In the last RBI MPC meeting, RBI has paused rate hike with a hint that it may take appropriate action if economic scenario requires it to do so. As consumer inflation mitigated to 5.66% in March, RBI may continue to pause in rate hike in the next policy meeting. System liquidity regained surplus level after remaining in a deficit zone for a while. As of 27th April, it stood at Rs 424 billion of surplus amount.

Although bond yields have come down, it is yet to see whether this fall will sustain in the near future. As this is the beginning of the current fiscal year, supply of government bonds is less which is also pulling down yield. In addition, the inflation level in the coming months is not clear from now. Hence, it is yet to be seen whether bond yields will fall further or reclaim pre-RBI policy levels.

Government bonds, SDL and OIS yield movements

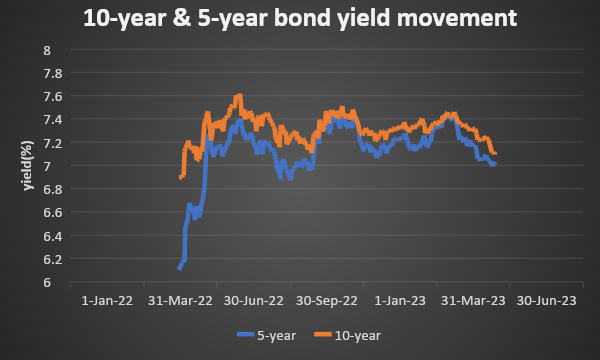

On a weekly basis, the 10-year benchmark 7.26% 2033 yield came down by 4 bps to 7.12% while 7.26% 2032 yield lost 15 bps to 7.14%. 7.06% 2028 yield declined by 1 bp to 7.01%. 7.38% 2027 yield decreased by 1 bp to 6.99%. 5.63% 2026 yield increased by 3 bps to 6.96%. Long-term paper, 7.40% 2062 yield came down by 8 bps to 7.26%.

The spread of 10-year bond over 5-year bond decreased to 11 bps from 14 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread declined to 10 bps from 12 bps while the 30-year benchmark over 10-year benchmark spread decreased to 15 bps from 17 bps on a weekly basis.

10-yr SDL auction cut-off yield declined to 7.43% from 7.56% in previous week while spread decreased to 29 bps from 34 bps as compared to previous week.

On a weekly basis, 1-year OIS yield stood flat at 6.60% while the 5-year OIS yield lost 5 bps to 6.06%.

We would love to hear back from you. Please Click here to share your valuable feedback,