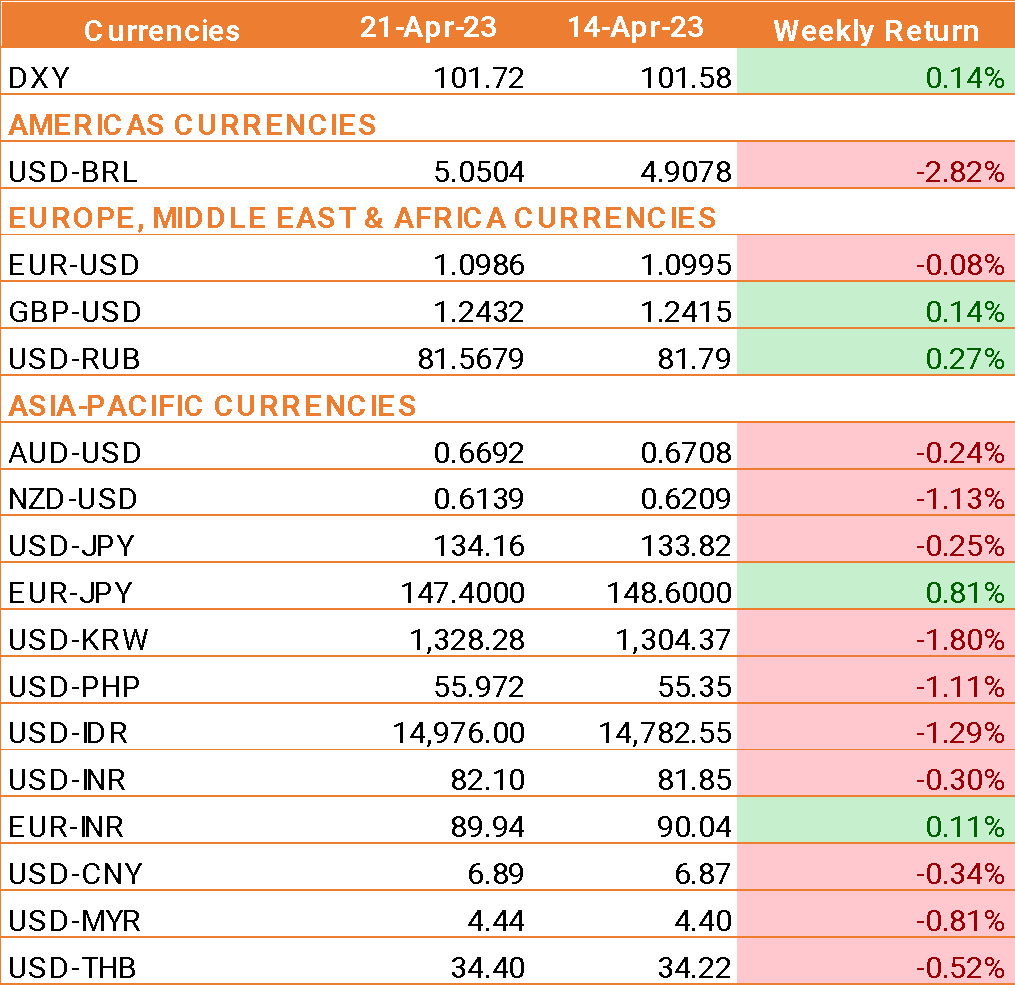

- The Indian rupee (INR) is currently experiencing a decline due to a negative market sentiment, which is affecting the demand for high-risk assets and currencies. In contrast, the US dollar (USD) is gaining strength.

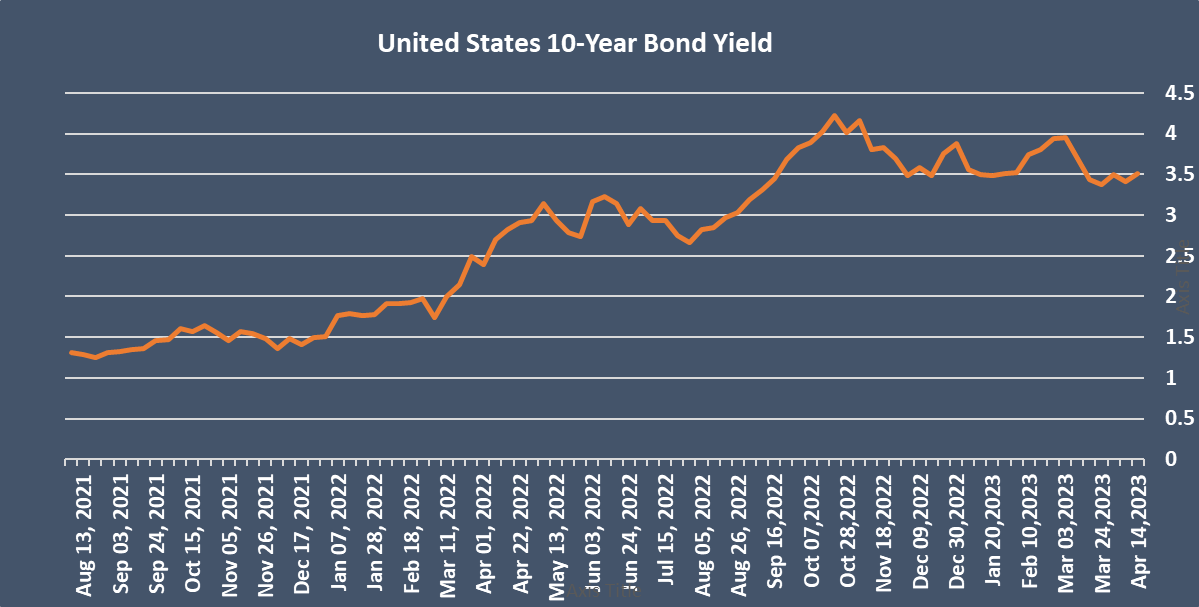

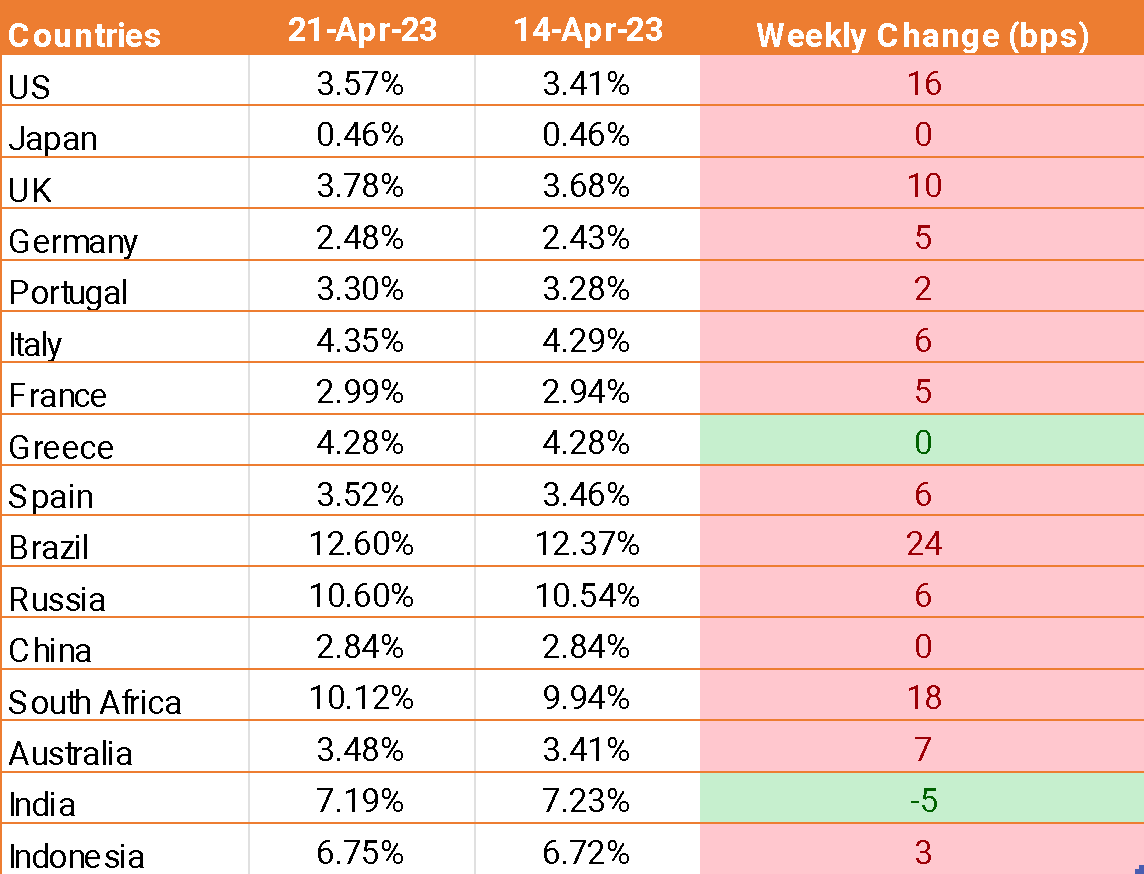

- This increase in the USD's value is partly due to recent comments made by the Federal Reserve, with Cleveland Federal Reserve president Loretta Mester suggesting that interest rates could rise to over 5% and remain at that level for a while in order to control inflation. Other Fed officials have also voiced similar opinions about the need for further rate hikes.

- The minutes from the April meeting of the central bank suggested that the current rate hike cycle may not be over, and that the Reserve Bank of India (RBI) may consider further rate hikes towards its 4% medium-term target.

- In the US, the latest weekly jobless claims data from the labour department shows a slow weakening of the labour market, with initial jobless claims rising to 245,000, up from 240,000 in the previous week and above the expected 240,000.

- Finally, the existing home sales in the US experienced a decline of 2.4% in March, following a 13.8% increase in February.

We would love to hear back from you. Please Click here to share your valuable feedback