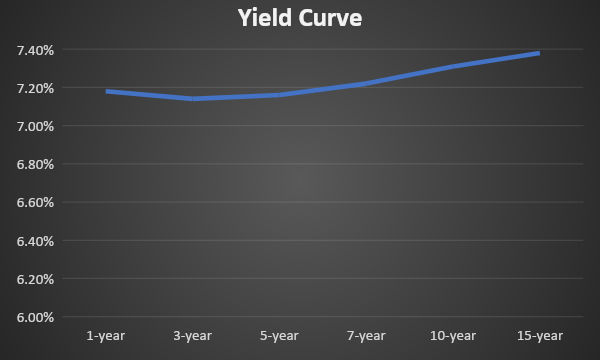

In the current scenario of policy repo rate hike by RBI, high inflation and deficit system liquidity, the government bond yield curve has become flat. Owing to tight monetary policy, system liquidity has entered deficit zone. As of 23rd March 2023, liquidity stood at Rs 449 billion of deficit. Domestic inflation is still beyond the upper limit pegged by the central bank as it stood 6.44% in Feb 23. Therefore, RBI will continue hawkish stance on monetary policy.

Globally, all major central banks are hiking policy rates to curb inflation in the current scenario of high inflation. So, RBI is expected to hike policy rates in the coming days. Consequently, the yield curve is likely to continue to remain flat in FY24.

If RBI continues rate hike while inflation continues to stand above 6% with system liquidity stays in deficit zone, yield curve is likely to exhibit inversion in FY24.

On the other hand, if inflation starts to decline significantly, RBI may pause rate hikes action. Consequently, system liquidity is likely to stay at a surplus. In that scenario, the yield curve may steepen in the next fiscal year.

Government bonds, SDL and OIS yield movements

On a weekly basis, the new 10-year benchmark 7.26% 2033 yield declined by 3 bps to 7.31% while 7.26% 2032 yield came down by 4 bps to 7.31%. The 5-year benchmark bond, 7.38% 2027 yield declined by 8 bps to 7.15%. 3-year benchmark 5.63% 2026 yield decreased by 10 bps to 7.10%. Long-term paper, 7.40% 2062 yield came down by 1 bp to 7.39%.

The spread of 10-year bond over 5-year bond increased to 16 bps from 11 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread stood unchanged at 7 bps while the 30-year benchmark over 10-year benchmark spread remained flat at 7 bps on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.77% from 7.73% in previous week while spread declined to 34 bps from 38 bps as compared to previous week.

On a weekly basis, 1-year OIS yield declined by 10 bps to 6.69% while the 5-year OIS yield decreased by 14 bps to 6.21%.

We would love to hear back from you. Please Click here to share your valuable feedback,