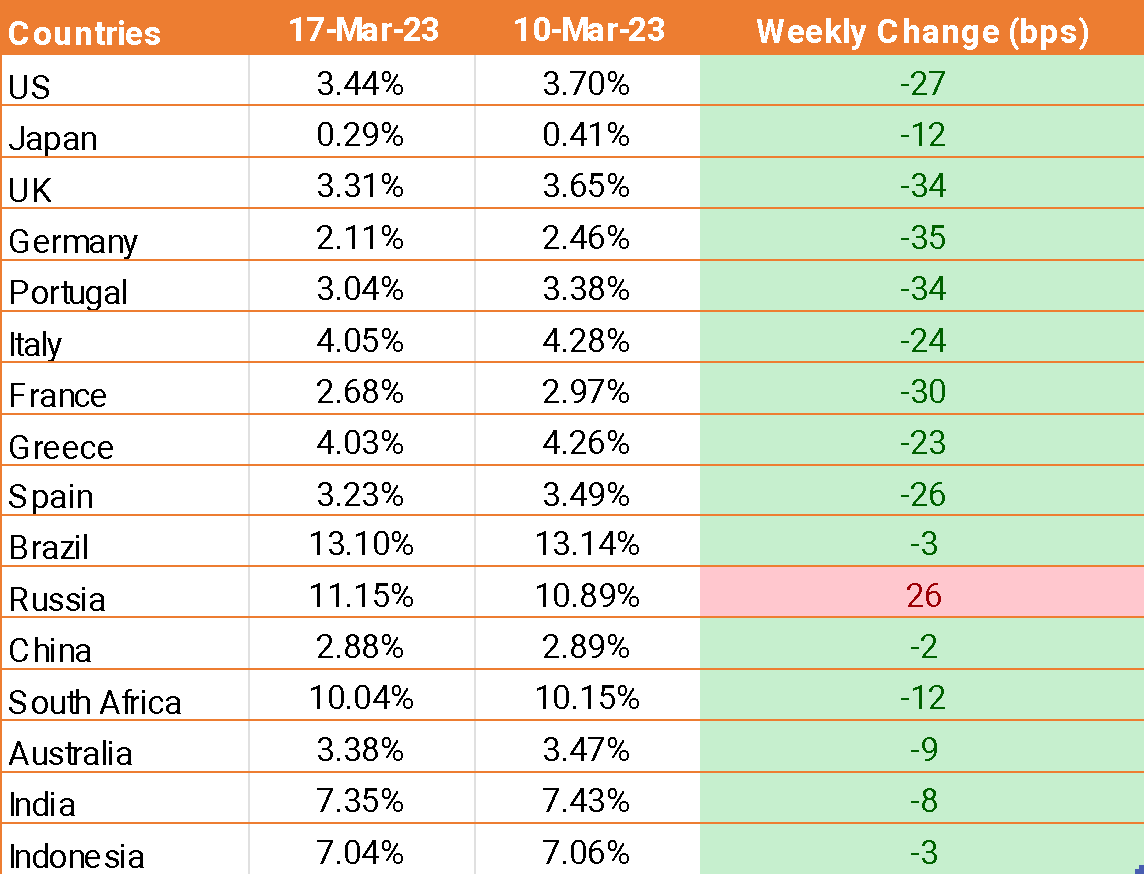

- USD traded lower as the ongoing turmoil in the financial sector boost the expectation of a less aggressive rate hike by the Federal Reserve despite stronger than forecast data.

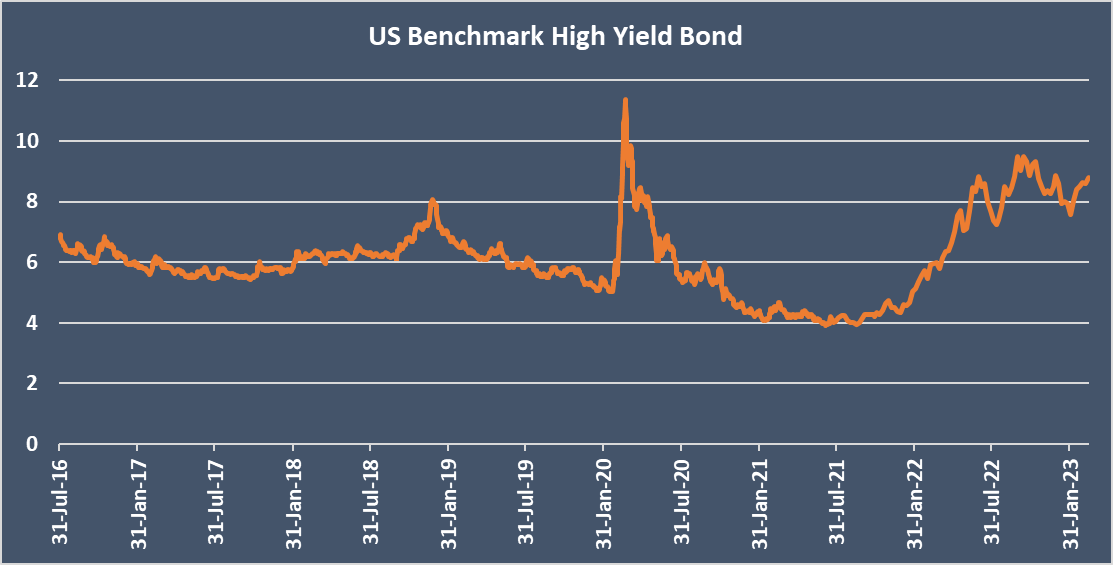

- The market sentiment also improved after a number of U.S. banks teamed together to inject USD 30 billion in deposits into the first Republic bank.

- US jobless claims fell by more than expected to 192,000, from 212,000, below the 205,000 expectations, highlighting strength in the labor market. US housing starts also climbed to a 5-month high.

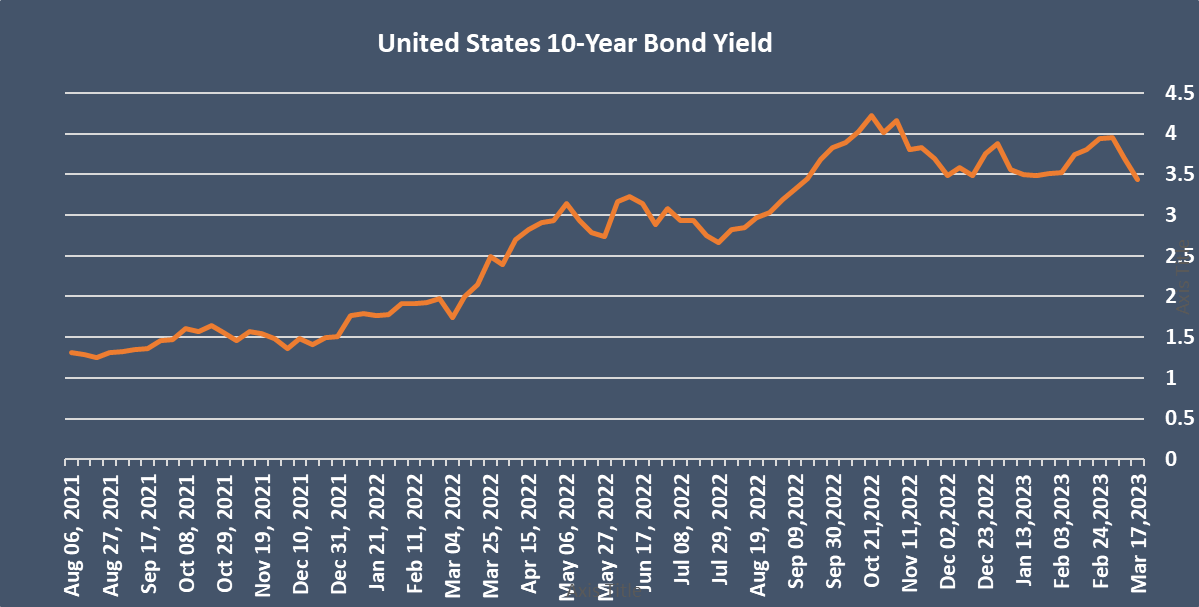

- Wholesale inflation, as measured by the producer price index, fell by a more-than-expected 4.6% year on year, well down from 5.2% in January. Cooling wholesale inflation usually points to a slowdown in consumer inflation, which would take pressure off the Fed to raise rates aggressively.

- Retail sales fell by -0.4% month on month, more than expected after rising 3.2% in January. The fall in sales suggests that consumers are reining in spending as interest rates rise.

We would love to hear back from you. Please Click here to share your valuable feedback