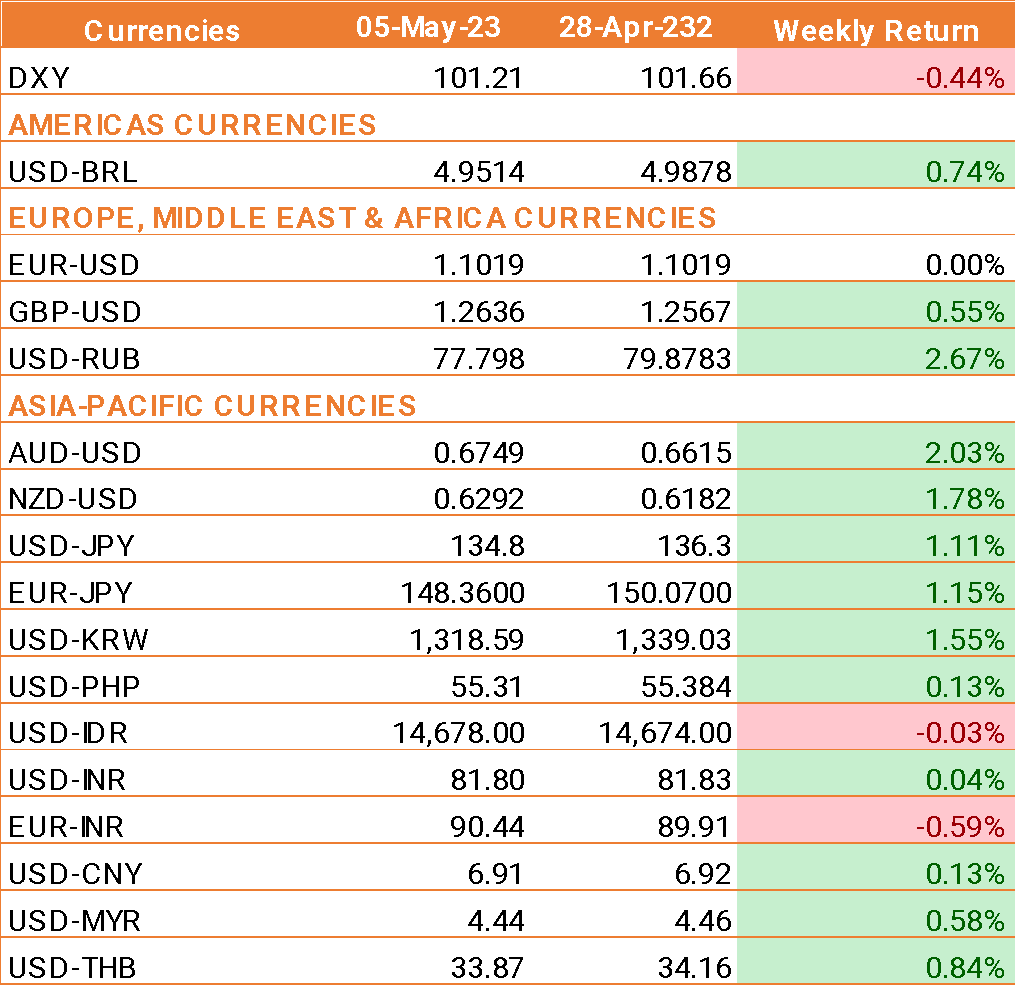

- The US dollar ended lower despite the April jobs report exceeding market expectations, as downward revisions to March's jobs figures weighed on investor sentiment.

- The US economy added 253,000 jobs in April, surpassing forecasts for a 180,000-job increase. Additionally, average hourly earnings rose at an annual rate of 4.4%, beating expectations for a 4.2% increase. However, the March jobs data was revised downward, showing only 165,000 jobs added instead of the previously reported 236,000.

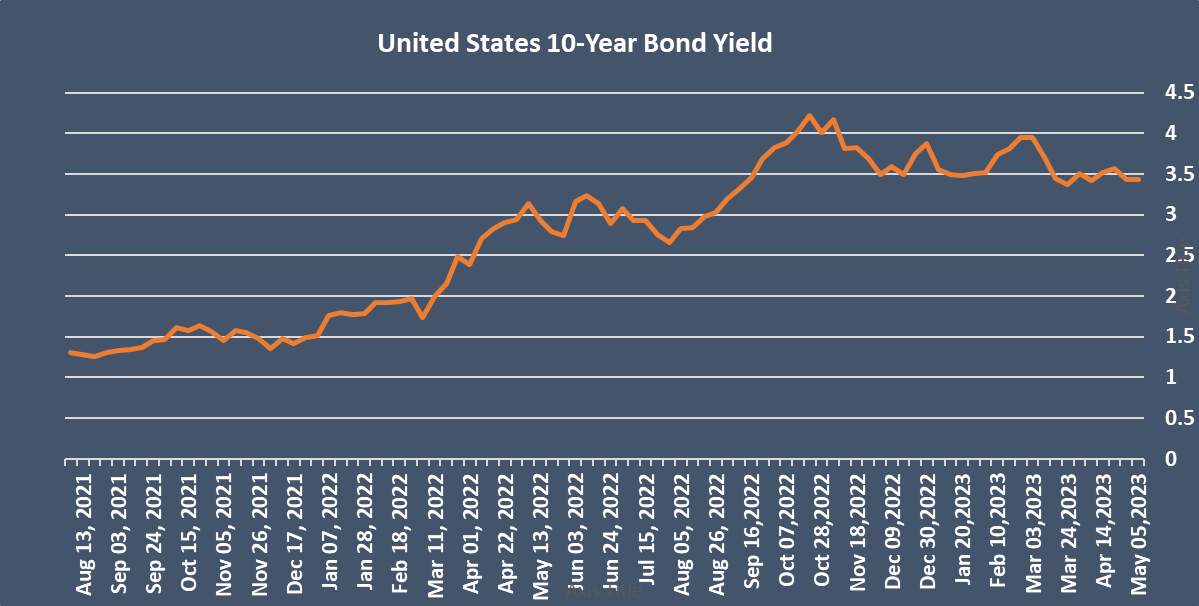

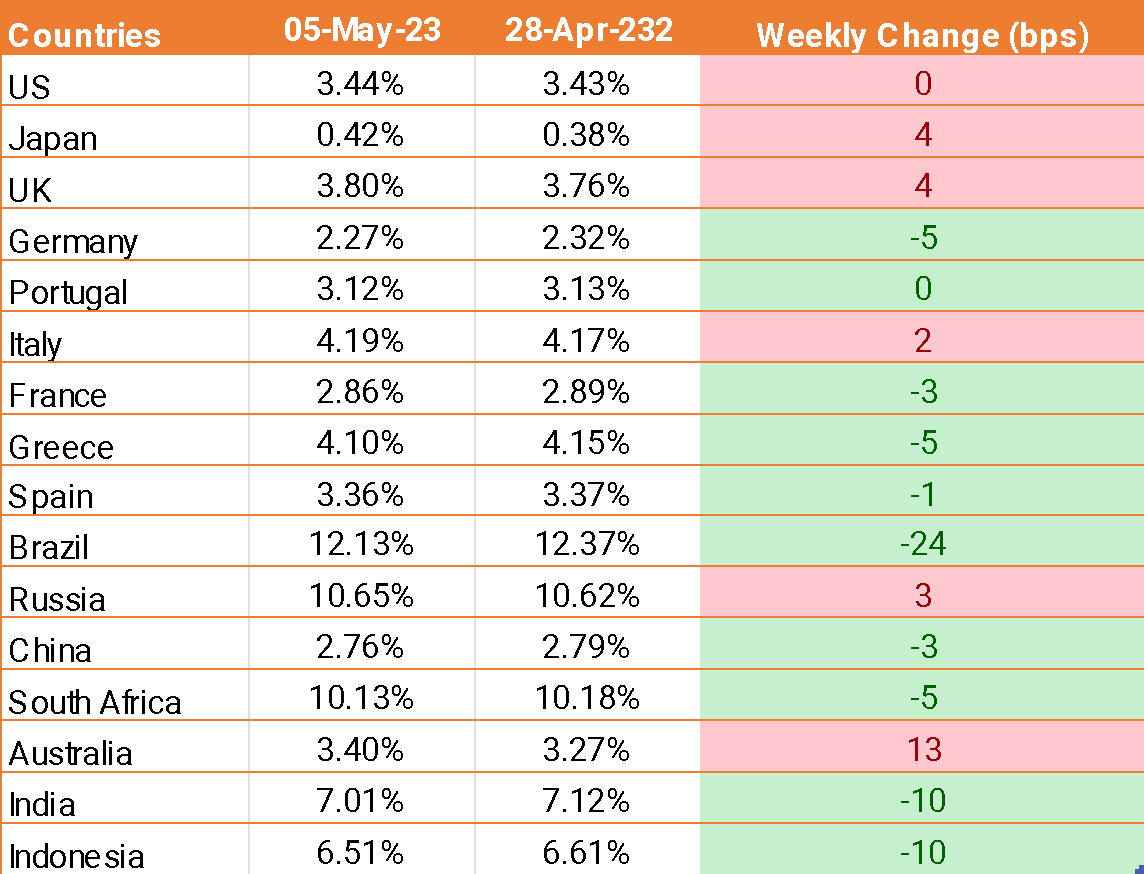

- The US Federal Reserve raised interest rates by 25 basis points on Wednesday, as anticipated. More importantly, the Fed no longer anticipates further rate hikes to curb inflation.

- The European Central Bank (ECB) also raised interest rates, but at a slower pace than previously. While the ECB's 25-basis-point hike was the smallest since it began raising rates last year, the bank indicated that more tightening would be necessary to combat inflation.

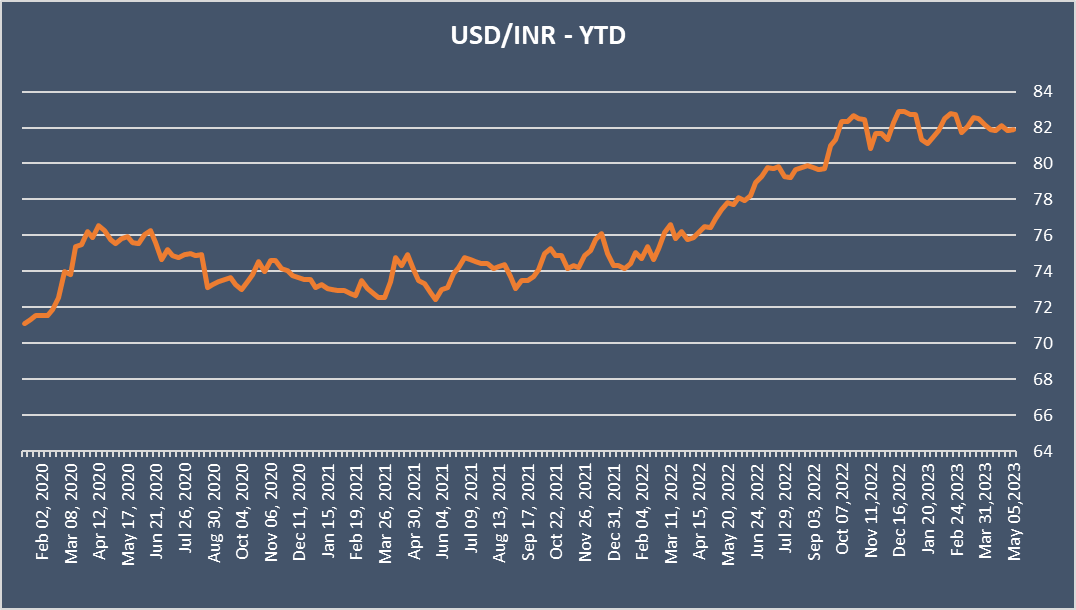

- The INR traded slightly higher, buoyed by strong equity gains.

- Foreign portfolio investors (FPIs) were net buyers of Indian equities in April, purchasing shares worth USD 1.42 billion. This marked the highest level of investment since November of the previous year. FPIs returned to Indian equities due to better-than-expected corporate earnings and stable macroeconomic indicators.

We would love to hear back from you. Please Click here to share your valuable feedback