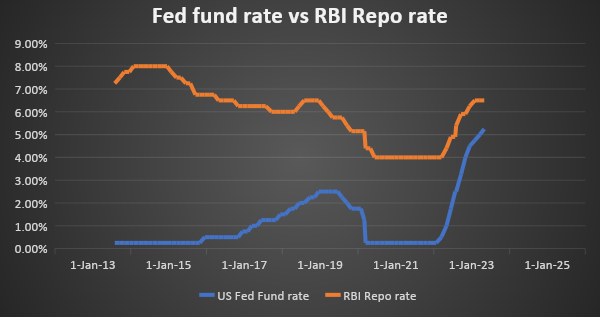

- Since March 2022, the US FOMC started hiking the fund rate in order to curb rising inflation. In the same line, RBI started raising the repo rate to check domestic inflation amid global rate hikes.

- Since March 2022, the US Fed has hiked the fed fund rate by 475 bps from 25%-50% to 5%-5.25%.

- In the same line, RBI has raised policy repo rate by 250 bps from 4% to 6.50%.

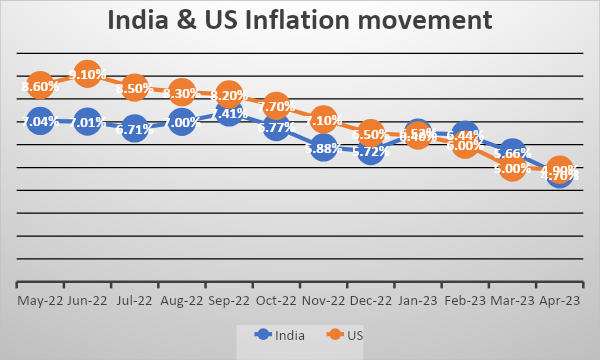

- US consumer inflation fell to 4.9% in April 23 from the peak level of 9.1% in June 2022.

- Domestic inflation fell to touch an 18-month low level at 4.70% in April. During the month, food inflation moderated to 3.84%. Core inflation stood at 5.2% during the mentioned month.

As inflation continues to fall, RBI is likely to maintain status quo on policy repo rates in coming days. The US Fed also indicated about end of rate hike cycle.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield came down by 2 bps to 6.99% while 7.26% 2032 yield lost 2 bps to 7.04%. 7.06% 2028 yield stood unchanged at 6.95%. 5.63% 2026 yield remained stable at 6.92%. Long-term paper, 7.40% 2062 yield came down by 3 bps to 7.14%.

The spread of 10-year bond over 5-year bond decreased to 4 bps from 6 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread stood unchanged at 9 bps while the 30-year benchmark over 10-year benchmark spread increased to 16 bps from 14 bps on a weekly basis.

10-yr SDL auction cut-off yield declined to 7.40% from 7.45% in previous week while spread stood unchanged at 36 bps as compared to previous week.

On a weekly basis, 1-year OIS yield rose by 3 bps to 6.61% while the 5-year OIS yield rose by 5 bps to 6.03%.

We would love to hear back from you. Please Click here to share your valuable feedback,