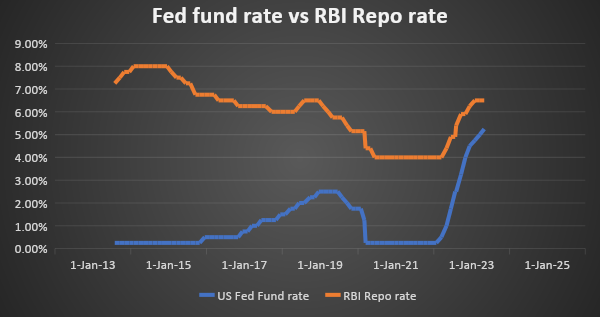

Since March 2022, the US FOMC started hiking the fund rate in order to curb rising inflation. In the same line, RBI started raising the repo rate to check domestic inflation amid global rate hikes. Since May 22, spread between RBI repo rate and US Fed Fund rate declined to 125 bps from 340 bps. As the rate differential between the US Fed rate and RBI repo rate has come down, this will encourage outflows of USD as investors park funds in USD bonds or deposits to take advantage of higher rates. However, given changing economic fundamentals, with US and Indian inflation almost at par, it could lead to more inflows into INR on stronger growth prospects. Bond yields could stabilize as inflation declines.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield came down by 11 bps to 7.01% while 7.26% 2032 yield lost 8 bps to 7.06%. 7.06% 2028 yield declined by 6 bps to 6.95%. 5.63% 2026 yield decreased by 4 bps to 6.92%. Long-term paper, 7.40% 2062 yield came down by 9 bps to 7.17%.

The spread of 10-year bond over 5-year bond decreased to 6 bps from 11 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread declined to 9 bps from 10 bps while the 30-year benchmark over 10-year benchmark spread decreased to 14 bps from 15 bps on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.45% from 7.53% in previous week while spread increased to 36 bps from 29 bps as compared to previous week.

On a weekly basis, 1-year OIS yield declined by 2 bps to 6.58% while the 5-year OIS yield lost 8 bps to 5.58%.

We would love to hear back from you. Please Click here to share your valuable feedback,