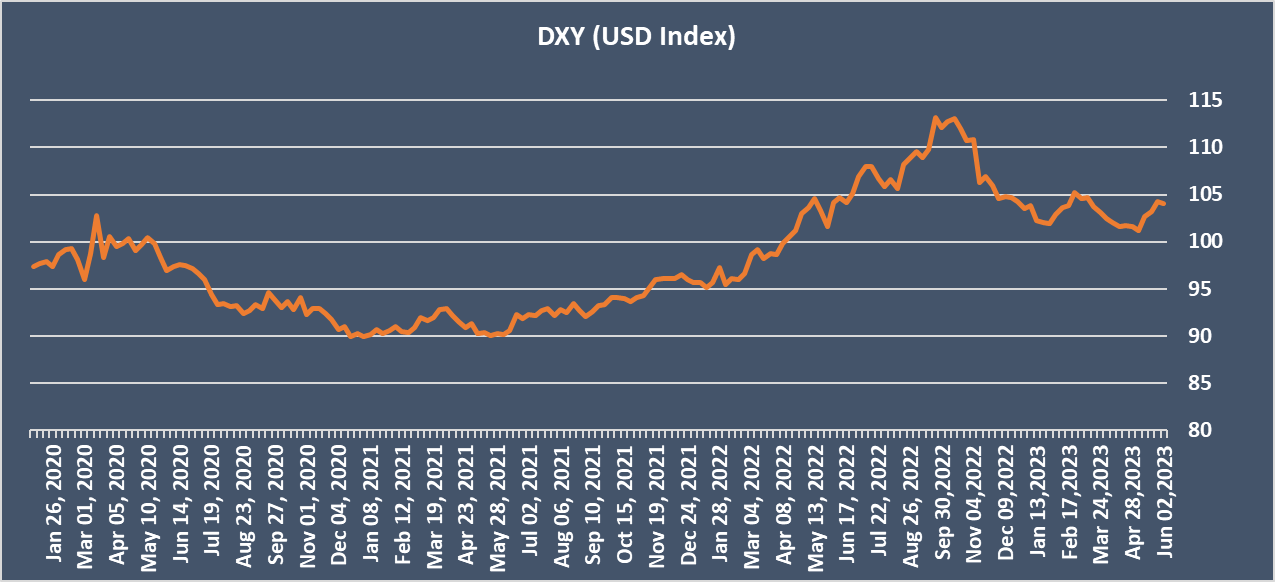

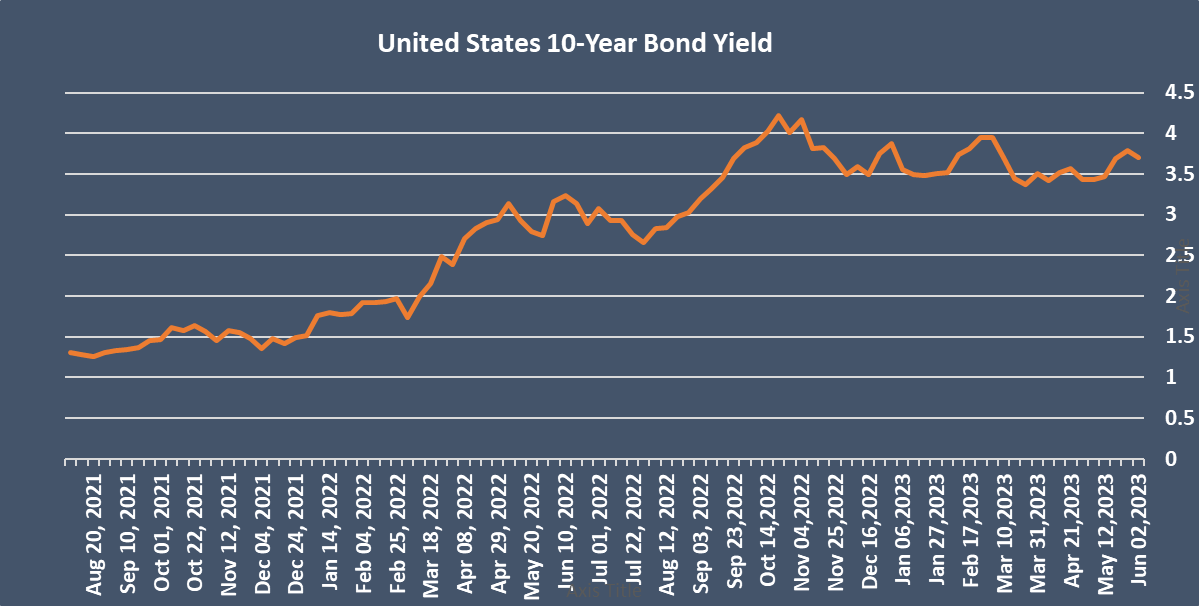

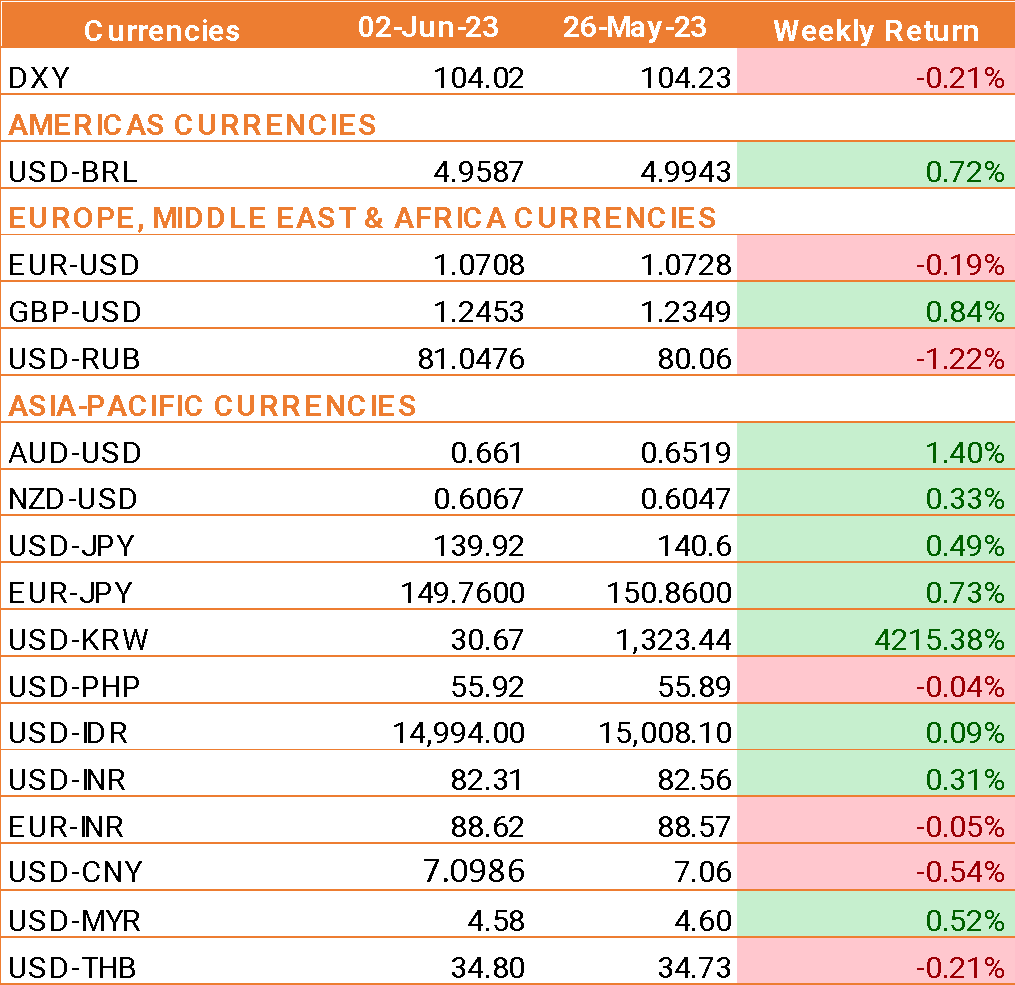

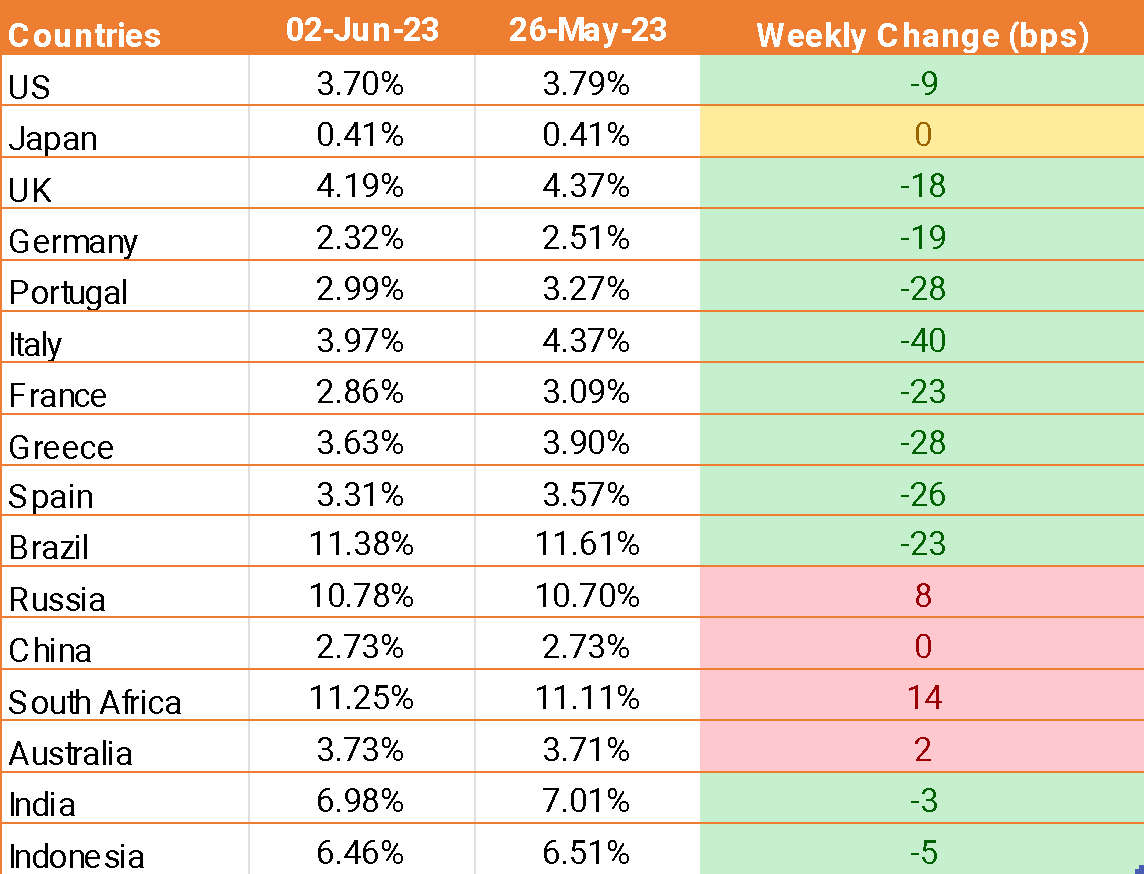

- The USD came under pressure last week after Federal speakers hinted towards skipping a rate hike in June.

- While May's non-farm payrolls report showed a surge in employment numbers, providing support to the USD.

- The report revealed that payrolls in the public and private sectors increased by 339,000 in May, far surpassing the expected 190,000. May's jump followed a rise of 253,000 in April.

- The unemployment rate rose to 3.7% from a 53-year low of 3.4% in April.

- The ISM manufacturing PMI was weaker than expected at 46.9, down from 47.1 in April.

- Philadelphia Fed President Patrick Harker said on Thursday that it was "time to at least hit the stop button for one meeting and see how it goes."

- A day earlier, Fed Governor Philip Jefferson stated that skipping a rate hike "would allow the committee to see more data before making decisions about the extent of additional policy firming."

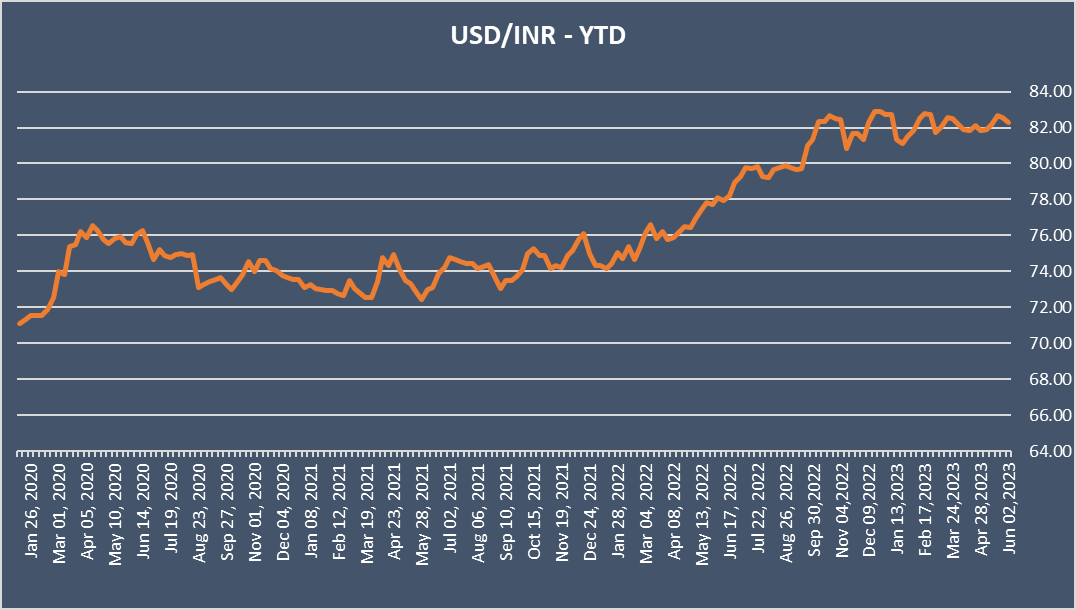

- The INR rose last week as risk sentiment improved across the globe after the US Senate passed the debt ceiling bill, meaning that the US will avoid a debt default.

- Furthermore, the data shows that India's factory output expanded at the fastest pace since October 2020 in May, owing to robust demand and output.

We would love to hear back from you. Please Click here to share your valuable feedback