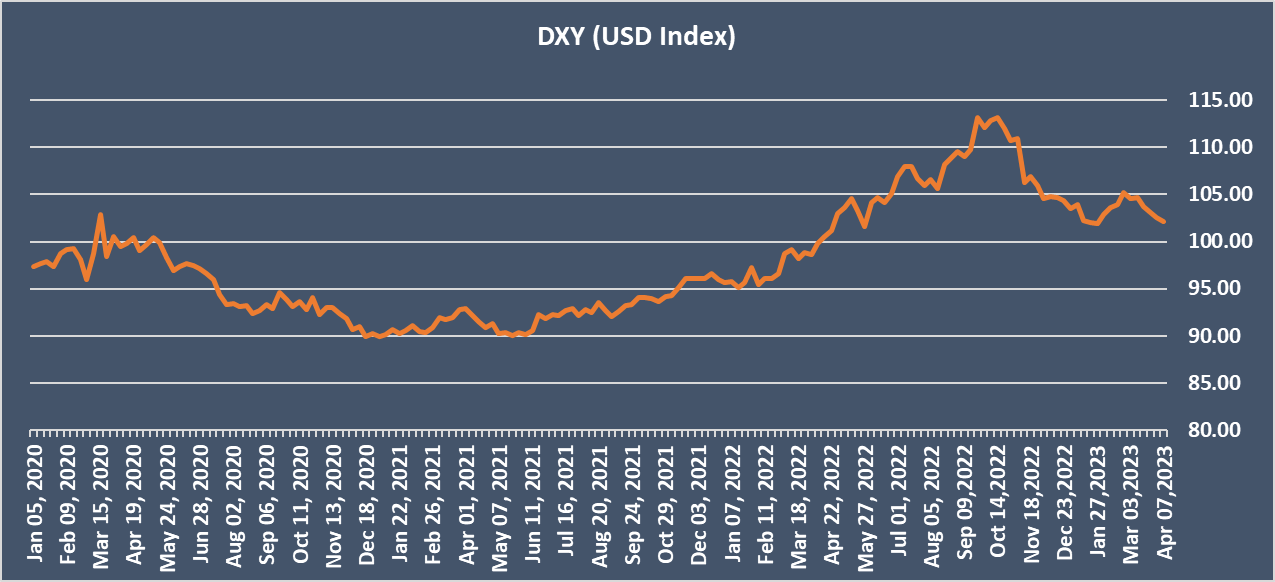

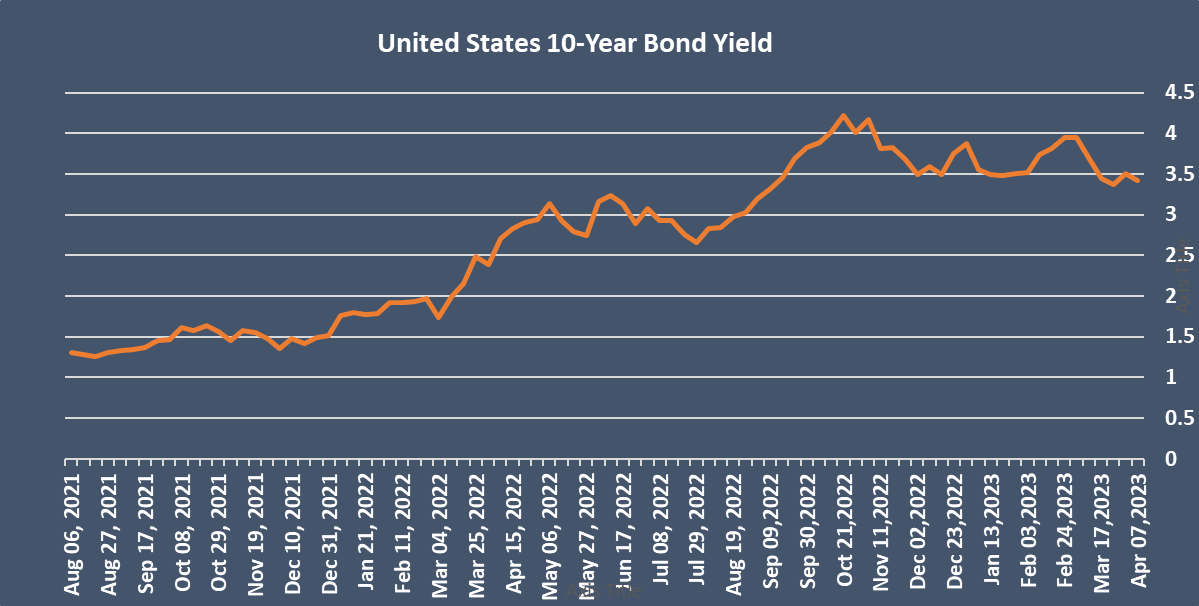

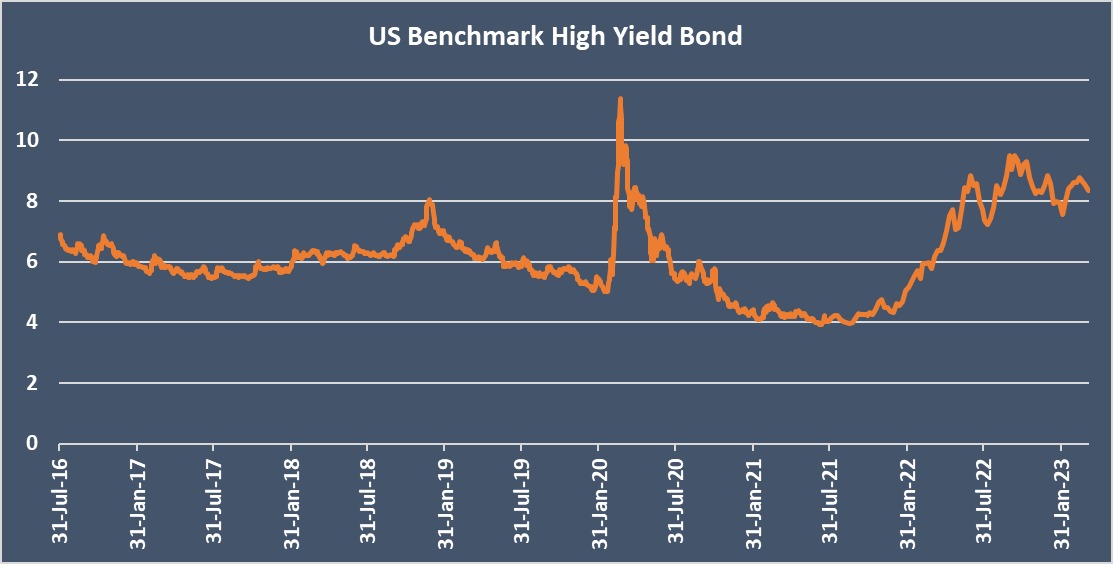

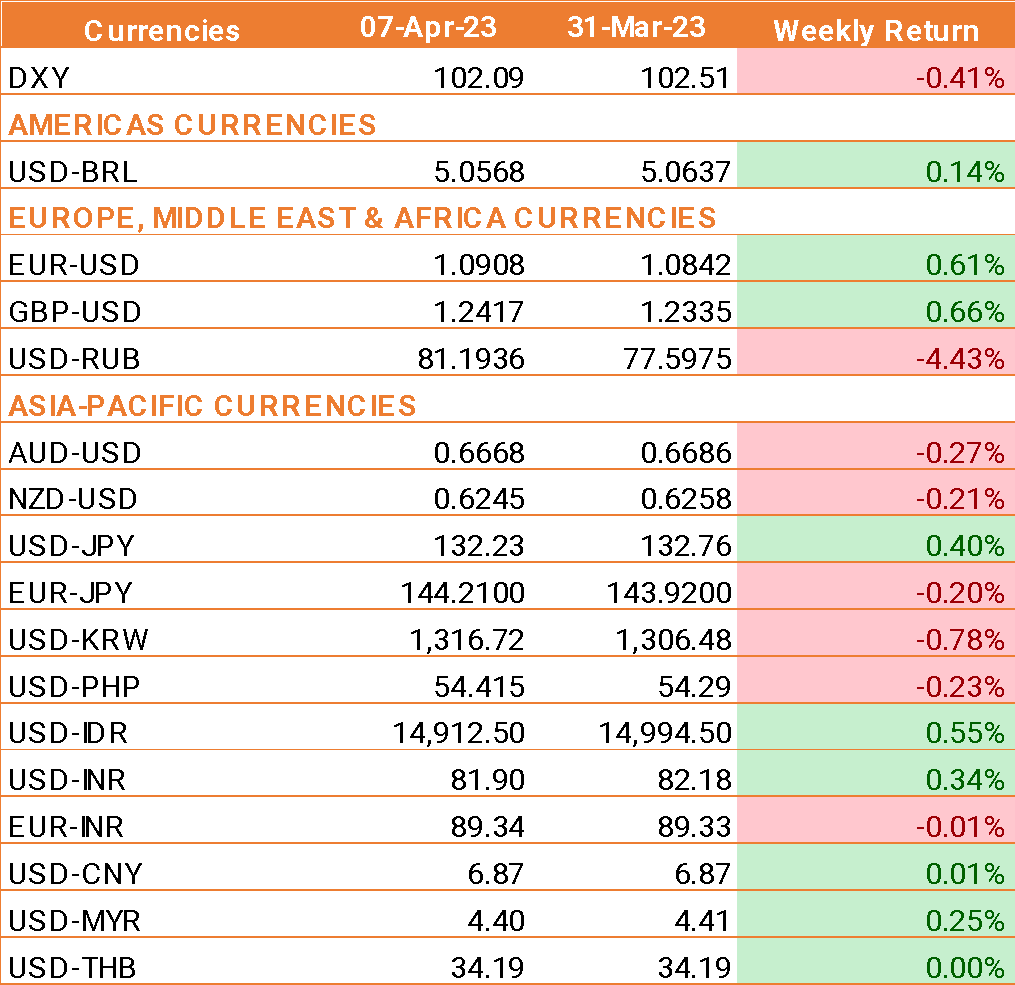

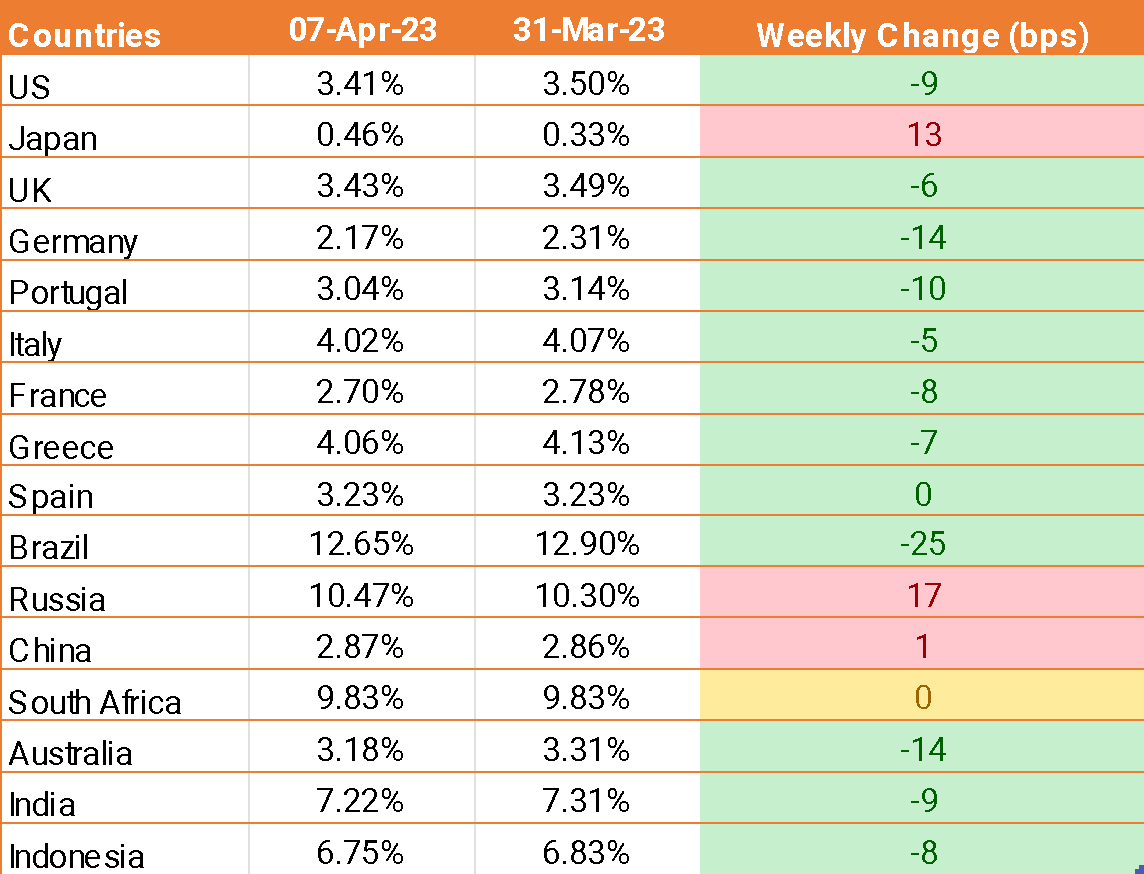

- USD ended the week lower as weak economic data support the idea that the U.S. Federal Reserve may be near the end of its rate-hiking cycle.

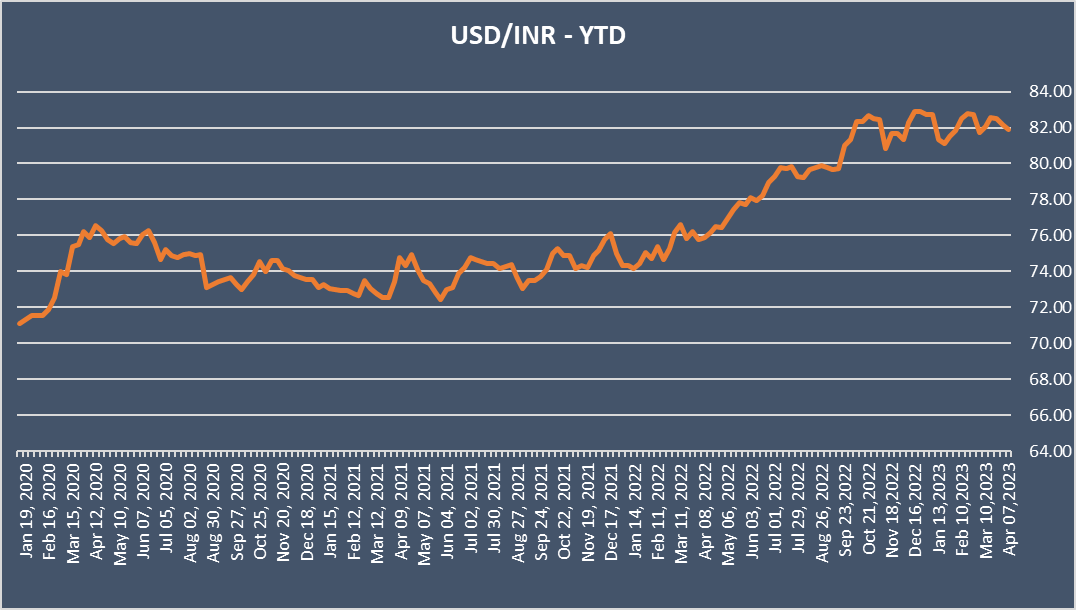

- INR traded higher against USD as the Reserve Bank of India surprised the market by keeping the repo rate on hold on Thursday after six straight rate hikes. The central bank has paused rate hikes at 6.5%, against the expectation of one more hike of 25 bps.

- U.S. monthly job report shows that nonfarm payrolls increased by 236,000 in March, in line with expectations of 239,000. Data for February was revised higher to show 326,000 jobs were added instead of 311,000 as previously reported.

- The unemployment rate fell to 3.5% from 3.6% in February. Average hourly earnings, which reflect wage inflation, rose 0.3% in March after gaining 0.2% in February.

- ISM services PMI fell by more than expected to 51.5 in March, down from 55.5 in February. The data comes after ISM manufacturing figures earlier in the week showed that activity had fallen to almost 2 year low.

We would love to hear back from you. Please Click here to share your valuable feedback