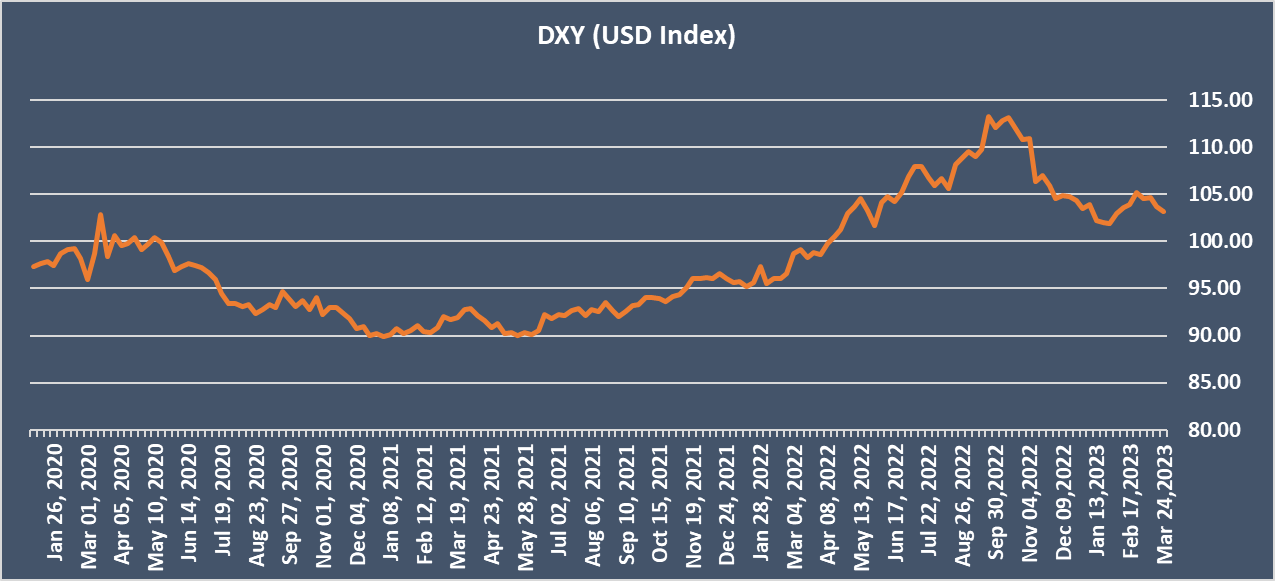

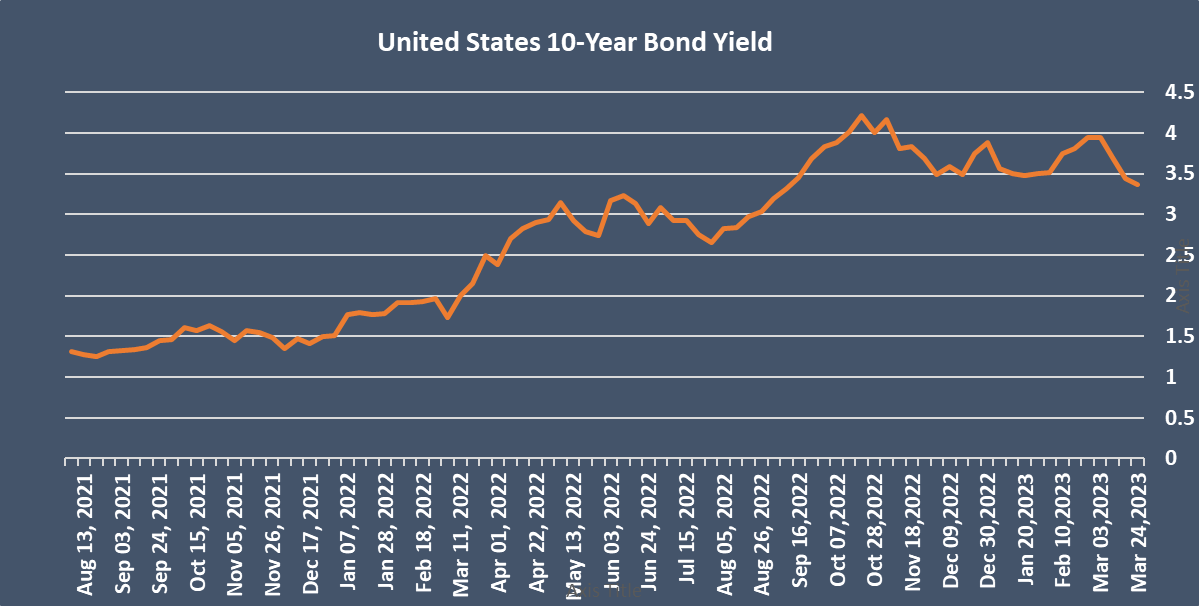

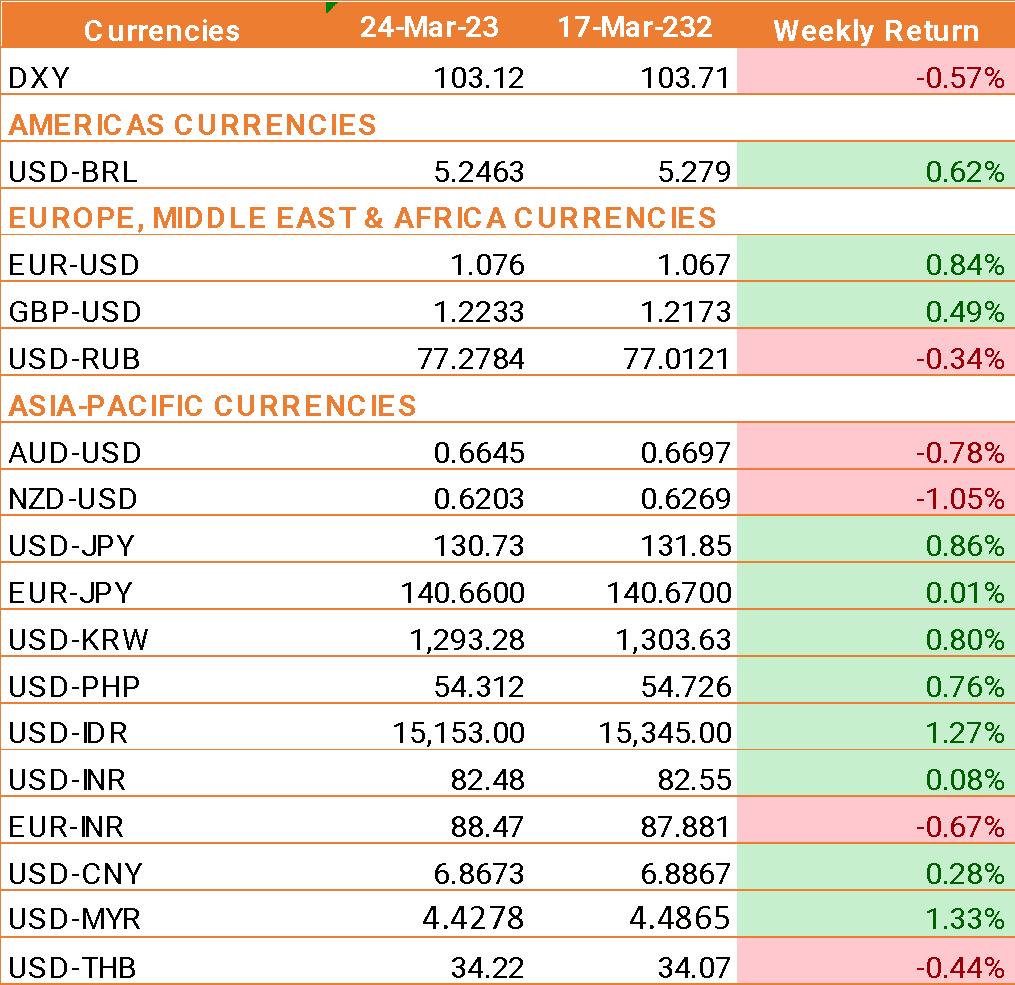

- USD falls after the Federal Reserve interest rate decision. The U.S. central bank raised interest rates by 25 bps taking the rate from 4.75% to 5%, in line with expectations.

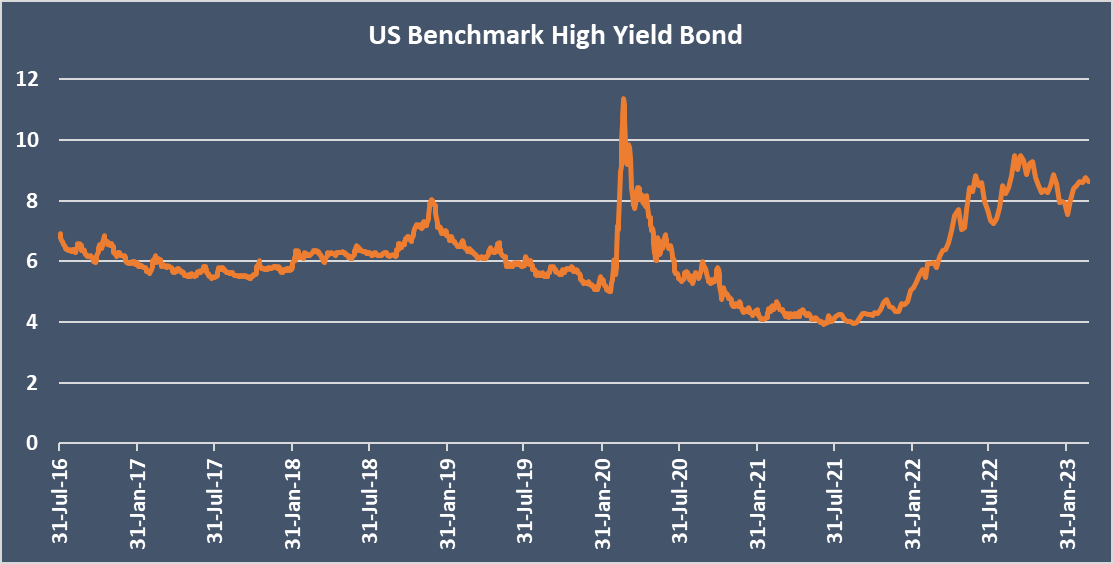

- The Fed Chairman Jerome Powell said that policymakers weighed up pausing rate hikes in light of the recent stress seen in the banking sector. However, they concluded that inflation is still too high and, therefore, interest rates must rise.

- However, stronger than expected US jobless claims data helped to boost the USD of Friday. U.S. initial jobless claims fell to a three-week low of 191,000 from 192,000 in the previous week.

- U.S. business activity gained steam in March as orders rebounded for the first time in six months. U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, increased to 53.3 this month. That was the highest reading since last May and followed a final reading of 50.1 in February.

- India’s current account deficit is expected to have improved in the final three months of 2022 from a nine-year high in the July to September quarter. Expectations are for an account deficit of USD 23 billion from October to December.

- Last week RBI said that the Indian economy emerged from the pandemic stronger than expected and has picked up momentum since Q2 of the current fiscal year.

- The RBI added that it does not expect India to slow down like the global economy in FY23, which raises concerns that inflation could push higher.

We would love to hear back from you. Please Click here to share your valuable feedback